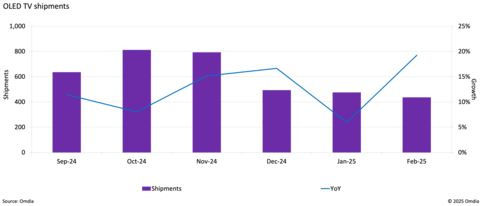

Omdia: OLED Shipments Hit 19.2% Growth Year-on-Year in February 2025

OLED TV shipments demonstrated strong growth with a 19.2% year-on-year increase in February 2025, following a milestone of over 2 million units shipped in Q4 2024. While OLED maintains dominance in Europe, representing 23% of TV revenue despite only 8% volume share, Mini LED technology is emerging as a significant competitor.

Mini LED reached 3 million shipment units in Q4 2024, surpassing OLED's 2 million units for the first time. This growth is particularly driven by China's incentive schemes for energy-efficient technology. LCD shipments, meanwhile, declined by 2.4% in February.

The European market, where premium TVs account for 14% of shipments above $1,000, faces potential disruption as Chinese vendors like Hisense and TCL promote Mini LED technology. While Mini LED offers advantages in brightness, contrast, and manufacturing costs, OLED manufacturers face challenges in consumer education and maintaining brand value in the premium segment.

Le spedizioni di TV OLED hanno mostrato una forte crescita con un aumento del 19,2% rispetto all'anno precedente a febbraio 2025, dopo aver superato il traguardo di oltre 2 milioni di unità spedite nel Q4 2024. Mentre l'OLED mantiene il dominio in Europa, rappresentando il 23% del fatturato delle TV nonostante una quota di volume del solo 8%, la tecnologia Mini LED sta emergendo come un concorrente significativo.

Il Mini LED ha raggiunto 3 milioni di unità spedite nel Q4 2024, superando per la prima volta le 2 milioni di unità dell'OLED. Questa crescita è particolarmente guidata dagli schemi di incentivazione della Cina per la tecnologia a risparmio energetico. Nel frattempo, le spedizioni di LCD sono diminuite del 2,4% a febbraio.

Il mercato europeo, dove le TV premium rappresentano il 14% delle spedizioni superiori a $1.000, affronta potenziali interruzioni poiché i fornitori cinesi come Hisense e TCL promuovono la tecnologia Mini LED. Sebbene il Mini LED offra vantaggi in termini di luminosità, contrasto e costi di produzione, i produttori di OLED devono affrontare sfide nell'educazione dei consumatori e nel mantenere il valore del marchio nel segmento premium.

Los envíos de televisores OLED mostraron un fuerte crecimiento con un aumento del 19.2% interanual en febrero de 2025, tras alcanzar un hito de más de 2 millones de unidades enviadas en el cuarto trimestre de 2024. Mientras que OLED mantiene el dominio en Europa, representando el 23% de los ingresos por TV a pesar de solo un 8% de participación en volumen, la tecnología Mini LED está emergiendo como un competidor significativo.

El Mini LED alcanzó 3 millones de unidades enviadas en el Q4 2024, superando por primera vez las 2 millones de unidades de OLED. Este crecimiento está impulsado particularmente por los esquemas de incentivos de China para tecnología eficiente en energía. Mientras tanto, los envíos de LCD disminuyeron un 2.4% en febrero.

El mercado europeo, donde los televisores premium representan el 14% de los envíos por encima de $1,000, enfrenta una posible interrupción a medida que los proveedores chinos como Hisense y TCL promueven la tecnología Mini LED. Aunque el Mini LED ofrece ventajas en brillo, contraste y costos de fabricación, los fabricantes de OLED enfrentan desafíos en la educación del consumidor y en mantener el valor de la marca en el segmento premium.

OLED TV 출하량은 2025년 2월에 전년 대비 19.2% 증가하며 강력한 성장을 보여주었으며, 2024년 4분기에는 200만 대 이상의 출하량을 기록했습니다. OLED는 유럽에서 여전히 지배적인 위치를 유지하고 있으며, TV 수익의 23%를 차지하고 있지만, 미니 LED 기술은 중요한 경쟁자로 부상하고 있습니다.

미니 LED는 2024년 4분기에 300만 대의 출하량을 기록하며, OLED의 200만 대를 처음으로 초과했습니다. 이러한 성장은 에너지 효율 기술에 대한 중국의 인센티브 프로그램에 의해 주도되고 있습니다. 한편, LCD 출하량은 2.4% 감소했습니다.

프리미엄 TV가 $1,000 이상 출하량의 14%를 차지하는 유럽 시장은 Hisense와 TCL과 같은 중국 공급업체가 미니 LED 기술을 홍보함에 따라 잠재적인 혼란에 직면해 있습니다. 미니 LED는 밝기, 대비 및 제조 비용에서 장점을 제공하지만, OLED 제조업체는 소비자 교육과 프리미엄 세그먼트에서 브랜드 가치를 유지하는 데 어려움을 겪고 있습니다.

Les expéditions de téléviseurs OLED ont montré une forte croissance avec une augmentation de 19,2% par rapport à l'année précédente en février 2025, après avoir franchi le cap des 2 millions d'unités expédiées au quatrième trimestre 2024. Alors que l'OLED maintient sa domination en Europe, représentant 23% des revenus des téléviseurs malgré une part de volume de seulement 8%, la technologie Mini LED émerge comme un concurrent significatif.

Le Mini LED a atteint 3 millions d'unités expédiées au Q4 2024, dépassant pour la première fois les 2 millions d'unités de l'OLED. Cette croissance est particulièrement soutenue par les programmes d'incitation de la Chine pour la technologie économe en énergie. Pendant ce temps, les expéditions de LCD ont diminué de 2,4% en février.

Le marché européen, où les téléviseurs premium représentent 14% des expéditions supérieures à 1 000 $, fait face à des perturbations potentielles alors que des fournisseurs chinois comme Hisense et TCL promeuvent la technologie Mini LED. Bien que le Mini LED offre des avantages en termes de luminosité, de contraste et de coûts de fabrication, les fabricants d'OLED doivent relever des défis en matière d'éducation des consommateurs et de maintien de la valeur de la marque dans le segment premium.

Die OLED-TV-Auslieferungen zeigten im Februar 2025 ein starkes Wachstum mit einem 19,2%igen Anstieg im Vergleich zum Vorjahr, nachdem im 4. Quartal 2024 über 2 Millionen Einheiten ausgeliefert wurden. Während OLED in Europa dominiert und 23% des TV-Umsatzes ausmacht, obwohl der Volumenanteil nur 8% beträgt, ist die Mini-LED-Technologie als bedeutender Konkurrent aufgetaucht.

Mini LED erreichte 3 Millionen ausgelieferte Einheiten im 4. Quartal 2024 und übertraf damit erstmals die 2 Millionen Einheiten von OLED. Dieses Wachstum wird insbesondere durch Chinas Anreizprogramme für energieeffiziente Technologien vorangetrieben. Die LCD-Auslieferungen hingegen gingen im Februar um 2,4% zurück.

Der europäische Markt, in dem Premium-TVs 14% der Auslieferungen über 1.000 $ ausmachen, sieht sich potenziellen Störungen gegenüber, da chinesische Anbieter wie Hisense und TCL die Mini-LED-Technologie fördern. Obwohl Mini LED Vorteile in Bezug auf Helligkeit, Kontrast und Herstellungskosten bietet, stehen OLED-Hersteller vor Herausforderungen in der Verbraucherbildung und der Aufrechterhaltung des Markenwerts im Premiumsegment.

- OLED shipments grew 19.2% YoY in February 2025

- OLED maintains strong premium market position in Europe with 23% revenue share

- Q4 2024 OLED shipments exceeded 2 million units, highest since 2022

- Mini LED shipments (3M) overtook OLED shipments (2M) in Q4 2024

- Increasing competition from cheaper Mini LED technology in premium segment

- LCD shipments declined 2.4% in February 2025

OLED TV shipments

According to Omdia’s latest TV Sets Market Tracker - February 2025, LCD shipments fell by

This global view on TV technology consumption is influenced by a surge in Mini LED demand in

Matthew Rubin, Principal Analyst, TV Set Research, Omdia explains: “With over

Mini LED offers several enticing benefits for consumers, including high brightness, better contrast and enhanced color vibrancy. Crucially, it is cheaper to manufacture than OLED, particularly for larger screen sizes. However, all is not lost for brands reliant on OLED, such as LG, Panasonic, and to a lesser degree Samsung. There remain key barriers to Mini LED adoption, such as consumer terminology confusion (educating buyers on the difference between standard LED LCD, Mini LED and now RGB LED), and the intrinsic brand value that OLED has built in consumers’ minds as the go-to premium technology.

“Overcoming these challenges will take time, but brands must make strategic decisions soon regarding product range and technology positioning. Few brands will want, or be able, to cover all bases, offering both OLED and Mini LED as premium options, as this could dilute their marketing initiatives. However, making the wrong choice or opting for late adoption could have serious consequences, particularly in the highly competitive European market,” concluded Rubin.

ABOUT OMDIA

Omdia, part of Informa TechTarget, Inc. (Nasdaq: TTGT), is a technology research and advisory group. Our deep knowledge of tech markets combined with our actionable insights empower organizations to make smart growth decisions.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250410477146/en/

Fasiha Khan – Fasiha.khan@omdia.com

Source: Omdia