The Evolution of Fourth - Fifth Generation HIV Rapid Test Kits is Booming, the Market to Create USD 2 Billion Opportunities by 2028 - Arizton

The global HIV rapid test kits market is projected to grow from

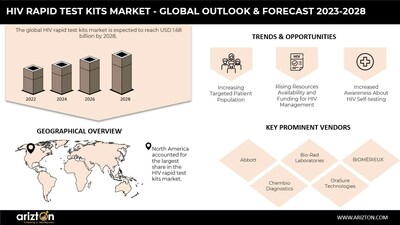

- Projected market growth from USD 1.43 billion in 2022 to USD 1.68 billion by 2028.

- Increased adoption of fourth- and fifth-generation HIV rapid test kits, enhancing reliability.

- Growth driven by government initiatives and digital innovations in HIV self-testing.

- High traction of digital health technologies in healthcare services.

- Potential challenges in addressing false negatives reported from some tests.

- Concerns over the accessibility and awareness of HIV self-testing tools.

Insights

Analyzing...

The application of fourth-generation and fifth-generation rapid test kits is currently high. The adoption and innovation of digital HIV self-testing tools have increased in recent times, with website-based innovation becoming highly popular.

Moreover, the introduction of digital support for HIV self-testing and government initiatives to boost the sales of the market. The application of digital tools in HIV management is increasing rapidly, which is expected to fuel the adoption of HIV self-testing rapid test kits. These interventions are currently improving HIV care and diagnosis. In 2021–2022, the HIV Self-Testing (HIVST) deployment and digital tool integrations in health services were emerging, but it was a priority for UNAIDS. In healthcare services, digital health technologies are achieving high traction in high-and middle-income countries. Furthermore, telemedicine has allowed the continuity of HIV care for many patients. The COVID-19 pandemic covers the roadmap for the evolution of HIV self-testing with digital support to reduce the gap in HIV care deliveries. . The application of digital tools in HIV management is increasing rapidly, which is expected to fuel the adoption of HIV self-testing rapid test kits. These interventions are currently improving HIV care and diagnosis. In 2021–2022, the HIV Self-Testing (HIVST) deployment and digital tool integrations in health services were at an emerging stage, but it was a priority for UNAIDS. In healthcare services, digital health technologies are achieving high traction in high-and middle-income countries. Furthermore, telemedicine has allowed the continuity of HIV care for many patients. The COVID-19 pandemic covers the roadmap for the evolution of HIV self-testing with digital support to reduce the gap in HIV care deliveries.

Implementing digital tools in the HIV rapid test kits market has a high potential to reach diverse audiences with the potential for widespread scale-up. The effective and efficient linkage between health services and patients increasing access to HIV testing. These factors are expected to increase HIV rapid test adoption in the diverse patient population, thereby driving the demand for market growth in upcoming years. According to the

Global HIV Rapid Test Kits Market Report Scope

Report Attributes | Details |

Market Size (2028) | |

Market Size (2022) | |

CAGR (2022-2028) | 2.70 % |

Base Year | 2022 |

Forecast Year | 2023-2028 |

Market Segments | Technology, Sample Type, Distribution Channels, and Geography |

Geographic Analysis | |

Countries Covered | The US, |

Key Leading Vendors | |

Market Dynamics |

|

Customization Request | If our report does not include the information you are searching for, you may contact us to have a report tailored to your specific business needs https://www.arizton.com/customize-report/3697 |

Click Here to Download the Free Sample Report

According to the

ADOPTION OF INNOVATION LATERAL FLOW IMMUNOASSAY IS HIGH ACROSS HIV RAPID TEST KITS MARKET

Several companies in the market are coming up with low-cost lateral flow-based HIV test kits. Many regulatory bodies, such as the WHO and other NGOs, are funding HIV test kit manufacturing. This will help companies to come up with unique products in the market. The level of innovations in the lateral flow immune assay is high in the market. In LMICs, there is a constant rise in the prevalence of HIV infection, which demands the usage of HIV rapid diagnostic test kits to increase significantly. Lateral flow immune assays are more user-friendly and are highly used among people with limited access to healthcare settings. Most health authorities and healthcare settings suggest immunochromatographic rapid test kits. In western African countries, the newly developed and available HIV rapid test kits, which are developed based on the immunochromatographic assay, are commonly used. Market players expect to have high market growth opportunities in

Click Here to Download the Free Sample Report

KEY COMPANY PROFILES

Abbott - Bio-Rad Laboratories

- BIOMÉRIEUX

- Chembio Diagnostics

- OraSure Technologies

- Atomo Diagnostics

- AccuBioTech

- bioLytical Laboratories

- Biosynex

- Cupid Limited

- DIALAB

- HUMAN

- INTEC

J. Mitra & Co- Meril Life Sciences

MP Biomedicals - Medsource Ozone Biomedicals

- Nanjing Synthgene Medical Technology

- Premier Medical

- SD Biosensor

- KHB (Shanghai Kehua Bio-Engineering co., Ltd.)

- Türklab

A.S . Trinity Biotech - Wantai BioPharma

- Wondfo

MARKET SEGMENTATION

Technology

- Lateral Flow Immunoassay

- Immunofiltration

Sample Type

- Blood

- Oral Fluid

- Urine

Distribution Channels

- Offline

- Online

Geography

North America - US

Canada Europe France Italy Ukraine Portugal Russia - APAC

China India Indonesia Thailand Vietnam Latin America Brazil Mexico Columbia Middle East &Africa South Africa Mozambique Kenya Nigeria Tanzania

CHECK OUT SOME OF THE TOP-SELLING RESEARCH RELATED REPORTS

Fertility Test Market - Global Outlook & Forecast 2022-2027: The global fertility test market is expected to reach

Lateral Flow Assays Market - Global Outlook & Forecast 2023-2028: The global lateral flow assays market is expected to reach

COVID-19 Rapid Antigen Test Kits Market - Global Outlook & Forecast 2022-2027: The COVID-19 rapid antigen tests market is expected to reach

DNA Extraction

WHY ARIZTON?

24x7 availability – we are always there when you need us

200+ Fortune 500 Companies trust Arizton's report

5+ years of experience in delivering Insights at the Global, Regional & Country Level

TABLE OF CONTENT

1 RESEARCH METHODOLOGY

2 RESEARCH OBJECTIVES

3 RESEARCH PROCESS

4

4.1 MARKET DEFINITION

4.1.1 INCLUSIONS

4.1.2 EXCLUSIONS

4.1.3 MARKET ESTIMATION CAVEATS

4.2 BASE YEAR

4.3 SCOPE OF THE STUDY

4.3.1 MARKET BY TECHNOLOGY

4.3.2 MARKET BY SAMPLE TYPE

4.3.3 MARKET BY DISTRIBUTION CHANNELS

4.3.4 MARKET SEGMENTATION BY GEOGRAPHY

5 REPORT ASSUMPTIONS & CAVEATS

5.1 KEY CAVEATS

5.2 CURRENCY CONVERSION

5.3 MARKET DERIVATION

6 MARKET AT A GLANCE

7 PREMIUM INSIGHTS

7.1 OVERVIEW

8 INTRODUCTION

8.1 OVERVIEW

9 MARKET OPPORTUNITIES & TRENDS

9.1 INTRODUCTION OF NEXT GENERATION HIV RAPID TEST KITS

9.2 INCREASE IN HIV SELF-TESTING BY GOVERNMENT BODIES

9.3 DIGITAL SUPPORT FOR HIV SELF-TESTING

10 MARKET GROWTH ENABLERS

10.1 INCREASING HIV PATIENT POPULATION

10.2 INCREASED RESOURCES AVAILABILITY AND FUNDING FOR HIV MANAGEMENT

10.3 INCREASED AWARENESS OF HIV SELF-TESTING

11 MARKET RESTRAINTS

11.1 INCREASING INCIDENCES OF FALSE NEGATIVES

11.2 LIMITATIONS & CHALLENGES ASSOCIATED WITH HIV TESTING

11.3 LOW ACCESSIBLITY & LACK OF AWARENESS FOR HIVST

12 MARKET LANDSCAPE

12.1 MARKET OVERVIEW

12.1.1 INSIGHTS BY TECHNOLOGY

12.1.2 INSIGHTS BY SAMPLE TYPE

12.1.3 INSIGHTS BY DISTRIBUTION CHANNELS

12.1.4 INSIGHTS BY GEOGRAPHY

12.2 MARKET SIZE & FORECAST

12.3 FIVE FORCES ANALYSIS

12.3.1 THREAT OF NEW ENTRANTS

12.3.2 BARGAINING POWER OF SUPPLIERS

12.3.3 BARGAINING POWER OF BUYERS

12.3.4 THREAT OF SUBSTITUTES

12.3.5 COMPETITIVE RIVALRY

13 TECHNOLOGY

13.1 MARKET SNAPSHOT & GROWTH ENGINE

13.2 MARKET OVERVIEW

13.3 LATERAL FLOW IMMUNOASSAY

13.3.1 MARKET OVERVIEW

13.3.2 MARKET SIZE & FORECAST

13.3.3 MARKET BY GEOGRAPHY

13.4 IMMUNOFILTRATION

13.4.1 MARKET OVERVIEW

13.4.2 MARKET SIZE & FORECAST

13.4.3 MARKET BY GEOGRAPHY

14 SAMPLE TYPE

14.1 MARKET SNAPSHOT & GROWTH ENGINE

14.2 MARKET OVERVIEW

14.3 BLOOD

14.3.1 MARKET OVERVIEW

14.3.2 MARKET SIZE & FORECAST

14.3.3 MARKET BY GEOGRAPHY

14.4 ORAL FLUID

14.4.1 MARKET OVERVIEW

14.4.2 MARKET SIZE & FORECAST

14.4.3 MARKET BY GEOGRAPHY

14.5 URINE

14.5.1 MARKET OVERVIEW

14.5.2 MARKET SIZE & FORECAST

14.5.3 MARKET BY GEOGRAPHY

15 DISTRIBUTION CHANNEL

15.1 MARKET SNAPSHOT & GROWTH ENGINE

15.2 MARKET OVERVIEW

15.3 OFFLINE

15.3.1 MARKET OVERVIEW

15.3.2 MARKET SIZE & FORECAST

15.3.3 MARKET BY GEOGRAPHY

15.4 ONLINE

15.4.1 MARKET OVERVIEW

15.4.2 MARKET SIZE & FORECAST

15.4.3 MARKET BY GEOGRAPHY

16 GEOGRAPHY

16.1 MARKET SNAPSHOT & GROWTH ENGINE

16.2 GEOGRAPHIC OVERVIEW

17 NORTH AMERICA

17.1 MARKET OVERVIEW

17.2 MARKET SIZE & FORECAST

17.3 TECHNOLOGY

17.3.1 MARKET SIZE & FORECAST

17.4 SAMPLE TYPE

17.4.1 MARKET SIZE & FORECAST

17.5 DISTRIBUTION CHANNELS

17.5.1 MARKET SIZE & FORECAST

17.6 KEY COUNTRIES

17.6.1 US: MARKET SIZE & FORECAST

17.6.2

18 APAC

18.1 MARKET OVERVIEW

18.2 MARKET SIZE & FORECAST

18.3 TECHNOLOGY

18.3.1 MARKET SIZE & FORECAST

18.4 SAMPLE TYPE

18.4.1 MARKET SIZE & FORECAST

18.5 DISTRIBUTION CHANNELS

18.5.1 MARKET SIZE & FORECAST

18.6 KEY COUNTRIES

18.6.1

18.6.2

18.6.3

18.6.4

18.6.5

19 MIDDLE EAST &

19.1 MARKET OVERVIEW

19.2 MARKET SIZE & FORECAST

19.3 TECHNOLOGY

19.3.1 MARKET SIZE & FORECAST

19.4 SAMPLE TYPE

19.4.1 MARKET SIZE & FORECAST

19.5 DISTRIBUTION CHANNELS

19.5.1 MARKET SIZE & FORECAST

19.6 KEY COUNTRIES

19.6.1

19.6.2

19.6.3

19.6.4

19.6.5

20 EUROPE

20.1 MARKET OVERVIEW

20.2 MARKET SIZE & FORECAST

20.3 TECHNOLOGY

20.3.1 MARKET SIZE & FORECAST

20.4 SAMPLE TYPE

20.4.1 MARKET SIZE & FORECAST

20.5 DISTRIBUTION CHANNELS

20.5.1 MARKET SIZE & FORECAST

20.6 KEY COUNTRIES

20.6.1

20.6.2

20.6.3

20.6.4

20.6.5

21 LATIN AMERICA

21.1 MARKET OVERVIEW

21.2 MARKET SIZE & FORECAST

21.3 TECHNOLOGY

21.3.1 MARKET SIZE & FORECAST

21.4 SAMPLE TYPE

21.4.1 MARKET SIZE & FORECAST

21.5 DISTRIBUTION CHANNELS

21.5.1 MARKET SIZE & FORECAST

21.6 KEY COUNTRIES

21.6.1

21.6.2

21.6.3

22 COMPETITIVE LANDSCAPE

22.1 COMPETITION OVERVIEW

22.2 MARKET SHARE ANALYSIS

22.2.1

22.2.2 BIO-RAD LABORATORIES

22.2.3 BIOMÉRIEUX

22.2.4 CHEMBIO DIAGNOSTICS

22.2.5 ORASURE TECHNOLOGIES

23 KEY COMPANY PROFILES

23.1

23.1.1 BUSINESS OVERVIEW

23.1.2 PRODUCT OFFERINGS

23.1.3 KEY STRATEGIES

23.1.4 KEY STRENGTHS

23.1.5 KEY OPPORTUNITIES

23.2 BIO-RAD LABORATORIES

23.3 BIOMÉRIEUX

23.4 CHEMBIO DIAGNOSTICS

23.5 ORASURE TECHNOLOGIES

24 OTHER PROMINENT VENDORS

24.1 ATOMO DIAGNOSTICS

24.1.1 BUSINESS OVERVIEW

24.1.2 PRODUCT OFFERINGS

24.2 ACCUBIOTECH

24.3 BIOLYTICAL LABORATORIES

24.4 BIOSYNEX

24.5 CUPID LIMITED

24.6 HUMAN

24.7 INTEC

24.8

24.9 MERIL LIFE SCIENCES

24.10

24.11 MEDSOURCE OZONE BIOMEDICALS

24.12

24.13 PREMIER MEDICAL

24.14 SD BIOSENSOR

24.15 KHB (SHANGHAI KEHUA BIO-ENGINEERING)

24.16 TÜRKLAB A.S.

24.17

24.18 WANTAI BIOPHARMA

24.19 WONDFO

25 REPORT SUMMARY

25.1 KEY TAKEAWAYS

25.2 STRATEGIC RECOMMENDATIONS

26 QUANTITATIVE SUMMARY

26.1 MARKET BY GEOGRAPHY

26.2 MARKET BY TECHNOLOGY

26.3 MARKET BY SAMPLE TYPE

26.4 MARKET BY DISTRIBUTION CHANNELS

26.5 TECHNOLOGY: MARKET BY GEOGRAPHY

26.5.1 LATERAL FLOW IMMUNOASSAY: MARKET BY GEOGRAPHY

26.5.2 IMMUNOFILTRATION: MARKET BY GEOGRAPHY

26.6 SAMPLE TYPE: MARKET BY GEOGRAPHY

26.6.1 BLOOD SAMPLE TYPE: MARKET BY GEOGRAPHY

26.6.2 ORAL FLUID SAMPLE TYPE: MARKET BY GEOGRAPHY

26.6.3 URINE SAMPLE TYPE: MARKET BY GEOGRAPHY

26.7 DISTRIBUTION CHANNELS: MARKET BY GEOGRAPHY

26.7.1 OFFLINE DISTRIBUTION CHANNELS: MARKET BY GEOGRAPHY

26.7.2 ONLINE DISTRIBUTION CHANNELS: MARKET BY GEOGRAPHY

27 APPENDIX

27.1 ABBREVIATIONS

About Us:

Arizton Advisory and Intelligence is an innovative and quality-driven firm that offers cutting-edge research solutions to clients worldwide. We excel in providing comprehensive market intelligence reports and advisory and consulting services.

We offer comprehensive market research reports on consumer goods & retail technology, automotive and mobility, smart tech, healthcare, life sciences, industrial machinery, chemicals, materials, I.T. and media, logistics, and packaging. These reports contain detailed industry analysis, market size, share, growth drivers, and trend forecasts.

Arizton comprises a team of exuberant and well-experienced analysts who have mastered generating incisive reports. Our specialist analysts possess exemplary skills in market research. We train our team in advanced research practices, techniques, and ethics to outperform in fabricating impregnable research reports.

Call: +1-312-235-2040

+1 302 469 0707

Mail: enquiry@arizton.com

Photo: https://mma.prnewswire.com/media/1984906/HIV_Rapid_Tests_Kit_Market.jpg

Logo: https://mma.prnewswire.com/media/818553/Arizton_Logo.jpg

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/the-evolution-of-fourth--fifth-generation-hiv-rapid-test-kits-is-booming-the-market-to-create-usd-2-billion-opportunities-by-2028---arizton-301723724.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/the-evolution-of-fourth--fifth-generation-hiv-rapid-test-kits-is-booming-the-market-to-create-usd-2-billion-opportunities-by-2028---arizton-301723724.html

SOURCE Arizton Advisory & Intelligence