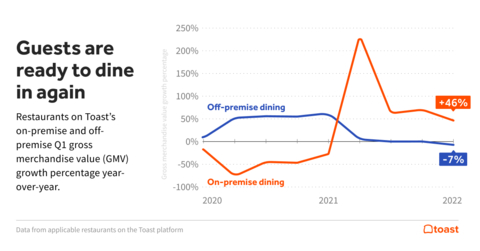

Toast Restaurant Q1 Trends Report: Dine In Growth Surges While Takeout and Delivery Decline

Guests tip

(Graphic: Business Wire)

In Q1, the operating environment continued to change rapidly for restaurant operators – pandemic restrictions lifted throughout the

Dining in surges while takeout and delivery decline

Diners are ready for the warm weather and enjoying their favorite meals in person. On-premise dining sales were up

Restaurant sales saw strongest growth in the West and Northeast

While all regions in the

The restaurant recovery is real in major markets across the

Tipping remains steady

On average across all tipped transactions, tipping across full-service and quick-service restaurants remained steady at an average of

Guests in the Midwest were slightly more generous this quarter, with

Guests tip more when they dine-in versus ordering take-out or delivery

Guests continue to appreciate great service when dining in. Across all tipped transactions they are tipping significantly more when they are on premise versus when ordering takeout or delivery.

Top performing cuisines

Asian-Inspired cuisine is the top performing cuisine among guests followed by breakfast and middle eastern.

Methodology

The Restaurant Trends Report, powered by Toast, uncovers key trends across the restaurant industry through aggregated sales data from restaurants on the Toast platform, which has approximately 62,000 locations as of

About Toast

Toast is the end-to-end platform built for restaurants of all sizes. Toast provides a single platform of software as a service (SaaS) products and financial technology solutions that give restaurants everything they need to run their business across point of sale, operations, digital ordering and delivery, marketing and loyalty, and team management. By serving as the restaurant operating system across dine-in, takeout, and delivery channels, Toast helps restaurants streamline operations, increase revenue, and deliver amazing guest experiences. Toast proudly serves approximately 48,000 restaurant locations.

TOST-CORP

View source version on businesswire.com: https://www.businesswire.com/news/home/20220518005199/en/

Media: media@toasttab.com

Source: