Annual Letter to Shareholders, 2024 In Review

Tekumo (TKMO) reported significant growth in 2024, achieving gross revenue of $4.36 million, marking a 62.1% YOY increase and a 43.8% Q4 over Q3 growth. The company maintained a 35.3% gross margin while operating at a net loss of $0.75 million (17.6% of Revenue).

Key developments include substantial progress in Tekumo software development, featuring automated workflows and AI-driven improvements. The company launched Tekumo Managed Services for OEM and Enterprise customer support, and strengthened its leadership team with key appointments bringing 90+ years of collective industry experience.

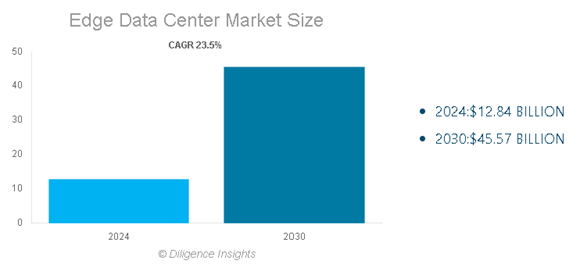

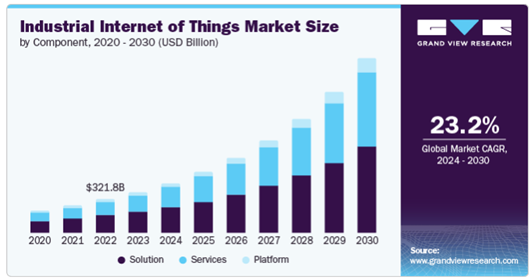

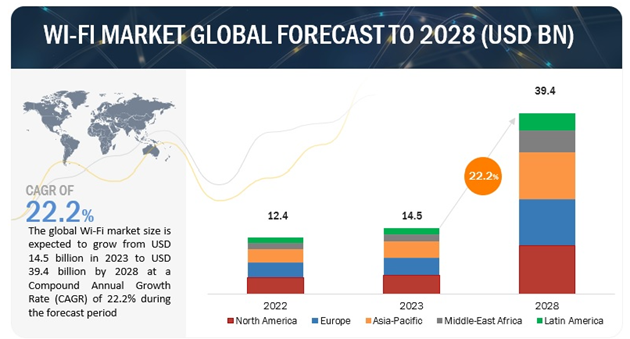

Operating in the global IT services market valued at $1.16 trillion, Tekumo targets multiple growth sectors including edge data centers (projected $45.57 billion by 2030), Industrial IoT (expected to reach $3.3 trillion by 2030), and WiFi market (forecasted $39.4 billion by 2028).

Tekumo (TKMO) ha registrato una crescita significativa nel 2024, raggiungendo un fatturato lordo di 4,36 milioni di dollari, segnando un aumento del 62,1% rispetto all'anno precedente e una crescita del 43,8% dal terzo al quarto trimestre. L'azienda ha mantenuto un margine lordo del 35,3% pur registrando una perdita netta di 0,75 milioni di dollari (17,6% del fatturato).

Sviluppi chiave includono progressi sostanziali nello sviluppo del software Tekumo, con flussi di lavoro automatizzati e miglioramenti guidati dall'IA. L'azienda ha lanciato i Servizi Gestiti Tekumo per il supporto ai clienti OEM e alle imprese, e ha rafforzato il suo team di leadership con importanti nomine che portano oltre 90 anni di esperienza collettiva nel settore.

Operando nel mercato globale dei servizi IT, valutato 1,16 trilioni di dollari, Tekumo si concentra su più settori di crescita, tra cui i centri dati edge (previsione di 45,57 miliardi di dollari entro il 2030), l'IoT industriale (che si prevede raggiunga 3,3 trilioni di dollari entro il 2030) e il mercato del WiFi (stimato a 39,4 miliardi di dollari entro il 2028).

Tekumo (TKMO) reportó un crecimiento significativo en 2024, alcanzando ingresos brutos de 4.36 millones de dólares, marcando un aumento del 62.1% interanual y un crecimiento del 43.8% del cuarto trimestre con respecto al tercero. La empresa mantuvo un margen bruto del 35.3% mientras operaba con una pérdida neta de 0.75 millones de dólares (17.6% de los ingresos).

Los desarrollos clave incluyen un progreso sustancial en el desarrollo del software Tekumo, con flujos de trabajo automatizados y mejoras impulsadas por IA. La empresa lanzó Tekumo Managed Services para soporte a clientes OEM y empresariales, y fortaleció su equipo de liderazgo con nombramientos clave que aportan más de 90 años de experiencia colectiva en la industria.

Operando en el mercado global de servicios IT valorado en 1.16 billones de dólares, Tekumo se dirige a múltiples sectores de crecimiento, incluidos los centros de datos en el borde (se proyecta que alcancen 45.57 billones de dólares para 2030), IoT industrial (se espera que llegue a 3.3 billones de dólares para 2030) y el mercado de WiFi (pronosticado en 39.4 billones de dólares para 2028).

Tekumo (TKMO)는 2024년에 상당한 성장을 기록하며 436만 달러의 총 수익을 달성했습니다. 이는 전년 대비 62.1% 증가한 수치이며, 3분기 대비 4분기 성장률은 43.8%에 달합니다. 회사는 35.3%의 총 마진을 유지하면서 75만 달러(수익의 17.6%)의 순손실을 기록했습니다.

주요 개발 사항으로는 Tekumo 소프트웨어 개발의 획기적인 발전이 있으며, 자동화된 워크플로우와 AI 기반의 개선 사항이 포함됩니다. 회사는 OEM 및 기업 고객 지원을 위한 Tekumo 관리 서비스를 출시했으며, 90년 이상의 집단 산업 경험을 갖춘 주요 인사들을 영입하여 리더십 팀을 강화했습니다.

1.16조 달러로 평가되는 글로벌 IT 서비스 시장에서 운영되는 Tekumo는 2030년까지 455억 달러로 예상되는 엣지 데이터 센터, 2030년까지 3.3조 달러에 이를 것으로 예상되는 산업 IoT, 그리고 2028년까지 394억 달러로 예측되는 WiFi 시장 등 여러 성장 분야를 목표로 하고 있습니다.

Tekumo (TKMO) a enregistré une croissance significative en 2024, atteignant un chiffre d'affaires brut de 4,36 millions de dollars, marquant une augmentation de 62,1% par rapport à l'année précédente et une croissance de 43,8% du quatrième trimestre par rapport au troisième trimestre. L'entreprise a maintenu une marge brute de 35,3% tout en opérant avec une perte nette de 0,75 million de dollars (17,6% du chiffre d'affaires).

Les développements clés comprennent des progrès substantiels dans le développement du logiciel Tekumo, avec des flux de travail automatisés et des améliorations alimentées par l'IA. L'entreprise a lancé les Services Gérés Tekumo pour le soutien aux clients OEM et aux entreprises, et a renforcé son équipe de direction avec des nominations clés apportant plus de 90 ans d'expérience collective dans l'industrie.

Opérant sur un marché mondial des services informatiques évalué à 1,16 trillion de dollars, Tekumo cible plusieurs secteurs de croissance, notamment les centres de données en périphérie (prévision de 45,57 milliards de dollars d'ici 2030), l'IoT industriel (prévu d'atteindre 3,3 trillions de dollars d'ici 2030) et le marché du WiFi (estimé à 39,4 milliards de dollars d'ici 2028).

Tekumo (TKMO) berichtete über ein signifikantes Wachstum im Jahr 2024 und erzielte einen Bruttoumsatz von 4,36 Millionen Dollar, was einem Anstieg von 62,1% im Jahresvergleich und einem Wachstum von 43,8% im vierten Quartal gegenüber dem dritten Quartal entspricht. Das Unternehmen hielt eine Bruttomarge von 35,3%, während es mit einem Nettoverlust von 0,75 Millionen Dollar (17,6% des Umsatzes) operierte.

Wichtige Entwicklungen umfassen wesentliche Fortschritte in der Softwareentwicklung von Tekumo, einschließlich automatisierter Arbeitsabläufe und KI-gesteuerter Verbesserungen. Das Unternehmen hat die Tekumo Managed Services für OEM- und Unternehmenssupport eingeführt und sein Führungsteam mit wichtigen Ernennungen verstärkt, die gemeinsam über 90 Jahre Branchenerfahrung mitbringen.

Im globalen IT-Dienstleistungsmarkt, der auf 1,16 Billionen Dollar geschätzt wird, zielt Tekumo auf mehrere Wachstumssektoren ab, darunter Edge-Datenzentren (voraussichtlich 45,57 Milliarden Dollar bis 2030), Industrial IoT (für 2030 auf 3,3 Billionen Dollar geschätzt) und den WiFi-Markt (voraussichtlich 39,4 Milliarden Dollar bis 2028).

- Revenue growth of 62.1% YOY to $4.36 million

- Strong Q4 performance with 43.8% growth over Q3

- Maintained healthy gross margin of 35.3%

- Net loss percentage improved from 20.7% to 17.6%

- Successfully diversified customer base reducing dependency on few clients

- Strategic expansion into managed services with new division launch

- Operating at net loss of $0.75 million

- Gross margin declined from 38.5% in 2023 to 35.3% in 2024

New York, Jan. 07, 2025 (GLOBE NEWSWIRE) -- Tekumo Inc. (TKMO or the "Company").

Dear Shareholders,

As we close out another year, we want to take this opportunity to reflect on our achievements, challenges, and the path forward. This year has been transformative for Tekumo, marked by significant milestones and strategic advancements.

Achievements and Milestones

1. Financial Performance: We closed 2024 with gross revenue of

We maintained a gross margin of

This year has been instrumental in bringing a new and innovative approach to Field Service Management. Our foundation for growth and scalability has been solidified. We are poised to disrupt the market.

2. Development: We made substantial progress in the development of our Tekumo software including fully automated workflows, dynamic cost guardrails, powerful AI driven process improvements, and further data visualization. These tools will enable Tekumo’s Platform to become a fully self-managed solution, “Uberizing” the tech marketplace.

3. Diversification: Our commitment to field services innovation has led to the successful launch of Tekumo Managed Services. This division is focused on the managed support of OEMs and Enterprise level customers. We operate as an extension of their delivery model in the industry’s first a` la carte support offering. We further drive flexibility and scalability of these organizations for both internal and external resources.

4. Innovation: We continue to focus on transformation of our systems and technology, by leveraging AI to drive service efficiency, extending our reach into multiple industry verticals and monetizing all data flows within our ecosystem.

Challenges and Resilience

Every year is not without its own challenges. Our early concentration around a few customers left us subject to variability in those projects. Adding new customers both in number and size has reduced that dependency.

In 2024, we have successfully brought in new people, new processes, and new technologies into the Tekumo family. These additions will enable us to change how services are procured and delivered, effectively shaping the Future of Work.

Looking Ahead

As we move into the new year, we remain focused on our long-term vision of “uber-izing” product and service delivery. Our priorities include:

- Enhancing Customer Experience: We continue to prioritize customer satisfaction by improving our products, interface, accessibility, and services. We have launched a new division of Tekumo, under the direction of our Customer Experience Officer (CXO) Graham King. Graham will head our efforts in Client, Employee, and Technician experience, including UX/UI, Training, Onboarding, Support, and Advocacy.

- Investing in Talent: Our people are our greatest asset. Tekumo is committed to fostering a culture of growth and development. In 2024, we added key resources in multiple verticals in our organization, including, Derrick Youngblood (CRO), Wendi Greene (Director, Operations), Chad Parker (Director, Technical Solutions), and Tiffany McNeely (Service and Parts Delivery). These individuals collectively bring over 90+ years of knowledge and direct industry experience. Their skills have brought an immediate impact to their respective roles and we are excited about their continued impact for 2025 and beyond.

- Systems and Technology: Kicking off 2025 is a very exciting time for Tekumo. Our focus continues to be on efficiency, scalability, and profitability. As we deploy new automation in our service management platform, we will usher in a new era of managing field labor that can be leveraged in any technology and any environment. Leaders in this market, including ServiceNow (Ticker NOW), offer robust platforms that greatly benefit from the granularity of the Data and process our systems and software provide.

- Dramatically Expanding Our Market Reach: We plan to enter multiple new verticals and strengthen our presence in existing ones. These verticals include impacting The Future of Work by integrating internal and external resources, heavily utilizing AI in service delivery, leveraging Data at the Edge, harnessing Remote Power Generation, expanding Industrial IoT, and advancing Wi-Fi and Connectivity.

Global Market and Key Verticals

We play in an enormous sandbox. The broader IT services market globally, which includes onsite technical services, was valued at approximately USD 1.16 trillion in 2023 and is expected to reach USD 2.25 trillion by 2032, growing at a compound annual growth rate (CAGR) of

Decentralized edge data centers - The global market for decentralized edge data centers is experiencing rapid growth due to the increasing demand for low-latency data processing and the proliferation of IoT devices.

Its market size was USD 12.84 billion in 2024 and is expected to reach USD 45.57 billion by 2030, growing at a CAGR of

Data: Diligence Insights

These figures highlight the significant expansion and potential of the decentralized edge data center market, driven by advancements in 5G, AI, and the increasing need for real-time data processing, all of which must be installed and maintained through platforms like Tekumo.

Industrial IoT - The market for IIOT was valued at USD 394 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of

Data: Grand View Research

These figures highlight the substantial expansion and potential of the IIoT market, driven by advancements in technology and the increasing adoption of IoT solutions across various industries that all require installation, monitoring and maintenance.

Future of Wi-Fi - The global WiFi market is experiencing robust growth, driven by the increasing demand for seamless connectivity and the proliferation of smart devices.

The market size is expected to grow from USD 14.5 billion in 2023 to USD 39.4 billion by 2028, with a compound annual growth rate (CAGR) of

Data: Markets And Markets

These figures highlight the significant expansion and potential of the WiFi market, driven by advancements in WiFi technology, such as WiFi 6, and the increasing adoption of connected devices in both residential and commercial settings that also require a service delivery platform to support installation and maintenance of such systems.

Gratitude

We want to extend our heartfelt gratitude to all our stakeholders for their support and trust. Your confidence in our vision and strategy is the foundation of our success.

Together, we are building a strong organization and a better industry, and we are excited about the opportunities that lie ahead. Thank you for being a part of our journey.

“If you’d like to go fast, go alone. If you’d like to go far, go together!” – Mufasa

Wishing you a prosperous and joyful 2025!

Sincerely,

Strings, Phillip, Chris, Derrick

Tekumo, Inc.

About Tekumo, Inc.

Tekumo, Inc (OTC: TKMO) is an alternative reporting publicly held company that wholly owns Tekumo LLC.

Tekumo offers a field services delivery platform that solves the "last-mile" of installing, monitoring, and maintaining technology systems and smart connected devices. Distributed real-time data is at the core of all Tekumo offerings.

We play at the intersection of several major trends: the “Uber-ization” of product and service delivery, the explosion of smart connected devices brought about by the “Industrial Internet of Things” (IIoT), the advent of AI driven process efficiency, and the rise of the gig worker. Our Service Delivery platform is designed to intelligently automate the installation and maintenance of products by offering On-Demand local technician resources, as well as providing a “smart interface” for the monitoring and management of connected devices.

This service platform caters for a broad range of technologies from POS systems, kiosks, digital menu boards, print services, cameras, cabling, Wi-Fi and networking, as well as smart homes devices, wearable sensors, and access control.

Our platform results in “less people, less time and less cost” for our customers.

When we discuss our strategy, plans, future financial and operating performance, or other things that have not yet taken place, we are making statements considered to be forward-looking statements under United States (US) securities laws. Please see the disclosure relative to forward-looking statements at the base of this discussion.

Safe Harbor:

Forward-Looking Statements

Any statements made in this press release which are not historical facts contain certain forward-looking statements, as such term is defined in the Private Security Litigation Reform Act of 1995, concerning potential developments affecting the business, prospects, financial condition and other aspects of the company to which this release pertains. The actual results of the specific items described in this release, and the Company's operations generally, may differ materially from what is projected in such forward-looking statements. Although such statements are based upon the best judgments of management of the Company as of the date of this release, significant deviations in magnitude, timing and other factors may result from business risks and uncertainties including, without limitation, the Company's dependence on third parties, general market and economic conditions, technical factors, the availability of outside capital, receipt of revenues and other factors, many of which are beyond the control of the company. The Company disclaims any obligation to update the information contained in any forward-looking statement. This press release shall not be deemed a general solicitation.

Colorado Springs

Phillip Dignan, President & CFO

719-900-4535

Investors@Tekumo.com