thredUP Releases 10th Annual Resale Report with Insights on a Decade of Resale

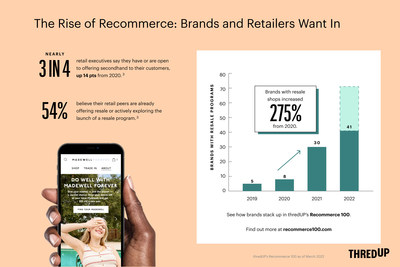

thredUP (NASDAQ: TDUP) released its 2022 Resale Report, indicating that the U.S. secondhand market will more than double by 2026, reaching $82 billion. The report highlights the growth in online resale, projected to quadruple, making it the fastest-growing sector. Notably, 58% of consumers found secondhand shopping helpful during inflation, with 80% buying more secondhand items. Brands embracing resale have grown 275% since 2020, showcasing a shift in consumer behavior towards sustainable shopping.

- U.S. secondhand market projected to reach $82 billion by 2026.

- Online resale expected to grow nearly 4 times by 2026, accounting for 50% of total secondhand dollars by 2024.

- 58% of consumers say secondhand shopping helped during inflation.

- None.

Insights

Analyzing...

- The 2022 Resale Report estimates that the U.S. secondhand market is projected to double by 2026, reaching

- A one-time special section exploring inflation's impact on purchasing behavior shows resale is a bright spot for the consumer

OAKLAND, Calif., May 17, 2022 /PRNewswire/ -- thredUP (NASDAQ: TDUP), one of the largest online resale platforms for women's and kids' apparel, shoes, and accessories, today released the results of the 2022 Resale Report. Conducted by third-party retail analytics firm GlobalData, the study serves as the most comprehensive measure of the secondhand market and includes global market sizing for the first time.

The 10th annual study reveals that secondhand is becoming a global phenomenon led by North America, with the U.S. secondhand market estimated to more than double by 2026, reaching

"The last 10 years of resale were dominated by marketplaces, but brands and retailers are driving the next wave of secondhand. We're still in the very beginning of this trend, but the acceleration of resale adoption is a positive signal with enormous benefits for the planet. This year's report proves that with the collective power of conscious consumers, resale marketplaces, and forward-thinking brands and retailers, we can pioneer a more sustainable future for the fashion industry." – James Reinhart, thredUP CEO & Co-Founder

Notable findings from thredUP's 2022 Resale Report (all U.S. figures unless otherwise noted):

Secondhand is becoming a global phenomenon, led by the U.S.

- The global secondhand apparel market will grow

127% by 2026 – 3X faster than the global apparel market overall. - The U.S. secondhand market is expected to more than double by 2026, reaching

$82 billion . - Secondhand saw record growth in 2021 at

32% . - Resale is expected to grow 16 times faster than the broader retail clothing sector by 2026.

Technology and online marketplaces are driving the growth of the U.S. secondhand market.

- Online resale is the fastest-growing sector of secondhand and is expected to grow nearly 4 times by 2026.

50% of total secondhand dollars are expected to come from online resale by 2024.70% of consumers say it's easier to shop secondhand now than it was 5 years ago.

In an inflationary environment, resale is a bright spot for the consumer.

58% of consumers say secondhand has helped them in some way during a time of inflation.80% of consumers are buying the same or more secondhand apparel items, compared to49% of consumers buying the same or more apparel items overall.25% of consumers say they'll consider buying more secondhand products if prices in apparel, footwear, and accessories keep rising.

Brands and retailers are embracing resale to satisfy consumer demand, and resale is becoming an inevitable part of retail.

- Brands with resale shops increased

275% in 2021 compared to 2020, according to the Recommerce 100. 78% of retail executives say their customers are already participating in resale – up 16 points from 2020.52% of retail executives say offering resale is becoming table stakes for retailers – up 16 points from 2020.88% of retail executives who currently offer resale say it's helping drive revenue.

Resale is a powerful solution to the fashion industry's wastefulness.

- Secondhand displaced nearly one billion new clothing purchases in 2021.

- Nearly 2 in 3 consumers believe their individual consumption habits have a significant impact on the planet.

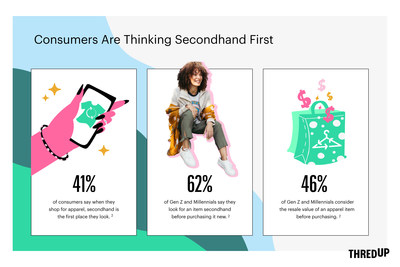

Consumers are thinking secondhand first.

41% of consumers say when they shop for apparel, secondhand is the first place they look.62% of Gen Z and Millennials say they look for an item secondhand before purchasing a new item.46% of Gen Z and Millennials consider the resale value of an apparel item before purchasing it.

Social pressure fuels consumers' addiction to disposable fashion.

62% of fast fashion shoppers say fast fashion retailers encourage people to buy things they don't need.- 1 in 5 fast fashion shoppers say they feel pressured to have the latest styles due to social media.

65% of those who bought their first thrifted item a year ago say they want to quit buying fast fashion.65% of consumers who shop fast fashion say they aspire to buy more secondhand fashion.

"Resale has emerged from the pandemic in an extremely strong position. More consumers are shopping secondhand, growth has accelerated, and the interest from traditional retailers has soared. The economic outlook remains uncertain, but with inflation driving apparel prices higher and higher, more shoppers appear to be turning to secondhand to make their budgets stretch further. These things will ensure resale remains a disruptive part of the market and a force for good in helping people shop sustainably." – Neil Saunders, Managing Director, GlobalData

To see the study's full results, visit http://www.thredup.com/resale. Download report imagery here and social media assets here.

About the 2022 Resale Report

thredUP's Annual Resale Report contains research and data from GlobalData, a third-party retail analytics firm. GlobalData's assessment of the secondhand market is determined through consumer surveys, retailer tracking, official public data, data sharing, store observation, and secondary sources. These inputs are used by analysts to model and calculate market sizes, channel sizes, and market shares. Further, for the purpose of this report, GlobalData conducted a January 2021 survey of 3,500 American adults over 18, asking specific questions about their behaviors and preferences for secondhand. GlobalData also surveyed the top 50 U.S. fashion retailers and brands in January and February 2022 to gather their opinions on resale. thredUP's Resale Report also leverages data from the following sources: Green Story Inc. research and internal thredUP customer and brand performance data.

Disclosure: All third-party brand names and logos appearing in this report are trademarks or registered trademarks of their respective holders. Any such appearance does not imply any affiliation with or endorsement of thredUP.

About thredUP

thredUP is transforming resale with technology and a mission to inspire a new generation of consumers to think secondhand first. By making it easy to buy and sell secondhand, thredUP has become one of the world's largest online resale platforms for women's and kids' apparel, shoes and accessories. Sellers love thredUP because we make it easy to clean out their closets and unlock value for themselves or for the charity of their choice while doing good for the planet. Buyers love shopping value, premium and luxury brands all in one place, at up to

Forward Looking Statements

This release contains forward-looking statements. Forward-looking statements include all statements that are not historical facts. The words "believe," "may," "will," "estimate," "continue," "anticipate," "intend," "expect," "predict" and similar expressions are intended to identify forward-looking statements. These forward-looking statements are subject to a number of risks, uncertainties and assumptions. Except as required by law, thredUP has no obligation to update any of these forward-looking statements to conform these statements to actual results or revised expectations.

Contact

Christina Berger

thredUP

media@thredup.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/thredup-releases-10th-annual-resale-report-with-insights-on-a-decade-of-resale-301548358.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/thredup-releases-10th-annual-resale-report-with-insights-on-a-decade-of-resale-301548358.html

SOURCE thredUP