TC Energy announces Canada’s largest Indigenous equity ownership agreement

TC Energy (TSX, NYSE: TRP) has announced a historic $1 billion equity interest purchase agreement for a 5.34% minority stake in its NGTL System and Foothills Pipeline assets. This partnership, backed by the Alberta Indigenous Opportunities (AIOC), will enable up to 72 Indigenous Communities across Alberta, British Columbia, and Saskatchewan to become equity owners in the 25,000-kilometer natural gas infrastructure network.

The AIOC will provide a $1 billion equity loan guarantee to support the newly-formed Indigenous-owned investment partnership. This agreement is expected to create long-term revenue sources for Indigenous Communities, fostering economic sovereignty and prosperity. The transaction is anticipated to close in the third quarter of 2024, subject to Community approvals and financing.

TC Energy (TSX, NYSE: TRP) ha annunciato un accordo storico per l'acquisto di un interesse azionario di 1 miliardo di dollari per una quota di minoranza del 5,34% nel suo Sistema NGTL e negli asset del Foothills Pipeline. Questa partnership, sostenuta dalle Opportunità Indigene dell'Alberta (AIOC), permetterà fino a 72 Comunità Indigene in Alberta, Columbia Britannica e Saskatchewan di diventare proprietarie di quote nel rete di infrastruttura per il gas naturale lunga 25.000 chilometri.

L'AIOC fornirà una garanzia di prestito azionario di 1 miliardo di dollari per supportare il nuovo partenariato di investimento di proprietà indigena. Ci si aspetta che questo accordo crei fonti di reddito a lungo termine per le Comunità Indigene, favorendo la sovranità economica e la prosperità. Si prevede che la transazione si concluda nel terzo trimestre del 2024, soggetta all'approvazione delle Comunità e al finanziamento.

TC Energy (TSX, NYSE: TRP) ha anunciado un acuerdo histórico de compra de interés en acciones de 1 mil millones de dólares por una participación minoritaria del 5.34% en su Sistema NGTL y activos del Oleoducto Foothills. Esta asociación, respaldada por las Oportunidades Indígenas de Alberta (AIOC), permitirá que hasta 72 Comunidades Indígenas en Alberta, Columbia Británica y Saskatchewan se conviertan en propietarios de acciones en la red de infraestructura de gas natural de 25,000 kilómetros.

La AIOC proporcionará una garantía de préstamo en acciones de 1 mil millones de dólares para apoyar la nueva asociación de inversión de propiedad indígena. Se espera que este acuerdo genere fuentes de ingresos a largo plazo para las Comunidades Indígenas, fomentando la soberanía económica y la prosperidad. Se anticipa que la transacción se cierre en el tercer trimestre de 2024, sujeto a las aprobaciones de la Comunidad y al financiamiento.

TC Energy (TSX, NYSE: TRP)는 NGTL 시스템과 Foothills 파이프라인 자산에 대한 5.34% 소수 지분을 위한 10억 달러의 주식 구매 계약을 발표했습니다. 앨버타 원주율 기회(AIOC)의 지원을 받는 이번 파트너십은 앨버타, 브리티시컬럼비아, 사스카추완 전역의 72개 원주율 공동체가 25,000킬로미터에 달하는 천연가스 인프라 네트워크의 지분 소유자가 될 수 있는 기회를 제공합니다.

AIOC는 새롭게 형성된 원주율 소유 투자 파트너십을 지원하기 위해 10억 달러의 주식 대출 보증을 제공할 것입니다. 이 계약은 원주율 공동체에 장기적인 수익원을 창출하여 경제적 주권과 번영을 도모할 것으로 기대됩니다. 이번 거래는 2024년 3분기에 종료될 것으로 예상되며, 이는 공동체의 승인과 자금 조달에 따라 달라질 수 있습니다.

TC Energy (TSX, NYSE: TRP) a annoncé un accord historique d'achat d'intérêts en actions de 1 milliard de dollars pour une participation minoritaire de 5,34 % dans son système NGTL et ses actifs de pipeline Foothills. Ce partenariat, soutenu par les Opportunités Autochtones de l'Alberta (AIOC), permettra à jusqu'à 72 communautés autochtones en Alberta, en Colombie-Britannique et en Saskatchewan de devenir propriétaires d'actions dans le réseau d'infrastructure de gaz naturel de 25 000 kilomètres.

L'AIOC fournira une garantie de prêt en actions de 1 milliard de dollars pour soutenir le nouveau partenariat d'investissement détenu par des autochtones. Cet accord devrait créer des sources de revenus à long terme pour les communautés autochtones, favorisant ainsi la souveraineté économique et la prospérité. La transaction devrait se conclure au troisième trimestre de 2024, sous réserve des approbations communautaires et du financement.

TC Energy (TSX, NYSE: TRP) hat eine historische Vereinbarung zum Erwerb von Eigenkapital im Wert von 1 Milliarde Dollar für eine 5,34%ige Minderheitsbeteiligung an seinem NGTL-System und den Foothills-Pipeline-Vermögenswerten angekündigt. Diese Partnerschaft, unterstützt von den Alberta Indigenous Opportunities (AIOC), ermöglicht es bis zu 72 indigenen Gemeinschaften in Alberta, Britisch-Kolumbien und Saskatchewan, Anteilseigner im 25.000 Kilometer langen Infrastrukturnetz für Erdgas zu werden.

Die AIOC wird eine Eigenkapitaldarlehensgarantie von 1 Milliarde Dollar bereitstellen, um die neu gegründete indigene Investmentpartnerschaft zu unterstützen. Es wird erwartet, dass dieses Abkommen langfristige Einnahmequellen für indigene Gemeinschaften schafft und wirtschaftliche Souveränität sowie Wohlstand fördert. Die Transaktion wird voraussichtlich im dritten Quartal 2024 abgeschlossen, vorbehaltlich der Genehmigungen der Gemeinschaft und der Finanzierung.

- Historic $1 billion equity interest purchase agreement for 5.34% stake in NGTL System and Foothills Pipeline assets

- Partnership enables up to 72 Indigenous Communities to become equity owners in critical energy infrastructure

- Agreement backed by $1 billion equity loan guarantee from Alberta Indigenous Opportunities

- Transaction expected to provide long-term, predictable cash flows from rate-regulated assets

- Enhances TC Energy's relationships with Indigenous communities and advances economic reconciliation

- None.

Insights

This landmark agreement between TC Energy and Indigenous Communities marks a significant shift in Canada's energy sector, with potential ripple effects across the industry. The $1 billion deal for a 5.34% equity stake in TC Energy's NGTL System and Foothills Pipeline assets is groundbreaking in its scale and structure.

From a financial perspective, this deal values the Partnership Assets at an impressive

For investors, this deal presents a mixed bag. On one hand, it demonstrates TC Energy's commitment to ESG principles and Indigenous reconciliation, which could enhance its reputation and potentially its valuation. On the other hand, the sale of a stake in these critical assets means sharing future revenues.

The involvement of the Alberta Indigenous Opportunities (AIOC) with a

Long-term, this partnership could lead to more stable operations and reduced regulatory risks for TC Energy, as Indigenous Communities become vested partners rather than potential opponents. This alignment of interests could prove valuable in future project approvals and expansions.

Investors should watch for similar deals in the sector, as this could become a new standard for Indigenous participation in major Canadian energy projects, potentially affecting valuations and operational strategies across the industry.

This agreement represents a watershed moment in Indigenous economic participation in Canada's energy sector. The scale of this deal - potentially involving up to 72 Indigenous Communities across three provinces - is unprecedented and could serve as a model for future partnerships.

The 5.34% equity stake provides Indigenous Communities with a significant ownership position in critical energy infrastructure. This goes beyond traditional impact and benefit agreements, offering a direct stake in the assets' performance and future growth.

The structure of the deal, utilizing the AIOC's loan guarantee, is particularly noteworthy. It addresses one of the key barriers to Indigenous participation in major projects - access to capital. This model could be replicated across other sectors, potentially accelerating Indigenous economic reconciliation.

However, it's important to note that each Community will independently decide on participation. This respects Indigenous self-determination but may lead to complexities in governance and benefit distribution. The addition of an Indigenous representative to TC Energy's Indigenous Advisory Council is a positive step towards ensuring ongoing dialogue and representation.

Long-term, this deal could lead to increased Indigenous influence in Canada's energy sector, potentially affecting future project development, environmental standards and benefit-sharing arrangements. It may also provide valuable experience and capacity building for Indigenous Communities in managing large-scale investments.

For investors, this partnership could reduce project risks by aligning Indigenous and corporate interests, potentially leading to smoother project approvals and operations in the future.

This groundbreaking agreement between TC Energy and Indigenous Communities represents a significant shift in Canada's energy policy landscape. It goes beyond traditional consultation and accommodation practices, establishing a new paradigm of Indigenous ownership in critical energy infrastructure.

The deal's structure, involving a 5.34% equity stake in the NGTL System and Foothills Pipeline assets, is particularly noteworthy. These assets, spanning 25,000 kilometers and connecting

From a policy perspective, this agreement aligns with broader governmental efforts to advance economic reconciliation with Indigenous peoples. The involvement of the Alberta Indigenous Opportunities (AIOC) through a

This deal could set a precedent for future energy projects across Canada. It may influence regulatory processes, with authorities potentially looking more favorably on projects that include substantial Indigenous ownership. This could accelerate project approvals while ensuring more equitable distribution of benefits.

For investors, this shift in policy landscape could mean a new era of project development in Canada's energy sector. Projects with significant Indigenous ownership may face less opposition and enjoy smoother regulatory processes, potentially reducing timelines and costs.

However, the complexity of managing partnerships with multiple Indigenous Communities across provincial boundaries should not be underestimated. It will require careful governance structures and ongoing dialogue to ensure the partnership's success and to fully realize its potential benefits.

Made possible by the Alberta Indigenous Opportunities Corporation, the partnership enables Indigenous Communities to own part of Canada’s largest natural gas pipeline network, while creating shareholder value and progressing TC Energy’s strategic priorities

TC Energy’s NGTL System compressor station and pipeline right-of-way near Nordegg, Alta.

CALGARY, Alberta, July 30, 2024 (GLOBE NEWSWIRE) -- TC Energy Corporation (TSX, NYSE: TRP) (TC Energy or the Company) is pleased to announce an equity interest purchase agreement (Agreement) with an Indigenous-owned investment partnership for a minority equity interest of 5.34 per cent in the NGTL System and the Foothills Pipeline assets (together, Partnership Assets) for a gross purchase price of

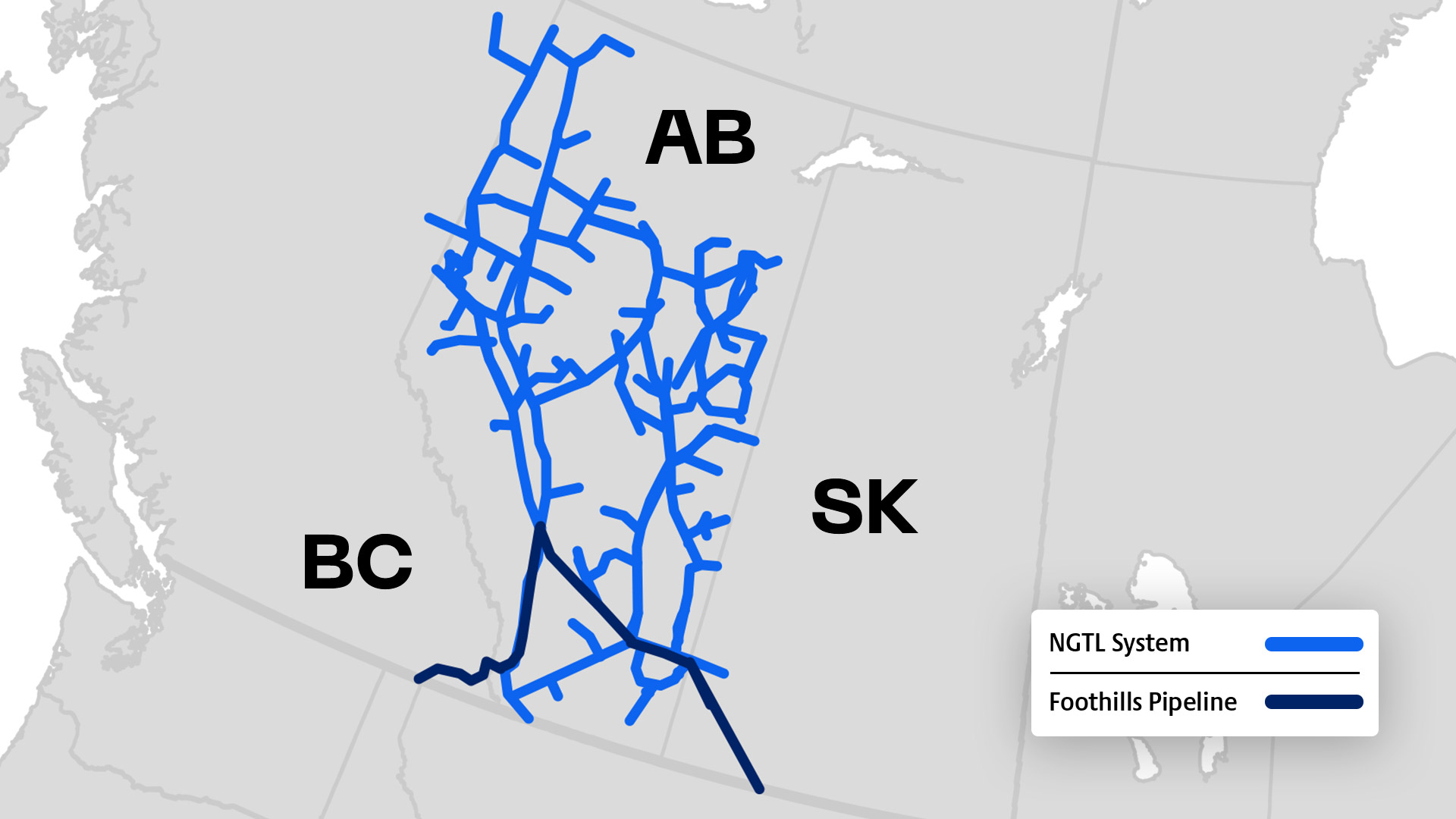

This historic partnership will enable up to 72 Indigenous Communities closest to the Partnership Assets to become equity owners in the 25,000-kilometre highly integrated network of natural gas infrastructure assets spanning western Canada. Investment in these critical energy assets delivers access to long-term revenue sources that will help create meaningful change for Indigenous Communities.

“Indigenous ownership is the path to a more prosperous nation. As owners, Indigenous Communities will have resources to invest for the future and greater economic sovereignty. The Alberta Indigenous Opportunities Corporation is leading the world with its innovative approach to supporting Indigenous economic opportunity. TC Energy is proud to be a part of this historic agreement,” said François Poirier, TC Energy’s President and Chief Executive Officer.

A leading Indigenous loan guarantee program

The Agreement will create a pathway for equity participation that builds upon TC Energy’s long history of fostering positive and meaningful relationships with Indigenous peoples. Loan guarantees, such as the one presented by the AIOC, are instrumental in supporting inclusive participation in Canada’s critical energy assets.

The AIOC will provide the Communities with a

“In only four years, the Alberta Indigenous Opportunities Corporation has truly made an impact for Indigenous communities. This newest agreement builds on earlier successes and shows Canada and the world that energy partnerships with First Nations and Métis peoples are both desired and possible. I’m thrilled to celebrate this agreement and look forward to the next steps that will ensure more Indigenous communities are true partners in prosperity.”

Honourable Danielle Smith

Premier of Alberta

“Alberta continues to lead on economic reconciliation with Indigenous Peoples. It’s so exciting to see this historic investment partnership come together thanks to an unprecedented loan guarantee from the AIOC. This will create significant new long-term revenue streams for the Indigenous Communities involved. The AIOC continues to break down barriers and build bridges by supporting Indigenous ownership and inclusion in Alberta’s biggest projects. Many thanks to all the partners involved for working tirelessly to make this a reality.”

Honourable Rick Wilson

Minister of Indigenous Relations, Government of Alberta

“AIOC is proud to support this partnership with Communities across Alberta, British Columbia and Saskatchewan with a

Chana Martineau

CEO, Alberta Indigenous Opportunities Corporation

Building meaningful partnerships through project equity

The Consortium consists of members appointed by the Communities to represent their unique interests throughout the partnership discussions. The Consortium, along with the AIOC and TC Energy, have shaped a partnership focused on a mutually-beneficial future within Canada's resource economy.

“The Consortium Committee, tasked with negotiating this transaction, deserves notable credit for significantly improving the terms of this deal. As a result, we anticipate that the Indigenous investors will benefit from this partnership for some years to come. We appreciate the efforts of all parties involved. I also give much thanks to the Consortium Committee for placing their trust in me to serve as their Chair."

Chief Isaac Twinn

Consortium Committee Chairman and Chief of Sawridge FN, Treaty 8

To further reinforce the significance of this relationship and the importance of ongoing dialogue, a member of the participating Communities will be invited to join TC Energy’s Indigenous Advisory Council (IAC). The IAC was formed in 2021 to guide the Company’s executive leadership team on reconciliation-related initiatives to support resilient Indigenous Communities.

"Today’s announcement is about advancing economic opportunities for Indigenous participation through equity ownership – something that Indigenous communities have been asking for. The NGTL and Foothills assets have a longstanding presence in our communities – from our relatives who helped construct it, to our youth who are training to operate it. This equity partnership agreement represents a significant evolution in TC Energy’s relationship with Indigenous Peoples and marks substantial progress on the industry’s broader journey toward advancing reconciliation. We look forward to welcoming a new member to the IAC from this partnership, to bring another important voice to our collective efforts."

Raylene Whitford

Chair, TC Energy’s Indigenous Advisory Council

Critical natural gas infrastructure

As an essential part of TC Energy’s pipeline network, the Partnership Assets play a vital role in reliable energy transportation across North America. These systems are critical infrastructure that connect approximately 80 per cent of natural gas production from the Western Canadian Sedimentary Basin – one of the world's largest natural gas reserves – to both domestic and export markets.

The Partnership Assets, which are underpinned by federal rate-regulation, are expected to provide enduring value through predictable and long-term cash flows.

Map showing the NGTL System and Foothills Pipeline

Transaction details

Now that the agreement has the support of the AIOC and the Consortium, the Consortium will present the agreement to Communities for review. Each independent Community will determine their participation in the opportunity, exercising their right to self-determination. Following the review, the Communities will commence formal authorization of their participation. The transaction and transaction size are not contingent on any given Community, nor on all Communities, electing to participate.

The transaction is expected to close in the third quarter of 2024, subject to receipt of Band Council and Settlement Resolutions by participating Communities and financing.

CIBC Capital Markets acted as financial advisor to TC Energy and Osler, Hoskin & Harcourt LLP as legal counsel. TD Securities acted as financial advisor to the Indigenous-owned investment partnership and Borden Ladner Gervais LLP as legal counsel.

News conference

Members of the media are invited to attend a news conference in person or via teleconference. The event will be live streamed at http://www.alberta.ca/news.

| When: Where: Who: How: | Tuesday, July 30, 2024. Arrival by: 12:30 p.m. MDT. Event: 1 – 2 p.m. MDT TC Energy Tower – 450 1 Street SW, Calgary AB Danielle Smith, Premier of Alberta François Poirier, President and Chief Executive Officer, TC Energy Chana Martineau, Chief Executive Officer, Alberta Indigenous Opportunities Corporation Makiinima, Chief Roy Fox, Kainai, Blood Tribe, Consortium Committee Lee Thom, Councillor, Kikino Metis Settlement, Consortium Committee To attend in person, RSVP to media@tcenergy.com with the names of media and crew attending. Deadline to register is 11 a.m. MDT, Tuesday, July 30, 2024. To attend via teleconference: Toll Free dial-in: 1-800-717-1738 Conference ID: 18896

|

About TC Energy

We’re a team of 7,000+ energy problem solvers working to safely move, generate and store the energy North America relies on. Today, we’re delivering solutions to the world’s toughest energy challenges – from innovating to deliver the natural gas that feeds LNG to global markets, to working to reduce emissions from our assets, to partnering with our neighbours, customers and governments to build the energy system of the future. It’s all part of how we continue to deliver sustainable returns for our investors and create value for communities.

TC Energy’s common shares trade on the Toronto (TSX) and New York (NYSE) stock exchanges under the symbol TRP. To learn more, visit us at TCEnergy.com.

FORWARD-LOOKING INFORMATION

This release contains certain information that is forward-looking and is subject to important risks and uncertainties (such statements are usually accompanied by words such as "anticipate", "expect", "believe", "may", "will", "should", "estimate", "intend" or other similar words). Forward-looking statements in this document are intended to provide TC Energy security holders and potential investors with information regarding TC Energy and its subsidiaries, including management's assessment of TC Energy's and its subsidiaries' future plans and financial outlook. All forward-looking statements reflect TC Energy's beliefs and assumptions based on information available at the time the statements were made and as such are not guarantees of future performance. As actual results could vary significantly from the forward-looking information, you should not put undue reliance on forward-looking information and should not use future-oriented information or financial outlooks for anything other than their intended purpose. We do not update our forward-looking information due to new information or future events, unless we are required to by law. For additional information on the assumptions made, and the risks and uncertainties which could cause actual results to differ from the anticipated results, refer to the most recent Quarterly Report to Shareholders and Annual Report filed under TC Energy’s profile on SEDAR+ at www.sedarplus.ca and with the U.S. Securities and Exchange Commission at www.sec.gov.

-30-

Media Inquiries:

Media Relations

media@tcenergy.com

403-920-7859 or 800-608-7859

Investor & Analyst Inquiries:

Gavin Wylie / Hunter Mau

investor_relations@tcenergy.com

403-920-7911 or 800-361-6522

Photos accompanying this announcement are available at https://www.globenewswire.com/NewsRoom/AttachmentNg/00f8fe89-e75d-431f-986e-590362a9de4f

https://www.globenewswire.com/NewsRoom/AttachmentNg/9c942deb-77d5-4e8e-a1fe-07124775dd70

A video accompanying this announcement is available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/0e06c85e-6fa0-43e5-b945-b61efd180c12

PDF available: http://ml.globenewswire.com/Resource/Download/f743bf5c-8728-4e9c-81d8-fd7b29e4a1e1