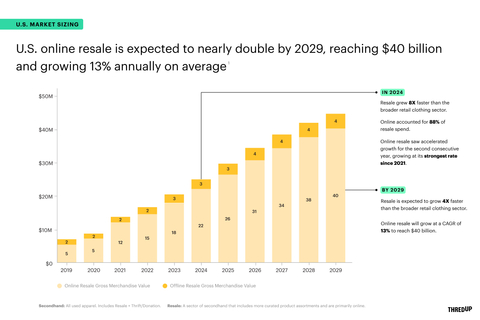

ThredUp’s 13th Resale Report Shows Online Resale Saw Accelerated Growth in 2024 and Is Expected to Reach $40 Billion by 2029

ThredUp has released its 13th annual Resale Report, revealing significant growth in the secondhand apparel market. The U.S. secondhand market grew 14% in 2024, outpacing the broader retail clothing market by 5X. Online resale saw accelerated 23% growth, its strongest since 2021, and is projected to reach $40 billion by 2029.

Key findings show that 59% of consumers will seek secondhand options if tariffs make apparel more expensive. The global secondhand market is expected to reach $367 billion by 2029, with a 10% CAGR. Notably, younger generations plan to spend 46% of their apparel budget on secondhand in the next 12 months.

The report highlights the growing integration of social commerce and AI in resale, with 39% of younger shoppers making secondhand purchases through social platforms. 48% of consumers report that personalization and improved search make shopping secondhand as convenient as buying new items.

ThredUp ha pubblicato il suo 13° rapporto annuale sul mercato del riuso, rivelando una crescita significativa nel mercato dell'abbigliamento di seconda mano. Il mercato statunitense dell'usato è cresciuto del 14% nel 2024, superando il mercato dell'abbigliamento al dettaglio di 5 volte. Le vendite online di usato hanno registrato una crescita accelerata del 23%, la più forte dal 2021, e si prevede che raggiungerà 40 miliardi di dollari entro il 2029.

I risultati chiave mostrano che il 59% dei consumatori cercherà opzioni di seconda mano se i dazi rendono l'abbigliamento più costoso. Si prevede che il mercato globale dell'usato raggiunga i 367 miliardi di dollari entro il 2029, con un CAGR del 10%. È interessante notare che le generazioni più giovani pianificano di spendere il 46% del proprio budget per l'abbigliamento in articoli di seconda mano nei prossimi 12 mesi.

Il rapporto evidenzia la crescente integrazione del social commerce e dell'IA nel riuso, con il 39% dei giovani acquirenti che effettuano acquisti di seconda mano tramite piattaforme social. Il 48% dei consumatori riporta che la personalizzazione e la ricerca migliorata rendono lo shopping di seconda mano altrettanto conveniente quanto l'acquisto di nuovi articoli.

ThredUp ha publicado su 13° informe anual sobre la reventa, revelando un crecimiento significativo en el mercado de ropa de segunda mano. El mercado de segunda mano en EE. UU. creció un 14% en 2024, superando el mercado minorista de ropa en 5 veces. La reventa en línea vio un crecimiento acelerado del 23%, el más fuerte desde 2021, y se proyecta que alcanzará $40 mil millones para 2029.

Los hallazgos clave muestran que el 59% de los consumidores buscará opciones de segunda mano si los aranceles hacen que la ropa sea más cara. Se espera que el mercado global de segunda mano alcance los 367 mil millones de dólares para 2029, con un CAGR del 10%. Notablemente, las generaciones más jóvenes planean gastar el 46% de su presupuesto de ropa en segunda mano en los próximos 12 meses.

El informe destaca la creciente integración del comercio social y la IA en la reventa, con el 39% de los compradores más jóvenes realizando compras de segunda mano a través de plataformas sociales. El 48% de los consumidores informa que la personalización y la búsqueda mejorada hacen que comprar de segunda mano sea tan conveniente como comprar artículos nuevos.

ThredUp은 제13회 연례 재판매 보고서를 발표하며 중고 의류 시장의 상당한 성장을 밝혔습니다. 2024년 미국의 중고 시장은 14% 성장하여 소매 의류 시장을 5배 초과했습니다. 온라인 재판매는 2021년 이후 가장 강력한 23%의 성장을 보였으며, 2029년까지 400억 달러에 이를 것으로 예상됩니다.

주요 발견 사항에 따르면, 59%의 소비자가 의류에 대한 관세가 상승하면 중고 옵션을 찾을 것이라고 합니다. 글로벌 중고 시장은 2029년까지 3,670억 달러에 이를 것으로 예상되며, 연평균 성장률(CAGR)은 10%입니다. 특히, 젊은 세대는 향후 12개월 동안 의류 예산의 46%를 중고에 지출할 계획입니다.

보고서는 소셜 커머스와 AI의 재판매 통합이 증가하고 있음을 강조하며, 39%의 젊은 소비자가 소셜 플랫폼을 통해 중고 제품을 구매하고 있습니다. 소비자의 48%는 개인화와 개선된 검색 기능이 중고 쇼핑을 새 제품 구매만큼 편리하게 만든다고 보고하고 있습니다.

ThredUp a publié son 13ème rapport annuel sur la revente, révélant une croissance significative du marché de l'habillement de seconde main. Le marché américain de la seconde main a connu une croissance de 14% en 2024, dépassant le marché de l'habillement de détail par 5 fois. La revente en ligne a enregistré une croissance accélérée de 23%, la plus forte depuis 2021, et devrait atteindre 40 milliards de dollars d'ici 2029.

Les résultats clés montrent que 59% des consommateurs rechercheront des options de seconde main si les tarifs rendent les vêtements plus chers. Le marché mondial de la seconde main devrait atteindre 367 milliards de dollars d'ici 2029, avec un taux de croissance annuel composé (CAGR) de 10%. Notamment, les générations plus jeunes prévoient de dépenser 46% de leur budget habillement en seconde main au cours des 12 prochains mois.

Le rapport met en évidence l'intégration croissante du commerce social et de l'IA dans la revente, avec 39% des jeunes acheteurs effectuant des achats de seconde main via des plateformes sociales. 48% des consommateurs rapportent que la personnalisation et la recherche améliorée rendent l'achat de seconde main aussi pratique que l'achat d'articles neufs.

ThredUp hat seinen 13. jährlichen Resale-Bericht veröffentlicht und zeigt ein signifikantes Wachstum im Markt für Secondhand-Bekleidung. Der US-Markt für Secondhand-Waren wuchs 2024 um 14% und übertraf den breiteren Einzelhandelsmarkt für Bekleidung um das Fünffache. Online-Resale verzeichnete ein beschleunigtes Wachstum von 23%, das stärkste seit 2021, und wird voraussichtlich bis 2029 40 Milliarden Dollar erreichen.

Wichtige Erkenntnisse zeigen, dass 59% der Verbraucher nach Secondhand-Optionen suchen werden, wenn Zölle Bekleidung teurer machen. Der globale Secondhand-Markt wird bis 2029 voraussichtlich 367 Milliarden Dollar erreichen, mit einer CAGR von 10%. Bemerkenswert ist, dass jüngere Generationen planen, 46% ihres Bekleidungsbudgets in den nächsten 12 Monaten für Secondhand auszugeben.

Der Bericht hebt die wachsende Integration von Social Commerce und KI im Resale-Bereich hervor, wobei 39% der jüngeren Käufer Secondhand-Käufe über soziale Plattformen tätigen. 48% der Verbraucher berichten, dass Personalisierung und verbesserte Suchfunktionen das Einkaufen von Secondhand genauso bequem machen wie den Kauf neuer Artikel.

- Online resale growth accelerated to 23% in 2024

- Market outperformed broader retail clothing sector by 5X

- Projected strong growth to $40 billion by 2029 (13% CAGR)

- 94% of retail executives report customer participation in resale

- Potential market expansion due to tariff-driven price increases

- None.

Insights

ThredUp's 2025 Resale Report highlights accelerated growth in online resale at

The report strategically positions ThredUp to capitalize on pending tariff policies, with

Particularly noteworthy is the convergence of social commerce and resale, with

While this report doesn't contain specific financial figures for ThredUp itself, it demonstrates the company's position as a thought leader in a rapidly expanding sector with multiple growth catalysts including tariff tailwinds, social commerce integration, and AI-enhanced shopping experiences.

“As consumers are increasingly thinking secondhand first, the retail industry is adopting powerful new pathways for resale. From the integration of social commerce and innovative AI applications to the establishment of trade organizations and interfacing with government, it’s clear why resale is seeing accelerated growth and has such a promising growth trajectory.”

– James Reinhart, CEO, ThredUp

“Resale continues to outpace the broader retail sector, with online resale in particular driving the sector’s growth. Shoppers are prioritizing quality as resale value becomes an increasingly important factor in purchasing decisions, and retailers are evolving their secondhand offerings to meet consumer demand with new avenues like social commerce, further driving adoption and preference for secondhand.”

– Neil Saunders, Managing Director, GlobalData

The top five trends from ThredUp’s 2025 Resale Report:

(all figures pertain to the

In 2024, the

-

The global secondhand apparel market is expected to reach

$367 billion 10% . -

The

U.S. secondhand apparel market is expected to reach$74 billion -

The

U.S. secondhand apparel market grew14% in 2024, seeing its strongest annual growth since 2021 and outpacing the broader retail clothing market by 5X. -

In 2024, online resale saw accelerated growth for the second consecutive year at

23% , growing at its strongest rate since 2021. It’s expected to nearly double in the next 5 years, growing at a CAGR of13% to reach$40 billion

Tariffs are expected to provide a tailwind to the secondhand market as shoppers prioritize affordability and retailers seek stability.

-

59% of consumers say if new government policies around tariffs and trade make apparel more expensive, they will seek more affordable options like secondhand. This figure is highest among Millennials at69% . -

Consumers plan to spend

34% of their apparel budget on secondhand in the next 12 months. This figure is higher among younger generations (Gen Z and Millennials) who say they'll spend nearly half (46% ) on secondhand. -

80% of retail executives expect new government policies around tariffs and trade to disrupt their global supply chain. -

44% of retail executives are looking to reduce reliance on imported goods, and54% of retail executives believe resale offers a more stable and predictable source of clothing in the face of potential tariff fluctuations.

Retailers view resale as a new revenue stream that helps them stay competitive and acquire new customers.

-

94% of retail executives say their customers are already participating in resale – an all-time high, +4 pts from 2023. -

32% of consumers who bought secondhand apparel in 2024 made a purchase directly from a brand.47% of younger generations did. -

47% of consumers are more likely to make a first-time purchase with a brand if they offer shopping credit for trading in used apparel, +25 pts from 2023.

Retailers can unlock revenue by integrating social commerce and resale for omnichannel success.

-

39% of younger generation shoppers have made a secondhand apparel purchase on a social commerce platform in the last 12 months.28% of consumers overall have. -

Half (

50% ) of younger generation shoppers who purchased secondhand apparel in the last 12 months purchased to create content or share on social media. -

76% of retail executives say social commerce will play a significant role in driving resale adoption within their brand. -

38% of retail executives allow customers to shop secondhand through a social commerce platform. Another48% are considering integrating social commerce in the future. -

22% of retail executives believe social commerce will generate meaningful (>10% of total) revenue within the next 3 years.

AI is driving resale adoption by reducing thrift overwhelm and bridging the gap between shopping used and new.

-

48% of consumers say personalization, improved search, and discovery make shopping secondhand apparel as easy as shopping new.59% of younger generations say this. -

46% of consumers say if they can find an item secondhand, they won’t buy it new.55% of younger generations say this. -

78% of retailers have already made significant investments in AI; and58% plan to launch AI-powered tools in the next year. -

62% of retailers agree that AI has the power to make the secondhand shopping experience more appealing. -

44% of retailers agree that AI bridging the gap between secondhand and new apparel.

To see the 2025 Resale Report, visit thredup.com/resale.

About the 2025 Resale Report

ThredUp’s annual Resale Report contains research and data from GlobalData, a third-party retail analytics firm. GlobalData’s assessment of the secondhand market is determined through consumer surveys, retailer tracking, official public data, data sharing, store observation, and secondary sources. These inputs are used by analysts to model and calculate market sizes, channel sizes, and market shares. Further, for the purpose of this report, GlobalData conducted a January-February 2025 survey of 3,034 American adults over 18, asking specific questions about their behaviors and preferences for secondhand. GlobalData also surveyed the top 50 U.S. fashion retailers and brands from January-February 2025 to gather their opinions on resale. In addition, ThredUp’s Resale Report also leverages data from internal ThredUp customer and brand performance data.

About ThredUp

ThredUp is transforming resale with technology and a mission to inspire the world to think secondhand first. By making it easy to buy and sell secondhand, ThredUp has become one of the world's largest online resale platforms for apparel, shoes and accessories. Sellers love ThredUp because we make it easy to clean out their closets and unlock value for themselves or for the charity of their choice while doing good for the planet. Buyers love shopping value, premium and luxury brands all in one place, at up to

Forward-Looking Statements

This release contains forward-looking statements. Forward-looking statements include all statements that are not historical facts. The words "believe," "may," "will," "estimate," "continue," "anticipate," "intend," "expect," "predict" and similar expressions are intended to identify forward-looking statements. These forward-looking statements are subject to a number of risks, uncertainties and assumptions. Except as required by law, ThredUp has no obligation to update any of these forward-looking statements to conform these statements to actual results or revised expectations.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250319230685/en/

Media Contact

Christina Berger

media@thredup.com

Investor Relations Contact

Lauren Frasch

ir@thredup.com

Resale-as-a-Service Contact

Christine Iovino

raas@thredup.com

Source: ThredUp