COP26 Article 6 Adoption Opens Door to Billions of Dollars of Investment in Voluntary Carbon Markets

The adoption of Article 6 at COP26 signals significant investment potential in Voluntary Carbon Markets (VCMs), valued over $1 billion and projected to increase rapidly by 2030, according to S&P Global Platts. The new regulations will prevent double-counting of emissions and enhance market credibility. This shift empowers countries producing carbon credits, particularly in the Global South, to manage their offerings and meet national targets. Enhanced price transparency in carbon credits, which surged by 944% in 2021, is also expected to drive financing for climate initiatives.

- VCM market value over $1 billion, projected to grow fifteen-fold by 2030.

- Adoption of Article 6 to enhance credibility and prevent double-counting of emissions.

- New regulations empowering Global South countries in carbon credit management.

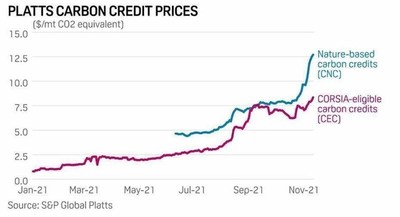

- Carbon credits prices surged by 944% in 2021, reaching $8.35 per metric ton.

- None.

LONDON, Nov. 15, 2021 /PRNewswire/ -- Voluntary carbon markets (VCMs) have the potential to play a pivotal role in closing the gap between what governments can deliver and what the world needs to achieve to deliver on the Paris Agreement, according to the latest analysis by S&P Global Platts.

The value of the VCM market is now more than

Paula VanLaningham, head of carbon pricing, S&P Global Platts, said: "Sunday's adoption of Article 6 has opened the door for billions of dollars of investment to flood into the Voluntary Carbon Markets over the next several years. Crucially, Sunday's agreement around Article 6 creates a system that will avoid the potential double-counting of offset emissions between countries, which will help to lend much-needed credibility to the emissions markets in the coming years."

"The decision to limit the number of older Clean Development Mechanism Credits that can be claimed in national targets will lend further credibility to these markets and will, critically, increase the overall price of carbon offsetting, thereby encouraging additional emissions reductions," she noted.

Further, VanLaningham explained, "the new scheme also empowers those countries – many in the Global South – who produce the bulk of the credits on the carbon market, to make their own decisions about which credits they offer for sale on the international market. It also provides them with the opportunity to meet their own national targets with the credits generated by projects within their own borders."

"While there is a lot of work to be done to ensure that the Voluntary Carbon Markets are able to play the role they need to play to meet the objectives of the Paris Climate Agreement, the adoption of Article 6 – long one of the most contentious, unsolved complications of the Treaty – ensures that there is a confirmed role for the market moving forward. This unlocks the potential for a heavy, and much needed increase in green financing for climate projects that can make a real difference in the fight against global heating."

"Rigorously structured and accountable carbon trading across borders will help drive new flows of finance that can achieve real, incremental reductions at lower cost," VanLaningham said.

"Markets can drive cost-effective decisions that recognize differences in abatement potential across geographies and allow for accomplishing more with less of burden."

PRICE TRANSPARENCY

The transparency provided the S&P Global Platts suite of VCM assessments increasingly is relied upon by market participants. S&P Global Platts launched the market's first daily voluntary carbon credit assessments with the publication of Platts CEC, representing CORSIA-eligible carbon credits in January 2021. These new prices have surged by

CONTACT

S&P Global Platts

Americas: Kathleen Tanzy, + 1 917-331-4607, kathleen.tanzy@spglobal.com

About S&P Global Platts

At S&P Global Platts, we provide the insights; you make better informed trading and business decisions with confidence. We're the leading independent provider of information and benchmark prices for the commodities and energy markets. Customers in over 150 countries look to our expertise in news, pricing, and analytics to deliver greater transparency and efficiency to markets. S&P Global Platts coverage includes oil, gas, LNG, power, petrochemicals, metals, agriculture, and shipping.

S&P Global Platts is a division of S&P Global (NYSE: SPGI), which provides essential intelligence for individuals, companies, and governments to make decisions with confidence. For more information, visit www.platts.com.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/cop26-article-6-adoption-opens-door-to-billions-of-dollars-of-investment-in-voluntary-carbon-markets-301424273.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/cop26-article-6-adoption-opens-door-to-billions-of-dollars-of-investment-in-voluntary-carbon-markets-301424273.html

SOURCE S&P Global Platts