S&P Global Commodity Insights Launches Carbon Intensity Measures & Carbon-Accounted Price Assessments for North America Natural Gas Markets

- The introduction of carbon intensity measures and associated price assessments by S&P Global Commodity Insights is a unique and innovative step toward transparency in the natural gas market.

- The launch includes carbon intensity measures and price assessments for eight key North America natural gas locations, providing detailed insights into the carbon footprint of these locations.

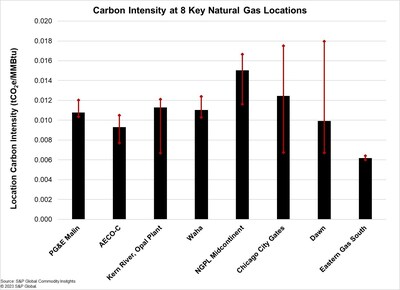

- The measures are modeled using proprietary research, data, analysis, and daily natural gas pipeline flows, reflecting averages throughout the gas value chain and ranging from 0.006 to 0.016 mtCO2e/MMBtu for the specified locations.

- S&P Global Commodity Insights aims to bring transparency to the carbon footprint of the North American natural gas market, as well as the US liquefied natural gas (LNG) export markets, enabling more informed business decisions.

- None.

-- Initial Launch includes 8 key North America Natural Gas Locations –

Kevin Birn, Global Head of Center of Emissions Excellence, S&P Global Commodity Insights, said: "We're excited to be offering our clients and the marketplace this truly unique assembly of carbon intensity insight that brings transparency to carbon across the value chain of natural gas -- from upstream production, gathering and boosting, and gas processing, to transport and amalgamation into market hubs. Not only is the offering unparalleled in detail and complexity, but it enables and facilitates the benchmarking of carbon and aids its incorporation into asset and commodity valuations."

The new S&P Global Commodity Insights carbon intensity measures are modeled utilizing proprietary research, data, analysis, daily natural gas pipeline flows and more; published monthly and expressed in metric tons of carbon dioxide equivalent per million British thermal units (mtCO2e/MMBtu). The initial suite of carbon intensity measures focuses on the following natural gas locations:

- AECO-C

Chicago City Gates- Dawn

- PG&E Malin

- Eastern Gas, South

- Waha

- Kern River, Opal plant

- NGPL Midcontinent

The new S&P Global Commodity Insights natural gas carbon intensity measures represent averages throughout the gas value chain and range from 0.006 to 0.016 mtCO2e/MMBtu for the above locations. They reflect blendings from multiple basins with varying production-level intensities; different levels of required processing; and relevant in transport distances from basin to hub. All such factors contribute to variability in the final carbon intensity by location. Lowest carbon-intensity locations are those with shorter transport distances from basin to hub, less processing requirements (i.e., dry sweet gas) and lower methane emissions throughout the supply chain.

Heather Jones, Head of Emissions Technical Analysis, S&P Global Commodity Insights, said: "The illumination of natural gas' carbon intensity at various locations allows the industry and marketplace the prospect of evaluating whether to transact on a carbon basis. It is important to note that carbon intensity measures are not static. They can change as natural gas flows into key market locations shift month to month and they change over time. Also, any individual natural gas company's carbon intensity pathway can vary dramatically from the overall average."

Alongside the natural gas carbon intensity measures, Platts, part of S&P Global Commodity Insights, will publish a daily associated carbon-accounted natural gas price assessment for each location, expressed in US dollars per MMBtu, and using the Platts Carbon Removal Credit Assessment (Platts CRC).

Marie-Louise

Not only are the new measures and price assessments aimed at bringing transparency to the carbon footprint of the North American natural gas market, but also the US liquefied natural gas (LNG) export markets. US LNG is a key supply source for European natural gas demand and market interest around de-carbonization of imports it rapidly expanding.

For more details about Platts low-carbon gas and carbon-accounted price assessments, access this methodology and specifications guide.

Today's launch builds on the S&P Global Commodity Insights' pre-existing suite of carbon intensity measures and related carbon-accounted Platts price premiums in oil, which cover basins, fields, blended grades, and key crude oil benchmarks, such as Brent,

The new natural gas carbon intensity measures and associated carbon-accounted price premiums may be found in S&P Global Commodity Insights products and services, including such as: Platts Gas Daily, Americas Natural Gas Alert pages, Platts Connect, and in the Platts price database.

Media Contacts:

Americas: Kathleen Tanzy + 1 917-331-4607, kathleen.tanzy@spglobal.com

EMEA: Paul Sandell + 44 (0)7816 180039, paul.sandell@spglobal.com

About S&P Global Commodity Insights

At S&P Global Commodity Insights, our complete view of global energy and commodity markets enables our customers to make decisions with conviction and create long-term, sustainable value.

We're a trusted connector that brings together thought leaders, market participants, governments, and regulators and we create solutions that lead to progress. Vital to navigating commodity markets, our coverage includes oil and gas, power, chemicals, metals, agriculture, shipping and energy transition. Platts® products and services, including leading benchmark price assessments in the physical commodity markets, are offered through S&P Global Commodity Insights. S&P Global Commodity Insights maintains clear structural and operational separation between its price assessment activities and the other activities carried out by S&P Global Commodity Insights and the other business divisions of S&P Global.

S&P Global Commodity Insights is a division of S&P Global (NYSE: SPGI). S&P Global is the world's foremost provider of credit ratings, benchmarks, analytics and workflow solutions in the global capital, commodity and automotive markets. With every one of our offerings, we help many of the world's leading organizations navigate the economic landscape so they can plan for tomorrow, today. For more information visit https://www.spglobal.com/commodityinsights.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/sp-global-commodity-insights-launches-carbon-intensity-measures--carbon-accounted-price-assessments-for-north-america-natural-gas-markets-301989115.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/sp-global-commodity-insights-launches-carbon-intensity-measures--carbon-accounted-price-assessments-for-north-america-natural-gas-markets-301989115.html

SOURCE S&P Global Commodity Insights

FAQ

What is the new suite of measures introduced by S&P Global Commodity Insights?

How are the carbon intensity measures calculated?

What is the purpose of these measures and price assessments?