Pegasus Resources Secures Key Uranium Asset with Successful Private Placement

Pegasus Resources (SLTFF) has successfully closed a non-brokered private placement, raising $340,354.02 through the issuance of 5,672,567 units at C$0.06 per unit. Each unit includes one common share and one warrant exercisable at C$0.12 for two years.

The financing will enable Pegasus to secure 75% ownership in the Utah uranium project Jupiter through a final payment. Finders' fees included $15,076 in cash and 251,272 finders' warrants exercisable at C$0.06 for two years. Company insiders, including CEO Christian Timmins, Noah Komavli, and Derrick Stickland, participated in the offering, which constituted a related party transaction.

Pegasus Resources (SLTFF) ha concluso con successo un collocamento privato non mediato, raccogliendo $340,354.02 attraverso l'emissione di 5,672,567 unità a C$0.06 per unità. Ogni unità comprende una azione ordinaria e un warrant esercitabile a C$0.12 per due anni.

Il finanziamento consentirà a Pegasus di ottenere il 75% di proprietà nel progetto di uranio Utah Jupiter attraverso un pagamento finale. Le commissioni per i mediatori includevano $15,076 in contante e 251,272 warrant per mediatori esercitabili a C$0.06 per due anni. I membri della dirigenza dell'azienda, tra cui il CEO Christian Timmins, Noah Komavli e Derrick Stickland, hanno partecipato all'offerta, che ha costituito una transazione con parti correlate.

Pegasus Resources (SLTFF) ha cerrado con éxito una colocación privada no mediada, recaudando $340,354.02 mediante la emisión de 5,672,567 unidades a C$0.06 por unidad. Cada unidad incluye una acción común y una opción de compra ejercitable a C$0.12 durante dos años.

El financiamiento permitirá a Pegasus asegurar el 75% de propiedad en el proyecto de uranio de Utah, Jupiter, a través de un pago final. Las comisiones de los intermediarios incluyeron $15,076 en efectivo y 251,272 opciones de compra para intermediarios ejercitables a C$0.06 durante dos años. Los miembros de la empresa, incluido el CEO Christian Timmins, Noah Komavli y Derrick Stickland, participaron en la oferta, que constituyó una transacción con partes relacionadas.

페가수스 리소스(Pegasus Resources, SLTFF)는 비중개 사모 배치를 성공적으로 마감하고, C$0.06의 가격으로 5,672,567 유닛을 발행하여 $340,354.02를 모금했습니다. 각 유닛은 하나의 보통주와 2년 동안 C$0.12에 행사 가능한 하나의 워런트를 포함합니다.

이번 자금 조달을 통해 페가수스는 유타주 우라늄 프로젝트인 주피터에서 75%의 소유권을 확보할 수 있게 됩니다. 중개 수수료는 현금 $15,076와 2년 동안 C$0.06에 행사 가능한 251,272개의 중개인 워런트를 포함했습니다. CEO인 크리스찬 팀민스(Christian Timmins), 노아 코마블리(Noah Komavli), 데릭 스틱랜드(Derrick Stickland)를 포함한 회사 내부자들이 이 제안에 참여했으며, 이는 관련 당사자 거래로 간주되었습니다.

Pegasus Resources (SLTFF) a réussi à clôturer un placement privé non intermédiaire, levant $340,354.02 par l'émission de 5,672,567 unités à C$0.06 par unité. Chaque unité comprend une action ordinaire et un bon de souscription exerçable à C$0.12 pendant deux ans.

Ce financement permettra à Pegasus d'assurer 75% de propriété sur le projet d'uranium Jupiter dans l'Utah grâce à un paiement final. Les frais de recherche incluaient 15,076 $ en espèces et 251,272 bons de souscription exerçables à C$0.06 pendant deux ans. Des membres de la direction de l'entreprise, y compris le PDG Christian Timmins, Noah Komavli et Derrick Stickland, ont participé à l'offre, qui constituait une transaction entre parties liées.

Pegasus Resources (SLTFF) hat erfolgreich eine nicht vermittelte Privatplatzierung abgeschlossen und $340,354.02 durch die Ausgabe von 5,672,567 Einheiten zu je C$0.06 gesammelt. Jede Einheit umfasst eine Stammaktie und ein warrant, das für zwei Jahre zu C$0.12 ausgeübt werden kann.

Die Finanzierung ermöglicht es Pegasus, 75% Eigentum am Uranprojekt Jupiter in Utah durch eine letzte Zahlung zu sichern. Die Findergebühren betrugen $15,076 in bar sowie 251,272 Finder-Warrants, die für zwei Jahre zu C$0.06 ausgeübt werden können. Unternehmensinsider, darunter CEO Christian Timmins, Noah Komavli und Derrick Stickland, nahmen an dem Angebot teil, das eine Transaktion mit nahestehenden Personen darstellt.

- Successful raise of $340,354.02 through private placement

- Acquisition of 75% ownership in Jupiter uranium project

- Insider participation demonstrates management confidence

- Strategic expansion of uranium asset portfolio

- Dilutive financing at C$0.06 per unit

- Related party transaction with insider participation

VANCOUVER, BC / ACCESS Newswire / March 12, 2025 / Pegasus Resources Inc. (TSXV:PEGA)(Frankfurt:0QS0)(OTC PINK:SLTFF) (the "Company" or "Pegasus") is pleased to announce that it has closed its non-brokered private placement offering (the "Offering") announced February 27, 2025, raising gross proceeds of

Each Unit consists of one common share (each, a "Common Share", and collectively the "Common Shares") and one full common share purchase warrant (each warrant, a "Warrant" and collectively the "Warrants"). Each Warrant entitles the holder thereof to acquire one Common Share at a price of C

"We appreciate the continued confidence and support from our investors and insiders, which enables us to advance our uranium projects and take critical steps toward resource development and long-term value creation. With this financing closed, Pegasus will secure

All securities issued in connection with the Offering are subject to a statutory hold period of four months plus one day from the date of issuance, in accordance with applicable securities laws.

Finders' fees of

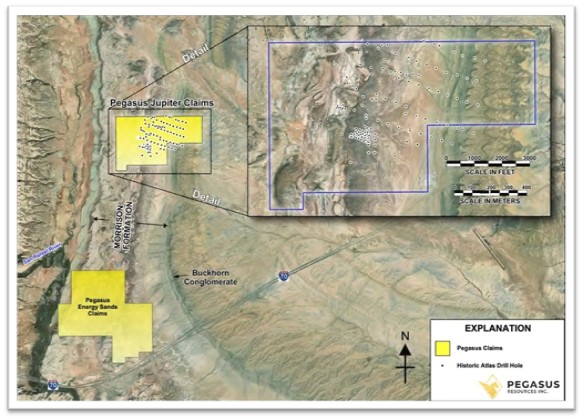

The net proceeds from the Offering will be used to complete the final payment on the Jupiter Uranium Property, securing Pegasus a

The Offering constitutes a "related party transaction" within the meaning of TSXV Policy 5.9 and Multilateral Instrument 61-101 Protection of Minority Security Holders in Special Transactions ("MI 61-101") because Insiders of the Company, including Christian Timmins, Noah Komavli, and Derrick Stickland, participated in the Offering. Additionally, the Offering included one Pro-group participant. The Company has relied on exemptions from the formal valuation and minority shareholder approval requirements of MI 61-101 under sections 5.5(a) and 5.7(1)(a), as the fair market value of Insider participation is below

This news release does not constitute an offer to sell or a solicitation of an offer to sell any securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act"), or any state securities laws, and may not be offered or sold within the United States or to, or for the account or benefit of, any U.S. person unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available.

For further information, please contact:

About Pegasus Resources Inc.

Pegasus Resources Inc. is a diversified Junior Canadian Mineral Exploration Company with a focus on uranium, gold, and base metal properties in North America. The Company is also actively pursuing the right opportunity in other resources to enhance shareholder value. For additional information, please visit the Company at www.pegasusresourcesinc.com.

On Behalf of the Board of Directors:

Christian Timmins

President, CEO and Director

Pegasus Resources Inc.

700 - 838 West Hastings Street

Vancouver, BC V6C 0A6

PH: 1-403-597-3410

Twitter: https://twitter.com/MrChris_Timmins

Twitter: https://twitter.com/pegasusresinc

E: info@pegasusresourcesinc.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accept responsibility for the adequacy or accuracy of this release.

Forward Looking Statements

This news release contains certain information that may be deemed "forward-looking information" with respect to the Company within the meaning of applicable securities laws. Such forward-looking information involves known and unknown risks, uncertainties and other factors that may cause the Company's actual results, performance or achievements, or developments in the industry to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking information. Forward-looking information includes statements that are not historical facts and are generally, but not always, identified by the words "expects," "plans," "anticipates," "believes," "intends," "estimates," "projects," "potential" and similar expressions, or that events or conditions "will," "would," "may," "could" or "should" occur. Forward-looking information contained in this press release may include, without limitation, statements regarding creation of value for Company shareholders, results of operations the size, timing and completion of the Offering, the use of proceeds from the Offering and the listing of the Common Shares (including the Common Shares underlying the Warrants and the broker warrants) on the TSXV upon closing of the Offering.

Although the Company believes the forward-looking information contained in this news release is reasonable based on information available on the date hereof, by its nature, forward-looking information involves assumptions and known and unknown risks, uncertainties and other factors which may cause our actual results, level of activity, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking information.

Examples of such assumptions, risks and uncertainties include, without limitation, assumptions, risks and uncertainties associated with general economic conditions; the COVID-19 pandemic; adverse industry events; the receipt of required regulatory approvals and the timing of such approvals; that the Company maintains good relationships with the communities in which it operates or proposes to operate, future legislative and regulatory developments in the mining sector; the Company's ability to access sufficient capital from internal and external sources, and/or inability to access sufficient capital on favorable terms; mining industry and markets in Canada and generally; the ability of the Company to implement its business strategies; competition; the risk that any of the assumptions prove not to be valid or reliable, which could result in delays, or cessation in planned work, risks associated with the interpretation of data, the geology, grade and continuity of mineral deposits, the possibility that results will not be consistent with the Company's expectations, as well as other assumptions risks and uncertainties applicable to mineral exploration and development activities and to the Company, including as set forth in the Company's public disclosure documents filed on the SEDAR+ website at www.sedarplus.ca.

The forward-looking information contained in this press release represents the expectations of Pegasus as of the date of this press release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward-looking information and should not rely upon this information as of any other date. While Pegasus may elect to, it does not undertake to update this information at any particular time except as required in accordance with applicable laws.

SOURCE: Pegasus Resources, Inc.

View the original press release on ACCESS Newswire