S&P 500 Q3 2023 Buybacks Up 6.1% and Impact to Earnings Per Share Continues to Decline; Buyback Tax Reduced Operating Earnings by 0.39%

- None.

- None.

Insights

The reported increase in S&P 500 share repurchases for Q3 2023 indicates a continued reliance on buybacks as a method for companies to return value to shareholders. The 6.1% quarter-over-quarter increase, despite a year-over-year decrease of 12.0%, suggests a complex dynamic where companies are balancing the use of their cash reserves against a backdrop of economic uncertainty and regulatory changes.

With the financial sector reducing its buyback expenditure, possibly in response to new banking regulations and margin pressures, there is a clear shift in how different sectors are approaching capital return strategies. The Information Technology sector's increased expenditure reflects its robust cash flow generation, which allows for aggressive buyback programs.

The introduction of the 1% excise tax on net buybacks is a critical development, slightly reducing operating and GAAP earnings. While the immediate impact appears manageable, the potential for increasing this tax rate could significantly influence future buyback activities and corporate financial strategies.

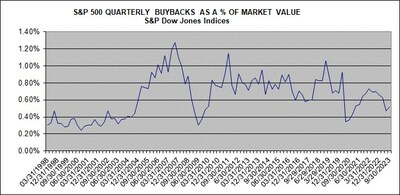

Investors should note that the reduction in share counts contributing to EPS growth is less pronounced than in previous quarters, which may affect the perceived earnings quality. The top-heavy nature of buybacks, with a small number of companies accounting for a large portion of the activity, highlights the concentration risk and the influence of major players on market dynamics.

The Energy sector's pullback in buyback activity aligns with the volatility in commodity prices and the sector's historical investment cycles. This strategic reduction may reflect a more conservative approach to capital allocation in anticipation of potential sector-specific challenges.

Health Care's increased buyback expenditure suggests confidence in the sector's stability and profitability, even as it faced a year-over-year decline. The Real Estate sector's notable increase in buybacks, though on a smaller scale, indicates a potential recovery or strategic positioning within the industry.

For companies like Apple, Alphabet and Meta Platforms, their significant buyback activities underscore the tech industry's continued financial strength and commitment to shareholder returns, even as they navigate a landscape of regulatory scrutiny and market competition.

The broader economic implications of the buyback data include the potential impact on stock market liquidity and investor sentiment. As companies repurchase their shares, they may be signaling confidence in their intrinsic value, which can be a positive sign for investors. However, a decrease in the number of companies engaging in buybacks could indicate a more cautious approach to capital expenditure amid economic headwinds.

The new tax on buybacks may also have broader fiscal implications, as it represents a new revenue stream for the government. Its future trajectory will be closely watched by corporate finance departments and could influence decisions on capital allocation between buybacks and dividends.

Overall, the data reflects a complex interplay between corporate strategy, regulatory environment and economic conditions, with varying implications for different sectors and individual companies.

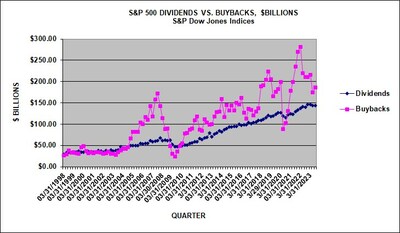

- S&P 500 Q3 2023 buybacks were

$185.6 billion 6.1% from Q2 2023's$174.9 billion 12.0% from Q3 2022's$210.8 billion - The 12-month September 2023 expenditure of

$787.3 billion 19.8% from the$981.6 billion - Financials pulled back again to

$29.3 billion $32.7 billion $46.9 billion $48.6 billion $47.1 billion - Energy pulled back to

$16.2 billion 8.7% of all buybacks; whereas the sector represented4.4% of the market value and had four issues in the top 20 for the quarter - The new net buyback

1% tax reduced Q3 2023 operating earnings by0.39% (0.34% in Q2 2023) and As Reported GAAP by0.42% (0.38% )

Historical data on S&P 500 buybacks are available at www.spdji.com/indices/equity/sp-500.

Key Takeaways:

- Q3 2023 share repurchases were

$185.6 billion 6.1% from Q2 2023's$174.9 billion 12.0% from Q3 2022's$210.8 billion - 281 companies reported buybacks of at least

$5 million - Buybacks remained top heavy with the top 20 S&P 500 companies accounting for

50.9% of Q3 2023 buybacks, down from Q2 2023's52.0% but still above the historical average of47.3% , and above the pre-COVID historical average of44.5% . - For the 12-months ending September 2023, buybacks were

$787.3 billion $981.6 billion 13.5% of companies reduced share counts used for earnings per share (EPS) by at least4% year-over-year, down from Q2 2023's16.3% and down from Q3 2022's21.2% ; for Q3 2023, 172 issues increased their shares used for EPS over Q2 2023 and 246 reduced them.- S&P 500 Q3 2023 dividends increased

0.7% to$144.2 billion $143.2 billion 2.7% greater than the$140.3 billion $580.2 billion 5.0% on an aggregate basis from the 12-month September 2022's$552.4 billion - Total shareholders return of buybacks and dividends increased to

$329.8 billion 3.7% from Q2 2023's$318.1 billion 6.1% from Q3 2022's$351.2 billion $1.36 7 trillion$1.53 4 trillion - The new

1% tax on net buybacks, which started in 2023, reduced the Q3 2023 S&P 500 operating earnings by0.39% and As Reported GAAP earnings by0.42% ; the proforma for full year 2022 was a0.51% reduction for operating and a0.58% reduction for as reported.

"The share count impact on EPS decreased for the fourth consecutive quarter, even as companies increased their overall buybacks due to the counter impact of both share issuance and option exercising coverage. While buybacks supported share price, only

"Given the market's expectations for interest rates to decline even as higher-for-longer interest rates continue, companies may be shy of financing buybacks going forward as discretionary buybacks may need to be financed from ongoing operations. For Financials, the new banking regulations are seen as limiting buybacks, as purchases may be used for option coverage, with minimal discretionary purchases, which reduce share count and increase EPS. Top-tier cash-flow issues however are seen as continuing their buybacks and positively impacting their EPS. Notably, and potentially adding to the cost later in 2024, is the ongoing budget discussions and quest for government income as increasing the

The new

Silverblatt added: "The

Q3 2023 GICS® Sector Analysis:

Information Technology maintained its lead in buybacks. For Q3 2023, the sector increased their expenditure

Financials pulled back again for the quarter, as concerns over new regulations and declining margins increased. The sector pulled back in Q2, Q3 and Q4 2022 over economic issues and to protect their dividends, but then started up again in Q1 2023. For Q3 2023, Financials spent

Energy decreased their buybacks for the fourth consecutive quarter, after significantly increasing them in the years prior. For Q3 2023, Energy expenditures declined

Health Care buybacks increased

Of note, Real Estate significantly increased their Q3 2023 buybacks to

Issues:

The five issues with the highest total buybacks for Q3 2023 were:

- Apple (AAPL): continued to dominate the issue level buybacks, as it again spent the most of any issue with its Q3 2023 expenditure ranking as the 13th highest in S&P 500 history. For the quarter, the company spent

$21.3 billion $19.9 billion $83.0 billion $95.6 billion $417 billion $641 billion - Alphabet (GOOG/L):

$15.8 billion $15.0 billion $60.7 billion $57.4 billion - Meta Platforms (META):

$5.7 billion $2.6 billion $26.1 billion $45.6 billion - Microsoft (MSFT):

$4.8 billion $5.7 billion $21.5 billion $30.6 billion - NVIDA (NVDA):

$4.6 billion for Q3 2023, up from$3.7 billion $10.4 billion $10.6 billion

For more information about S&P Dow Jones Indices, please visit https://www.spglobal.com/spdji/en/.

S&P Dow Jones Indices | |||

S&P 500 proforma net buyback tax impact | |||

TAX | TAX % OF | TAX % OF | |

$ BILLIONS | OPERATING | AS REPORTED | |

Q3 2023 | 0.39 % | 0.42 % | |

Q2 2023 | 0.34 % | 0.38 % | |

Q1 2023 | 0.45 % | 0.49 % | |

2022 proforma | 0.51 % | 0.58 % | |

2021 proforma | 0.45 % | 0.47 % | |

S&P Dow Jones Indices | ||||||||

S&P 500, $ | (preliminary in bold) | |||||||

PERIOD | MARKET | OPERATING | AS REPORTED | DIVIDEND & | ||||

VALUE | EARNINGS | EARNINGS | DIVIDENDS | BUYBACKS | DIVIDEND | BUYBACK | BUYBACK | |

$ BILLIONS | $ BILLIONS | $ BILLIONS | $ BILLIONS | $ BILLIONS | YIELD | YIELD | YIELD | |

12 Mo Sep,'23 | 1.61 % | 2.19 % | 3.81 % | |||||

12 Mo Sep,'22 | 1.83 % | 3.26 % | 5.09 % | |||||

2022 | 1.76 % | 2.87 % | 4.63 % | |||||

2021 | 1.27 % | 2.18 % | 3.45 % | |||||

2020 | 1.53 % | 1.64 % | 3.17 % | |||||

2019 | 1.81 % | 2.72 % | 4.54 % | |||||

2018 | 2.17 % | 3.84 % | 6.01 % | |||||

9/30/203 Prelim. | 1.61 % | 2.19 % | 3.81 % | |||||

6/30/2023 | 1.55 % | 2.19 % | 3.74 % | |||||

3/31/2023 | 1.67 % | 2.50 % | 4.17 % | |||||

12/31/2022 | 1.76 % | 2.87 % | 4.63 % | |||||

9/30/2022 | 1.83 % | 3.26 % | 5.09 % | |||||

6/30/2022 | 1.70 % | 3.15 % | 4.85 % | |||||

3/31/2022 | 1.37 % | 2.57 % | 3.94 % | |||||

12/31/2021 | 1.27 % | 2.18 % | 3.45 % | |||||

9/30/2021 | 1.37 % | 2.03 % | 3.40 % | |||||

6/30/2021 | 1.33 % | 1.68 % | 3.01 % | |||||

3/31/2021 | 1.43 % | 1.48 % | 2.91 % | |||||

12/31/2020 | 1.53 % | 1.64 % | 3.17 % | |||||

9/30/2020 | 1.75 % | 2.05 % | 3.80 % | |||||

6/30/2020 | 1.93 % | 2.52 % | 4.45 % | |||||

3/31/2020 | 2.31 % | 3.37 % | 5.68 % | |||||

12/31/2019 | 1.81 % | 2.72 % | 4.54 % | |||||

9/30/2019 | 1.94 % | 3.12 % | 5.06 % | |||||

S&P Dow Jones Indices | |||||||

S&P 500 SECTOR BUYBACKS | |||||||

SECTOR $ MILLIONS | Q3,'23 | Q2,'23 | Q3,'22 | 12MoSep,'23 | 12MoSep,'22 | 5-YEARS | 10-YEARS |

Consumer Discretionary | |||||||

Consumer Staples | |||||||

Energy | |||||||

Financials | |||||||

Healthcare | |||||||

Industrials | |||||||

Information Technology | |||||||

Materials | |||||||

Real Estate | |||||||

Communication Services | |||||||

Utilities | |||||||

TOTAL | |||||||

SECTOR BUYBACK MAKEUP % | Q3,'23 | Q2,'23 | Q3,'22 | 12MoSep,'23 | 12MoSep,'22 | 5-YEARS | 10-YEARS |

Consumer Discretionary | 10.13 % | 10.10 % | 9.27 % | 9.35 % | 10.83 % | 9.33 % | 11.64 % |

Consumer Staples | 2.70 % | 2.44 % | 5.37 % | 2.87 % | 4.40 % | 4.05 % | 5.52 % |

Energy | 8.75 % | 10.43 % | 10.44 % | 9.35 % | 5.25 % | 4.21 % | 4.01 % |

Financials | 15.79 % | 18.72 % | 10.92 % | 16.69 % | 15.33 % | 18.85 % | 18.46 % |

Healthcare | 8.06 % | 7.66 % | 9.56 % | 9.65 % | 10.22 % | 10.38 % | 11.48 % |

Industrials | 7.70 % | 7.19 % | 8.12 % | 8.07 % | 7.74 % | 7.85 % | 9.64 % |

Information Technology | 26.16 % | 26.95 % | 28.82 % | 25.31 % | 28.44 % | 29.90 % | 28.86 % |

Materials | 2.84 % | 1.80 % | 2.69 % | 2.38 % | 3.17 % | 2.43 % | 2.43 % |

Real Estate | 0.46 % | 0.04 % | 0.38 % | 0.28 % | 0.38 % | 0.34 % | 0.29 % |

Communication Services | 17.25 % | 14.50 % | 14.37 % | 15.79 % | 13.97 % | 12.33 % | 7.37 % |

Utilities | 0.16 % | 0.16 % | 0.07 % | 0.26 % | 0.28 % | 0.35 % | 0.29 % |

TOTAL | 100.00 % | 100.00 % | 100.00 % | 100.00 % | 100.00 % | 100.00 % | 100.00 % |

S&P Dow Jones Indices | ||||||||||

S&P 500 20 LARGEST Q3 2023 BUYBACKS, $ MILLIONS | ||||||||||

Company | Ticker | Sector | Q3 2023 | Q2 2023 | Q3 2022 | 12-Months | 12-Months | 5-Year | 10-Year | Indicated |

Buybacks | Buybacks | Buybacks | Sep,'23 | Sep,'22 | Buybacks | Buybacks | Dividend | |||

$ Million | $ Million | $ Million | $ Million | $ Million | $ Million | $ Million | $ Million | |||

Apple | AAPL | Information Technology | ||||||||

Alphabet | GOOGL | Communication Services | ||||||||

Meta Platforms | META | Communication Services | ||||||||

Microsoft | MSFT | Information Technology | ||||||||

NVIDIA | NVDA | Information Technology | ||||||||

Exxon Mobil | XOM | Energy | ||||||||

Bristol-Myers Squibb | BMY | Health Care | ||||||||

Visa | V | Financials | ||||||||

Comcast | CMCSA | Communication Services | ||||||||

Chevron | CVX | Energy | ||||||||

Marathon Petroleum | MPC | Energy | ||||||||

T-Mobile US | TMUS | Communication Services | ||||||||

Booking Holdings | BKNG | Consumer Discretionary | ||||||||

Deere & Company | DE | Industrials | ||||||||

Netflix | NFLX | Communication Services | ||||||||

JPMorgan Chase & Co. | JPM | Financials | ||||||||

DuPont de Nemours | DD | Materials | ||||||||

Salesforce) | CRM | Information Technology | ||||||||

Mastercard | MA | Financials | ||||||||

Valero Energy | VLO | Energy | ||||||||

Top 20 | ||||||||||

S&P 500 | ||||||||||

Top 20 % of S&P 500 | 50.86 % | 46.85 % | 39.46 % | 43.92 % | 33.14 % | 33.56 % | 26.98 % | 16.33 % | ||

Gross values are not adjusted for float | ||||||||||

S&P Dow Jones Indices | ||||

S&P 500 Q3 2023 Buyback Report | ||||

SECTOR | DIVIDEND | BUYBACK | COMBINED | |

YIELD | YIELD | YIELD | ||

Consumer Discretionary | 0.80 % | 1.80 % | 2.59 % | |

Consumer Staples | 2.79 % | 0.99 % | 3.78 % | |

Energy | 3.54 % | 4.69 % | 8.23 % | |

Financials | 1.89 % | 2.83 % | 4.71 % | |

HealthCare | 1.77 % | 1.55 % | 3.32 % | |

Industrials | 1.70 % | 1.98 % | 3.68 % | |

Information Technology | 0.80 % | 1.70 % | 2.51 % | |

Materials | 2.09 % | 2.03 % | 4.12 % | |

Real Estate | 3.63 % | 0.23 % | 3.86 % | |

Communications Services | 1.06 % | 4.70 % | 5.75 % | |

Utilities | 3.51 % | 0.22 % | 3.73 % | |

S&P 500 | 1.57 % | 2.08 % | 3.65 % | |

Uses full values (unadjusted for float) | ||||

Dividends based on indicated; buybacks based on the last 12-months ending Q3,'23 | ||||

Share Count Changes | ||

(Y/Y diluted shares used for EPS) | >= | <=- |

Q3 2023 | 4.44 % | 13.54 % |

Q2 2023 | 4.22 % | 16.27 % |

Q1 2023 | 4.02 % | 18.47 % |

Q4 2022 | 5.01 % | 19.44 % |

Q3 2022 | 7.21 % | 21.24 % |

Q2 2022 | 8.42 % | 19.84 % |

Q1 2022 | 7.62 % | 17.64 % |

Q4 2021 | 10.06 % | 14.89 % |

Q3 2021 | 10.22 % | 7.41 % |

Q2 2021 | 11.02 % | 5.41 % |

Q1 2021 | 10.40 % | 5.80 % |

Q4 2020 | 9.02 % | 6.01 % |

Q3 2020 | 8.62 % | 9.62 % |

ABOUT S&P DOW JONES INDICES

S&P Dow Jones Indices is the largest global resource for essential index-based concepts, data and research, and home to iconic financial market indicators, such as the S&P 500® and the Dow Jones Industrial Average®. More assets are invested in products based on our indices than products based on indices from any other provider in the world. Since Charles Dow invented the first index in 1884, S&P Dow Jones Indices has been innovating and developing indices across the spectrum of asset classes helping to define the way investors measure and trade the markets.

S&P Dow Jones Indices is a division of S&P Global (NYSE: SPGI), which provides essential intelligence for individuals, companies, and governments to make decisions with confidence. For more information, visit: https://www.spglobal.com/spdji/en/.

S&P Dow Jones Indices Media Contacts:

April Kabahar

(+1) 917 796 3121

april.kabahar@spglobal.com

Alyssa Augustyn

(+1) 773 919 4732

alyssa.augustyn@spglobal.com

S&P Dow Jones Indices Index Services:

Howard Silverblatt

Senior Index Analyst

(+1) 973 769 2306

howard.silverblatt@spglobal.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/sp-500-q3-2023-buybacks-up-6-1-and-impact-to-earnings-per-share-continues-to-decline-buyback-tax-reduced-operating-earnings-by-0-39-302019079.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/sp-500-q3-2023-buybacks-up-6-1-and-impact-to-earnings-per-share-continues-to-decline-buyback-tax-reduced-operating-earnings-by-0-39-302019079.html

SOURCE S&P Dow Jones Indices

FAQ

What were the S&P 500 Q3 2023 buybacks?

What was the 12-month expenditure of S&P 500 for September 2023?

What was the impact of the new net buyback 1% tax on operating earnings in Q3 2023?

How did Q3 2023 dividends change from the previous quarter?

What were the total shareholder returns in Q3 2023?

Which sector maintained its lead in buybacks for Q3 2023?