Tinka Increases Indicated Zinc Resources at Ayawilca by 68%

Tinka Resources Limited (TSXV:TK, OTCQB:TKRFF) announced an updated Mineral Resource estimate for its Ayawilca project in Peru. The Indicated Zinc Zone now boasts 19 million tonnes with a grade of 7.2% zinc, containing 3 billion pounds of zinc, a 68% increase from the previous estimate. The Inferred Zinc Zone holds 47.9 million tonnes at 5.4% zinc, with 5.7 billion pounds of zinc. The Tin Zone's Inferred resources increased to 8.4 million tonnes at 1.0% tin. The company has $13 million in cash and no debt, indicating strong financial positioning for future developments.

- Indicated Zinc Zone resources increased by 68% to 3 billion pounds of contained zinc.

- Indicated Mineral Resource now constitutes 35% of total zinc inventory.

- Updated Tin Zone grade increased to 1.0% Sn from 0.63% Sn.

- Company has C$13 million in cash and no debt, ensuring funding for future projects.

- Decrease in tonnage in the Tin Zone despite higher grades.

- The previous preliminary economic assessment is now outdated.

Insights

Analyzing...

VANCOUVER, BC / ACCESSWIRE / September 27, 2021 / Tinka Resources Limited ("Tinka" or the "Company") (TSXV:TK)(BVL:TK)(OTCQB:TKRFF) is pleased to announce an updated Mineral Resource estimate for its

Key Highlights of the Updated Mineral Resource Estimates at Ayawilca:

- Indicated Zinc Zone Mineral Resource of 19.0 million tonnes grading

7.2% zinc,0.2% lead and 16.8 g/t silver containing :- 3.0 billion pounds of zinc;

- 10.3 million ounces of silver; and

- 87 million pounds of lead.

- Inferred Zinc Zone Mineral Resource of 47.9 million tonnes grading

5.4% zinc,0.4% lead & 20.0 g/t silver containing :- 5.7 billion pounds of zinc;

- 30.7 million ounces of silver; and

- 370 million pounds of lead.

- Inferred Tin Mineral Resource of 8.4 million tonnes grading

1.0% tin, containing :- 189 million pounds of tin.

The Tin Zone and Zinc Zone resources do not overlap, with the Tin Zone situated predominantly beneath the Zinc Zone. The Mineral Resources are reported above a net smelter return (NSR) cut-off value of US

Dr. Graham Carman, Tinka's President and CEO, stated: "We are very pleased to report an updated mineral resource estimation for the Ayawilca Zinc and Tin Zones. A major step forward is the large increase in Indicated Zinc Zone resources to 3.0 billion pounds of contained zinc (previously 1.8 billion pounds), a

"In addition, the updated Tin Zone Mineral Resource is now at a substantially higher grade (

"Tinka has been growing the Ayawilca Mineral Resources consistently since 2015, and we have taken great strides positioning it as one of the largest and highest grade undeveloped zinc dominant deposits in the Americas. We look forward to completing and announcing results of an updated PEA for Ayawilca in the coming weeks. The Company's work programs are fully funded for the foreseeable future, with C

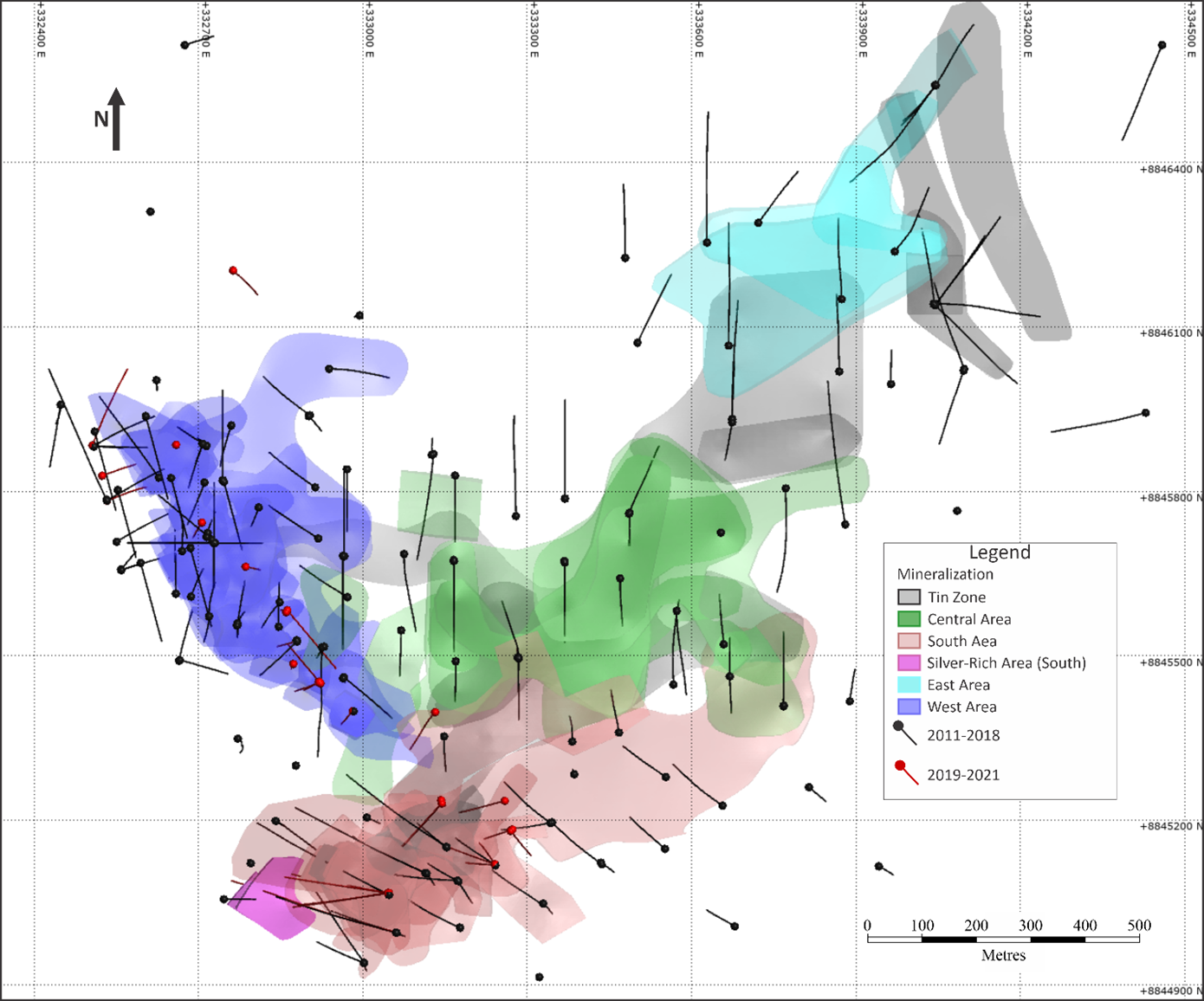

Figure 1 - Ayawilca drill hole map highlighting updated Mineral Resource wireframes and 2019-2021 holes

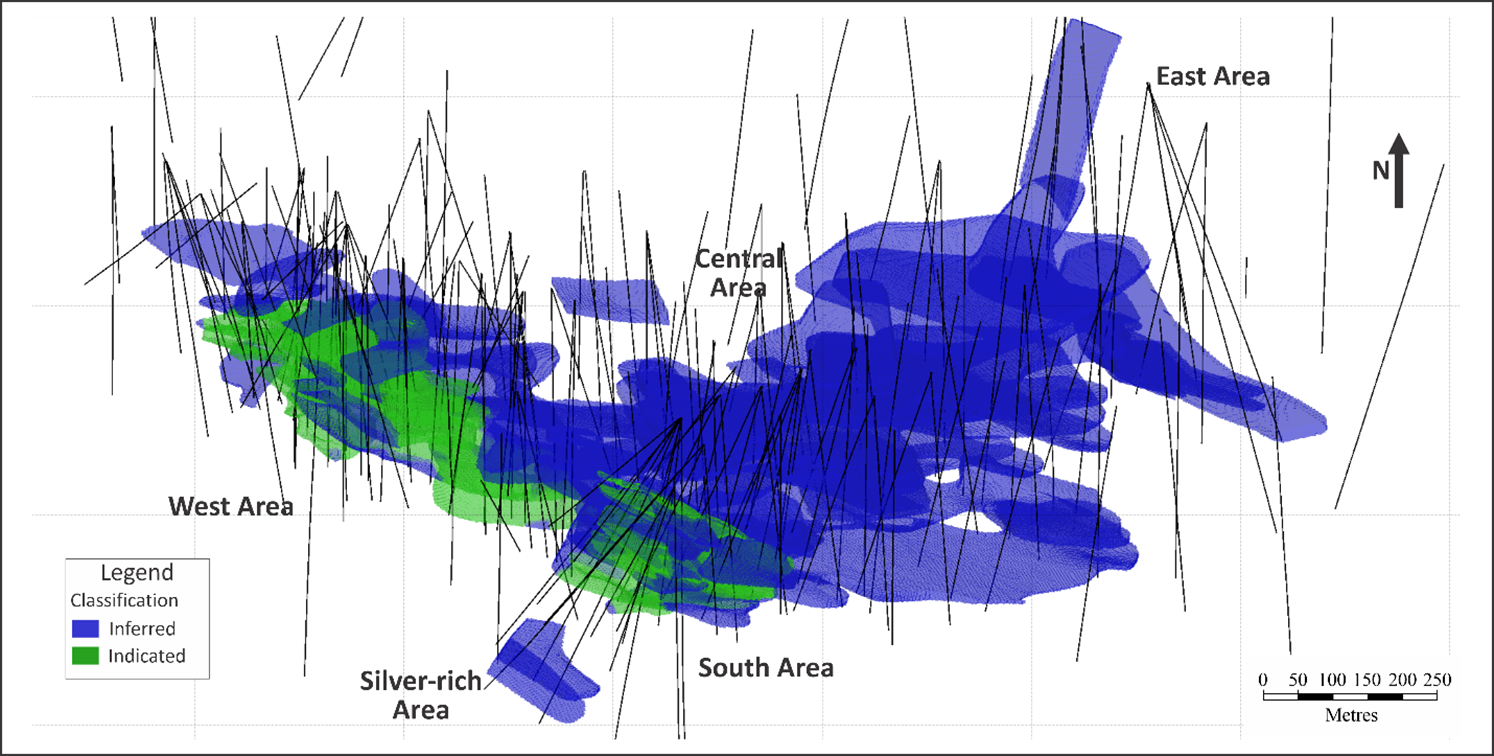

Figure 2 -3D image of Ayawilca Zinc Zone resource wireframes and resource classification

Detail of Mineral Resource Estimates

The updated Mineral Resource estimates for the Ayawilca Zinc Zone and Ayawilca Tin Zone, with an effective date of August 30, 2021, were prepared by SLR Consulting (Canada) Limited (SLR). Estimated Mineral Resources prepared by SLR used drill results available to February 28, 2021. The Ayawilca deposit resource database includes 209 drill holes totalling 88,110 m of drilling. The Zinc Zone Mineral Resources are hosted as lenses and veins of semi-massive to massive sulphides (mostly sphalerite, pyrite, galena and pyrrhotite) and magnetite hosted by Pucará Group limestone of Mesozoic age beneath a flat-dipping sandstone 150 m to 200 m thick belonging to the Goyllar Group. The Zinc Zone and Tin Zone Mineral Resources are reported separately as they host different metals and are spatially separated. The Mineral Resource estimates conform to Canadian Institute of Mining, Metallurgy and Petroleum Definition Standards for Mineral Resources and Mineral Reserves dated May 10, 2014 (CIM 2014 definitions).

Indicated Mineral Resources are estimated to total 19.0 Mt at average grades of

Table 1: Ayawilca Zinc Zone Mineral Resources as of August 30, 2021

Tinka Resources Limited - Ayawilca Property

Classification/ | Tonnage | NSR | Grade | Contained Metal | ||||||

(% Zn) | (g/t Ag) | (% Pb) | (Mlb Zn) | (Moz Ag) | (Mlb Pb) | |||||

| Indicated | ||||||||||

West | 11.6 | 108 | 6.26 | 15.9 | 0.25 | 1,607 | 6.0 | 65 | ||

South | 7.3 | 145 | 8.56 | 18.3 | 0.13 | 1,383 | 4.3 | 22 | ||

Total Indicated | 19.0 | 123 | 7.15 | 16.8 | 0.21 | 2,990 | 10.3 | 87 | ||

Inferred | ||||||||||

West | 5.5 | 106 | 5.90 | 20.8 | 0.42 | 719 | 3.7 | 52 | ||

South | 9.0 | 134 | 7.45 | 34.4 | 0.33 | 1,477 | 10.0 | 65 | ||

Central | 17.4 | 81 | 4.55 | 13.8 | 0.34 | 1,747 | 7.7 | 132 | ||

East | 10.6 | 88 | 5.04 | 14.4 | 0.20 | 1,177 | 4.9 | 46 | ||

Silver | 0.4 | 93 | 3.58 | 106.7 | 0.65 | 33 | 1.4 | 6 | ||

Buffer | 4.9 | 87 | 4.66 | 19.2 | 0.63 | 504 | 3.0 | 69 | ||

Total Inferred | 47.9 | 96 | 5.36 | 20.0 | 0.35 | 5,657 | 30.7 | 370 | ||

Notes:

- CIM (2014) definitions were followed for Mineral Resources.

- Mineral Resources are reported above a cut-off net smelter return (NSR) value of US

$55 /t. - The requirement of a reasonable prospect of eventual economic extraction is met by having a minimum modelling width for mineralized zones of three metres, a cut-off based on reasonable input parameters, and continuity of mineralization consistent with a potential underground mining scenario.

- The NSR value was based on estimated metallurgical recoveries, assumed metal prices, and smelter terms, which include payable factors, treatment charges, penalties, and refining charges. Metal price assumptions were, US

$1.20 /lb Zn, US$22 /oz Ag, and US$0.95 /lb Pb. Metal recovery assumptions were,92% Zn,85% Ag, and70% Pb. The NSR value for each block was calculated using the following NSR factors; US$16.23 /% Zn, US$0.27 /g Ag, and US$10.20 /% Pb. - Payability is as follows; Zn

84% , Pb94% and Ag47% - The NSR value was calculated using the following formula:

NSR = Zn(%)*US$16.23 +Ag(g/t)*US$0.27 +Pb(%)*US$10.20 - Numbers may not add due to rounding.

Indium was previously included in the Zinc Zone resource estimation but is no longer reported.

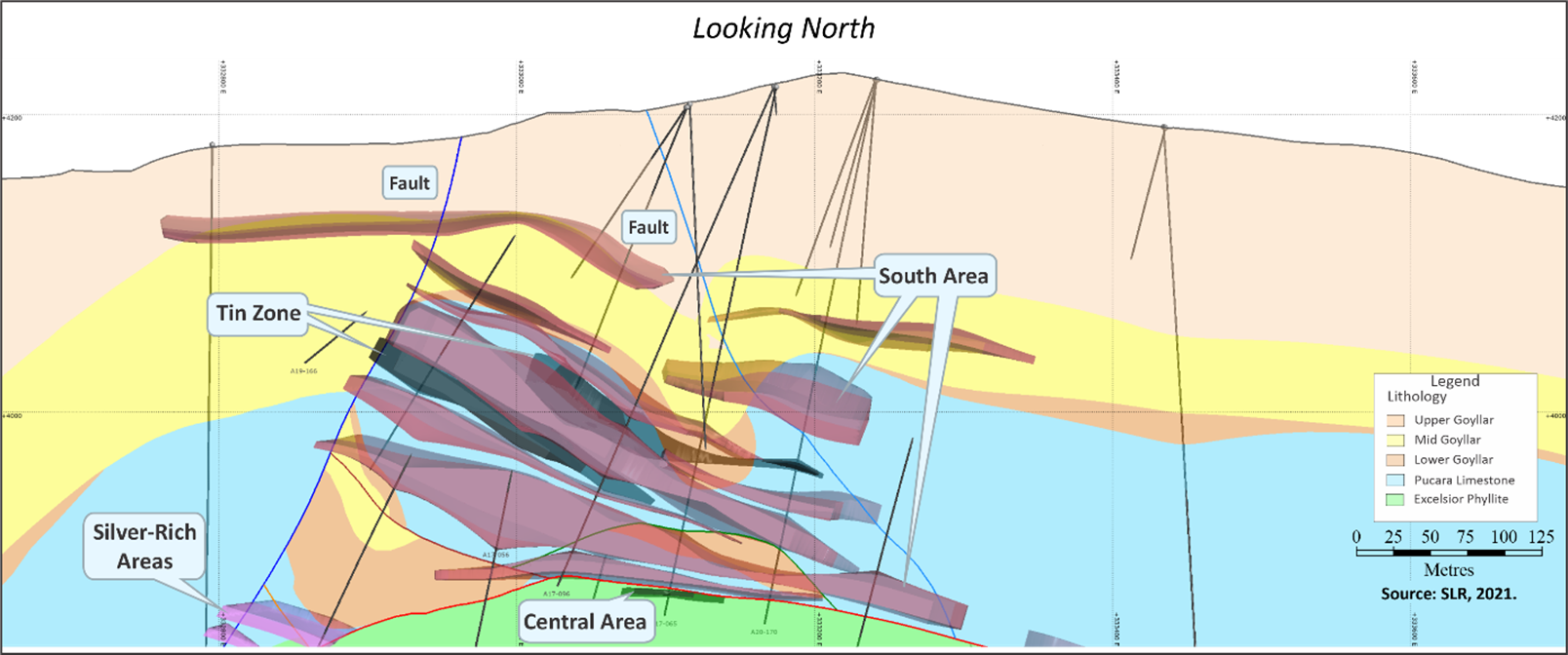

The Tin Zone Mineral Resources are hosted as disseminated cassiterite in massive to semi-massive pyrrhotite lenses typically (but not always) near the contact between the Pucara Group and underlying phyllite of the Devonian Excelsior Group.

Inferred Mineral Resources within the Tin Zone, reported at an NSR cut-off value of

Table 2: Ayawilca Tin Zone Inferred Mineral Resources as of August 30, 2021

Tinka Resources Limited - Ayawilca Property

Classification | Tonnage | NSR | Grade | Contained Metal |

| Inferred | 8.4 | 103 | 1.02 | 189 |

Notes:

- CIM (2014) definitions were followed for Mineral Resources.

- Mineral Resources are reported above a cut-off grade NSR value of US

$60 /t. - The requirement of a reasonable prospect of eventual economic extraction is met by having a minimum modelling width for mineralized zones of three metres, a cut-off based on reasonable input parameters, and continuity of mineralization consistent with a potential underground mining scenario.

- The NSR value was based on estimated metallurgical recoveries, assumed metal prices, and smelter terms, which include payable factors, treatment charges, penalties, and refining charges. Metal price assumptions were, US

$11.00 /lb Sn. Metal recovery assumptions were,70% Sn for blocks with Sn:Cu ≥ 5 and40% for Sn:Cu < 5. The NSR value for each block was calculated using the following NSR factors, US$141.64 per % Sn for blocks with Sn:Cu ≥ 5 and US$80.94 for blocks with Sn:Cu <5. - The NSR value was calculated using the following formulae:

If Sn:Cu ≥ 5: US$NSR = Sn(%)*US$141.64 - If Sn:Cu < 5: US$NSR = Sn(%)*US

$80.94 - Numbers may not add due to rounding.

Copper and silver were reported in the Tin Zone previously but are no longer reported because they are not expected to contribute materially to the economics of the project.

Depending on the deposit area, high grade tin and silver values were capped to

The Mineral Resource estimate for the Colquipucro silver oxide deposit (also referred to as "Colqui"), located 1.5 km from the Ayawilca deposit, remains unchanged since the 2016 effective date and is presented in Table 3.

Table 3: Colquipucro Silver Oxide Deposit Mineral Resources as of May 25, 2016

Tinka Resources Limited - Ayawilca Property

Classification/Zone | Tonnage | Grade | Contained Metal |

Indicated | |||

High Grade Lenses | 2.9 | 112 | 10.4 |

Low Grade Halo | 4.5 | 27 | 3.9 |

Total Indicated | 7.4 | 60 | 14.3 |

Inferred | |||

High Grade Lenses | 2.2 | 105 | 7.5 |

Low Grade Halo | 6.2 | 28 | 5.7 |

Total Inferred | 8.5 | 48 | 13.2 |

Notes:

- CIM (2014) definitions were followed for Mineral Resources.

- Mineral Resources are reported within a preliminary pit shell and above a cut-off grade of 15 g/t Ag for the low grade halo and 60 g/t Ag for the high grade lenses.

- The cut-off grade is based on a price of US

$24 /oz Ag. - Numbers may not add due to rounding.

Discussion and Analysis

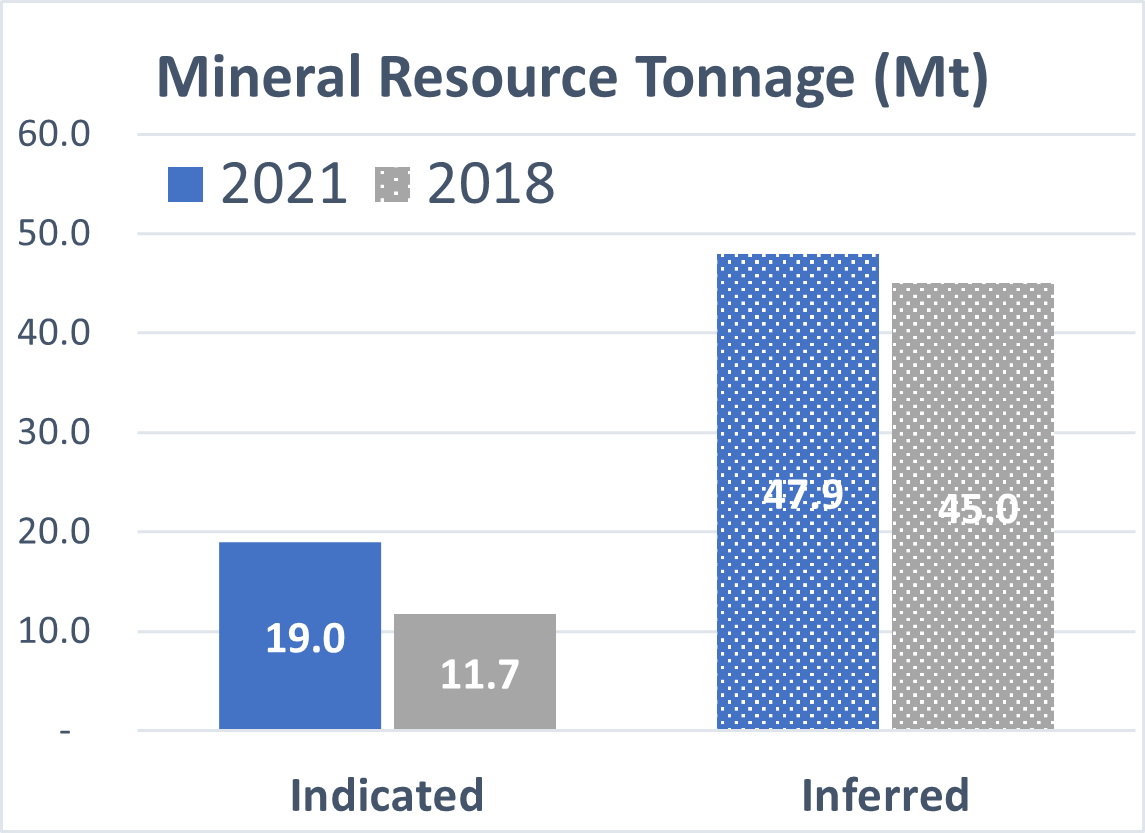

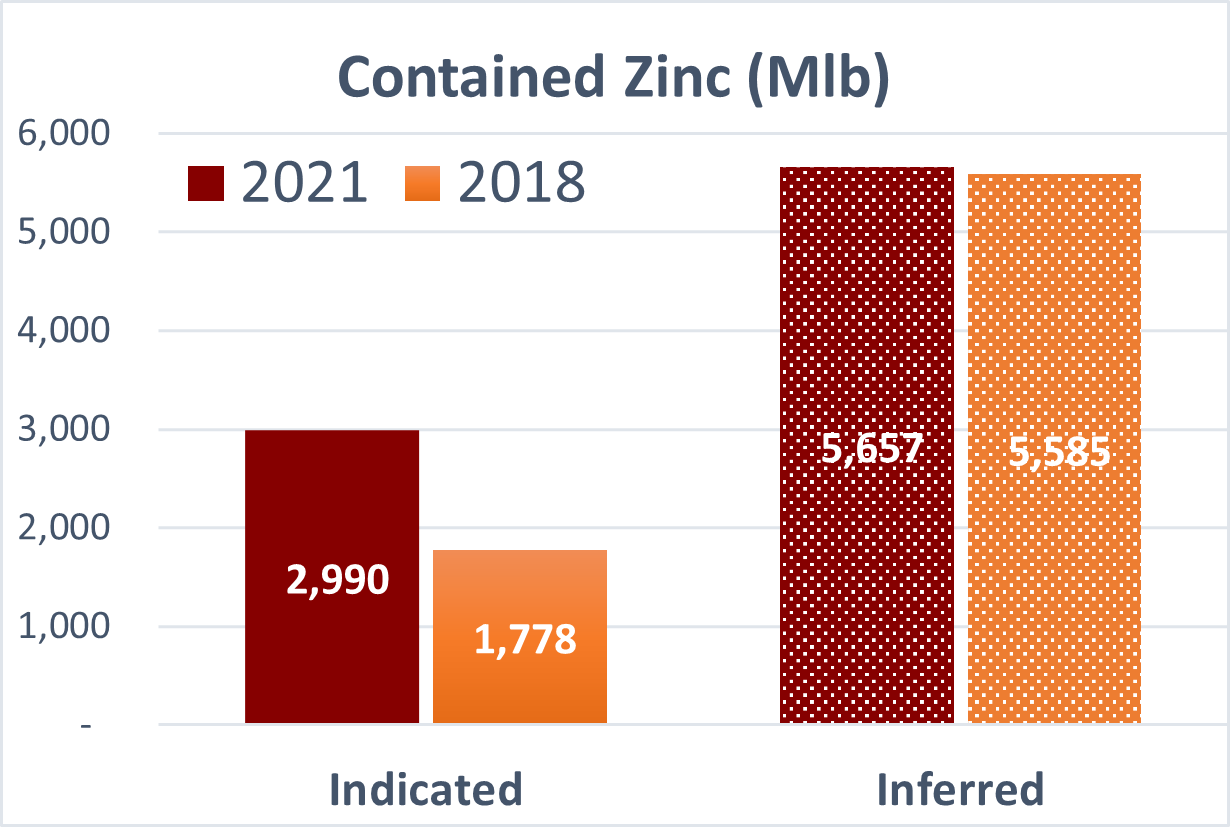

A comparison of the 2021 and 2018 Zinc Zone resources at US

Figure 3 - Ayawilca Zinc Zone deposit classification model

|  |

The geological model and wireframes for the updated model were produced in-house by Tinka. SLR refined the resource domains to align with the stratigraphy and limited their extent to the Pucará and Lower and Mid-Goyllar Formations. Similarly, the domains were constrained by the faults that are known to limit the mineralization. The new geological model, improved mineralization domains, as well as the new infill drilling led to an increase in resources assigned to the Indicated category. SLR constructed a buffer zone to allow interpolation in a limited area of 50 m surrounding the mineralization wireframe models. The Buffer Zone captures local high grade mineralization, in particular post-main stage zinc mineralization for which controls are not yet well constrained, and is highlighted in Figure 3. A generalized layout of the Zinc Zones at South Ayawilca is shown in Figure 4.

Increased average grades of lead and silver in the Ayawilca Zinc Zone resource are due to the inclusion of new resource areas higher in lead and silver (i.e., silver rich domains in the South Area) but low in zinc. These new areas are now included in the resource estimate due to higher NSR factors for both lead and zinc. The removal of indium from the 2018 NSR value calculation for the Ayawilca Zinc Zone has slightly improved the average zinc grade by narrowing the resource wireframes to better represent the zinc mineralization. In addition, although the NSR cut-off value is the same as in 2018 (US

While the mineralization domains were expanded for the Ayawilca Tin Zone in the current estimation, there was nevertheless a decrease in tonnage from the 2018 resource estimation. The decrease in tonnage was accompanied by a significant increase in tin grade. The increase in average tin grade is due to several factors including:

- The discovery of new high grade tin mineralization in 2020 and 2021;

- A higher effective NSR cut-off value applied to the Mineral Resource (US

$60 /t); - The removal of copper and silver mineralization from NSR value; and

- A decrease in the tin factor in the NSR value calculation.

A National Instrument 43-101 Technical Report will be filed on SEDAR within 45 days.

Figure 4 - 3D view of Ayawilca Zinc Zone wireframes

Figure 5 - Generalized E-W cross section of Zinc Zones at South Ayawilca

Qualified Person - Mineral Resources: The Mineral Resources disclosed in this press release have been estimated by Ms. Dorota El Rassi, P.Eng., SLR Consultant Engineer and Ms. Katharine M. Masun, MSA, M.Sc., P.Geo., SLR Consultant Geologist, both independent of Tinka. By virtue of their education and relevant experience, Ms. El Rassi and Ms. Masun are "Qualified Persons" for the purpose of National Instrument 43-101. The Mineral Resources have been classified in accordance with CIM Definition Standards for Mineral Resources and Mineral Reserves (May, 2014). Ms. El Rassi and Ms. Masun have read and approved the contents of this press release as it pertains to the disclosed Mineral Resource estimates.

The Qualified Person, Dr. Graham Carman, Tinka's President and CEO, and a Fellow of the Australasian Institute of Mining and Metallurgy, has reviewed and verified the technical contents of this release.

Disclaimer: As a result of the new resource estimation, the Company's previously disclosed preliminary economic assessment on the Ayawilca project is no longer current and should not be relied on. The Company has commissioned an updated PEA on the Ayawilca project based on the new resource estimate and upon receipt of the updated PEA (expected in approximately 2 weeks), the Company intends to issue a news release disclosing the results of the PEA.

On behalf of the Board, " Graham Carman " | Further Information: |

About Tinka Resources Limited

Tinka is an exploration and development company with its flagship property being the

Forward Looking Statements: Certain information in this news release contains forward-looking statements and forward-looking information within the meaning of applicable securities laws (collectively "forward-looking statements"). All statements, other than statements of historical fact are forward-looking statements. Forward-looking statements are based on the beliefs and expectations of Tinka as well as assumptions made by and information currently available to Tinka's management. Such statements reflect the current risks, uncertainties and assumptions related to certain factors including, without limitations: timing of planned work programs and results varying from expectations; delay in obtaining results; changes in equity markets; uncertainties relating to the availability and costs of financing needed in the future; equipment failure, unexpected geological conditions; imprecision in resource estimates or metal recoveries; success of future development initiatives; competition and operating performance; environmental and safety risks; the Company's expectations regarding the Ayawilca Project PEA; the political environment in which the Company operates continuing to support the development and operation of mining projects; risks related to negative publicity with respect to the Company or the mining industry in general; the threat associated with outbreaks of viruses and infectious diseases, including the novel COVID-19 virus; delays in obtaining or failure to obtain necessary permits and approvals from local authorities; community agreements and relations; and, other development and operating risks. Should any one or more of these risks or uncertainties materialize, or should any underlying assumptions prove incorrect, actual results may vary materially from those described herein. Although Tinka believes that assumptions inherent in the forward-looking statements are reasonable, forward-looking statements are not guarantees of future performance and accordingly undue reliance should not be put on such statements due to the inherent uncertainty therein. Except as may be required by applicable securities laws, Tinka disclaims any intent or obligation to update any forward-looking statement.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release

SOURCE: Tinka Resources Limited

View source version on accesswire.com:

https://www.accesswire.com/665504/Tinka-Increases-Indicated-Zinc-Resources-at-Ayawilca-by-68