Spotify Technology S.A. Announces Financial Results for First Quarter 2022

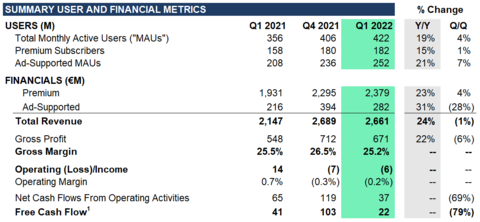

Spotify Technology S.A. (NYSE:SPOT) reported strong Q1 2022 results, with Monthly Active Users (MAUs) growing 19% year-over-year to 422 million, surpassing guidance. Revenue rose 24% year-over-year to €2,661 million, driven by a 31% increase in Ad-Supported Revenue. Premium Subscribers increased to 182 million, a 15% growth despite some involuntary churn due to the exit from Russia. Gross Margin held at 25.2%. The company also announced partnerships with Google and FC Barcelona, enhancing its market presence.

- MAUs up 19% YoY to 422 million, exceeding guidance by 4 million.

- Revenue increased 24% YoY to €2,661 million, above expectations.

- Ad-Supported Revenue grew 31% YoY.

- Premium Subscribers rose to 182 million, up 15% YoY, despite some churn from exiting Russia.

- New agreements with Google for User Choice Billing announced.

- Premium Subscriber growth fell slightly below initial guidance.

- Gross Margin decreased Y/Y by 29 bps, despite being slightly above guidance.

- Operating Expenses rose 27% YoY, influenced by higher personnel costs.

Insights

Analyzing...

(Graphic: Business Wire)

Dear Shareholders,

Our business exhibited strength and resiliency in Q1. Nearly all of our key metrics surpassed guidance, led by MAU outperformance, healthy revenue growth, and better Gross Margin. Excluding the impact of our exit from

First Quarter 2022 Earnings Highlights

-

MAUs grew

19% Y/Y to 422 million or 419 million excluding a one-time benefit of 3 million MAUs -

Premium Subscribers grew

15% Y/Y to 182 million (inclusive of approximately 1.5 million disconnects from the wind-down of our Russian operations) -

Premium ARPU grew

6% Y/Y in Q1 and3% Y/Y on a constant currency basis -

Gross Margin finished at

25.2% -

Announced agreement with Google for User

Choice Billing and a long-term partnership agreement with FC Barcelona

MONTHLY ACTIVE USERS (“MAUs”)

Total MAUs grew

PREMIUM SUBSCRIBERS

Our Premium Subscribers grew

During Q1, we entered into a multiyear agreement with Google for User

FINANCIAL METRICS

Revenue

Revenue of

Within Premium, average revenue per user (“ARPU”) of

We achieved our largest Q1 ever for Ad-Supported Revenue (

During the quarter, we announced the acquisition of Podsights, a leading podcast advertising measurement service that helps advertisers better measure and scale their podcast advertising. Additionally, we acquired Chartable, a podcast analytics platform that enables publishers to know and grow their podcast audiences through promotional attribution and audience insight tools.

Gross Margin

Gross Margin finished at

Premium Gross Margin was

Operating Expenses

Operating Expenses totaled

As a reminder, Social Charges are payroll taxes associated with employee salaries and benefits, including share-based compensation. We are subject to social taxes in several countries in which we operate, although

At the end of Q1, our workforce consisted of 8,230 FTEs globally.

Free Cash Flow

Free Cash Flow was

At the end of Q1, we maintained a strong liquidity position with

PRODUCT AND PLATFORM UPDATES

In Q1, we increased the number of artists and labels who can create Sponsored Recommendations by rolling out our self-serve campaign management tool to all eligible artists in

Podcasting

At the end of Q1, we had 4.0 million podcasts on the platform (up from 3.6 million at the end of Q4). Growth in the number of MAUs that engaged with podcast content continued to outstrip total MAU growth, podcast consumption rates grew in the double digits Y/Y, and podcast share of overall consumption hours on our platform reached another all-time high. We saw a double-digit Y/Y increase in new podcasts across key growth markets in

Product Enhancements

In Q1, we collaborated with

Global Marketing Partnerships

On

Q2 2022 OUTLOOK

The following forward-looking statements reflect Spotify’s expectations for Q2 2022 as of

-

Total MAUs: 428 million

- Reflects a loss from the closure of Russian operations as well as the full reversal of the March service outage benefit (combined these two items reflect approximately 8 million of the 422 million MAUs reported in Q1 2022); excluding the impact of these items, our Q2 guidance implies the addition of approximately 14 million net new MAUs in the quarter

-

Total Premium Subscribers: 187 million

-

Assumes an additional 600k disconnects from full closure of Russian operations in April; excluding

Russia , our Q2 guidance implies the addition of approximately 6 million net new subscribers in the quarter

-

Assumes an additional 600k disconnects from full closure of Russian operations in April; excluding

-

Total Revenue:

€2.80 billion - Assumes approximately 600 bps tailwind to growth Y/Y due to movements in foreign exchange rates

-

Gross Margin:

25.2% - As a reminder Q2 2021 Gross Margin benefitted 190 bps due to the release of accruals for prior period publishing royalty estimates

-

Operating Profit/Loss:

€(197) million -

Inclusive of the Operating Loss is approximately a

€50 million impact to Operating Expenses due to unfavorable movements in foreign exchange rates

-

Inclusive of the Operating Loss is approximately a

EARNINGS QUESTION & ANSWER SESSION

We will host a live question and answer session starting at

Direct Event Registration Portal: https://conferencingportals.com/event/txExvogt

We use investors.spotify.com and newsroom.spotify.com websites as well as other social media listed in the “Resources – Social Media” tab of our Investors website to disclose material company information.

Use of Non-IFRS Measures

To supplement our financial information presented in accordance with IFRS, we use the following non-IFRS financial measures: Revenue excluding foreign exchange effect, Premium revenue excluding foreign exchange effect, Ad-Supported revenue excluding foreign exchange effect, and Free Cash Flow. Management believes that Revenue excluding foreign exchange effect, Premium revenue excluding foreign exchange effect, and Ad-Supported revenue excluding foreign exchange effect are useful to investors because they present measures that facilitate comparison to our historical performance. However, Revenue excluding foreign exchange effect, Premium revenue excluding foreign exchange effect, and Ad-Supported revenue excluding foreign exchange effect should be considered in addition to, not as a substitute for or superior to, Revenue, Premium revenue, Ad-Supported revenue or other financial measures prepared in accordance with IFRS. Management believes that Free Cash Flow is useful to investors because it presents a measure that approximates the amount of cash generated that is available to repay debt obligations, to make investments, and for certain other activities that exclude certain infrequently occurring and/or non-cash items. However, Free Cash Flow should be considered in addition to, not as a substitute for or superior to, net cash flows (used in)/from operating activities or other financial measures prepared in accordance with IFRS. For more information on these non-IFRS financial measures, please see “Reconciliation of IFRS to Non-IFRS Results” table below.

Forward-Looking Statements

This shareholder letter contains estimates and forward-looking statements. All statements other than statements of historical fact are forward-looking statements. The words “may,” “might,” “will,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,” “intend,” “seek,” “believe,” “estimate,” “predict,” “potential,” “continue,” “contemplate,” “possible,” and similar words are intended to identify estimates and forward-looking statements.

Our estimates and forward-looking statements are mainly based on our current expectations and estimates of future events and trends, which affect or may affect our businesses and operations. Although we believe that these estimates and forward-looking statements are based upon reasonable assumptions, they are subject to numerous risks and uncertainties and are made in light of information currently available to us. Many important factors may adversely affect our results as indicated in forward-looking statements. These factors include, but are not limited to: our ability to attract prospective users, retain existing users, and monetize our products and services; competition for users, user listening time, and advertisers; risks associated with our international operations and our ability to manage our growth; our emphasis on innovation and long-term user engagement over short-term results; our ability to predict, recommend, and play content that our users enjoy; our ability to be profitable or generate positive cash flow on a sustained basis; our ability to convince advertisers of the benefits of our advertising offerings; our ability to forecast or optimize advertising inventory amid emerging industry trends in digital advertising; our ability to generate revenues from podcasts and other non-music content; potential disputes or liabilities associated with content made available on our Service; risks relating to acquisitions, investments, and strategic alliances; the impact of the COVID-19 pandemic and other public health crises; our dependence upon third-party licenses for most of the content we stream; our lack of control over third-party content providers who are concentrated and can unilaterally affect our access to content; our ability to comply with complex license agreements; our ability to accurately estimate royalty payments under our license agreements and relevant statutes; the limitations on our operating flexibility due to financial commitments required under certain of our license agreements; our ability to identify the compositions and ownership thereof embodied in sound recordings in order to obtain licenses or comply with existing license agreements; assertions by third parties of infringement or other violations by us of their intellectual property rights; our ability to protect our intellectual property; the dependence of streaming on operating systems, online platforms, hardware, networks, regulations, and standards that we do not control; our ability to maintain user data security; undetected errors, bugs or vulnerabilities in our products; interruptions, delays, or discontinuations in service arising from our systems or systems of third parties; changes in laws or regulations affecting us; risks relating to privacy and data security; our ability to maintain, protect, and enhance our brand; our ability to achieve our net zero emissions target or make progress in other environmental, social, and governance initiatives; payment-related risks; our dependence on key personnel and ability to attract, retain, and motivate highly skilled employees; our ability to access to capital to support growth; risks relating to currency exchange rate fluctuations and foreign exchange controls; the impact of economic, social, or political conditions, such as the current conflict between

Rounding

Certain monetary amounts, percentages, and other figures included in this letter have been subject to rounding adjustments. The sum of individual metrics may not always equal total amounts indicated due to rounding.

Consolidated statement of operations |

|||||||||

(Unaudited) |

|||||||||

(in € millions, except share and per share data) |

|||||||||

|

|

Three months ended |

|||||||

|

|

|

|

|

|

|

|||

Revenue |

|

2,661 |

|

|

2,689 |

|

|

2,147 |

|

Cost of revenue |

|

1,990 |

|

|

1,977 |

|

|

1,599 |

|

Gross profit |

|

671 |

|

|

712 |

|

|

548 |

|

Research and development |

|

250 |

|

|

253 |

|

|

196 |

|

Sales and marketing |

|

296 |

|

|

340 |

|

|

236 |

|

General and administrative |

|

131 |

|

|

126 |

|

|

102 |

|

|

|

677 |

|

|

719 |

|

|

534 |

|

Operating (loss)/income |

|

(6 |

) |

|

(7 |

) |

|

14 |

|

Finance income |

|

175 |

|

|

20 |

|

|

104 |

|

Finance costs |

|

(14 |

) |

|

(21 |

) |

|

(31 |

) |

Finance income/(costs) - net |

|

161 |

|

|

(1 |

) |

|

73 |

|

Income/(loss) before tax |

|

155 |

|

|

(8 |

) |

|

87 |

|

Income tax expense |

|

24 |

|

|

31 |

|

|

64 |

|

Net income/(loss) attributable to owners of the parent |

|

131 |

|

|

(39 |

) |

|

23 |

|

Earnings/(loss) per share attributable to owners of the parent |

|

|

|

|

|

|

|||

Basic |

|

0.68 |

|

|

(0.20 |

) |

|

0.12 |

|

Diluted |

|

0.21 |

|

|

(0.21 |

) |

|

(0.25 |

) |

Weighted-average ordinary shares outstanding |

|

|

|

|

|

|

|||

Basic |

|

192,476,022 |

|

|

191,952,473 |

|

|

190,565,397 |

|

Diluted |

|

197,077,256 |

|

|

192,144,654 |

|

|

191,815,695 |

|

Consolidated statement of financial position |

||||||

(Unaudited) |

||||||

(in € millions) |

||||||

|

|

|

|

|

||

Assets |

|

|

|

|

||

Non-current assets |

|

|

|

|

||

Lease right-of-use assets |

|

443 |

|

|

437 |

|

Property and equipment |

|

369 |

|

|

372 |

|

|

|

978 |

|

|

894 |

|

Intangible assets |

|

109 |

|

|

89 |

|

Long term investments |

|

682 |

|

|

916 |

|

Restricted cash and other non-current assets |

|

82 |

|

|

77 |

|

Deferred tax assets |

|

8 |

|

|

13 |

|

|

|

2,671 |

|

|

2,798 |

|

Current assets |

|

|

|

|

||

Trade and other receivables |

|

556 |

|

|

621 |

|

Income tax receivable |

|

5 |

|

|

5 |

|

Short term investments |

|

816 |

|

|

756 |

|

Cash and cash equivalents |

|

2,721 |

|

|

2,744 |

|

Other current assets |

|

270 |

|

|

246 |

|

|

|

4,368 |

|

|

4,372 |

|

Total assets |

|

7,039 |

|

|

7,170 |

|

Equity and liabilities |

|

|

|

|

||

Equity |

|

|

|

|

||

Share capital |

|

— |

|

|

— |

|

Other paid in capital |

|

4,789 |

|

|

4,746 |

|

|

|

(262 |

) |

|

(260 |

) |

Other reserves |

|

709 |

|

|

853 |

|

Accumulated deficit |

|

(3,089 |

) |

|

(3,220 |

) |

Equity attributable to owners of the parent |

|

2,147 |

|

|

2,119 |

|

Non-current liabilities |

|

|

|

|

||

Exchangeable Notes |

|

1,146 |

|

|

1,202 |

|

Lease liabilities |

|

587 |

|

|

579 |

|

Accrued expenses and other liabilities |

|

30 |

|

|

37 |

|

Provisions |

|

6 |

|

|

7 |

|

|

|

1,769 |

|

|

1,825 |

|

Current liabilities |

|

|

|

|

||

Trade and other payables |

|

695 |

|

|

793 |

|

Income tax payable |

|

13 |

|

|

23 |

|

Deferred revenue |

|

469 |

|

|

458 |

|

Accrued expenses and other liabilities |

|

1,882 |

|

|

1,841 |

|

Provisions |

|

22 |

|

|

22 |

|

Derivative liabilities |

|

42 |

|

|

89 |

|

|

|

3,123 |

|

|

3,226 |

|

Total liabilities |

|

4,892 |

|

|

5,051 |

|

Total equity and liabilities |

|

7,039 |

|

|

7,170 |

|

Consolidated statement of cash flows |

|||||||||

(Unaudited) |

|||||||||

(in € millions) |

|||||||||

|

|

Three months ended |

|||||||

|

|

|

|

|

|

|

|||

Operating activities |

|

|

|

|

|

|

|||

Net income/(loss) |

|

131 |

|

|

(39 |

) |

|

23 |

|

Adjustments to reconcile net income/(loss) to net cash flows |

|

|

|

|

|

|

|||

Depreciation of property and equipment and lease right-of-use assets |

|

27 |

|

|

25 |

|

|

22 |

|

Amortization of intangible assets |

|

10 |

|

|

8 |

|

|

8 |

|

Share-based compensation expense |

|

68 |

|

|

50 |

|

|

48 |

|

Finance income |

|

(175 |

) |

|

(20 |

) |

|

(104 |

) |

Finance costs |

|

14 |

|

|

21 |

|

|

31 |

|

Income tax expense |

|

24 |

|

|

31 |

|

|

64 |

|

Other |

|

4 |

|

|

3 |

|

|

2 |

|

Changes in working capital: |

|

|

|

|

|

|

|||

Decrease/(increase) in trade receivables and other assets |

|

59 |

|

|

(63 |

) |

|

15 |

|

(Decrease)/increase in trade and other liabilities |

|

(103 |

) |

|

92 |

|

|

(67 |

) |

Increase in deferred revenue |

|

6 |

|

|

17 |

|

|

37 |

|

(Decrease)/increase in provisions |

|

(3 |

) |

|

8 |

|

|

(1 |

) |

Interest paid on lease liabilities |

|

(13 |

) |

|

(13 |

) |

|

(11 |

) |

Interest received |

|

1 |

|

|

— |

|

|

— |

|

Income tax paid |

|

(13 |

) |

|

(1 |

) |

|

(2 |

) |

Net cash flows from operating activities |

|

37 |

|

|

119 |

|

|

65 |

|

Investing activities |

|

|

|

|

|

|

|||

Business combinations, net of cash acquired |

|

(85 |

) |

|

(14 |

) |

|

(59 |

) |

Purchases of property and equipment |

|

(10 |

) |

|

(16 |

) |

|

(24 |

) |

Purchases of short term investments |

|

(133 |

) |

|

(112 |

) |

|

(115 |

) |

Sales and maturities of short term investments |

|

78 |

|

|

88 |

|

|

90 |

|

Proceeds from sale of long term investment |

|

— |

|

|

144 |

|

|

— |

|

Change in restricted cash |

|

(5 |

) |

|

— |

|

|

— |

|

Other |

|

(1 |

) |

|

(3 |

) |

|

(6 |

) |

Net cash flows (used in)/from investing activities |

|

(156 |

) |

|

87 |

|

|

(114 |

) |

Financing activities |

|

|

|

|

|

|

|||

Payments of lease liabilities |

|

(10 |

) |

|

(10 |

) |

|

(8 |

) |

Lease incentives received |

|

2 |

|

|

— |

|

|

— |

|

Proceeds from exercise of stock options |

|

43 |

|

|

64 |

|

|

51 |

|

Proceeds from issuance of Exchangeable Notes, net of costs |

|

— |

|

|

— |

|

|

1,223 |

|

Repurchases of ordinary shares |

|

(2 |

) |

|

(65 |

) |

|

— |

|

Payments for employee taxes withheld from restricted stock unit releases |

|

(11 |

) |

|

(14 |

) |

|

(16 |

) |

Net cash flows from/(used in) financing activities |

|

22 |

|

|

(25 |

) |

|

1,250 |

|

Net (decrease)/increase in cash and cash equivalents |

|

(97 |

) |

|

181 |

|

|

1,201 |

|

Cash and cash equivalents at beginning of the period |

|

2,744 |

|

|

2,512 |

|

|

1,151 |

|

Net foreign exchange gains on cash and cash equivalents |

|

74 |

|

|

51 |

|

|

90 |

|

Cash and cash equivalents at period end |

|

2,721 |

|

|

2,744 |

|

|

2,442 |

|

Calculation of basic and diluted earnings/(loss) per share |

|||||||||

(Unaudited) |

|||||||||

(in € millions, except share and per share data) |

|||||||||

|

|

Three months ended |

|||||||

|

|

|

|

|

|

|

|||

Basic earnings/(loss) per share |

|

|

|

|

|

|

|||

Net income/(loss) attributable to owners of the parent |

|

131 |

|

|

(39 |

) |

|

23 |

|

Share used in computation: |

|

|

|

|

|

|

|||

Weighted-average ordinary shares outstanding |

|

192,476,022 |

|

|

191,952,473 |

|

|

190,565,397 |

|

Basic earnings/(loss) per share attributable to owners of the parent |

|

0.68 |

|

|

(0.20 |

) |

|

0.12 |

|

|

|

|

|

|

|

|

|||

Diluted earnings/(loss) per share |

|

|

|

|

|

|

|||

Net income/(loss) attributable to owners of the parent |

|

131 |

|

|

(39 |

) |

|

23 |

|

Fair value gains on dilutive warrants |

|

— |

|

|

(2 |

) |

|

(22 |

) |

Fair value gains on dilutive Exchangeable Notes |

|

(90 |

) |

|

— |

|

|

(49 |

) |

Net income/(loss) used in the computation of diluted earnings/(loss) per share |

|

41 |

|

|

(41 |

) |

|

(48 |

) |

Shares used in computation: |

|

|

|

|

|

|

|||

Weighted-average ordinary shares outstanding |

|

192,476,022 |

|

|

191,952,473 |

|

|

190,565,397 |

|

Warrants |

|

— |

|

|

192,181 |

|

|

312,148 |

|

Exchangeable Notes |

|

2,911,500 |

|

|

— |

|

|

938,150 |

|

Stock options |

|

1,055,820 |

|

|

— |

|

|

— |

|

Restricted stock units |

|

562,670 |

|

|

— |

|

|

— |

|

Other contingently issuable shares |

|

71,244 |

|

|

— |

|

|

— |

|

Diluted weighted-average ordinary shares |

|

197,077,256 |

|

|

192,144,654 |

|

|

191,815,695 |

|

Diluted earnings/(loss) per share attributable to owners of the parent |

|

0.21 |

|

|

(0.21 |

) |

|

(0.25 |

) |

Reconciliation of IFRS to Non-IFRS Results |

|||||

(Unaudited) |

|||||

(in € millions, except percentages) |

|||||

|

|

Three months ended |

|||

|

|

|

|

|

|

IFRS revenue |

|

2,661 |

|

|

2,147 |

Foreign exchange effect on 2022 revenue using 2021 rates |

|

109 |

|

|

|

Revenue excluding foreign exchange effect |

|

2,552 |

|

|

|

IFRS revenue year-over-year change % |

|

24 |

% |

|

|

Revenue excluding foreign exchange effect year-over-year change % |

|

19 |

% |

|

|

IFRS Premium revenue |

|

2,379 |

|

|

1,931 |

Foreign exchange effect on 2022 Premium revenue using 2021 rates |

|

91 |

|

|

|

Premium revenue excluding foreign exchange effect |

|

2,288 |

|

|

|

IFRS Premium revenue year-over-year change % |

|

23 |

% |

|

|

Premium revenue excluding foreign exchange effect year-over-year change % |

|

18 |

% |

|

|

IFRS Ad-Supported revenue |

|

282 |

|

|

216 |

Foreign exchange effect on 2022 Ad-Supported revenue using 2021 rates |

|

18 |

|

|

|

Ad-Supported revenue excluding foreign exchange effect |

|

264 |

|

|

|

IFRS Ad-Supported revenue year-over-year change % |

|

31 |

% |

|

|

Ad-Supported revenue excluding foreign exchange effect year-over-year change % |

|

22 |

% |

|

|

Free Cash Flow |

|||||||||

(Unaudited) |

|||||||||

(in € millions) |

|||||||||

|

|

Three months ended |

|||||||

|

|

|

|

|

|

|

|||

Net cash flows from operating activities |

|

37 |

|

|

119 |

|

|

65 |

|

Capital expenditures |

|

(10 |

) |

|

(16 |

) |

|

(24 |

) |

Change in restricted cash |

|

(5 |

) |

|

— |

|

|

— |

|

Free Cash Flow |

|

22 |

|

|

103 |

|

|

41 |

|

View source version on businesswire.com: https://www.businesswire.com/news/home/20220427005371/en/

Investor Relations:

ir@spotify.com

Public Relations:

press@spotify.com

Source: