Q1 2021 S&P 500 Buybacks Double their Post-Covid Low; Companies repurchased 36.5% more shares than in Q4 2020

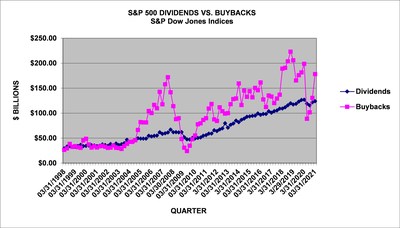

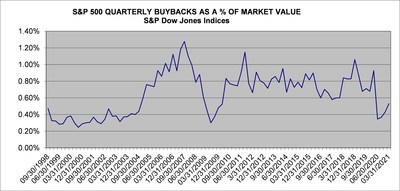

The S&P Dow Jones Indices reported preliminary Q1 2021 S&P 500 stock buybacks totaling $178.1 billion, a significant 36.5% increase from Q4 2020 and 100.9% above Q2 2020's recent low. However, this figure is down 10.4% year-over-year from Q1 2020's $198.7 billion. For the 12-month period ending March 2021, buybacks were $499.1 billion, 30.8% lower than the previous year. Companies are expected to enhance buybacks in 2021, particularly with big banks returning to the market.

- Q1 2021 buybacks of $178.1 billion show a strong rebound from Q4 2020's $130.5 billion.

- 335 companies reported buybacks of at least $5 million, indicating increased corporate confidence.

- Total shareholder returns from buybacks and dividends in Q1 2021 reached $302 billion, up 19.8% from Q4 2020.

- Year-over-year buybacks down by 10.4% from Q1 2020's $198.7 billion.

- Total buybacks for the 12-month period ending March 2021 decreased by 30.8% from the previous year.

NEW YORK, June 15, 2021 /PRNewswire/ -- S&P Dow Jones Indices ("S&P DJI") announced today that preliminary Q1 2021 S&P 500® stock buybacks, or share repurchases, were

Historical data on S&P 500 buybacks are available at www.spdji.com/indices/equity/sp-500.

Key Takeaways:

- Q1 2021 share repurchases were

$178.1 billion , rebounding36.5% from Q4 2020's$130.5 billion expenditure, up100.9% from the Q2 2020 recent low of$88.7 billion , but down10.4% year-over-year from the pre-COVID Q1 2020$198.7 billion . - 335 companies reported buybacks of at least

$5 million for the quarter, up from 244 in Q4 2020, 190 in Q3 2020, 170 in Q2 2020 and down from 373 in Q1 2020. - Buybacks remained top heavy but significantly less so, with the top 20 issues accounting for

53.3% of Q1 2021 buybacks, down from66.3% in Q4 2020,77.4% in Q3 2020, and87.2% in Q2 2020, but still up from the historical pre-COVID historical average of44.5% . - For the 12-month March 2021 period, buybacks were

$499.1 billion , a30.8% decrease from the prior 12-month March 2020 period of$721.6 billion . - Buybacks are expected to continue at a higher level in 2021 as big banks, via Fed approval for the second half of the year, have returned to the buyback market, and more companies are expected to expand their buybacks to discretionary purchases used to reduce share count and increase earnings-per-share.

5.9% of companies reduced share counts by at least4% year-over-year, down from Q4 2020's6.0% , and down significantly from Q1 2020's19.6% (the recent high was in Q1 2016, at28.2% ).- S&P 500 Q1 2021 dividends increased

1.9% to$123.9 billion from Q4 2020's$121.6 billion and were2.4% less than the record$127.0 billion in Q1 2020. For the 12-month March 2021 period, dividends were$480.1 billion , down3.0% on an aggregate basis from prior period's$495.1 billion . - Total shareholder return of buybacks and dividends in Q1 2021 was

$302.0 billion , up19.8% from Q4 2020's$252.1 billion and down7.3% from Q1 2020's$325.7 billion (Q4 2018 holds the record, at$342.8 billion ). - Total shareholder return for the 12-months March 2021 declined to

$0.98 trillion from 12-month March 2020's$1.22 trillion .

"Companies almost fully returned to the buyback market in Q1 2021 after their Q2 2020 COVID inspired departure, as 335 issues did significant open-market purchases, up from 244 last quarter and 170 in Q2 2020. Given the strong and expected record level cash-flow from Q1 2021, the full return to pre-COVID levels is expected later in the year," said Howard Silverblatt, Senior Index Analyst at S&P Dow Jones Indices.

Remainder of 2021 Outlook:

Silverblatt added, "Companies are expected to fully cover their employee stock options via buybacks, as discretionary buybacks, which reduce share count and increase earnings-per-share, are expected to increase to near record levels by year-end, subject to the continuance of consumer spending which produced a record Q1 earnings series."

Q1 2021 GICS® Sector Analysis:

Information Technology continued to lead and dominate in buybacks, but at a reduced rate, as Financials re-entered the buyback market. For Q1 2021 IT's share declined to

Financial buybacks returned, spending

Health Care increased

Issues:

The five issues with the highest total buybacks for Q1 2021 are:

- Apple (AAPL) continued to be the poster-child for buybacks, again spending more than any other issue, as it spent

$18.8 billion in Q1 2021 (down from the Q4 2020$27.6 billion ), which ranked as the eighth largest expenditure in index history, as Apple held 14 of the top 15 record quarters (QUALCOM holds #6, posted in Q3 2018, with$21.2 billion ). For the 12-month period, Apple has spent$81.6 billion on buybacks, up from the prior period's$76.6 billion . Over the five-year period, they have spent$319.2 billion and$441.9 billion over the ten-year period. - Alphabet (GOOG/L), was next:

$11.4 billion for Q1 2021, up from$7.9 billion in Q4 2020; the 12-month March 2021 expenditure was$34.0 billion versus$23.9 billion for the 12-months ending March 2020. - Microsoft (MSFT):

$6.9 billion for Q1 2021, up from$6.5 billion in Q4 2020; for the 12-month period it was$26.0 billion versus$21.8 billion . - Berkshire Hathaway (BRK.B):

$6.6 billion for Q1 2021, down from the$9.0 billion spent in Q4 2020; for the 12 months it was$29.5 billion versus$5.0 billion . - Facebook (FB):

$5.0 billion for Q1 2021, up from$3.0 billion in Q4 2020; for the 12-months they spent$12.9 billion versus$7.4 billion .

For more information about S&P Dow Jones Indices, please visit www.spdji.com.

S&P Dow Jones Indices | ||||||||

S&P 500, $ U.S. BILLIONS | (preliminary in bold) | |||||||

PERIOD | MARKET | OPERATING | AS REPORTED | DIVIDEND & | ||||

VALUE | EARNINGS | EARNINGS | DIVIDENDS | BUYBACKS | DIVIDEND | BUYBACK | BUYBACK | |

$ BILLIONS | $ BILLIONS | $ BILLIONS | $ BILLIONS | $ BILLIONS | YIELD | YIELD | YIELD | |

12 Mo Mar,21 Prelim. | ||||||||

12 Mo Mar,20 | ||||||||

2020 | ||||||||

2019 | ||||||||

2018 | ||||||||

3/31/2021 Prelim. | ||||||||

12/31/2020 | ||||||||

9/30/2020 | ||||||||

6/30/2020 | ||||||||

3/31/2020 | ||||||||

12/31/2019 | ||||||||

9/30/2019 | ||||||||

6/28/2019 | ||||||||

3/29/2019 | ||||||||

12/31/2018 | ||||||||

9/30/2018 | ||||||||

6/30/2018 | ||||||||

3/29/2018 | ||||||||

12/29/2017 | ||||||||

9/29/2017 | ||||||||

6/30/2017 | ||||||||

3/31/2017 | ||||||||

S&P Dow Jones Indices | |||||||||

S&P 500 SECTOR BUYBACKS | |||||||||

SECTOR $ MILLIONS | Q1,'21 | Q4,'20 | Q1,'20 | 12MoMar,'21 | 12MoMar,'20 | 5-YEARS | 10-YEARS | Q4,'18 | Q2,'20 |

(high) | (recent low) | ||||||||

Consumer Discretionary | |||||||||

Consumer Staples | |||||||||

Energy | |||||||||

Financials | |||||||||

Healthcare | |||||||||

Industrials | |||||||||

Information Technology | |||||||||

Materials | |||||||||

Real Estate | |||||||||

Communication Services | |||||||||

Utilities | |||||||||

TOTAL | |||||||||

SECTOR BUYBACK MAKEUP % | Q1,'21 | Q4,'20 | Q1,'20 | 12MoMar,'21 | 12MoMar,'20 | 5-YEARS | 10-YEARS | Q4,'18 | Q2,'20 |

Consumer Discretionary | |||||||||

Consumer Staples | |||||||||

Energy | |||||||||

Financials | |||||||||

Healthcare | |||||||||

Industrials | |||||||||

Information Technology | |||||||||

Materials | |||||||||

Real Estate | |||||||||

Communication Services | |||||||||

Utilities | |||||||||

TOTAL |

S&P Dow Jones Indices | ||||||||||

S&P 500 20 LARGEST Q1 2021 BUYBACKS, $ MILLIONS | ||||||||||

Company | Ticker | Sector | Q1 2021 | Q4 2020 | Q1 20209 | 12-Months | 12-Months | 5-Year | 10-Year | Indicated |

Buybacks | Buybacks | Buybacks | Mar,'21 | Mar,'20 | Buybacks | Buybacks | Dividend | |||

$ Million | $ Million | $ Million | $ Million | $ Million | $ Million | $ Million | $ Million | |||

Apple | AAPL | Information Technology | ||||||||

Alphabet | GOOGL | Communication Services | ||||||||

Microsoft | MSFT | Information Technology | ||||||||

Berkshire Hathaway | BRK.B | Financials | ||||||||

FB | Communication Services | |||||||||

JPMorgan Chase | JPM | Financials | ||||||||

Oracle | ORCL | Information Technology | ||||||||

Home Depot | HD | Consumer Discretionary | ||||||||

Charter Communications | CHTR | Communication Services | ||||||||

Goldman Sachs Group | GS | Financials | ||||||||

Bank of America | BAC | Financials | ||||||||

Lowe's Companies | LOW | Consumer Discretionary | ||||||||

Procter & Gamble | PG | Consumer Staples | ||||||||

Walmart | WMT | Consumer Staples | ||||||||

Cigna | CI | Health Care | ||||||||

Morgan Stanley | MS | Financials | ||||||||

Intel | INTC | Information Technology | ||||||||

PayPal Holdings | PYPL | Information Technology | ||||||||

Northrop Grumman | NOC | Industrials | ||||||||

Thermo Fisher Scientific | TMO | Health Care | ||||||||

Top 20 | ######## | ######## | ####### | |||||||

S&P 500 | ######## | ######## | ####### | |||||||

Top 20 % of S&P 500 | ||||||||||

Gross values are not adjusted for float | ||||||||||

S&P Dow Jones Indices | ||||

S&P 500 Q1 2021 Buyback Report | ||||

SECTOR | DIVIDEND | BUYBACK | COMBINED | |

YIELD | YIELD | YIELD | ||

Consumer Discretionary | ||||

Consumer Staples | ||||

Energy | ||||

Financials | ||||

HealthCare | ||||

Industrials | ||||

Information Technology | ||||

Materials | ||||

Real Estate | ||||

Communications Services | ||||

Utilities | ||||

S&P 500 | ||||

Uses full values (unadjusted for float) | ||||

Dividends based on indicated; buybacks based on the last 12-months ending Q1,'21 | ||||

S&P Dow Jones Indices | ||

Share Count Changes | ||

(Y/Y diluted shares used for EPS) | >= | <=- |

Q1 2021 | ||

Q4 2020 | ||

Q3 2020 | ||

Q2 2020 | ||

Q1 2020 | ||

Q4 2019 | ||

Q3 2019 | ||

Q2 2019 | ||

Q1 2019 | ||

Q4 2018 | ||

Q3 2018 | ||

Q2 2018 | ||

Q1 2018 |

ABOUT S&P DOW JONES INDICES

S&P Dow Jones Indices is the largest global resource for essential index-based concepts, data and research, and home to iconic financial market indicators, such as the S&P 500® and the Dow Jones Industrial Average®. More assets are invested in products based on our indices than products based on indices from any other provider in the world. Since Charles Dow invented the first index in 1884, S&P DJI has been innovating and developing indices across the spectrum of asset classes helping to define the way investors measure and trade the markets.

S&P Dow Jones Indices is a division of S&P Global (NYSE: SPGI), which provides essential intelligence for individuals, companies, and governments to make decisions with confidence. For more information, visit: www.spdji.com.

![]() View original content to download multimedia:http://www.prnewswire.com/news-releases/q1-2021-sp-500-buybacks-double-their-post-covid-low-companies-repurchased-36-5-more-shares-than-in-q4-2020--301312766.html

View original content to download multimedia:http://www.prnewswire.com/news-releases/q1-2021-sp-500-buybacks-double-their-post-covid-low-companies-repurchased-36-5-more-shares-than-in-q4-2020--301312766.html

SOURCE S&P Dow Jones Indices

FAQ

What were the total stock buybacks for S&P 500 in Q1 2021?

How do the Q1 2021 buybacks compare to previous quarters?

What was the total shareholder return in Q1 2021?

What factors contributed to the increase in buybacks in Q1 2021?