S&P Global Mobility: November US auto sales stay the course; projection of 1.23 million units

- None.

- Affordability concerns continue to be prevalent, impacting the potential relief from the end of the UAW strikes on automakers. The report suggests that there may not be a significant increase in auto sales in the near future and that early 2024 production may create a progression for inventory and incentive levels to develop in spring 2024.

Auto demand levels expected to continue tapering from 2Q results

"While the end of the UAW strikes provides some potential relief to those automakers impacted, the ever-present affordability concerns remain prevalent for the foreseeable future," reports Chris Hopson, principal analyst at S&P Global Mobility. "Over the course of the next few months, it's difficult to imagine auto sales getting a jump start from the current pace of demand, with the upshot being a bounce in early 2024 production creating a progression for inventory and incentive levels to develop come spring of 2024."

New vehicle retail advertised inventory listings peaked in mid-October just shy of 2.5 million units and have seen a slight decrease since then – from an end-of-October level of 2.35 million units to about 2.3 million in mid-November.

"As of mid-October, there was still more advertised dealer inventory of outgoing 2023 model year models than incoming 2024s, and the 2024 model year inventory was growing at a faster rate than the 2023 model year sell-down," said Matt Trommer, associate director of Market Reporting at S&P Global Mobility. "But as of mid-November, that tide seems to have reversed; there are now fewer 2023s (about 955,000 units) than 2024s (about 1.34 million)."

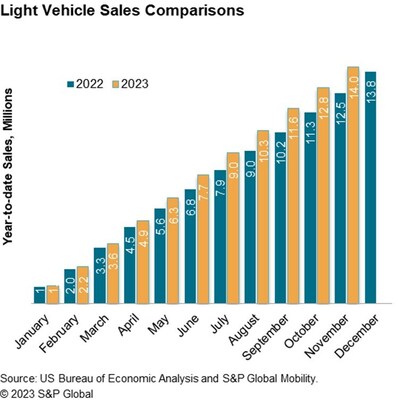

US Light Vehicle Sales | ||||

Nov 23 (Est) | Oct 23 | Nov 22 | ||

Total Light Vehicle | Units, NSA | 1,234,100 | 1,200,286 | 1,135,484 |

In millions, SAAR | 15.5 | 15.5 | 14.3 | |

Light Truck | In millions, SAAR | 12.3 | 12.4 | 11.2 |

Passenger Car | In millions, SAAR | 3.2 | 3.1 | 3.1 |

Source: S&P Global Mobility (Est), | ||||

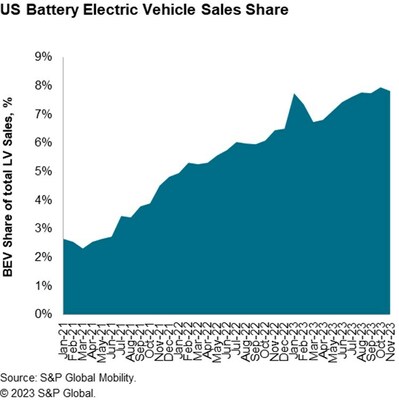

Continued development of battery-electric vehicle (BEV) sales remains an assumption in the longer term S&P Global Mobility light vehicle sales forecast. In the immediate term, some month-to-month volatility is anticipated. October 2023 BEV share is expected to reach

Electric vehicle retail advertised inventories (not including Tesla) also peaked in mid-October at 135,000 units and have declined slightly since then. Most BEV nameplates have reached an inventory plateau and flattened off.

About S&P Global Mobility

At S&P Global Mobility, we provide invaluable insights derived from unmatched automotive data, enabling our customers to anticipate change and make decisions with conviction. Our expertise helps them to optimize their businesses, reach the right consumers, and shape the future of mobility. We open the door to automotive innovation, revealing the buying patterns of today and helping customers plan for the emerging technologies of tomorrow.

S&P Global Mobility is a division of S&P Global (NYSE: SPGI). S&P Global is the world's foremost provider of credit ratings, benchmarks, analytics and workflow solutions in the global capital, commodity, and automotive markets. With every one of our offerings, we help many of the world's leading organizations navigate the economic landscape so they can plan for tomorrow, today. For more information, visit www.spglobal.com/mobility.

Media Contact:

Michelle Culver

S&P Global Mobility

248.728.7496 or 248.342.6211

Michelle.culver@spglobal.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/sp-global-mobility-november-us-auto-sales-stay-the-course-projection-of-1-23-million-units-301998145.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/sp-global-mobility-november-us-auto-sales-stay-the-course-projection-of-1-23-million-units-301998145.html

SOURCE S&P Global Mobility

FAQ

What are the projected November US light vehicle sales and SAAR according to S&P Global Mobility?

What concerns are mentioned regarding auto sales in the foreseeable future?

What impact did the end of the UAW strikes have on automakers?