Silver Tiger Announces PFS With NPV of US$222M for the Stockwork Zone of the El Tigre Silver-Gold Project, Sonora, Mexico

Silver Tiger announced a Preliminary Feasibility Study (PFS) for its El Tigre Silver-Gold Project in Sonora, Mexico. Key highlights include:

NPV: US$222 million (5% discount rate) with a 40% IRR and a 2-year payback period.

Mine Life: 10 years, recovering 43 million payable silver equivalent ounces (AgEq).

Financials: Total after-tax cash flow of US$318 million, initial capital costs of $86.8 million, expansion capital of $20.1 million in year 3, and sustaining capital costs of $6.2 million.

Costs: Average operating cash costs of $973/oz AuEq and AISC of $1,214/oz AuEq.

Production: Average annual production of 4.8 million AgEq oz.

The updated Mineral Resource Estimate (MRE) shows:

- 200 Moz AgEq grading 92 g/t AgEq in Measured & Indicated categories.

- 84 Moz AgEq grading 180 g/t AgEq in Inferred category.

The PFS was prepared by independent consultants, with metallurgical test work and process plant design contributing to the robust economic outlook of the project.

Silver Tiger ha annunciato uno Studio di Fattibilità Preliminare (PFS) per il suo Progetto Argento-Oro El Tigre in Sonora, Messico. I punti salienti includono:

NPV: 222 milioni di USD (tasso di sconto del 5%) con un IRR del 40% e un periodo di recupero di 2 anni.

Vita della Miniera: 10 anni, recuperando 43 milioni di once equivalenti di argento pagabili (AgEq).

Finanziamenti: Flusso di cassa totale dopo le tasse di 318 milioni di USD, costi di capitale iniziali di 86,8 milioni di USD, costi per espansione di 20,1 milioni di USD nel terzo anno e costi di capitale sostenibili di 6,2 milioni di USD.

Costi: Costi medi operativi in contante di 973 USD/oz AuEq e AISC di 1.214 USD/oz AuEq.

Produzione: Produzione annuale media di 4,8 milioni di once AgEq.

La Stima Aggiornata delle Risorse Minerali (MRE) mostra:

- 200 Moz AgEq con un grado di 92 g/t AgEq nelle categorie Misurate e Indicate.

- 84 Moz AgEq con un grado di 180 g/t AgEq nella categoria Inferred.

Il PFS è stato preparato da consulenti indipendenti, con prove metallurgiche e progettazione dell'impianto di processo che contribuiscono alla robusta prospettiva economica del progetto.

Silver Tiger anunció un Estudio de Factibilidad Preliminar (PFS) para su Proyecto de Plata-Oro El Tigre en Sonora, México. Los puntos destacados incluyen:

NPV: 222 millones de USD (tasa de descuento del 5%) con un TIR del 40% y un período de recuperación de 2 años.

Vida de la Mina: 10 años, recuperando 43 millones de onzas equivalentes de plata pagables (AgEq).

Finanzas: Flujo de caja total después de impuestos de 318 millones de USD, costos de capital iniciales de 86,8 millones de USD, costos de expansión de 20,1 millones de USD en el tercer año y costos de capital sostenido de 6,2 millones de USD.

Costos: Costos de efectivo operativos promedio de 973 USD/oz AuEq y AISC de 1,214 USD/oz AuEq.

Producción: Producción anual promedio de 4,8 millones de onzas AgEq.

La Estimación de Recursos Minerales Actualizada (MRE) muestra:

- 200 Moz AgEq con un grado de 92 g/t AgEq en las categorías Medidas e Indicadas.

- 84 Moz AgEq con un grado de 180 g/t AgEq en la categoría Inferida.

El PFS fue preparado por consultores independientes, con pruebas metalúrgicas y diseño de planta de procesos que contribuyen a la robusta perspectiva económica del proyecto.

실버 타이거는 멕시코 소노라에 있는 엘 티그레 은-금 프로젝트에 대한 예비 타당성 조사(PFS)를 발표했습니다. 주요 사항은 다음과 같습니다:

NPV: 2억 2천2백만 달러(5% 할인율)로, 40% 내부 수익률(IRR)과 2년의 회수 기간을 기록했습니다.

광산 수명: 10년 동안 4,300만 온스(AgEq)의 지급 가능한 은을 회수합니다.

재무: 세후 총 현금 흐름은 3억 1천8백만 달러이며, 초기 자본 비용은 8천6백80만 달러, 3년 차 확장 자본 비용은 2천1백만 달러, 유지 자본 비용은 620만 달러입니다.

비용: 평균 운영 현금 비용은 973 달러/oz AuEq이며, 총 지속 비용(AISC)은 1,214 달러/oz AuEq입니다.

생산: 연간 평균 생산량은 480만 온스 AgEq입니다.

갱신된 광물 자원 추정(MRE)는 다음과 같습니다:

- 2억 온스의 AgEq가 측정 및 표시 카테고리에서 92 g/t AgEq 등급으로 확인되었습니다.

- 8400만 온스의 AgEq가 추정 카테고리에서 180 g/t AgEq 등급으로 확인되었습니다.

PFS는 독립적인 컨설턴트에 의해 준비되었으며, 금속 시험 작업과 공정 플랜트 설계가 프로젝트의 견고한 경제 전망에 기여하고 있습니다.

Silver Tiger a annoncé une Étude de Faisabilité Préliminaire (PFS) pour son Projet Argent-Or El Tigre dans l'État de Sonora, au Mexique. Les points clés incluent :

NPV : 222 millions USD (taux d'actualisation de 5 %) avec un TRI de 40 % et une période de retour sur investissement de 2 ans.

Durée de vie de la mine : 10 ans, récupérant 43 millions d'onces d'argent équivalent payables (AgEq).

Finances : Flux de trésorerie total après impôts de 318 millions USD, coûts d'investissement initiaux de 86,8 millions USD, coûts d'expansion de 20,1 millions USD au cours de la troisième année et coûts d'exploitation durables de 6,2 millions USD.

Coûts : Coûts de fonctionnement moyens de 973 USD/oz AuEq et AISC de 1 214 USD/oz AuEq.

Production : Production annuelle moyenne de 4,8 millions d'onces AgEq.

L' Estimation des Ressources Minérales (MRE) mise à jour montre :

- 200 Moz AgEq avec une teneur de 92 g/t AgEq dans les catégories Mesurées et Indiquées.

- 84 Moz AgEq avec une teneur de 180 g/t AgEq dans la catégorie Inférée.

La PFS a été réalisée par des consultants indépendants, avec des tests métallurgiques et la conception de l'usine de traitement qui contribuent à la solide perspective économique du projet.

Silver Tiger hat eine Vorläufige Machbarkeitsstudie (PFS) für sein Silber-Gold-Projekt El Tigre in Sonora, Mexiko, bekannt gegeben. Die wichtigsten Highlights sind:

NPV: 222 Millionen USD (5 % Diskontsatz) mit einer IRR von 40 % und einer Amortisationszeit von 2 Jahren.

Bergbauleben: 10 Jahre, wobei 43 Millionen zahlbare Silberäquivalentunzen (AgEq) gewonnen werden.

Finanzen: Gesamter Cashflow nach Steuern von 318 Millionen USD, Anfangskapitalaufwand von 86,8 Millionen USD, Erweiterungskosten von 20,1 Millionen USD im dritten Jahr und nachhaltige Kapitalaufwendungen von 6,2 Millionen USD.

Kosten: Durchschnittliche Betriebskosten von 973 USD/oz AuEq und AISC von 1.214 USD/oz AuEq.

Produktion: Durchschnittliche Jahresproduktion von 4,8 Millionen AgEq Unzen.

Die aktualisierte Mineralressourcenschätzung (MRE) zeigt:

- 200 Moz AgEq mit einer Gehalt von 92 g/t AgEq in den gemessenen und angezeigten Kategorien.

- 84 Moz AgEq mit einer Gehalt von 180 g/t AgEq in der kategorisierten Schätzung.

Die PFS wurde von unabhängigen Beratern erstellt, wobei metallurgische Tests und Design der Prozessanlage zur soliden wirtschaftlichen Perspektive des Projekts beitragen.

- NPV of US$222 million with a 40% IRR.

- 10-year mine life recovering 43 million AgEq ounces.

- Total after-tax cash flow of US$318 million.

- Initial capital costs of $86.8 million.

- Average annual production of 4.8 million AgEq oz.

- Average operating cash costs of $973/oz AuEq.

- AISC of $1,214/oz AuEq.

HALIFAX, NS / ACCESSWIRE / October 22, 2024 / Silver Tiger Metals Inc. (TSXV:SLVR)(OTCQX:SLVTF) ("Silver Tiger" or the "Corporation") is pleased to announce a Preliminary Feasibility Study ("PFS") for its

Highlights of the PFS are as follows (all figures in US dollars unless otherwise stated):

After-Tax net present value ("NPV") (using a discount rate of

5% ) of US$222 million with an After-Tax IRR of40.0% and Payback Period of 2.0 years (Base Case);10-year mine life recovering a total of 43 million payable silver equivalent ounces ("AgEq") or 510 thousand payable gold equivalent ounces ("AuEq"), consisting of 9 million silver ounces and 408 thousand gold ounces;

Total Project undiscounted after-tax cash flow of US

$318 million ;Initial capital costs of

$86.8 million , which includes$9.3 million of contingency costs, over an expected 18-month build, expansion capital of$20.1 million in year 3 and sustaining capital costs of$6.2 million over the life of mine ("LOM");Average LOM operating cash costs of

$973 /oz AuEq, and all in sustaining costs ("AISC") of$1,214 /oz AuEq or Average LOM operating cash costs of$12 /oz AgEq, and all in sustaining costs ("AISC") of$14 /oz AgEq;Average annual production of approximately 4.8 million AgEq oz or 56.7 thousand AuEq oz; and

Three (3) years of production in the Proven category in the Phase 1 Starter Pit.

Glenn Jessome, President & CEO stated "We are very pleased with the work completed by our consultants and our technical team on the PFS for the open pit at El Tigre. The open pit delivers robust economics with an NPV of US

Highlights of the updated Mineral Resource

Increased confidence in MRE, with increase of

132% in Total Measured & Indicated Silver Equivalent ("AgEq") Ounces from September 2023 MRE, with59% increase in Measured & Indicated AgEq grade;Total Measured & Indicated Mineral Resource of 200 Moz AgEq grading 92 g/t AgEq contained in 68.0 million tonnes ("Mt");

Inferred Mineral Resource of 84 Moz AgEq grading 180 g/t AgEq contained in 14.5 Mt; and

Inclusion of Out-of-Pit Mineral Resource of 5.3 Mt Measured & Indicated Mineral Resource at grade of 255 g/t AgEq and 10.1 Mt Inferred Mineral Resource grading 216 g/t AgEq.

Preliminary Feasibility Summary

The PFS was prepared by independent consultants P&E Mining Consultants Inc. ("P&E"), with metallurgical test work completed by McClelland Laboratories, Inc. - Sparks, Nevada, process plant design and costing by D.E.N.M. Engineering Ltd., and environmental and permitting led by CIMA Mexico. Following are tables and figures showing key assumptions, results, and sensitivities.

Table 1: El Tigre PFS Key Economic Assumptions and Results (1-2)

Assumption / Result | Unit | Value |

| Assumption / Result | Unit | Value |

|---|---|---|---|---|---|---|

Total OP Plant Feed Mined | kt | 40,292 |

| Net Revenue | US$M | 1,093 |

Operating Strip Ratio | Ratio | 1.7:1 |

| Initial Capital Costs | US$M | 87 |

Silver Grade 1 | g/t | 14.9 |

| Expansion Capital Costs | US$M | 15 |

Gold Grade 1 | g/t | 0.40 |

| Sustaining Capital Costs | US$M | 11 |

Silver Recovery (Oxide/Sul.) 2 | % | 45 / 40 |

| Mining Costs | $/t Material | 2.24 |

Gold Recovery (Oxide/Sul.) 2 | % | 83 / 56 |

| Processing Costs (Phase 1 and Phase 2) | $/t Feed | 5.79/4.74 |

Silver Price | US$/oz | 26.00 |

| G&A Costs | $/t Feed | 1.27 |

Gold Price | US$/oz | 2,150 |

| Operating Cash Cost | US$/oz AgEq | 11.6 |

Payable Silver Metal | Moz | 8.57 |

| All-in Sustaining Cost | US$/oz AgEq | 14.4 |

Payable Gold Metal | koz | 408 |

| After-Tax NPV ( | US$M | 222 |

Payable AgEq | Moz | 42.9 |

| Pre-Tax NPV ( | US$M | 342 |

Mine Life | Yrs | 10 |

| After-Tax IRR | % | 40.0 |

Average mining rate | t/day | 30,000 |

| Pre-Tax IRR | % | 51.2 |

|

|

|

| After-Tax Payback Period | Yrs | 2.0 |

Grades shown are LOM average process plant feed grades include only OP sources. Mining losses and external dilution of

3.7% were incorporated in the mining schedule.Column testing indicated both variable gold and silver recovery for the oxide material vs the previously reported non-discounted PEA (

83% and64% ) at a 3/8-in crush size. In the process design and financial model for the PFS process design and financial model recoveries have been discounted by3% for leaching in the field versus optimum conditions in the laboratory and shown accordingly. The presence of transition and sulfide zones has affected both the gold and silver recoveries and are shown as separate recoveries. These are reasonable and appropriate for use in this PFS design and economic analysis.

Figure 2: El Tigre Cash Flow Profile by Year

Figure 2 above highlights the post-tax cash flows of US

Table 2 - El Tigre PFS Gold and Silver Price Sensitivities

Sensitivity |

|

| Base Case |

|

|

|

|

|---|---|---|---|---|---|---|---|

Silver Price (US$/oz) | 18 | 22 | 26 | 30 | 34 | 38 | 42 |

Gold Price (US$/oz) | 1,500 | 1,750 | 2,150 | 2,500 | 2,750 | 3,000 | 3,250 |

After-Tax NPV ( | 55.9 | 123.9 | 221.5 | 308.7 | 375.6 | 442.5 | 509.4 |

After-Tax IRR (%) | 15.8 | 26.7 | 40.0 | 50.2 | 57.2 | 63.9 | 70.3 |

After-Tax Payback (years) | 4.5 | 3.4 | 2.0 | 1.7 | 1.6 | 1.4 | 1.3 |

Table 3 - El Tigre PFS Operating Cost and Capital Cost Sensitivities

Sensitivity | - | - | Base Case | ||

|---|---|---|---|---|---|

Operating Costs - NPV ( | 270.4 | 246.0 | 221.5 | 194.2 | 169.6 |

Operating Costs - IRR (%) | 46.2 | 43.2 | 40.0 | 36.1 | 32.7 |

Capital Costs - NPV ( | 236.7 | 229.1 | 221.5 | 211.1 | 203.4 |

Capital Costs - IRR (%) | 48.5 | 43.9 | 40.0 | 36.1 | 33.2 |

Capital and Operating Costs

The El Tigre Project has been envisioned as an open pit mining operation starting at a processing rate of 7,500 tonnes per day for years 1-3 and then ramping up to 15,000 tonnes per day by year 4 after 1 year construction for ramp up in year 3.

The process plant is comprised of conventional three (3) stage crushing to an optimum -3/8 inch (10 mm) crush size. The crushed material will be conveyed and loaded on the lined pad areas. A series of pumping and piping will allow irrigation of the stacked heap material and subsequent production of pregnant solution to flow to the respective impoundment pond. The pregnant solution will be pumped to the recovery facility consisting of the Merrill - Crowe process (zinc precipitation) and refinery to produce the gold and silver dore for marketing. The process barren solution will be recycled (with NaCN addition) and pumped back to the heap for further leaching. The process plant location will be adjacent to the pad and pond infrastructure area.

Water supply to the process plant is provided by pumping from nearby Bavispe River to the process area water distribution system and high voltage grid power will be installed by the local utility to supply process and infrastructure electrical requirements. Expansion capital includes the cost to increase the process plant capacity from 7,500 tonnes per day to 15,000 tonnes per day as noted in Year 4 of operation.

Table 4 - LOM Capital Cost Estimate

Type | Initial | Expansion | Sustaining | Total |

(US$k) | (US$k) | (US$k) | (US$k) | |

Process Plant direct costs | 42,851 | 13,584 | 1,600 | 58,034 |

Mining direct costs | 2,660 | 4,362 | 3,956 | 10,978 |

Pre-stripping | 3,362 |

|

| 3,362 |

Infrastructure | 20,489 |

|

| 20,489 |

Process indirect costs (with EPCM) | 8,121 |

|

| 8,121 |

Total | 77,483 | 17,946 | 5,556 | 100,985 |

Contingency ( | 9,298 | 2,199 | 622 | 12,118 |

Total with Contingency | 86,780 | 20,145 | 6,178 | 113,103 |

Mining

Open pit mining will be contracted and carried out by drill and blast followed by conventional loading and truck haulage to the waste rock storage facilities and the process plant.

Metallurgy

A detailed metallurgical test program was carried out by McClelland Laboratories, Inc., Sparks, Nevada on six (6) El Tigre starter pit samples. The program included crushing, coarse bottle rolls, and column testing at both

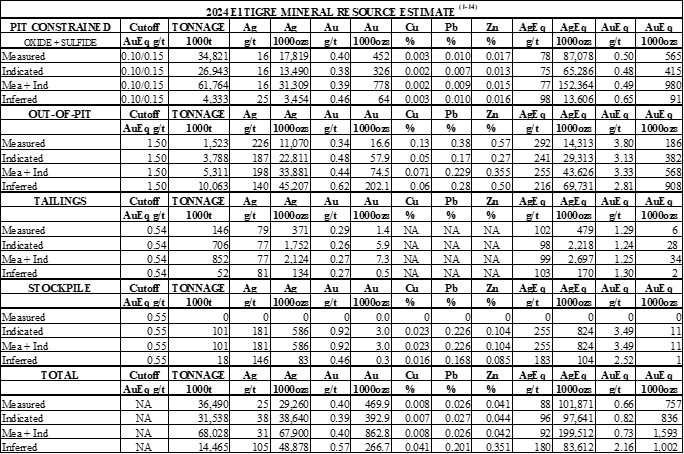

Mineral Resource Estimate

The basis for the PFS is the Mineral Resource Estimate completed by P&E for the El Tigre Project located in Sonora State, Mexico, which has an effective date of October 22, 2024, with an NI 43-101 Technical Report to be filed within 45 days of this news release. A summary of the Mineral Resource Estimate is provided in Table 5.

Table 5 - Updated Mineral Resource Estimate October 2024

Mineral Resources, which are not Mineral Reserves, do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

The Inferred Mineral Resource in this estimate has a lower level of confidence than that applied to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of the Inferred Mineral Resource could be upgraded to an Indicated Mineral Resource with continued exploration.

The Mineral Resources were estimated in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), CIM Standards on Mineral Resources and Reserves, Definitions and Guidelines prepared by the CIM Standing Committee on Reserve Definitions and adopted by the CIM Council.

Historically mined areas were depleted from the Mineral Resource model.

Prices used are US

$2,000 /oz Au, US$25 /oz Ag, US$4.00 /lb Cu, US$0.95 lb Pb and US$1.25 /lb Zn.The pit-constrained AuEq respective oxide and sulfide cut-off grades of 0.10 and 0.15 g/t were derived from

40% Ag and83% Au oxide process recovery,40% Ag and56% Au sulfide process recovery, US$5.25 /tonne process and G&A cost. The constraining pit optimization parameters were$2.00 /t mining cost and 45-degree pit slopes. Regarding recoveries, the PFS recovery for Ag in oxide material was increased to45% after a more detailed study was complete after the MRE was finalized.The out-of-pit AuEq cut-off grade of 1.50 g/t was derived

93% Ag and89% Au process recovery, US$28 /tonne process and G&A cost, and a$60 /tonne mining cost. The out-of-pit Mineral Resource grade blocks were quantified above the 1.50 g/t AuEq cut-off, below the constraining pit shell and within the constraining mineralized wireframes. Out-of-Pit Mineral Resources are restricted to the El Tigre Main Veins, which exhibit historical continuity and reasonable potential for extraction by cut and fill and long hole mining methods.The Low-Grade Stockpile AuEq cut-off grade of 0.54 g/t was derived from

85% Ag and85% Au recovery US$28 /tonne process and G&A cost, and a$2 /tonne mining cost.The Tailings AuEq cut-off grade of 0.55 g/t was derived from

82% Ag and83% Au process recovery, US$28.72 /tonne process and G&A cost.AgEq and AuEq were calculated at an Ag/Au ratio of 166:1 (oxide) and 122:1 (sulfide) for pit-constrained Mineral Resources.

AgEq and AuEq were calculated at an Ag/Au ratio of 77:1 for out-of-pit Mineral Resources.

AgEq and AuEq were calculated at an Ag/Au ratio of 80:1 for Low-Grade Stockpile Mineral Resources.

AgEq and AuEq were calculated at an Ag/Au ratio of 79:1 for Tailings Mineral Resources

Totals may not sum due to rounding.

Mineral Resource Estimate Methodology - El Tigre Project

The El Tigre Project includes the El Tigre Veins, El Tigre Tailings and the El Tigre Low-Grade Stockpile.

The databases used for this Mineral Resource update contain a total of 20,149 collar records that contribute directly to the Mineral Resource Estimate and includes collar, survey, assay, lithology and bulk density data. Assay data includes Au g/t, Ag g/t, Cu %, Pb % and Zn % grades. The drilling extends approximately five km along strike.

P&E Mining Consultants Inc. ("P&E") collaborated with Silver Tiger personnel to develop the mineralization models, grade estimates, and reporting criteria for the Mineral Resources at El Tigre. Mineralized domains were initially developed by Silver Tiger and were reviewed and modified by P&E. A total of twenty-seven individual mineralized domains have been identified through drilling and surface sampling. Interpreted mineralization wireframes were developed by Silver Tiger geologists for the El Tigre Veins based on logged drill hole lithology, assay grades and historical records. Silver Tiger identified continuous zones of mineralization from assay grades equal to or greater than 0.30 g/t AuEq with observed continuity along strike and down-dip, using a calculated Ag:Au equivalent factor of 75:1. The selected intervals include lower grade material where necessary to maintain wireframe continuity between drill holes.

P&E developed mineralized domains for the El Tigre Low-Grade Stockpile and the El Tigre Tailings based on lithological logging and LiDAR surface topography.

Assay samples were composited to either 1.00 m or 1.50 m for the vein domains. No compositing was used for the Low-Grade Stockpiles and Tailings models. Composites were capped prior to grade estimation based on the analysis of individual composite log-probability distributions.

A total of 5,542 bulk density values were taken by Silver Tiger from drill hole core. Mineralized bulk density values were assigned for each of the El Tigre Main Veins based on the median vein measurement. For the El Tigre North Veins, a bulk density of 2.65 t/m 3 was assigned for the veins and a value of 2.42 t/m 3 was assigned for the Protectora Halo. For the Low-Grade Stockpile a value of 1.60 t/m 3 was assigned, and for the Tailings a value of 1.39 t/m 3 was used based on 37 nuclear density measurements.

Vein block grades for gold and silver were estimated by Inverse Distance Cubed ("ID3") interpolation of capped composites using a minimum of four and a maximum of twelve composites. Vein block grades for copper, lead and zinc were estimated by Inverse Distance Squared ("ID2") interpolation of capped composites using a minimum of four and a maximum of twelve composites.

Nearest-Neighbour grade interpolation was used for the Low-Grade Stockpiles, and for the Tailings, block grades were estimated by ID2 estimation of capped assays using a minimum of four and a maximum of twelve samples.

For the El Tigre Main Veins, blocks within 30 m of three or more drill holes/channels were classified as Measured Mineral Resources, and blocks within 60 m of three or more drill holes/channels were classified as Indicated Mineral Resources. All additional estimated blocks were classified as Inferred Mineral Resources.

For the North Veins, blocks interpolated by at least two drill holes within 50 m were classified as Indicated Mineral Resources. Blocks interpolated by at least one drill hole within a maximum distance of 200 m were classified as Inferred Mineral Resources.

For the Low-Grade Stockpiles, blocks within 15 m of two or more drill holes were classified as Indicated Mineral Resources. All additional estimated blocks were classified as Inferred Mineral Resources.

For the Tailings, blocks within 30 m of three or more auger or core drill holes were classified as Measured Mineral Resources. Blocks within 60 m of two or more auger/drill holes/pits or trenches were classified as Indicated Mineral Resources. All additional estimated blocks were classified as Inferred Mineral Resources.

P&E considers that the block model Mineral Resource Estimates and Mineral Resource classification represent a reasonable estimation of the global mineral resources for the El Tigre Project with regard to compliance with generally accepted industry standards and guidelines, the methodology used for estimation, the classification criteria used and the actual implementation of the methodology in terms of Mineral Resource estimation and reporting. The Mineral Resources have been estimated in conformity with the requirements of the CIM "Estimation of Mineral Resource and Mineral Reserves Best Practices" guidelines as required by the Canadian Securities Administrators' National Instrument 43-101. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

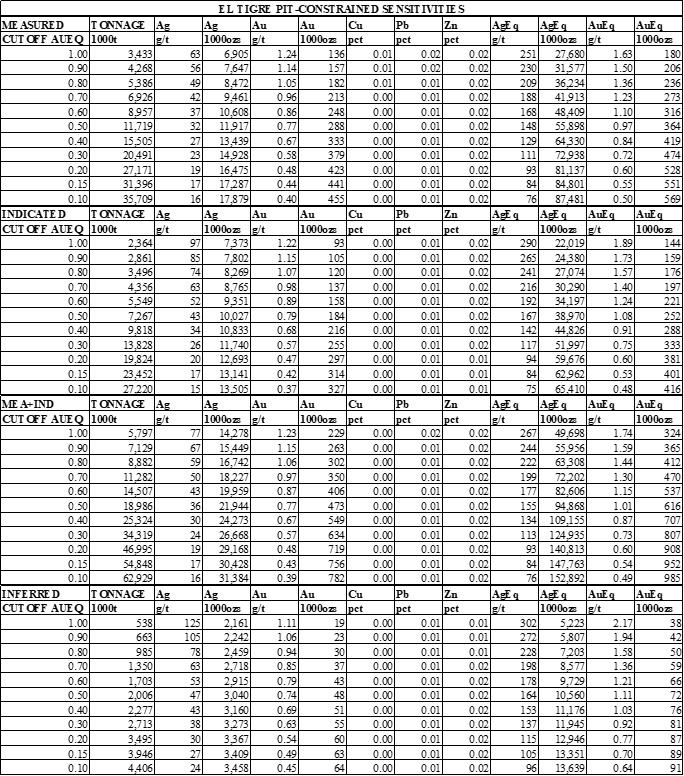

Table 6: AuEq Cut-off Sensitivities - ET Pit-Constrained Mineral Resource

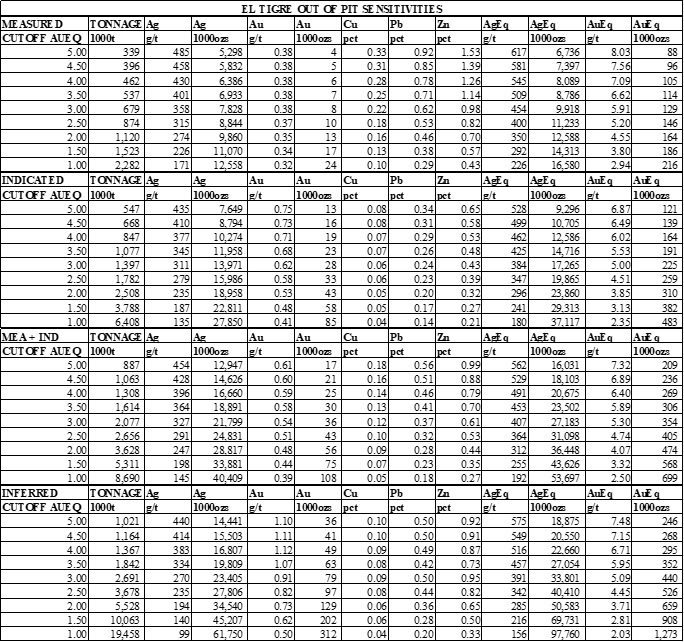

Table 7: AuEq Cut-off Sensitivities - ET Out-of-Pit Mineral Resource

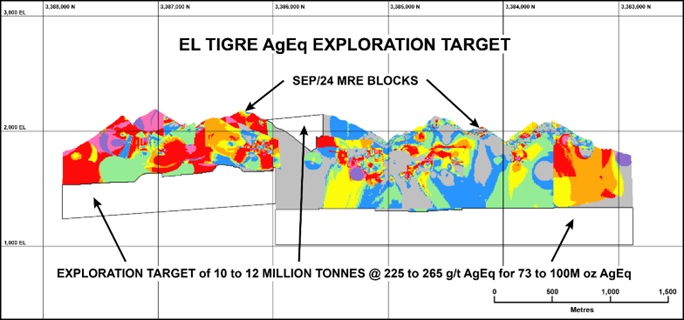

Exploration Potential

Exploration potential at the El Tigre Project is substantial with prospective areas for exploration both down dip and along strike with the disclosed Exploration Target establishing 10 to 12 million tonnes at 225 to 265 g/t AgEq for 73 to 100 Moz AgEq.

Figure 3-Exploration Potential released October 2024

Surface Rights Agreement

The Company owns royalty-free,

Underground Preliminary Economic Assessment

The Company will also continue to work on this substantial, permitted underground Mineral Resource Estimate and advance this towards a Preliminary Economic Assessment by H1-2025. The Measured and Indicated Out-of-Pit Mineral Resource at El Tigre is 44 Moz AgEq grading 255 g/t AgEq contained in 5.3 Mt and the Inferred Mineral Resource is 70 Moz AgEq grading 216 g/t AgEq contained in 10.1 Mt.

Qualified Persons

Mineral Resource Estimate: Dave Duncan P. Geo. VP Exploration of Silver Tiger, Charles Spath P.Geo., VP of Technical Services of Silver Tiger, and Fred Brown, P.Geo RM-SME Senior Associate Geologist of P&E Mining Consultants, and Eugene Puritch, P.Eng., FEC, CET, President of P&E Mining Consultants are the Qualified Persons as defined under National Instrument 43-101. All Qualified Persons have reviewed and approved the scientific and technical information in this press release.

Preliminary Feasibility Study: Andrew Bradfield P. Eng of P&E Mining Consultants, Eugene Puritch, P.Eng., FEC, CET, President of P&E Mining Consultants and David J. Salari, P. Eng. of D.E.N.M. Engineering Ltd are the Qualified Persons as defined under National Instrument 43-101. All Qualified Persons have reviewed and approved the scientific and technical information in this press release.

A Technical Report is being prepared on the Preliminary Feasibility Study in accordance with National Instrument 43-101 ("NI-43-101"), and will be available on the Company's website and SEDAR within 45 days of the date of this news release. The effective date of this Preliminary Feasibility Study is October 22, 2024.

VRIFY Slide Deck and 3D Presentation - Silver Tiger's El Tigre Project

VRIFY is a platform being used by companies to communicate with investors using 360° virtual tours of remote mining assets, 3D models and interactive presentations. VRIFY can be accessed by website and with the VRIFY iOS and Android apps.

Access the Silver Tiger Metals Inc. Company Profile on VRIFY at: https://vrify.com

The VRIFY Slide Deck and 3D Presentation for Silver Tiger Metals Inc. can be viewed at: https://vrify.com/explore/decks/492 and on the Corporation's website at: www.silvertigermetals.com.

About Silver Tiger and the El Tigre Historic Mine District

Silver Tiger Metals Inc. is a Canadian company whose management has more than 25 years' experience discovering, financing and building large epithermal silver projects in Mexico. Silver Tiger's

The El Tigre historic mine district is located in Sonora, Mexico and lies at the northern end of the Sierra Madre silver and gold belt which hosts many epithermal silver and gold deposits, including Dolores, Santa Elena and Las Chispas at the northern end. In 1896, gold was first discovered on the property in the Gold Hill area and mining started with the Brown Shaft in 1903. The focus soon changed to mining high-grade silver veins in the area with production coming from 3 parallel veins the El Tigre Vein, the Seitz Kelley Vein and the Sooy Vein. Underground mining on the middle El Tigre Vein extended 1,450 metres along strike and was mined on 14 levels to a depth of approximately 450 metres. The Seitz Kelley Vein was mined along strike for 1 kilometre to a depth of approximately 200 metres. The Sooy Vein was only mined along strike for 250 metres to a depth of approximately 150 metres. Mining abruptly stopped on all 3 of these veins when the price of silver collapsed to less than 20¢ per ounce with the onset of the Great Depression. By the time the mine closed in 1930, it is reported to have produced a total of 353,000 ounces of gold and 67.4 million ounces of silver from 1.87 million tons (Craig, 2012). The average grade mined during this period was over 2 kilograms silver equivalent per ton.

For further information, please contact:

Glenn Jessome

President and CEO

902 492 0298

jessome@silvertigermetals.com

CAUTIONARY STATEMENT:

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

This News Release includes certain "forward-looking statements". All statements other than statements of historical fact included in this release, including, without limitation, statements regarding potential mineralization, Mineral Resources and Reserves, the ability to convert Inferred Mineral Resources to Indicated Mineral Resources, the ability to complete future drilling programs and infill sampling, the ability to extend Mineral Resource blocks, the similarity of mineralization at El Tigre to Delores, Santa Elena and Chispas, exploration results, and future plans and objectives of Silver Tiger, are forward-looking statements that involve various risks and uncertainties. Forward-looking statements are frequently characterized by words such as "may", "is expected to", "anticipates", "estimates", "intends", "plans", "projection", "could", "vision", "goals", "objective" and "outlook" and other similar words. Although Silver Tiger believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, there can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from Silver Tiger's expectations include risks and uncertainties related to exploration, development, operations, commodity prices and global financial volatility, risk and uncertainties of operating in a foreign jurisdiction as well as additional risks described from time to time in the filings made by Silver Tiger with securities regulators.

SOURCE: Silver Tiger Metals Inc.

View the original press release on accesswire.com