Southern Energy Corp. Announces Amendments to Outstanding Convertible Debentures

Southern Energy Corp. (TSXV: SOU, AIM: SOUC, OTCQX: SOUTF) has received approval from holders of its convertible debentures to amend the debenture indenture. The amendments include extending the maturity date by one year to June 30, 2025, and raising the interest rate from 8.00% to 10.00% per annum starting June 30, 2024. Southern Energy will issue 1,863,478 common share purchase warrants to the debenture holders, allowing them to buy shares at C$0.25 each for 12 months. These changes are subject to final acceptance by the TSX Venture Exchange.

- Approved extension of debenture maturity date to June 30, 2025.

- Interest rate on debentures increased from 8.00% to 10.00% per annum.

- Issue of 1,863,478 common share purchase warrants to debentureholders.

- Warrants allow purchase of common shares at C$0.25 for a 12-month period.

- Increased interest rate on debentures may lead to higher interest expenses.

- Issuance of warrants could lead to potential shareholder dilution.

- Amendments are still subject to final acceptance by the TSX Venture Exchange, adding regulatory uncertainty.

CALGARY, AB / ACCESSWIRE / June 14, 2024 / Southern Energy Corp. ("Southern" or the "Company") (TSXV:SOU)(AIM:SOUC)(OTCQX:SOUTF) announces it has received an extraordinary resolution from the holders (the "Debentureholders") of its outstanding convertible unsecured subordinated debentures (the "Debentures") approving certain amendments to the debenture indenture entered into between the Company and Computershare Trust Company of Canada (the "Trustee") dated June 14, 2019, as amended by a first supplemental indenture dated June 30, 2021, to: (a) extend the maturity date of the Debentures by one year to June 30, 2025; and (b) increase the interest on the Debentures from

Pursuant to receipt of the extraordinary resolution from the Debentureholders, Southern will enter into a second supplemental indenture (the "Second Supplemental Indenture") with the Trustee to effect the Debenture Amendments on or prior to June 30, 2024. As at the date hereof, the Company has 4,286 Debentures outstanding at face value of C

As a condition of the Debentureholders' approval of the Debenture Amendments, the Company will issue a total of 1,863,478 common share purchase warrants (the "Warrants") to the Debentureholders for no additional consideration, with each Warrant entitling the Debentureholder to purchase one common share of the Company at a price of C

The completion of the Debenture Amendments and the issuance of the Warrants remain subject to final acceptance of the TSX Venture Exchange (the "TSXV").

A copy of the Second Supplemental Indenture will be filed under the Company's profile on SEDAR+ at www.sedarplus.ca.

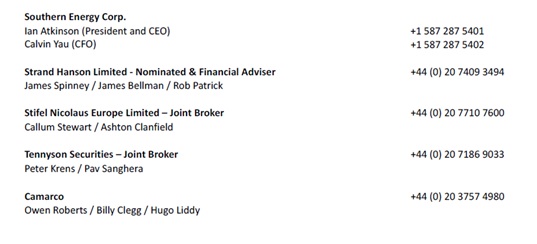

For further information about Southern, please visit our website at www.southernenergycorp.com or contact:

About Southern Energy Corp.

Southern Energy Corp. is a natural gas exploration and production company characterized by a stable, low-decline production base, a significant low-risk drilling inventory and strategic access to premium commodity pricing in North America. Southern has a primary focus on acquiring and developing conventional natural gas and light oil resources in the southeast Gulf States of Mississippi, Louisiana, and East Texas. Our management team has a long and successful history working together and have created significant shareholder value through accretive acquisitions, optimization of existing oil and natural gas fields and the utilization of re-development strategies utilizing horizontal drilling and multi-staged fracture completion techniques.

READER ADVISORIES

Forward-Looking Statements. Certain information included in this press release constitutes forward-looking information under applicable securities legislation. Forward-looking information typically contains statements with words such as "anticipate", "believe", "expect", "plan", "intend", "estimate", "propose", "project", "budget", "continue", "evaluate", "forecast", "may", "will", "can", "target" "potential", "result", "could", "should" or similar words suggesting future outcomes or statements regarding an outlook. Forward-looking information in this press release may include, but is not limited to, statements concerning the Debenture Amendments, including the execution of the Second Supplemental Indenture, the issuance of the Warrants, the issuance of Common Shares to settle the Company's Interest Obligations, and the approval of the TSXV. The forward-looking statements contained in this press release are based on certain key expectations and assumptions made by Southern, including receipt of the required approvals from the TSXV. Although Southern believes that the expectations and assumptions on which the forward-looking statements are based are reasonable, undue reliance should not be placed on the forward-looking statements because Southern can give no assurance that they will prove to be correct. Since forward-looking statements address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results could differ materially from those currently anticipated due to a number of factors and risks, including the risks set out in more detail in Southern's management discussion and analysis and annual information form for the year ended December 31, 2023, and the Company's management discussion and analysis for the period ended March 31, 2024, copies of which are available on the Company's website at www.southernenergycorp.com and filed under the Company's profile on SEDAR+ at www.sedarplus.ca.

The forward-looking information contained in this press release is made as of the date hereof and Southern undertakes no obligation to update publicly or revise any forward-looking information, whether as a result of new information, future events or otherwise, unless required by applicable securities laws. The forward-looking information contained in this press release is expressly qualified by this cautionary statement.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Southern Energy Corp.

View the original press release on accesswire.com