S&P Global Market Intelligence 2024 Capital Markets Outlook says issuance looks to rebound despite notably higher rates

- Corporate bond issuance stabilized in 2023 despite a surge in interest rates and the U.S. banking liquidity crunch. High-yield market issuance climbed 45% year over year in 2023. Some signs of life in the IPO market with activity rebounding in the third quarter.

- Weaker economic growth expected in 2024 in major economies, including the U.S.

In the new report, S&P Global Market Intelligence's financial institution research analysts highlighted that corporates maintained access to debt markets in 2023 despite significant interest rate increases and the

"While equity issuance activity has been abysmal, the debt markets have remained open despite considerably higher interest rates and macroeconomic uncertainty," said Nathan Stovall, Director of Financial Institutions Research at S&P Global Market Intelligence. "There are some signs of life in the

Key highlights from the report include:

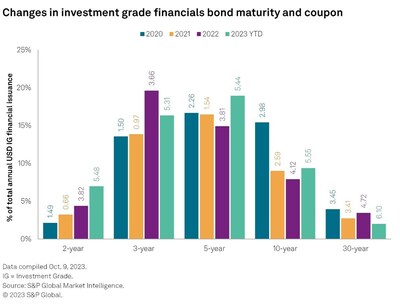

- Corporate bond issuance stabilized in 2023 after a massive drop off in 2022 following the surge fueled by ultra-low interest rates and the Fed's bond-buying program. Investment grade issuance dipped just

1.5% year-over-year to$1 trillion 15% year-over-year drop in 2022. In the high-yield market, issuance has climbed45% year over year in 2023 through the end of September, a recovery from an80% year-over-year drop in 2022. - Global equity issuance has fallen since the Fed began raising interest rates in the first quarter of 2022. The aggregate amount of global equity issued has come in below

$101 billion $215 billion - Weaker economic growth is expected in 2024 in most major economies, including the

U.S. Even as central banks reach peak cyclical policy rates, most are maintaining biases toward tightening.

To request a copy of the 2024 Capital Markets Outlook: Issuance looks to rebound despite notably higher rates, please contact press.mi@spglobal.com.

S&P Global Market Intelligence's opinions, quotes, and credit-related and other analyses are statements of opinion as of the date they are expressed and not statements of fact or recommendation to purchase, hold, or sell any securities or to make any investment decisions, and do not address the suitability of any security.

About S&P Global Market Intelligence

At S&P Global Market Intelligence, we understand the importance of accurate, deep and insightful information. Our team of experts delivers unrivaled insights and leading data and technology solutions, partnering with customers to expand their perspective, operate with confidence, and make decisions with conviction.

S&P Global Market Intelligence is a division of S&P Global (NYSE: SPGI). S&P Global is the world's foremost provider of credit ratings, benchmarks, analytics and workflow solutions in the global capital, commodity and automotive markets. With every one of our offerings, we help many of the world's leading organizations navigate the economic landscape so they can plan for tomorrow, today. For more information, visit www.spglobal.com/marketintelligence.

Media Contact

Katherine Smith

S&P Global Market Intelligence

+1 781-301-9311

katherine.smith@spglobal.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/sp-global-market-intelligence-2024-capital-markets-outlook-says-issuance-looks-to-rebound-despite-notably-higher-rates-301983607.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/sp-global-market-intelligence-2024-capital-markets-outlook-says-issuance-looks-to-rebound-despite-notably-higher-rates-301983607.html

SOURCE S&P Global Market Intelligence

FAQ

What is the 2024 Capital Markets Outlook report by S&P Global Market Intelligence about?

How did corporate bond issuance perform in 2023?

What happened to global equity issuance since the Fed began raising interest rates?