Southern Energy Corp. Announces Payment of Interest In-Kind to Its 8% Convertible Unsecured Subordinated Debentures

- None.

- None.

CALGARY, AB / ACCESSWIRE / December 27, 2023 / Southern Energy Corp. ("Southern" or the "Company") (TSXV:SOU)(AIM:SOUC)(OTCQX:SOUTF) announces that the Company has agreed to issue, in aggregate, 779,273 new common shares of Southern (the "Common Shares") to holders of its

Director/PDMR Participation

It is noted that certain Directors and PDMRs of the Company hold Convertible Debentures, on the same terms as all other participants, and, accordingly, were issued, in aggregate, 9,455 Common Shares were issued. Further details regarding individual participation of the Company's Directors and PDMRs is set out in the PDMR notification forms below.

Admission and Total Voting Rights

The new Common Shares issued in respect of the Interest Payment will be credited as fully paid, rank pari passu in all respects with the existing Common Shares, and are expected to be admitted to trading on AIM on or around 8.00 a.m. (GMT) on or around 3 January 2024 ("Admission").

Following Admission, the total number of Common Shares in the Company in issue will be 166,497,433, and this figure may be used by shareholders as the denominator for the calculations by which they will determine if they are required to notify their interest in, or a change to their interest in, the Company.

About Southern Energy Corp.

Southern Energy Corp. is a natural gas exploration and production company. Southern has a primary focus on acquiring and developing conventional natural gas and light oil resources in the southeast Gulf States of Mississippi, Louisiana, and East Texas. Our management team has a long and successful history working together and have created significant shareholder value through accretive acquisitions, optimization of existing oil and natural gas fields and the utilization of re-development strategies utilizing horizontal drilling and multi-staged fracture completion techniques.

READER ADVISORY

Forward Looking Statements. Certain information included in this press release constitutes forward-looking information under applicable securities legislation. Forward-looking information typically contains statements with words such as "anticipate", "believe", "expect", "plan", "intend", "estimate", "propose", "project" or similar words suggesting future outcomes or statements regarding an outlook. The forward-looking statements contained in this press release are based on certain key expectations and assumptions made by Southern. Although Southern believes that the expectations and assumptions on which the forward-looking statements are based are reasonable, undue reliance should not be placed on the forward-looking statements because Southern can give no assurance that they will prove to be correct. Since forward-looking statements address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results could differ materially from those currently anticipated due to a number of factors and risks. These include, but are not limited to: risks associated with the oil and gas industry in general (e.g., operational risks in development, exploration and production, the uncertainty of reserve estimates, the uncertainty of estimates and projections relating to production, costs and expenses, regulatory risks, and health, safety and environmental risks); the uncertainty of reserve estimates; the uncertainty of estimates and projections relating to production, costs and expenses, and health, safety and environmental risks; the impact of pandemics; constraint in the availability of labour, supplies or services; commodity price and exchange rate fluctuations; geo-political risks, political and economic instability abroad and wars (including the Russo-Ukrainian war and the Israel-Palestinian conflict); changes in legislation impacting the oil and gas industry; inflationary risks, including potential increases to operating and capital costs; adverse weather or break-up conditions; and uncertainties resulting from potential delays or changes in plans with respect to exploration or development projects or capital expenditures. The Russo-Ukrainian war and the Israel-Palestinian conflict are particularly noteworthy, as these conflicts have the potential to disrupt the global supply of oil and gas, and their full impact remains uncertain. Other risks faced by the Company are set out in more detail in Southern's Annual Information Form for the year ended December 31, 2022, which is available under the Company's SEDAR+ profile at www.sedarplus.ca. The forward-looking information contained in this press release is made as of the date hereof and Southern undertakes no obligation to update publicly or revise any forward-looking information, whether as a result of new information, future events or otherwise, unless required by applicable securities laws. The forward-looking information contained in this press release is expressly qualified by this cautionary statement.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

PDMR NOTIFICATION FORMS

| 1 | Details of the person discharging managerial responsibilities / person closely associated | |

| a) | Name | Neil Smith |

| 2 | Reason for the notification | |

| a) | Position/status | Non-Executive Director |

| b) | Initial notification /Amendment | Initial notification |

| 3 | Details of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor | |

| a) | Name | Southern Energy Corp. |

| b) | LEI | 213800R25GL7J3EBJ698 |

| 4 | Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each date; and (iv) each place where transactions have been conducted | |

| a) | Description of the financial instrument, type of instrument | Common shares in Southern Energy Corp. |

| Identification code | CA8428131059 | |

| b) | Nature of the transaction | Issuance of new common shares |

| c) | Price(s) and volume(s) | 9,455 common shares at a price of CAD |

| d) | Aggregated information | N/A |

| e) | Date of the transaction | 27 December 2023 |

| f) | Place of the transaction | Outside of a trading venue |

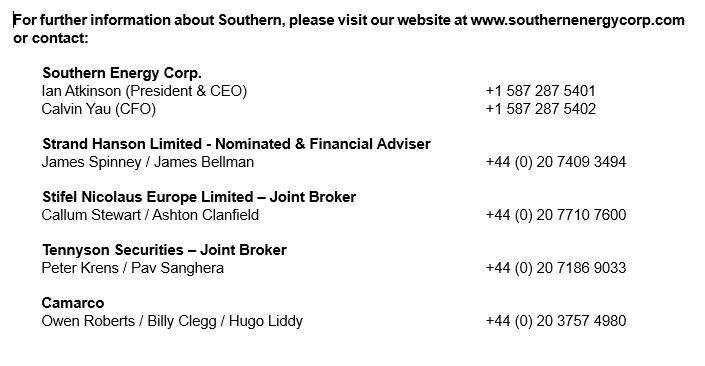

SOURCE: Southern Energy Corp.

View the original press release on accesswire.com