Platts of S&P Global Commodity Insights Launches First-of-Type Daily Price Assessments for North America Renewable Natural Gas

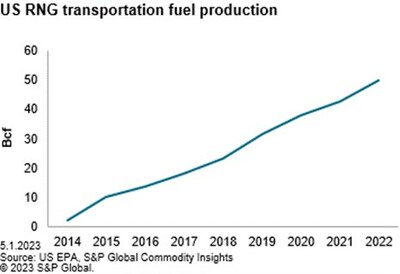

Production of US renewable natural gas has grown steadily since its inclusion in the federal Renewable Fuel Standard and interest in RNG will continue to expand as companies seek to reduce their carbon footprint. According to S&P Global Commodity Insights' Planning Scenario forecasts, renewable natural gas supply will grow threefold to 2030, and as much as fivefold, according to its more ambitious Fast Transition outlook to 2050.

Platts has launched two RNG price assessments: One that reflects

- Platts North America RNG (

California ) -- assessment reflects the price premium for renewable natural gas sold into and purchased inCalifornia - Platts North America RNG Premium (Excl.

California ) – assessment reflects the price premium for renewable natural gas sold and purchased outside ofCalifornia

Alan Hayes, Head of Energy Transition Pricing, S&P Commodity Insights, said: "We believe our new Platts RNG assessments bring much needed price transparency to this nascent and growing market, and we see the demand for renewable natural gas pricing information continuing to grow, as RNG becomes ever more important as a component of the energy transition."

Platts will also publish the

Mark

The assessments may be found in S&P Global Commodity Insights products and services, including: Platts Gas Daily, Americas Natural Gas Alert pages, Platts Dimensions Pro, and in the Platts price database.

*The CI of 45 was chosen to reflect a typical CI for landfill-derived RNG, the most commonly available type of RNG currently on the market

Media Contacts:

Americas: Kathleen Tanzy + 1 917-331-4607, kathleen.tanzy@spglobal.com

EMEA: Paul Sandell + 44 (0)7816 180039, paul.sandell@spglobal.com

About S&P Global Commodity Insights

At S&P Global Commodity Insights, our complete view of global energy and commodities markets enables our customers to make decisions with conviction and create long-term, sustainable value.

We're a trusted connector that brings together thought leaders, market participants, governments, and regulators and we create solutions that lead to progress. Vital to navigating Energy Transition, S&P Global Commodity Insights' coverage includes oil and gas, power, chemicals, metals, agriculture and shipping.

S&P Global Commodity Insights is a division of S&P Global (NYSE: SPGI). S&P Global is the world's foremost provider of credit ratings, benchmarks, analytics and workflow solutions in the global capital, commodity and automotive markets. With every one of our offerings, we help many of the world's leading organizations navigate the economic landscape so they can plan for tomorrow, today. For more information visit https://www.spglobal.com/commodityinsights.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/platts-of-sp-global-commodity-insights-launches-first-of-type-daily-price-assessments-for-north-america-renewable-natural-gas-301825631.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/platts-of-sp-global-commodity-insights-launches-first-of-type-daily-price-assessments-for-north-america-renewable-natural-gas-301825631.html

SOURCE S&P Global Commodity Insights