FACTORY DEMAND WEAKENS ACROSS MAJOR ECONOMIES IN OCTOBER: GEP GLOBAL SUPPLY CHAIN VOLATILITY INDEX

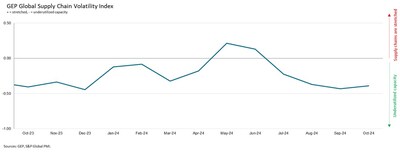

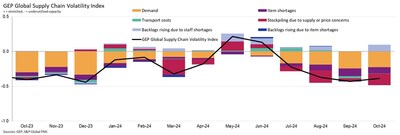

Global manufacturing demand showed continued weakness in October 2024, according to the GEP Global Supply Chain Volatility Index, which posted -0.39. U.S. factories made their strongest cutbacks to buying volumes in nearly 18 months, while Europe's industrial recession persisted, particularly affecting Germany's automotive sector.

In contrast, China's factory production rebounded after three months of contraction, and India maintained strong expansion. The index indicated one of the highest levels of spare capacity at global suppliers in over a year, with October marking the 14th consecutive month of excess supply relative to manufacturing demand globally.

By region, North America recorded the weakest purchasing activity (-0.72), followed by Europe (-0.52), while Asia showed more resilience (-0.20).

La domanda di produzione globale ha mostrato una continua debolezza nell'ottobre 2024, secondo l'Indice di Volatilità della Catena di Fornitura GEP, che ha registrato -0,39. Le fabbriche statunitensi hanno effettuato i tagli più consistenti agli acquisti degli ultimi 18 mesi, mentre la recessione industriale in Europa è continuata, influenzando in particolare il settore automobilistico della Germania.

Al contrario, la produzione industriale in Cina è rimbalzata dopo tre mesi di contrazione e l'India ha mantenuto una forte espansione. L'indice ha indicato uno dei livelli più alti di capacità inutilizzata presso i fornitori globali in oltre un anno, con ottobre che segna il 14° mese consecutivo di offerta eccessiva rispetto alla domanda di produzione a livello globale.

Per regione, il Nord America ha registrato l'attività di acquisto più debole (-0,72), seguito dall'Europa (-0,52), mentre l'Asia ha mostrato maggiore resilienza (-0,20).

La demanda de manufactura global mostró una debilidad continua en octubre de 2024, según el Índice de Volatilidad de la Cadena de Suministro GEP, que marcó -0,39. Las fábricas de EE. UU. hicieron sus recortes más significativos en los volúmenes de compra en casi 18 meses, mientras que la recesión industrial en Europa persistió, afectando especialmente al sector automotriz de Alemania.

En contraste, la producción industrial de China se recuperó después de tres meses de contracción, y India mantuvo una fuerte expansión. El índice indicó uno de los niveles más altos de capacidad sobrante en los proveedores globales en más de un año, con octubre marcando el 14º mes consecutivo de oferta excesiva en relación con la demanda de manufactura global.

Por regiones, América del Norte registró la actividad de compras más débil (-0,72), seguida de Europa (-0,52), mientras que Asia mostró más resiliencia (-0,20).

글로벌 제조 수요는 2024년 10월에 계속된 약세를 보였으며, GEP 글로벌 공급망 변동성 지수는 -0.39를 기록했습니다. 미국의 공장들은 거의 18개월 동안 가장 강력한 구매량 감소를 단행했습니다. 유럽의 산업 침체는 지속되었으며, 특히 독일의 자동차 산업에 큰 영향을 미쳤습니다.

대조적으로, 중국의 공장 생산은 3개월의 수축 후 반등하였으며, 인도는 강력한 확장을 유지했습니다. 이 지수는 전세계 공급업체에서 1년 넘게 가장 높은 여유 용량 수준 중 하나를 나타내었고, 10월에는 글로벌 제조 수요에 비해 과잉 공급의 14개월 연속을 기록했습니다.

지역별로는 북미가 가장 약한 구매 활동을 기록했는데 (-0.72), 그 뒤를 유럽이 이었으며 (-0.52), 아시아는 더 많은 회복력을 보였습니다 (-0.20).

La demande mondiale en fabrication a montré une faiblesse persistante en octobre 2024, selon l'Indice de Volatilité de la Chaîne d'Approvisionnement GEP, qui a affiché -0,39. Les usines américaines ont effectué leurs plus fortes réductions de volumes d'achats en près de 18 mois, tandis que la récession industrielle en Europe a persisté, affectant particulièrement le secteur automobile allemand.

En revanche, la production industrielle en Chine a rebondi après trois mois de contraction, et l'Inde a maintenu une forte expansion. L'indice a indiqué l'un des niveaux les plus élevés de capacité excédentaire chez les fournisseurs mondiaux depuis plus d'un an, avec octobre marquant le 14ème mois consécutif d'excès d'offre par rapport à la demande de fabrication à l'échelle mondiale.

Par région, l'Amérique du Nord a enregistré l'activité d'achat la plus faible (-0,72), suivie par l'Europe (-0,52), tandis que l'Asie a montré plus de résilience (-0,20).

Die globale Nachfrage in der Produktion zeigte im Oktober 2024 eine anhaltende Schwäche, wie der GEP Global Supply Chain Volatility Index mit -0,39 belegte. US-Fabriken haben ihre stärksten Rückgänge bei den Einkaufsvolumina seit nahezu 18 Monaten vorgenommen, während die industrielle Rezession in Europa anhaltete, insbesondere den Automobilsektor in Deutschland stark beeinträchtigte.

Im Gegensatz dazu erholte sich die Produktionsleistung in China nach drei Monaten der Kontraktion und Indien setzte sein starkes Wachstum fort. Der Index zeigte eines der höchsten Niveaus an ungenutzter Kapazität bei globalen Zulieferern seit über einem Jahr, wobei der Oktober den 14. Monat in Folge markierte, in dem es ein Überangebot im Vergleich zur globalen Produktionsnachfrage gab.

Nach Regionen verzeichnete Nordamerika die schwächste Einkaufsaktivität (-0,72), gefolgt von Europa (-0,52), während Asien mehr Resilienz zeigte (-0,20).

- None.

- None.

U.S. factories cut back purchases sharply, signaling heightened risks of manufacturing weakness spilling over into the broader economy in 2025- In contrast, Chinese factories report growth following three months of shrinking input purchasing

Europe's industrial recession shows no sign of abating, with German, French and Austrian producers at the heart of the downturn

Suppliers feeding the world's largest markets reported contractions in October. Most notable was another steep rise in slack across North American supply chains due to declining factory activity in the

Suppliers feeding

Additionally, October is the 14th consecutive month that the items in short supply indicator has been negative. This shows an excess supply of commodities and intermediate goods relative to current manufacturing demand globally.

"We're in a buyers' market. October is the fourth straight month that suppliers worldwide reported spare capacity, with notable contractions in factory demand across

OCTOBER 2024 KEY FINDINGS

- DEMAND: Procurement activity remains weak across the globe. Demand for commodities, components and raw materials continues to contract, and at one of the steepest rates seen in 2024 so far. By region,

North America saw the weakest purchasing activity in October, followed byEurope . Input demand was more resilient inAsia , but still subdued overall. - INVENTORIES: Inventory drawdowns intensified across factories worldwide in October. Reports of safety stockpiling remained low by historical standards as companies look to make their warehouses leaner to preserve cash flow and tightly manage stocks in line with the weak order situation.

- MATERIAL SHORTAGES: The items in short supply indicator, an aggregate measure which tracks the availability of critical components and raw materials, remains low, pointing to robust supply levels.

- LABOR SHORTAGES: Reports of manufacturers' backlogs rising due to labor shortages ticked higher in October and were above the long-term average. However, factory employment levels have fallen in recent months, suggesting throughput has decreased as a result of lower workforce capacity and companies aren't clearing backlogs as quickly.

- TRANSPORTATION: Global transportation costs were in line with their long-run average during October.

REGIONAL SUPPLY CHAIN VOLATILITY

NORTH AMERICA : Index at -0.72, versus -0.78 previously. The latest figure is consistent with a substantial level of spare capacity atNorth America's suppliers.EUROPE : Index at -0.52, from -0.74. Albeit an improvement from September, the latest data indicate a continuation ofEurope's industrial recession.U.K. : Index fell notably to -0.40, from -0.12, its lowest level in six months, signaling a deterioration in theU.K. manufacturing sector.ASIA : Index at -0.20, from -0.36. While indicative of spare capacity, the level of slack is much lower than seen in Western markets.India continues to have a strongly positive influence on the region.

For more information, visit www.gep.com/volatility.

Note: Full historical data dating back to January 2005 is available for subscription. Please contact economics@spglobal.com.

The next release of the GEP Global Supply Chain Volatility Index will be 8 a.m. ET, Dec. 11, 2024.

About the GEP Global Supply Chain Volatility Index

The GEP Global Supply Chain Volatility Index is produced by S&P Global and GEP. It is derived from S&P Global's PMI® surveys, sent to companies in over 40 countries, totaling around 27,000 companies. The headline figure is a weighted sum of six sub-indices derived from PMI data, PMI Comments Trackers and PMI Commodity Price & Supply Indicators compiled by S&P Global.

- A value above 0 indicates that supply chain capacity is being stretched and supply chain volatility is increasing. The further above 0, the greater the extent to which capacity is being stretched.

- A value below 0 indicates that supply chain capacity is being underutilized, reducing supply chain volatility. The further below 0, the greater the extent to which capacity is being underutilized.

A Supply Chain Volatility Index is also published at a regional level for

About GEP

GEP® delivers AI-powered procurement and supply chain solutions that help global enterprises become more agile and resilient, operate more efficiently and effectively, gain competitive advantage, boost profitability and increase shareholder value. Fresh thinking, innovative products, unrivaled domain expertise, smart, passionate people — this is how GEP SOFTWARE™, GEP STRATEGY™ and GEP MANAGED SERVICES™ together deliver procurement and supply chain solutions of unprecedented scale, power and effectiveness. Our customers are the world's best companies, including more than 1,000 Fortune 500 and Global 2000 industry leaders who rely on GEP to meet ambitious strategic, financial and operational goals. A leader in multiple Gartner Magic Quadrants, GEP's cloud-native software and digital business platforms consistently win awards and recognition from industry analysts, research firms and media outlets, including Gartner, Forrester, IDC, ISG, and Spend Matters. GEP is also regularly ranked a top procurement and supply chain consulting and strategy firm, and a leading managed services provider by ALM, Everest Group, NelsonHall, IDC, ISG and HFS, among others. Headquartered in

About S&P Global

S&P Global (NYSE: SPGI) S&P Global provides essential intelligence. We enable governments, businesses and individuals with the right data, expertise and connected technology so that they can make decisions with conviction. From helping our customers assess new investments to guiding them through ESG and energy transition across supply chains, we unlock new opportunities, solve challenges and accelerate progress for the world. We are widely sought after by many of the world's leading organizations to provide credit ratings, benchmarks, analytics and workflow solutions in the global capital, commodity and automotive markets. With every one of our offerings, we help the world's leading organizations plan for tomorrow, today.

Media Contacts

Derek Creevey | Joe Hayes | S&P Global Market Intelligence |

GEP | Principal Economist | Email: Press.mi@spglobal.com |

Phone: +1 646-276-4579 | S&P Global Market Intelligence | |

Email: | Phone: +44-1344-328-099 | |

Email: joe.hayes@spglobal.com |

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/factory-demand-weakens-across-major-economies-in-october-gep-global-supply-chain-volatility-index-302301525.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/factory-demand-weakens-across-major-economies-in-october-gep-global-supply-chain-volatility-index-302301525.html

SOURCE GEP