Tocvan Closes Oversubscribed Private Placement for $3.15 Million

Tocvan Ventures Corp. (CSE:TOC)(OTCQB:TCVNF) has successfully closed an oversubscribed private placement, raising total gross proceeds of $3.15 million. The second tranche raised $1,045,267.20 through the issuance of 2,177,640 Units at $0.48 per Unit, following the first tranche of $2,105,320. Each Unit includes one common share and one warrant exercisable at $0.75 for 36 months.

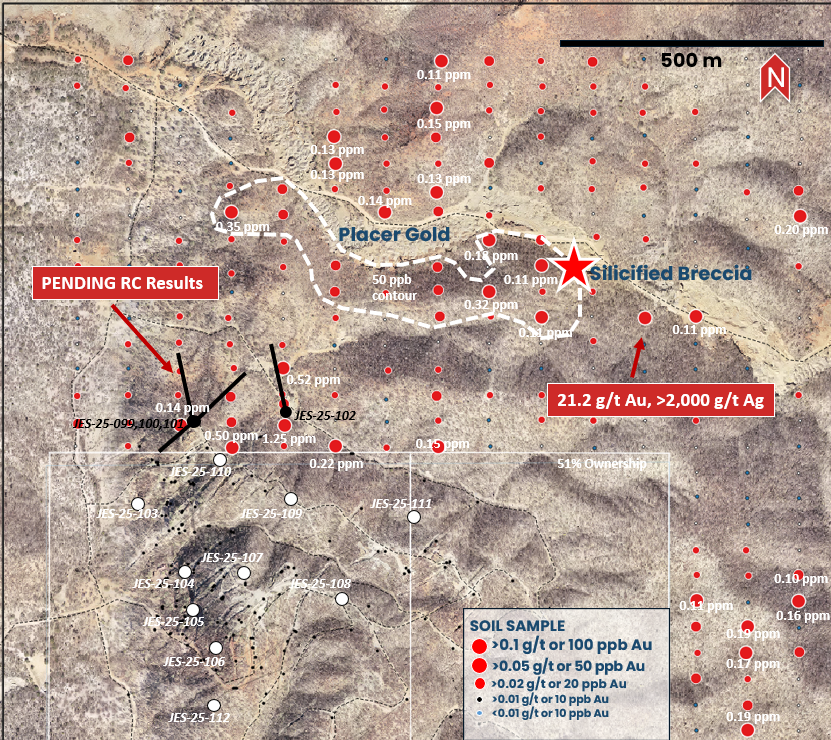

The company paid approximately $39,744 in cash commissions and issued 82,800 finders' warrants. The proceeds will fund the advancement of the Gran Pilar Au-Ag project in Sonora, Mexico. Currently, results are pending for four RC drill holes in the expansion area, with first results expected soon. Additionally, ten core drill holes were completed across the Main Zone, with initial results anticipated in March.

Tocvan Ventures Corp. (CSE:TOC)(OTCQB:TCVNF) ha chiuso con successo un collocamento privato sovrascritto, raccogliendo un totale di 3,15 milioni di dollari. La seconda tranche ha raccolto 1.045.267,20 dollari attraverso l'emissione di 2.177.640 unità a 0,48 dollari per unità, dopo la prima tranche di 2.105.320 dollari. Ogni unità include un'azione comune e un warrant esercitabile a 0,75 dollari per 36 mesi.

La società ha pagato circa 39.744 dollari in commissioni in contante e ha emesso 82.800 warrant per i trovatori. I proventi finanzieranno l'avanzamento del progetto Gran Pilar Au-Ag in Sonora, Messico. Attualmente, i risultati sono in attesa per quattro fori di perforazione RC nell'area di espansione, con i primi risultati previsti a breve. Inoltre, dieci fori di perforazione a carota sono stati completati nella Zona Principale, con risultati iniziali attesi a marzo.

Tocvan Ventures Corp. (CSE:TOC)(OTCQB:TCVNF) ha cerrado con éxito una colocación privada sobre suscripción, recaudando un total de 3,15 millones de dólares. La segunda tranche recaudó 1.045.267,20 dólares a través de la emisión de 2.177.640 Unidades a 0,48 dólares por Unidad, después de la primera tranche de 2.105.320 dólares. Cada Unidad incluye una acción común y una opción de compra ejercitable a 0,75 dólares durante 36 meses.

La empresa pagó aproximadamente 39.744 dólares en comisiones en efectivo y emitió 82.800 opciones de compra para los buscadores. Los fondos se destinarán a avanzar en el proyecto Gran Pilar Au-Ag en Sonora, México. Actualmente, se están esperando resultados de cuatro agujeros de perforación RC en el área de expansión, con los primeros resultados esperados pronto. Además, se completaron diez agujeros de perforación en el área principal, con resultados iniciales anticipados para marzo.

Tocvan Ventures Corp. (CSE:TOC)(OTCQB:TCVNF)는 초과 구독된 사모펀드를 성공적으로 마감하여 총 315만 달러의 수익을 올렸습니다. 두 번째 분할은 0.48달러에 2,177,640 유닛을 발행하여 1,045,267.20달러를 모금하였으며, 이는 2,105,320달러의 첫 번째 분할 이후입니다. 각 유닛은 하나의 보통주와 36개월 동안 0.75달러에 행사 가능한 하나의 워런트를 포함합니다.

회사는 약 39,744달러의 현금 수수료를 지급하고 82,800개의 파인더 워런트를 발행했습니다. 이 수익금은 멕시코 소노라의 Gran Pilar Au-Ag 프로젝트의 발전에 사용될 것입니다. 현재 확장 지역의 네 개의 RC 드릴 홀에 대한 결과를 기다리고 있으며, 첫 번째 결과는 곧 나올 것으로 예상됩니다. 또한, 메인 존에서 열 개의 코어 드릴 홀이 완료되었으며, 초기 결과는 3월에 예상됩니다.

Tocvan Ventures Corp. (CSE:TOC)(OTCQB:TCVNF) a réussi à clôturer un placement privé sursouscrit, levant un total de 3,15 millions de dollars. La deuxième tranche a levé 1.045.267,20 dollars par l'émission de 2.177.640 unités à 0,48 dollar par unité, après la première tranche de 2.105.320 dollars. Chaque unité comprend une action ordinaire et un bon de souscription exerçable à 0,75 dollar pendant 36 mois.

L'entreprise a payé environ 39.744 dollars en commissions en espèces et a émis 82.800 bons de souscription pour les apporteurs d'affaires. Les fonds serviront à financer l'avancement du projet Gran Pilar Au-Ag au Sonora, au Mexique. Actuellement, les résultats de quatre forages RC dans la zone d'expansion sont en attente, avec les premiers résultats attendus prochainement. De plus, dix forages de carottage ont été réalisés dans la zone principale, avec des résultats initiaux anticipés en mars.

Tocvan Ventures Corp. (CSE:TOC)(OTCQB:TCVNF) hat erfolgreich eine überzeichnete Privatplatzierung abgeschlossen und insgesamt 3,15 Millionen Dollar eingenommen. Die zweite Tranche brachte 1.045.267,20 Dollar durch die Ausgabe von 2.177.640 Einheiten zu je 0,48 Dollar pro Einheit ein, nach der ersten Tranche von 2.105.320 Dollar. Jede Einheit umfasst eine Stammaktie und einen Warrant, der für 36 Monate zu 0,75 Dollar ausgeübt werden kann.

Das Unternehmen zahlte etwa 39.744 Dollar in Barprovisionen und gab 82.800 Finder-Warrants aus. Die Einnahmen werden zur Förderung des Gran Pilar Au-Ag-Projekts in Sonora, Mexiko, verwendet. Derzeit warten wir auf Ergebnisse von vier RC-Bohrlöchern im Erweiterungsbereich, wobei die ersten Ergebnisse bald erwartet werden. Darüber hinaus wurden zehn Kernbohrlöcher in der Hauptzone abgeschlossen, und die ersten Ergebnisse werden im März erwartet.

- Successfully raised $3.15 million through oversubscribed private placement

- Expansion of drilling program with 14 holes completed (4 RC and 10 core holes)

- 100% control of expansion area for Gran Pilar Au-Ag project

- Potential dilution from issuance of new shares and warrants

- 36-month warrant exercise period creates long-term dilution risk

CALGARY, AB / ACCESS Newswire / February 18, 2025 / Tocvan Ventures Corp. (the "Company") (CSE:TOC)(OTCQB:TCVNF)(WKN:TV3/A2PE64), is pleased to announce that it has closed a final tranche of its previously announced non-brokered private placement of Units ("Units") for gross proceeds of

In connection with the Offering, the Company paid aggregate cash commissions to arm's length finders who assisted with the Offering of approximately

The Units under the Offering are subject to a statutory hold period of four months plus a day from the date of issuance in accordance with applicable securities legislation in Canada.

"Excited to see great support for our Company and our plans to advance expanding gold and silver targets in mine-friendly Sonora." commented, CEO Brodie Sutherland. "With the financing closed we now focus on the next steps quickly advancing us towards resource estimation, new discovery potential and test mining. Our approach has two important fronts: 1) derisking project development through permitting and test mining; 2) the rapidly advancing resource potential of our broader expansion area where we believe two separate mineralized systems of significant size remain untapped for potential."

Use of Proceeds

The proceeds of the raise will go towards the advancement of the Gran Pilar Au-Ag project in Sonora, Mexico.

Update on Drilling

Results for the first ever drilling on the

About Tocvan Ventures Corp.

Tocvan's advancing gold-silver projects are located in the mine-friendly jurisdiction of Sonora, Mexico. Through ongoing exploration programs, Company is unveiling the high-potential at its Gran Pilar Gold-Silver Project where it holds

Tocvan currently has 58,893,995 shares outstanding.

Quality Assurance / Quality Control

Rock samples were shipped for sample preparation to ALS Limited in Hermosillo, Sonora, Mexico and for analysis at the ALS laboratory in North Vancouver. The ALS Hermosillo and North Vancouver facilities are ISO 9001 and ISO/IEC 17025 certified. Gold was analyzed using 50-gram nominal weight fire assay with atomic absorption spectroscopy finish. Over limits for gold (>10 g/t), were analyzed using fire assay with a gravimetric finish. Silver and other elements were analyzed using a four-acid digestion with an ICP finish. Over limit analyses for silver (>100 g/t) were re-assayed using an ore-grade four-acid digestion with ICP-AES finish. Control samples comprising certified reference samples and blank samples were systematically inserted into the sample stream and analyzed as part of the Company's robust quality assurance / quality control protocol.

Soil Samples were shipped for sample preparation to ALS Limited in Hermosillo, Sonora, Mexico and for analysis at the ALS laboratory in North Vancouver. The ALS Hermosillo and North Vancouver facilities are ISO 9001 and ISO/IEC 17025 certified. Gold and multi-element analysis of soils was completed by aqua regia digestion and ICP-MS finish using a 50-gram nominal weight. Over limit gold values greater than 1 g/t were re-assayed with a more robust aqua regia digestion ad ICP-MS finish. Over limit analyses for silver (>100 g/t) were re-assayed using an ore-grade four-acid digestion with ICP-AES finish. Control samples comprising blank samples and certified reference materials were systematically inserted into the sample stream and analyzed as part of the Company's robust quality assurance / quality control protocol.

Brodie A. Sutherland, CEO for Tocvan Ventures Corp. and a qualified person ("QP") as defined by Canadian National Instrument 43-101, has reviewed and approved the technical information contained in this release.

Cautionary Statement Regarding Forward Looking Statements

Neither the Canadian Securities Exchange nor its Regulation Services Provider (as that term is defined in the policies of the

Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains "forward-looking information" which may include, but is not limited to, statements with respect to the activities, events or developments that the Company expects or anticipates will or may occur in the future. Forward-looking information in this news release includes statements regarding the use of proceeds from the Offering. Such forward-looking information is often, but not always, identified by the use of words and phrases such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", or "believes" or variations (including negative variations) of such words and phrases, or state that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved.

These forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business. Management believes that these assumptions are reasonable. Forward-looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such factors include, among others, risks related to the speculative nature of the Company's business, the Company's formative stage of development and the Company's financial position. Forward-looking statements contained herein are made as of the date of this news release and the Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results, except as may be required by applicable securities laws.

There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information.

For more information, please contact:

TOCVAN VENTURES CORP.

Brodie A. Sutherland, CEO

820-1130 West Pender St.

Vancouver, BC V6E 4A4

Telephone: 1 888 772 2452

Email: ir@tocvan.ca

STAY CONNECTED:

LinkedIn: TOC LinkedIn

X: TOC X

Facebook: TOC Facebook

YouTube: TOC YouTube

Web: tocvan.com

This news release does not constitute an offer to sell or a solicitation of an offer to sell any of the securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act") or any state securities laws and may not be offered or sold within the United States or to U.S. Persons unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available.

SOURCE: Tocvan Ventures Corp.

View the original press release on ACCESS Newswire