S&P Global Market Intelligence commodities outlook projects global metals sector set to continue rebound in 2022 amid driving growth in electronic vehicles energy transition in key markets

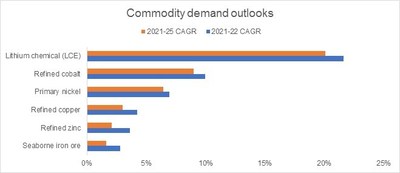

The 2022 Metals and Mining Outlook from S&P Global Market Intelligence predicts continued recovery in the metals sector into 2022, driven by factors like pent-up consumer demand and government stimulus. Demand growth is expected to keep prices above historical averages through 2025, despite a potential moderation in 2022 due to easing supply constraints. Exploration budgets are projected to increase by up to 15% in 2022, though still below the 2012 peak of $20.5 billion. Key trends include rising copper demand from renewable energy and electric vehicles, alongside potential iron ore price volatility.

- Global exploration budgets expected to rise by 5%-15% in 2022, led by key commodities.

- Copper demand forecasted to reach 1.1 million tonnes in 2022 from the electric vehicle sector.

- Moderating metal prices anticipated in 2022 amid rising input costs.

- Potential supply disruptions likely to increase iron ore price volatility.

HONG KONG, Nov. 8, 2021 /PRNewswire/ -- The metals sector is set to continue its rebound from the effects of the COVID-19 pandemic through 2022. According to the newly released 2022 Metals and Mining Outlook from S&P Global Market Intelligence, pent-up consumer spending, government stimulus efforts and the accelerating energy transition will continue to drive demand, prices and exploration budgets.

Published by S&P Global Market Intelligence's Metals and Mining Research team, the report spotlights the upswing in demand growth as driving prices higher across a range of metals in the medium term. While prices may moderate through 2022 as pandemic supply issues ease, building demand — due to factors including the growth of the electric vehicle sector and the energy transition — should set the stage for historically above-average prices through to 2025. The expected increase in demand and strong prices will help drive exploration budgets up to

"While we anticipate that metals prices will slip moderately in 2022 from their current highs, medium-term supply constraints are setting the stage for historically above-average prices through to 2025 – driven mostly by increasing demand for materials used in the accelerating global energy transition," said Mark Ferguson, research director with S&P Global Market Intelligence's Metals and Mining Research team.

Key highlights from the report include:

- Financings by junior and intermediate companies totaled

$14.8 billion for the first nine months of 2021 — well above the$12.1 billion raised in all of 2020. Should this trend continue through the first few months of 2022, we expect the year's global exploration budget total to be5% -15% above 2021 levels, led by gold and commodities key to the energy transition effort. - The combination of underlying market tightness, potential supply disruptions and project delays, global supply chain issues and power constraints is likely to increase iron ore price volatility into 2022.

- We forecast global copper demand from solar and wind energy generation to reach 852,000 tonnes by 2022 and the growing electric vehicle market to account for 1.1 million tonnes in 2022.

- Following a banner 2021 for producers amid high prices and relatively steady costs, margins are expected to remain healthy in 2022. Rising input costs and moderating prices, however, represent downside risks for margin levels across several commodities.

The S&P Global Market Intelligence 2022 Metals and Mining Outlook Report is part of a "Big Picture Outlook" series published by the division's research group that provides a look ahead to key strategic trends and opportunities. To learn more about this "Big Picture Outlook" research series, please visit here.

To request a copy of the report, please contact pressinquiries.mi@spglobal.com.

S&P Global Market Intelligence's Metals and Mining Research team offers comprehensive coverage on mining companies, projects and mines worldwide, exploration budgets and trend analysis, reserves replacement studies, Mine Economics cost curves, commodity market analysis and industry outlook insights. The Metals and Mining offering complements S&P Global Market Intelligence's broad universe of research sector coverage including energy, enterprise technology, financial institutions, and TMT (Technology, Media and Telecom).

S&P Global Market Intelligence's opinions, quotes, and credit-related and other analyses are statements of opinion as of the date they are expressed and not statements of fact or recommendation to purchase, hold, or sell any securities or to make any investment decisions, and do not address the suitability of any security.

About S&P Global Market Intelligence

At S&P Global Market Intelligence, we understand the importance of accurate, deep and insightful information. We integrate financial and industry data, research and news into tools that help track performance, generate alpha, identify investment ideas, perform valuations and assess credit risk. Investment professionals, government agencies, corporations and universities around the world use this essential intelligence to make business and financial decisions with conviction.

S&P Global Market Intelligence is a division of S&P Global (NYSE: SPGI), the world's foremost provider of credit ratings, benchmarks and analytics in the global capital and commodity markets, offering ESG solutions, deep data and insights on critical business factors. S&P Global has been providing essential intelligence that unlocks opportunity, fosters growth and accelerates progress for more than 160 years. For more information, visit www.spglobal.com/marketintelligence.

Media Contact

Vivian Liu

S&P Global Market Intelligence

+852 91791132

Vivian.liu@spglobal.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/sp-global-market-intelligence-commodities-outlook-projects-global-metals-sector-set-to-continue-rebound-in-2022-amid-driving-growth-in-electronic-vehicles-energy-transition-in-key-markets-301418237.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/sp-global-market-intelligence-commodities-outlook-projects-global-metals-sector-set-to-continue-rebound-in-2022-amid-driving-growth-in-electronic-vehicles-energy-transition-in-key-markets-301418237.html

SOURCE S&P Global Market Intelligence