SoFi Technologies, Inc. Reports Third Quarter 2022 Results

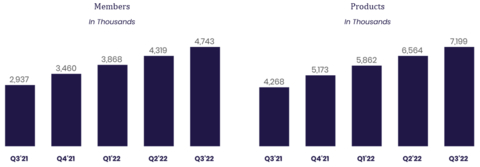

SoFi Technologies reported robust third-quarter results for 2022, with GAAP net revenue of $424 million, reflecting a 56% increase year-over-year. Adjusted net revenue also rose 51% to $419 million. The company achieved a record adjusted EBITDA of $44 million, a 332% year-over-year increase. Member growth was notable, with nearly 424,000 new members added, totaling over 4.7 million—a 61% increase. SoFi raised its full-year guidance for adjusted net revenue to $1.517-$1.522 billion and adjusted EBITDA to $115-$120 million.

- GAAP net revenue increased 56% year-over-year to $424 million.

- Adjusted net revenue rose 51% to $419 million.

- Adjusted EBITDA reached a record $44 million, up 332% year-over-year.

- New member growth of nearly 424,000, totaling over 4.7 million members, up 61%.

- Total products grew to nearly 7.2 million, reflecting a 69% increase.

- Management raised full-year adjusted net revenue guidance to $1.517-1.522 billion.

- GAAP net loss increased to $74.2 million from $30 million in the previous year.

- Student loan origination volume is down more than 50% compared to pre-pandemic levels.

Insights

Analyzing...

Record GAAP and Adjusted Net Revenue for Third Quarter 2022

GAAP Net Revenue of

Record Adjusted EBITDA of

New Member Adds of Nearly 424,000; Quarter-End Total Members Up

New Product Adds of Over 635,000; Quarter-End Total Products Up

Management Raises Full-Year 2022 Guidance

Note: For additional information on our company metrics, including the definitions of “Members”, “Total Products” and “Technology Platform Total Accounts”, see Table 5 in the “Financial Tables” herein. (Graphic: Business Wire)

“We delivered another quarter of record financial results with robust growth in members, products, and cross-buy. We generated our sixth consecutive quarter of record adjusted net revenue, which was up

Consolidated Results Summary

|

|

Three Months Ended |

|

% Change |

|||||||

($ in thousands) |

|

2022 |

|

2021 |

|

||||||

Consolidated – GAAP |

|

|

|

|

|

|

|||||

Total net revenue |

|

$ |

423,985 |

|

|

$ |

272,006 |

|

|

56 |

% |

Net loss |

|

|

(74,209 |

) |

|

|

(30,047 |

) |

|

n/m |

|

Loss per share – basic and diluted |

|

|

(0.09 |

) |

|

|

(0.05 |

) |

|

n/m |

|

|

|

|

|

|

|

|

|||||

Consolidated – Non-GAAP |

|

|

|

|

|

|

|||||

Adjusted net revenue(1) |

|

$ |

419,256 |

|

|

$ |

277,190 |

|

|

51 |

% |

Adjusted EBITDA(1) |

|

|

44,298 |

|

|

|

10,256 |

|

|

332 |

% |

(1) |

|

Adjusted net revenue and adjusted EBITDA are non-GAAP financial measures. For more information and reconciliations to the most comparable GAAP measures, see “Non-GAAP Financial Measures” and Table 2 to the “Financial Tables” herein. |

Noto continued: “Our strong momentum in member, product and cross-buy adds reflects the benefits of our broad product suite and unique

Noto concluded: “Our bank charter is enabling new flexibility that has proven even more valuable in light of the current macro environment, and the economic benefits are already starting to materialize and positively impact our operating and financial results. Total deposits grew

“As a result of this growth in high quality deposits, we have benefited from a lower cost of funding for our loans. Our deposit funding also increases our flexibility to capture additional net interest margin (NIM) and optimize returns, a critical advantage in light of notable macro uncertainty. In its second full quarter of operations,

Consolidated Results

Third quarter total GAAP net revenue increased

SoFi recorded a GAAP net loss of

Member and Product Growth

SoFi achieved strong year-over-year growth in both members and products in the third quarter of 2022. New member additions of nearly 424,000 brought total members to 4.7 million by quarter-end, up over 1.8 million, or

New product additions of over 635,000 in the third quarter brought total products to nearly 7.2 million at quarter-end, up

In the Financial Services segment, total products increased by

Lending products rose

Technology Platform enabled accounts increased by

Lending Segment Results

Lending segment GAAP and adjusted net revenues were

Lending segment third quarter contribution profit of

Lending – Segment Results of Operations |

|||||||||||

|

|

Three Months Ended |

|

|

|||||||

($ in thousands) |

|

2022 |

|

2021 |

|

% Change |

|||||

Total net revenue – Lending |

|

$ |

301,694 |

|

|

$ |

210,291 |

|

|

43 |

% |

Servicing rights – change in valuation inputs or assumptions |

|

|

(6,182 |

) |

|

|

(409 |

) |

|

n/m |

|

Residual interests classified as debt – change in valuation inputs or assumptions |

|

|

1,453 |

|

|

|

5,593 |

|

|

(74 |

)% |

Directly attributable expenses |

|

|

(116,403 |

) |

|

|

(97,807 |

) |

|

19 |

% |

Contribution Profit |

|

$ |

180,562 |

|

|

$ |

117,668 |

|

|

53 |

% |

|

|

|

|

|

|

|

|||||

Adjusted net revenue – Lending(1) |

|

$ |

296,965 |

|

|

$ |

215,475 |

|

|

38 |

% |

(1) |

|

Adjusted net revenue – Lending represents a non-GAAP financial measure. For more information and a reconciliation to the most comparable GAAP measure, see “Non-GAAP Financial Measures” and Table 2 to the “Financial Tables” herein. |

Third quarter Lending segment total origination volume increased

Record personal loan originations of over

Lending – Originations and Average Balances |

|||||||||||

|

|

Three Months Ended |

|

% Change |

|||||||

|

|

2022 |

|

2021 |

|

||||||

Origination volume ($ in thousands, during period) |

|

|

|

|

|

|

|||||

Home loans |

|

$ |

216,246 |

|

$ |

793,086 |

|

(73 |

)% |

||

Personal loans |

|

|

2,809,759 |

|

|

|

1,640,572 |

|

|

71 |

% |

Student loans |

|

|

457,184 |

|

|

|

967,939 |

|

|

(53 |

)% |

Total |

|

$ |

3,483,189 |

|

|

$ |

3,401,597 |

|

|

2 |

% |

|

|

|

|

|

|

|

|||||

Average loan balance ($, as of period end)(1) |

|

|

|

|

|

|

|||||

Home loans |

|

$ |

286,855 |

|

|

$ |

286,522 |

|

|

— |

% |

Personal loans |

|

|

24,772 |

|

|

|

22,207 |

|

|

12 |

% |

Student loans |

|

|

47,152 |

|

|

|

49,723 |

|

|

(5 |

)% |

(1) |

|

Within each loan product category, average loan balance is defined as the total unpaid principal balance of the loans divided by the number of loans that have a balance greater than zero dollars as of the reporting date. Average loan balance includes loans on the balance sheet and transferred loans with which SoFi has a continuing involvement through its servicing agreements. |

|

|

|

|

|

|||||||

Lending – Products |

|

2022 |

|

2021 |

|

% Change |

|||||

Home loans |

25,707 |

|

21,318 |

|

21 |

% |

|||||

Personal loans |

|

|

783,645 |

|

|

|

578,772 |

|

|

35 |

% |

Student loans |

|

|

471,141 |

|

|

|

430,792 |

|

|

9 |

% |

Total lending products |

|

|

1,280,493 |

|

|

|

1,030,882 |

|

|

24 |

% |

Technology Platform Segment Results

Technology Platform segment net revenue of

Technology Platform – Segment Results of Operations |

|||||||||||

|

|

Three Months Ended |

|

|

|||||||

($ in thousands) |

|

2022 |

|

2021 |

|

% Change |

|||||

Total net revenue |

|

$ |

84,777 |

|

|

$ |

50,225 |

|

|

69 |

% |

Directly attributable expenses |

|

|

(65,241 |

) |

|

|

(34,484 |

) |

|

89 |

% |

Contribution Profit |

|

$ |

19,536 |

|

|

$ |

15,741 |

|

|

24 |

% |

Technology Platform total enabled client accounts increased

|

|

|

|

|

|||||||

Technology Platform |

|

2022 |

|

2021 |

|

% Change |

|||||

Total accounts |

|

124,332,810 |

|

88,811,022 |

|

40 |

% |

||||

Financial Services Segment Results

Financial Services segment net revenue increased

The Financial Services segment contribution loss of

Financial Services – Segment Results of Operations |

|||||||||||

|

|

Three Months Ended |

|

|

|||||||

($ in thousands) |

|

2022 |

|

2021 |

|

% Change |

|||||

Total net revenue |

|

$ |

48,953 |

|

|

$ |

12,620 |

|

|

288 |

% |

Directly attributable expenses |

|

|

(101,576 |

) |

|

|

(52,085 |

) |

|

95 |

% |

Contribution loss |

|

$ |

(52,623 |

) |

|

$ |

(39,465 |

) |

|

33 |

% |

By continuously innovating for members with new and relevant offerings, features and rewards, SoFi grew total Financial Services products by approximately 2.7 million, or

Most notably, upon securing a bank charter in the first quarter of 2022, SoFi launched a new Checking and Savings offering, which today has an APY of up to

|

|

|

|

|

|||||||

Financial Services – Products |

|

2022 |

|

2021 |

|

% Change |

|||||

|

|

$ |

2,002,791 |

) |

|

$ |

1,161,322 |

) |

|

72 |

% |

Invest |

|

|

2,067,621 |

|

|

|

1,233,527 |

|

|

68 |

% |

Credit Card |

|

|

153,978 |

|

|

|

65,595 |

|

|

135 |

% |

Referred loans |

|

|

36,538 |

|

|

|

— |

|

|

n/m |

|

Relay |

|

|

1,600,102 |

|

|

|

749,972 |

|

|

113 |

% |

At Work |

|

|

57,775 |

|

|

|

26,367 |

|

|

119 |

% |

Total financial services products |

|

|

5,918,805 |

|

|

|

3,236,783 |

|

|

83 |

% |

(1) |

|

This product category includes SoFi Checking and Savings accounts held at |

Guidance and Outlook

Management now expects full-year 2022 adjusted net revenue of

Earnings Webcast

SoFi’s executive management team will host a live audio webcast beginning at

Cautionary Statement Regarding Forward-Looking Statements

Certain of the statements above are forward-looking and as such are not historical facts. This includes, without limitation, statements regarding our expectations for full year adjusted net revenue and adjusted EBITDA, our expectations regarding our ability to continue to grow our business, our ability to navigate the macroeconomic environment and the financial position, business strategy and plans and objectives of management for our future operations. These forward-looking statements are not guarantees of performance. Such statements can be identified by the fact that they do not relate strictly to historical or current facts. Words such as “anticipate”, “believe”, “continue”, “could”, “expect”, “intend”, “may”, “future”, “strategy”, “might”, “plan”, “should”, “would”, “will be”, “will continue”, “will likely result” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Factors that could cause actual results to differ materially from those contemplated by these forward-looking statements include: (i) the effect of and uncertainties related to macroeconomic factors such as inflation and rising interest rates and any resurgence of the COVID-19 pandemic; (ii) our ability to achieve profitability and continued growth across our business in the future; (iii) the impact on our business of the regulatory environment and complexities with compliance related to such environment, including any further extension of the student loan payment moratorium or loan forgiveness, and our expectations regarding the return to pre-pandemic student loan demand levels; (iv) our ability to realize the benefits of being a bank holding company and operating

These forward-looking statements are based on information available as of the date hereof and current expectations, forecasts and assumptions, and involve a number of judgments, risks and uncertainties. Accordingly, forward-looking statements should not be relied upon as representing our views as of any subsequent date, and we do not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

As a result of a number of known and unknown risks and uncertainties, our actual results or performance may be materially different from those expressed or implied by these forward-looking statements. You should not place undue reliance on these forward-looking statements.

Non-GAAP Financial Measures

This press release presents information about our adjusted net revenue and adjusted EBITDA, which are non-GAAP financial measures provided as supplements to the results provided in accordance with accounting principles generally accepted in

Forward-looking non-GAAP financial measures are presented without reconciliations of such forward-looking non-GAAP measures because the GAAP financial measures are not accessible on a forward-looking basis and reconciling information is not available without unreasonable effort due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliations, including adjustments reflected in our reconciliation of historic non-GAAP financial measures, the amounts of which, based on historical experience, could be material.

About SoFi

SoFi's mission is to help our members achieve financial independence to realize their ambitions. Our products for borrowing, saving, spending, investing and protecting give our over 4.5 million members fast access to tools to get their money right. SoFi membership comes with the key essentials for getting ahead, including career advisors and connection to a thriving community of like-minded, ambitious people. SoFi is also the naming rights partner of

Availability of Other Information About SoFi

Investors and others should note that we communicate with our investors and the public using our website (www.sofi.com), the investor relations website (https://investors.sofi.com), and on social media (Twitter and LinkedIn), including but not limited to investor presentations and investor fact sheets,

FINANCIAL TABLES

- Unaudited Condensed Consolidated Statements of Operations and Comprehensive Loss

- Reconciliation of GAAP to Non-GAAP Financial Measures

- Unaudited Condensed Consolidated Balance Sheets

- Unaudited Condensed Consolidated Statements of Cash Flows

- Company Metrics

- Segment Financials

Table 1 |

|||||||||||||||

Unaudited Condensed Consolidated Statements of Operations and Comprehensive Loss (In Thousands, Except for Share and Per Share Data) |

|||||||||||||||

|

Three Months Ended |

|

Nine Months Ended |

||||||||||||

|

2022 |

|

2021 |

|

2022 |

|

2021 |

||||||||

Interest income |

|

|

|

|

|

|

|

||||||||

Loans |

$ |

191,525 |

|

|

$ |

89,844 |

|

|

$ |

451,247 |

|

|

$ |

246,743 |

|

Securitizations |

|

2,633 |

|

|

|

2,999 |

|

|

|

7,958 |

|

|

|

11,260 |

|

Related party notes |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

211 |

|

Other |

|

3,881 |

|

|

|

758 |

|

|

|

6,758 |

|

|

|

2,023 |

|

Total interest income |

|

198,039 |

|

|

|

93,601 |

|

|

|

465,963 |

|

|

|

260,237 |

|

Interest expense |

|

|

|

|

|

|

|

||||||||

Securitizations and warehouses |

|

20,653 |

|

|

|

19,360 |

|

|

|

59,158 |

|

|

|

75,418 |

|

Deposits |

|

14,149 |

|

|

|

— |

|

|

|

19,123 |

|

|

|

— |

|

Corporate borrowings |

|

5,270 |

|

|

|

1,366 |

|

|

|

11,369 |

|

|

|

7,752 |

|

Other |

|

117 |

|

|

|

500 |

|

|

|

801 |

|

|

|

1,400 |

|

Total interest expense |

|

40,189 |

|

|

|

21,226 |

|

|

|

90,451 |

|

|

|

84,570 |

|

Net interest income |

|

157,850 |

|

|

|

72,375 |

|

|

|

375,512 |

|

|

|

175,667 |

|

Noninterest income |

|

|

|

|

|

|

|

||||||||

Loan origination and sales |

|

163,697 |

|

|

|

142,147 |

|

|

|

465,815 |

|

|

|

362,211 |

|

Securitizations |

|

(8,772 |

) |

|

|

(4,551 |

) |

|

|

(31,790 |

) |

|

|

(6,613 |

) |

Servicing |

|

7,296 |

|

|

|

458 |

|

|

|

30,003 |

|

|

|

(11,875 |

) |

Technology products and solutions |

|

82,035 |

|

|

|

49,951 |

|

|

|

223,562 |

|

|

|

140,560 |

|

Other |

|

21,879 |

|

|

|

11,626 |

|

|

|

53,754 |

|

|

|

39,314 |

|

Total noninterest income |

|

266,135 |

|

|

|

199,631 |

|

|

|

741,344 |

|

|

|

523,597 |

|

Total net revenue |

|

423,985 |

|

|

|

272,006 |

|

|

|

1,116,856 |

|

|

|

699,264 |

|

Noninterest expense |

|

|

|

|

|

|

|

||||||||

Technology and product development |

|

110,702 |

|

|

|

74,434 |

|

|

|

291,976 |

|

|

|

209,771 |

|

Sales and marketing |

|

162,129 |

|

|

|

114,985 |

|

|

|

444,121 |

|

|

|

297,170 |

|

Cost of operations |

|

83,083 |

|

|

|

69,591 |

|

|

|

232,611 |

|

|

|

187,785 |

|

General and administrative |

|

126,199 |

|

|

|

40,461 |

|

|

|

388,533 |

|

|

|

373,374 |

|

Provision for credit losses |

|

16,323 |

|

|

|

2,401 |

|

|

|

39,387 |

|

|

|

2,887 |

|

Total noninterest expense |

|

498,436 |

|

|

|

301,872 |

|

|

|

1,396,628 |

|

|

|

1,070,987 |

|

Loss before income taxes |

|

(74,451 |

) |

|

|

(29,866 |

) |

|

|

(279,772 |

) |

|

|

(371,723 |

) |

Income tax benefit (expense) |

|

242 |

|

|

|

(181 |

) |

|

|

(629 |

) |

|

|

(1,202 |

) |

Net loss |

$ |

(74,209 |

) |

|

$ |

(30,047 |

) |

|

$ |

(280,401 |

) |

|

$ |

(372,925 |

) |

Other comprehensive loss |

|

|

|

|

|

|

|

||||||||

Unrealized losses on available-for-sale securities, net |

|

(1,914 |

) |

|

|

(150 |

) |

|

|

(8,360 |

) |

|

|

(150 |

) |

Foreign currency translation adjustments, net |

|

325 |

|

|

|

204 |

|

|

|

231 |

|

|

|

(142 |

) |

Total other comprehensive income (loss) |

|

(1,589 |

) |

|

|

54 |

|

|

|

(8,129 |

) |

|

|

(292 |

) |

Comprehensive loss |

$ |

(75,798 |

) |

|

$ |

(29,993 |

) |

|

$ |

(288,530 |

) |

|

$ |

(373,217 |

) |

Loss per share |

|

|

|

|

|

|

|

||||||||

Loss per share – basic |

$ |

(0.09 |

) |

|

$ |

(0.05 |

) |

|

$ |

(0.35 |

) |

|

$ |

(0.94 |

) |

Loss per share – diluted |

$ |

(0.09 |

) |

|

$ |

(0.05 |

) |

|

$ |

(0.35 |

) |

|

$ |

(0.94 |

) |

Weighted average common stock outstanding – basic |

|

916,762,973 |

|

|

|

800,565,830 |

|

|

|

893,455,206 |

|

|

|

429,750,486 |

|

Weighted average common stock outstanding – diluted |

|

916,762,973 |

|

|

|

800,565,830 |

|

|

|

893,455,206 |

|

|

|

429,750,486 |

|

Table 2

Non-GAAP Financial Measures

Reconciliation of Adjusted Net Revenue

Adjusted net revenue is defined as total net revenue, adjusted to exclude the fair value changes in servicing rights and residual interests classified as debt due to valuation inputs and assumptions changes, which relate only to our Lending segment. For our consolidated results and for the Lending segment, we reconcile adjusted net revenue to total net revenue, the most directly comparable GAAP measure, as presented for the periods indicated below:

|

|

Three Months Ended |

|

Nine Months Ended |

||||||||||||

($ in thousands) |

|

2022 |

|

2021 |

|

2022 |

|

2021 |

||||||||

Total net revenue |

|

$ |

423,985 |

|

|

$ |

272,006 |

|

|

$ |

1,116,856 |

|

|

$ |

699,264 |

|

Servicing rights – change in valuation inputs or assumptions(1) |

|

|

(6,182 |

) |

|

|

(409 |

) |

|

|

(26,860 |

) |

|

|

11,924 |

|

Residual interests classified as debt – change in valuation inputs or assumptions(2) |

|

|

1,453 |

|

|

|

5,593 |

|

|

|

7,078 |

|

|

|

19,261 |

|

Adjusted net revenue |

|

$ |

419,256 |

|

|

$ |

277,190 |

|

|

$ |

1,097,074 |

|

|

$ |

730,449 |

|

|

|

Three Months Ended |

|

Nine Months Ended |

||||||||||||

($ in thousands) |

|

2022 |

|

2021 |

|

2022 |

|

2021 |

||||||||

Total net revenue – Lending |

|

$ |

301,694 |

|

|

$ |

210,291 |

|

|

$ |

811,800 |

|

|

$ |

524,559 |

|

Servicing rights – change in valuation inputs or assumptions(1) |

|

|

(6,182 |

) |

|

|

(409 |

) |

|

$ |

(26,860 |

) |

|

|

11,924 |

|

Residual interests classified as debt – change in valuation inputs or assumptions(2) |

|

|

1,453 |

|

|

|

5,593 |

|

|

$ |

7,078 |

|

|

|

19,261 |

|

Adjusted net revenue – Lending |

|

$ |

296,965 |

|

|

$ |

215,475 |

|

|

$ |

792,018 |

|

|

$ |

555,744 |

|

(1) |

|

Reflects changes in fair value inputs and assumptions on servicing rights, including conditional prepayment and default rates and discount rates. These assumptions are highly sensitive to market interest rate changes and are not indicative of our performance or results of operations. Moreover, these non-cash charges are unrealized during the period and, therefore, have no impact on our cash flows from operations. As such, these positive and negative changes are adjusted out of total net revenue to provide management and financial users with better visibility into the net revenue available to finance our operations and our overall performance. |

(2) |

|

Reflects changes in fair value inputs and assumptions on residual interests classified as debt, including conditional prepayment and default rates and discount rates. When third parties finance our consolidated securitization variable interest entities (“VIEs”) by purchasing residual interests, we receive proceeds at the time of the closing of the securitization and, thereafter, pass along contractual cash flows to the residual interest owner. These residual debt obligations are measured at fair value on a recurring basis, but they have no impact on our initial financing proceeds, our future obligations to the residual interest owner (because future residual interest claims are limited to contractual securitization collateral cash flows), or the general operations of our business. As such, these positive and negative non-cash changes in fair value attributable to assumption changes are adjusted out of total net revenue to provide management and financial users with better visibility into the net revenue available to finance our operations. |

Reconciliation of Adjusted EBITDA

Adjusted EBITDA is defined as net income (loss), adjusted to exclude, as applicable: (i) corporate borrowing-based interest expense (our adjusted EBITDA measure is not adjusted for warehouse or securitization-based interest expense, nor deposit interest expense and finance lease liability interest expense, as discussed further below), (ii) income tax expense (benefit), (iii) depreciation and amortization, (iv) share-based expense (inclusive of equity-based payments to non-employees), (v) impairment expense (inclusive of goodwill impairment and property, equipment and software abandonments), (vi) transaction-related expenses, (vii) fair value changes in warrant liabilities, and (viii) fair value changes in each of servicing rights and residual interests classified as debt due to valuation assumptions. We reconcile adjusted EBITDA to net loss, the most directly comparable GAAP measure, for the periods indicated below:

|

|

Three Months Ended |

|

Nine Months Ended |

||||||||||||

($ in thousands) |

|

2022 |

|

2021 |

|

2022 |

|

2021 |

||||||||

Net loss |

|

$ |

(74,209 |

) |

|

$ |

(30,047 |

) |

|

$ |

(280,401 |

) |

|

$ |

(372,925 |

) |

Non-GAAP adjustments: |

|

|

|

|

|

|

|

|

||||||||

Interest expense – corporate borrowings(1) |

|

|

5,270 |

|

|

|

1,366 |

|

|

|

11,369 |

|

|

|

7,752 |

|

Income tax expense (benefit)(2) |

|

|

(242 |

) |

|

|

181 |

|

|

|

629 |

|

|

|

1,202 |

|

Depreciation and amortization(3) |

|

|

40,253 |

|

|

|

24,075 |

|

|

|

109,007 |

|

|

|

75,041 |

|

Share-based expense |

|

|

77,855 |

|

|

|

72,681 |

|

|

|

235,018 |

|

|

|

162,289 |

|

Transaction-related expense(4) |

|

|

100 |

|

|

|

1,221 |

|

|

|

17,446 |

|

|

|

24,580 |

|

Fair value changes in warrant liabilities(5) |

|

|

— |

|

|

|

(64,405 |

) |

|

|

— |

|

|

|

96,504 |

|

Servicing rights – change in valuation inputs or assumptions(6) |

|

|

(6,182 |

) |

|

|

(409 |

) |

|

|

(26,860 |

) |

|

|

11,924 |

|

Residual interests classified as debt – change in valuation inputs or assumptions(7) |

|

|

1,453 |

|

|

|

5,593 |

|

|

|

7,078 |

|

|

|

19,261 |

|

Total adjustments |

|

|

118,507 |

|

|

|

40,303 |

|

|

|

353,687 |

|

|

|

398,553 |

|

Adjusted EBITDA |

|

$ |

44,298 |

|

|

$ |

10,256 |

|

|

$ |

73,286 |

|

|

$ |

25,628 |

|

(1) |

|

Our adjusted EBITDA measure adjusts for corporate borrowing-based interest expense, as these expenses are a function of our capital structure. Corporate borrowing-based interest expense primarily included (i) interest on our revolving credit facility, (ii) for the 2022 periods, the amortization of debt discount and debt issuance costs on our convertible notes, and (iii) for the nine-month 2021 period, interest on the seller note issued in connection with our acquisition of Galileo. Our adjusted EBITDA measure does not adjust for interest expense on warehouse facilities and securitization debt, which are recorded within interest expense—securitizations and warehouses in the unaudited condensed consolidated statements of operations and comprehensive income (loss), as these interest expenses are direct operating expenses driven by loan origination and sales activity. Additionally, our adjusted EBITDA measure does not adjust for interest expense on deposits or interest expense on our finance lease liability in connection with |

(2) |

|

Our income tax expense positions for the nine-month periods were primarily a function of |

(3) |

|

Depreciation and amortization expense for the three- and nine-month 2022 periods increased compared to the comparable 2021 periods primarily in connection with our recent acquisitions and growth in our software balance, partially offset by the acceleration of core banking infrastructure amortization during the nine-month 2021 period. |

(4) |

|

Transaction-related expenses in the nine-month 2022 period primarily included financial advisory and professional services costs associated with our acquisition of Technisys. Transaction-related expenses in the three-month 2021 period included costs associated with our then-exploratory acquisition of Technisys. Transaction-related expenses in the nine-month 2021 period also included the special payment to the holders of Series 1 Redeemable Preferred Stock in conjunction with the Business Combination and financial advisory and professional services costs associated with our then-pending acquisition of Golden Pacific. |

(5) |

|

Our adjusted EBITDA measure excludes the non-cash fair value changes in warrants accounted for as liabilities, which were measured at fair value through earnings. In conjunction with the Business Combination, |

(6) |

|

Reflects changes in fair value inputs and assumptions, including market servicing costs, conditional prepayment and default rates and discount rates. This non-cash change is unrealized during the period and, therefore, has no impact on our cash flows from operations. As such, these positive and negative changes in fair value attributable to assumption changes are adjusted out of net loss to provide management and financial users with better visibility into the earnings available to finance our operations. |

(7) |

|

Reflects changes in fair value inputs and assumptions, including conditional prepayment and default rates and discount rates. When third parties finance our consolidated VIEs through purchasing residual interests, we receive proceeds at the time of the securitization close and, thereafter, pass along contractual cash flows to the residual interest owner. These obligations are measured at fair value on a recurring basis, which has no impact on our initial financing proceeds, our future obligations to the residual interest owner (because future residual interest claims are limited to contractual securitization collateral cash flows), or the general operations of our business. As such, these positive and negative non-cash changes in fair value attributable to assumption changes are adjusted out of net loss to provide management and financial users with better visibility into the earnings available to finance our operations. |

Table 3 |

|||||||

Unaudited Condensed Consolidated Balance Sheets (In Thousands, Except for Share Data) |

|||||||

|

2022 |

|

2021 |

||||

Assets |

|

|

|

||||

Cash and cash equivalents |

$ |

935,159 |

|

|

$ |

494,711 |

|

Restricted cash and restricted cash equivalents |

|

326,274 |

|

|

|

273,726 |

|

Investments in available-for-sale securities (amortized cost of |

|

195,133 |

|

|

|

194,907 |

|

Loans, less allowance for credit losses on loans at amortized cost of |

|

11,204,403 |

|

|

|

6,068,884 |

|

Servicing rights |

|

168,438 |

|

|

|

168,259 |

|

Securitization investments |

|

261,672 |

|

|

|

374,688 |

|

Equity method investments |

|

— |

|

|

|

19,739 |

|

Property, equipment and software |

|

164,421 |

|

|

|

111,873 |

|

|

|

1,622,951 |

|

|

|

898,527 |

|

Intangible assets |

|

456,771 |

|

|

|

284,579 |

|

Operating lease right-of-use assets |

|

100,411 |

|

|

|

115,191 |

|

Other assets, less allowance for credit losses of |

|

399,270 |

|

|

|

171,242 |

|

Total assets |

$ |

15,834,903 |

|

|

$ |

9,176,326 |

|

Liabilities, temporary equity and permanent equity |

|

|

|

||||

Liabilities: |

|

|

|

||||

Deposits: |

|

|

|

||||

Noninterest-bearing deposits |

$ |

89,761 |

|

|

$ |

— |

|

Interest-bearing deposits |

|

4,941,869 |

|

|

|

— |

|

Total deposits |

|

5,031,630 |

|

|

|

— |

|

Accounts payable, accruals and other liabilities |

|

565,910 |

|

|

|

298,164 |

|

Operating lease liabilities |

|

121,729 |

|

|

|

138,794 |

|

Debt |

|

4,568,523 |

|

|

|

3,947,983 |

|

Residual interests classified as debt |

|

45,734 |

|

|

|

93,682 |

|

Total liabilities |

|

10,333,526 |

|

|

|

4,478,623 |

|

Commitments, guarantees, concentrations and contingencies |

|

|

|

||||

Temporary equity: |

|

|

|

||||

Redeemable preferred stock, |

|

320,374 |

|

|

|

320,374 |

|

Permanent equity: |

|

|

|

||||

Common stock, |

|

92 |

|

|

|

83 |

|

Additional paid-in capital |

|

6,654,026 |

|

|

|

5,561,831 |

|

Accumulated other comprehensive loss |

|

(9,600 |

) |

|

|

(1,471 |

) |

Accumulated deficit |

|

(1,463,515 |

) |

|

|

(1,183,114 |

) |

Total permanent equity |

|

5,181,003 |

|

|

|

4,377,329 |

|

Total liabilities, temporary equity and permanent equity |

$ |

15,834,903 |

|

|

$ |

9,176,326 |

|

Table 4 |

|||||||

Unaudited Condensed Consolidated Statements of Cash Flows (In Thousands) |

|||||||

|

Nine Months Ended |

||||||

|

2022 |

|

2021 |

||||

Operating activities |

|

|

|

||||

Net loss |

$ |

(280,401 |

) |

|

$ |

(372,925 |

) |

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

||||

Share-based compensation expense |

|

235,018 |

|

|

|

162,289 |

|

Depreciation and amortization |

|

109,007 |

|

|

|

75,041 |

|

Deferred debt issuance and discount expense |

|

12,106 |

|

|

|

14,228 |

|

Provision for credit losses |

|

39,387 |

|

|

|

2,887 |

|

Deferred income taxes |

|

(4,420 |

) |

|

|

699 |

|

Fair value changes in residual interests classified as debt |

|

7,078 |

|

|

|

19,261 |

|

Fair value changes in securitization investments |

|

13,256 |

|

|

|

(7,106 |

) |

Fair value changes in warrant liabilities |

|

— |

|

|

|

96,504 |

|

Other |

|

11,635 |

|

|

|

(7,275 |

) |

Changes in operating assets and liabilities: |

|

|

|

||||

Originations and purchases of loans |

|

(11,635,939 |

) |

|

|

(9,375,583 |

) |

Proceeds from sales and repayments of loans |

|

6,654,289 |

|

|

|

9,297,238 |

|

Other changes in loans |

|

10,566 |

|

|

|

2,138 |

|

Servicing assets |

|

(179 |

) |

|

|

(13,877 |

) |

Related party notes receivable interest income |

|

— |

|

|

|

1,399 |

|

Other assets |

|

(36,691 |

) |

|

|

(26,883 |

) |

Accounts payable, accruals and other liabilities |

|

28,265 |

|

|

|

18,037 |

|

Net cash used in operating activities |

$ |

(4,837,023 |

) |

|

$ |

(113,928 |

) |

Investing activities |

|

|

|

||||

Purchases of property, equipment, software and intangible assets |

$ |

(75,976 |

) |

|

$ |

(38,445 |

) |

Purchases of available-for-sale investments |

|

(44,974 |

) |

|

|

(205,128 |

) |

Proceeds from sales of available-for-sale investments |

|

23,497 |

|

|

|

15,789 |

|

Proceeds from maturities and paydowns of available-for-sale investments |

|

14,327 |

|

|

|

— |

|

Changes in loans, net |

|

(130,100 |

) |

|

|

— |

|

Proceeds from securitization investments |

|

99,760 |

|

|

|

201,093 |

|

Purchases of non-securitization investments |

|

— |

|

|

|

(20,000 |

) |

Proceeds from non-securitization investments |

|

— |

|

|

|

109,534 |

|

Acquisition of businesses, net of cash acquired |

|

58,540 |

|

|

|

— |

|

Proceeds from repayment of related party notes receivable |

|

— |

|

|

|

16,693 |

|

Net cash provided by (used in) investing activities |

$ |

(54,926 |

) |

|

$ |

79,536 |

|

Unaudited Condensed Consolidated Statements of Cash Flows (Continued) (In Thousands) |

|||||||

|

Nine Months Ended |

||||||

|

2022 |

|

2021 |

||||

Financing activities |

|

|

|

||||

Proceeds from debt issuances |

$ |

7,861,804 |

|

|

$ |

6,296,901 |

|

Repayment of debt |

|

(7,306,856 |

) |

|

|

(8,368,904 |

) |

Payment of debt issuance costs |

|

(4,076 |

) |

|

|

(5,136 |

) |

Net change in deposits |

|

4,859,240 |

|

|

|

— |

|

Taxes paid related to net share settlement of share-based awards |

|

(7,476 |

) |

|

|

(37,240 |

) |

Proceeds from stock option exercises |

|

2,489 |

|

|

|

20,642 |

|

Payment of redeemable preferred stock dividends |

|

(20,047 |

) |

|

|

(20,047 |

) |

Finance lease principal payments |

|

(364 |

) |

|

|

(397 |

) |

Purchases of common stock |

|

— |

|

|

|

(526 |

) |

Redemptions of redeemable common and preferred stock |

|

— |

|

|

|

(282,859 |

) |

Proceeds from Business Combination and |

|

— |

|

|

|

1,989,851 |

|

Payment of costs directly attributable to the issuance of common stock in connection with Business Combination and |

|

— |

|

|

|

(26,951 |

) |

Net cash provided by (used in) financing activities |

$ |

5,384,714 |

|

|

$ |

(434,666 |

) |

Effect of exchange rates on cash and cash equivalents |

|

231 |

|

|

|

(142 |

) |

Net increase (decrease) in cash, cash equivalents, restricted cash and restricted cash equivalents |

$ |

492,996 |

|

|

$ |

(469,200 |

) |

Cash, cash equivalents, restricted cash and restricted cash equivalents at beginning of period |

|

768,437 |

|

|

|

1,323,428 |

|

Cash, cash equivalents, restricted cash and restricted cash equivalents at end of period |

$ |

1,261,433 |

|

|

$ |

854,228 |

|

|

|

|

|

||||

Reconciliation to amounts on unaudited condensed consolidated balance sheets (as of period end) |

|

|

|

||||

Cash and cash equivalents |

$ |

935,159 |

|

|

$ |

533,523 |

|

Restricted cash and restricted cash equivalents |

|

326,274 |

|

|

|

320,705 |

|

Total cash, cash equivalents, restricted cash and restricted cash equivalents |

$ |

1,261,433 |

|

|

$ |

854,228 |

|

|

|

|

|

||||

Unaudited Condensed Consolidated Statements of Cash Flows (Continued) (In Thousands) |

|||||||

|

Nine Months Ended |

||||||

|

2022 |

|

2021 |

||||

Supplemental non-cash investing and financing activities |

|

|

|

||||

Issuance of common stock in acquisition |

$ |

873,377 |

|

$ |

— |

||

Vested awards assumed in acquisition |

|

2,855 |

|

|

|

— |

|

Loans received in acquisition |

|

84,485 |

|

|

|

— |

|

Debt assumed in acquisition |

|

2,000 |

|

|

|

— |

|

Deposits assumed in acquisition |

|

158,016 |

|

|

|

— |

|

Deposits credited but not yet received in cash |

|

14,374 |

|

|

|

||

Available-for-sale securities received in acquisition |

|

10,014 |

|

|

|

— |

|

Property, equipment and software received in acquisition |

|

3,192 |

|

|

|

— |

|

Non-cash loan reduction |

|

1,386 |

|

|

|

— |

|

Share-based compensation capitalized related to internally-developed software |

|

16,177 |

|

|

|

— |

|

Redeemable preferred stock dividends accrued but unpaid |

|

10,189 |

|

|

|

10,189 |

|

Non-cash property, equipment, software and intangible asset additions |

|

— |

|

|

|

859 |

|

Deferred debt issuance costs accrued but unpaid |

|

— |

|

|

|

850 |

|

Securitization investments acquired via loan transfers |

|

— |

|

|

|

89,111 |

|

Available-for-sale investment securities purchased but unpaid |

|

— |

|

|

|

7,712 |

|

Costs directly attributable to the issuance of common stock paid in 2020 |

|

— |

|

|

|

588 |

|

Reduction to temporary equity associated with purchase price adjustments |

|

— |

|

|

|

743 |

|

Warrant liabilities recognized in conjunction with the Business Combination |

|

— |

|

|

|

200,250 |

|

Series H warrant liabilities conversion to common stock warrants |

|

— |

|

|

|

39,959 |

|

Conversion of temporary equity into permanent equity in conjunction with the Business Combination |

|

— |

|

|

|

2,702,569 |

|

Table 5 |

||||||||||||||||||||||||||

Company Metrics |

||||||||||||||||||||||||||

|

2022 |

|

2022 |

|

2022 |

|

2021 |

|

2021 |

|

2021 |

|

2021 |

|

2020 |

|

2020 |

|||||||||

Members |

4,742,673 |

|

4,318,705 |

|

3,868,334 |

|

3,460,298 |

|

2,937,379 |

|

2,560,492 |

|

2,281,092 |

|

1,850,871 |

|

1,500,576 |

|||||||||

Total Products |

7,199,298 |

|

|

6,564,174 |

|

|

5,862,137 |

|

|

5,173,197 |

|

|

4,267,665 |

|

|

3,667,121 |

|

|

3,184,554 |

|

|

2,523,555 |

|

|

2,052,933 |

|

Total Products — Lending segment |

1,280,493 |

|

|

1,202,027 |

|

|

1,138,566 |

|

|

1,078,952 |

|

|

1,030,882 |

|

|

981,440 |

|

|

945,227 |

|

|

917,645 |

|

|

892,934 |

|

Total Products — Financial Services segment |

5,918,805 |

|

|

5,362,147 |

|

|

4,723,571 |

|

|

4,094,245 |

|

|

3,236,783 |

|

|

2,685,681 |

|

|

2,239,327 |

|

|

1,605,910 |

|

|

1,159,999 |

|

Total Accounts — Technology Platform segment(1) |

124,332,810 |

|

|

116,570,038 |

|

|

109,687,014 |

|

|

99,660,657 |

|

|

88,811,022 |

|

|

78,902,156 |

|

|

69,572,680 |

|

|

59,735,210 |

|

|

49,276,594 |

|

(1) |

|

Beginning in the fourth quarter of 2021, the Company included SoFi accounts on the Galileo platform-as-a-service in its total Technology Platform accounts metric to better align with the presentation of Technology Platform segment revenue. Quarterly amounts for the earlier quarters in 2021 and 2020 were determined to be immaterial, and as such were not recast. |

Members

We refer to our customers as “members”. We define a member as someone who has had a lending relationship with us through origination and/or ongoing servicing, opened a financial services account, linked an external account to our platform, or signed up for our credit score monitoring service. Once someone becomes a member, they are always considered a member unless they violate our terms of service. Our members have continuous access to our certified financial planners, our career advice services, our member events, our content, educational material, news, tools and calculators, which are provided at no cost to the member. We view members as an indication not only of the size and a measurement of growth of our business, but also as a measure of the significant value of the data we have collected over time.

Total Products

Total products refers to the aggregate number of lending and financial services products that our members have selected on our platform since our inception through the reporting date, whether or not the members are still registered for such products. In our Lending segment, total products refers to the number of home loans, personal loans and student loans that have been originated through our platform through the reporting date, whether or not such loans have been paid off. If a member has multiple loan products of the same loan product type, such as two personal loans, that is counted as a single product. However, if a member has multiple loan products across loan product types, such as one personal loan and one home loan, that is counted as two products. In our Financial Services segment, total products refers to the number of

Technology Platform Total Accounts

In our Technology Platform segment, total accounts refers to the number of open accounts at Galileo as of the reporting date. Beginning in the fourth quarter of 2021, we included SoFi accounts on the Galileo platform-as-a-service in our total accounts metric to better align with the Technology Platform segment revenue, which includes intercompany revenue from SoFi. We recast the accounts in the fourth quarters of 2021 and 2020, but did not recast the accounts for the earlier quarters in 2021 and 2020, as the impact was determined to be immaterial. Total accounts is a primary indicator of the accounts dependent upon Galileo’s technology platform to use virtual card products, virtual wallets, make peer-to-peer and bank-to-bank transfers, receive early paychecks, separate savings from spending balances, make debit transactions and rely upon real-time authorizations, all of which result in revenues for the Technology Platform segment. We do not measure total accounts for the Technisys products and solutions, as the revenue model is not dependent upon being a fully integrated, stand-ready service.

Table 6 |

||||||||||||||||||||||||||||||||||||

Segment Financials |

||||||||||||||||||||||||||||||||||||

|

|

Quarter Ended |

||||||||||||||||||||||||||||||||||

($ in thousands) |

|

2022 |

|

2022 |

|

2022 |

|

2021 |

|

2021 |

|

2021 |

|

2021 |

|

2020 |

|

2020 |

||||||||||||||||||

Lending |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

Net interest income |

|

$ |

139,516 |

|

|

$ |

114,003 |

|

|

$ |

94,354 |

|

|

$ |

77,246 |

|

|

$ |

72,257 |

|

|

$ |

56,822 |

|

|

$ |

51,777 |

|

|

$ |

57,127 |

|

|

$ |

52,222 |

|

Total noninterest income |

|

|

162,178 |

|

|

|

143,114 |

|

|

|

158,635 |

|

|

|

136,518 |

|

|

|

138,034 |

|

|

|

109,469 |

|

|

|

96,200 |

|

|

|

91,865 |

|

|

|

109,890 |

|

Total net revenue |

|

|

301,694 |

|

|

|

257,117 |

|

|

|

252,989 |

|

|

|

213,764 |

|

|

|

210,291 |

|

|

|

166,291 |

|

|

|

147,977 |

|

|

|

148,992 |

|

|

|

162,112 |

|

Adjusted net revenue(1) |

|

|

296,965 |

|

|

|

250,681 |

|

|

|

244,372 |

|

|

|

208,032 |

|

|

|

215,475 |

|

|

|

172,232 |

|

|

|

168,037 |

|

|

|

159,520 |

|

|

|

178,084 |

|

Contribution profit |

|

|

180,562 |

|

|

|

141,991 |

|

|

|

132,651 |

|

|

|

105,065 |

|

|

|

117,668 |

|

|

|

89,188 |

|

|

|

87,686 |

|

|

|

85,204 |

|

|

|

103,011 |

|

Technology Platform |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

Net interest income (expense) |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

39 |

|

|

$ |

(32 |

) |

|

$ |

(36 |

) |

|

$ |

(42 |

) |

|

$ |

(47 |

) |

Total noninterest income |

|

|

84,777 |

|

|

|

83,899 |

|

|

|

60,805 |

|

|

|

53,299 |

|

|

|

50,186 |

|

|

|

45,329 |

|

|

|

46,101 |

|

|

|

37,524 |

|

|

|

38,865 |

|

Total net revenue(2) |

|

|

84,777 |

|

|

|

83,899 |

|

|

|

60,805 |

|

|

|

53,299 |

|

|

|

50,225 |

|

|

|

45,297 |

|

|

|

46,065 |

|

|

|

37,482 |

|

|

|

38,818 |

|

Contribution profit |

|

|

19,536 |

|

|

|

21,841 |

|

|

|

18,255 |

|

|

|

20,008 |

|

|

|

15,741 |

|

|

|

13,013 |

|

|

|

15,685 |

|

|

|

16,806 |

|

|

|

23,986 |

|

Financial Services |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

Net interest income |

|

$ |

28,158 |

|

|

$ |

12,925 |

|

|

$ |

5,882 |

|

|

$ |

1,785 |

|

|

$ |

1,209 |

|

|

$ |

542 |

|

|

$ |

229 |

|

|

$ |

88 |

|

|

$ |

98 |

|

Total noninterest income |

|

|

20,795 |

|

|

|

17,438 |

|

|

|

17,661 |

|

|

|

20,171 |

|

|

|

11,411 |

|

|

|

16,497 |

|

|

|

6,234 |

|

|

|

3,963 |

|

|

|

3,139 |

|

Total net revenue |

|

|

48,953 |

|

|

|

30,363 |

|

|

|

23,543 |

|

|

|

21,956 |

|

|

|

12,620 |

|

|

|

17,039 |

|

|

|

6,463 |

|

|

|

4,051 |

|

|

|

3,237 |

|

Contribution loss(2) |

|

|

(52,623 |

) |

|

|

(53,700 |

) |

|

|

(49,515 |

) |

|

|

(35,189 |

) |

|

|

(39,465 |

) |

|

|

(24,745 |

) |

|

|

(35,519 |

) |

|

|

(36,753 |

) |

|

|

(37,467 |

) |

Corporate/Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

Net interest expense |

|

$ |

(9,824 |

) |

|

$ |

(4,199 |

) |

|

$ |

(5,303 |

) |

|

$ |

(2,454 |

) |

|

$ |

(1,130 |

) |

|

$ |

(1,320 |

) |

|

$ |

(4,690 |

) |

|

$ |

(18,350 |

) |

|

$ |

(3,061 |

) |

Total noninterest income (loss) |

|

|

(1,615 |

) |

|

|

(4,653 |

) |

|

|

(1,690 |

) |

|

|

(957 |

) |

|

|

— |

|

|

|

3,967 |

|

|

|

169 |

|

|

|

(684 |

) |

|

|

(319 |

) |

Total net revenue (loss)(2) |

|

|

(11,439 |

) |

|

|

(8,852 |

) |

|

|

(6,993 |

) |

|

|

(3,411 |

) |

|

|

(1,130 |

) |

|

|

2,647 |

|

|

|

(4,521 |

) |

|

|

(19,034 |

) |

|

|

(3,380 |

) |

Consolidated |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

Net interest income |

|

$ |

157,850 |

|

|

$ |

122,729 |

|

|

$ |

94,933 |

|

|

$ |

76,577 |

|

|

$ |

72,375 |

|

|

$ |

56,012 |

|

|

$ |

47,280 |

|

|

$ |

38,823 |

|

|

$ |

49,212 |

|

Total noninterest income. |

|

|

266,135 |

|

|

|

239,798 |

|

|

|

235,411 |

|

|

|

209,031 |

|

|

|

199,631 |

|

|

|

175,262 |

|

|

|

148,704 |

|

|

|

132,668 |

|

|

|

151,575 |

|

Total net revenue |

|

|

423,985 |

|

|

|

362,527 |

|

|

|

330,344 |

|

|

|

285,608 |

|

|

|

272,006 |

|

|

|

231,274 |

|

|

|

195,984 |

|

|

|

171,491 |

|

|

|

200,787 |

|

Adjusted net revenue(1) |

|

|

419,256 |

|

|

|

356,091 |

|

|

|

321,727 |

|

|

|

279,876 |

|

|

|

277,190 |

|

|

|

237,215 |

|

|

|

216,044 |

|

|

|

182,019 |

|

|

|

216,759 |

|

Net loss |

|

|

(74,209 |

) |

|

|

(95,835 |

) |

|

|

(110,357 |

) |

|

|

(111,012 |

) |

|

|

(30,047 |

) |

|

|

(165,314 |

) |

|

|

(177,564 |

) |

|

|

(82,616 |

) |

|

|

(42,878 |

) |

Adjusted EBITDA(1) |

|

|

44,298 |

|

|

|

20,304 |

|

|

|

8,684 |

|

|

|

4,593 |

|

|

|

10,256 |

|

|

|

11,240 |

|

|

|

4,132 |

|

|

|

11,817 |

|

|

|

33,509 |

|

(1) |

|

Adjusted net revenue and adjusted EBITDA are non-GAAP financial measures. For additional information on these measures and reconciliations to the most directly comparable GAAP measures, see “Non-GAAP Financial Measures” and Table 2 to the “Financial Tables” herein. |

(2) |

|

Technology Platform segment total net revenue includes intercompany fees earned by Galileo from SoFi, which is a Galileo client. There is an equal and offsetting expense reflected within the Financial Services segment contribution loss representing the intercompany fees incurred to Galileo. The intercompany revenue and expense are eliminated in consolidation. The revenue is eliminated within “Corporate/Other” and the expense represents a reconciling item of segment contribution profit (loss) to consolidated loss before income taxes. For the year ended |

SOFI-F

View source version on businesswire.com: https://www.businesswire.com/news/home/20221101005542/en/

Investors:

SoFi Investor Relations

IR@sofi.com

Media:

SoFi Media Relations

PR@sofi.com

Source: