S&P Global Market Intelligence expects economic and geopolitical volatility to drive continued global segmentation in 2024

- None.

- None.

Election outcomes, resource security and regional divergence in economic conditions to be key events to watch next year

"Among the indicators for volatility are a series of key elections across regions, central banks' monetary policy decisions, efforts to optimize the supply chain and access to critical resources," said Natznet Tesfay, Head of Insights & Analysis, Global Intelligence and Analytics, S&P Global Market Intelligence. "Businesses will continue facing the challenge of anticipating and quantifying the outcomes of geopolitical and economic events; however, this new reality is likely to surface potential opportunities."

S&P Global Market Intelligence identified the defining geopolitical and global macroeconomic themes next year as:

- Economic fault lines: Regional divergence in inflation rates and monetary policy is exposing economic fault lines. The ongoing stress caused by tighter financial conditions and growing geopolitical tensions appears likely to tip some economies into recession.

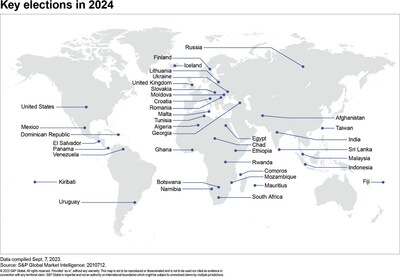

- Geopolitical reordering: National interest objectives will influence reordering of relationships between countries and in multilateral forums, impacting global challenges, flows of trade and investment. An important indicator underlying the direction of these risks in 2024 will be the outcome of scheduled elections including

India ,Indonesia ,Mexico , the US and to the European Parliament. - Supply chain resilience: Supply chain resilience is vital amid significant uncertainties related to labor and policy implementation. Labor costs will remain high, and strikes will continue to be a risk in 2024. Firms in 2024 will need to decide between the more conservative "just in case" approach to inventory management and the leaner "just in time" approach.

- Logistics rewired: Geopolitical tensions, coupled with intentions to diversify sourcing, are likely to increase risk for global supply chains in 2024. As supply chains are reshaped, and in many cases broadened, they will rely on cargo transportation outside of established shipping hubs — generally within the APAC and

Middle East regions. - Resource security: Prompted by extreme weather events, social and geopolitical challenges, and delayed energy transition targets, governments will focus on promoting strong industrial and sourcing policies that encourage and reward self-sufficiency to secure essential critical inputs and key minerals for 2024 and beyond.

Additional analysis is available here. To request a copy of 2024, A disjointed world, please contact press.mi@spglobal.com.

S&P Global Market Intelligence's opinions, quotes, and credit-related and other analyses are statements of opinion as of the date they are expressed and not statements of fact or recommendation to purchase, hold, or sell any securities or to make any investment decisions, and do not address the suitability of any security.

About S&P Global Market Intelligence

At S&P Global Market Intelligence, we understand the importance of accurate, deep and insightful information. Our team of experts delivers unrivaled insights and leading data and technology solutions, partnering with customers to expand their perspective, operate with confidence, and make decisions with conviction.

S&P Global Market Intelligence is a division of S&P Global (NYSE: SPGI). S&P Global is the world's foremost provider of credit ratings, benchmarks, analytics and workflow solutions in the global capital, commodity and automotive markets. With every one of our offerings, we help many of the world's leading organizations navigate the economic landscape so they can plan for tomorrow, today. For more information, visit www.spglobal.com/marketintelligence.

Media Contact

Katherine Smith

S&P Global Market Intelligence

+1 781-301-9311

katherine.smith@spglobal.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/sp-global-market-intelligence-expects-economic-and-geopolitical-volatility-to-drive-continued-global-segmentation-in-2024-302005040.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/sp-global-market-intelligence-expects-economic-and-geopolitical-volatility-to-drive-continued-global-segmentation-in-2024-302005040.html

SOURCE S&P Global Market Intelligence

FAQ

What are the key themes identified in S&P Global Market Intelligence's report for 2024?

How will regional divergence in inflation rates impact the global economy in 2024?

What are the upcoming elections that are expected to influence global challenges and trade flows in 2024?

Why is supply chain resilience vital in 2024?

How will geopolitical tensions impact global supply chains in 2024?