Pegasus Resources Highlights 2024 Progress and Readies for Uranium Industry Growth in 2025

Pegasus Resources reflects on a transformative 2024 and outlines plans for 2025 in uranium exploration. Key 2024 achievements include: successful exploration at Energy Sands with 13 samples showing over 1% U₃O₈ (peak 18.8%), acquisition of the Jupiter Project with 100+ historical drill holes, and securing Notice of Intention permits for drilling campaigns.

For 2025, the company plans drilling programs at both flagship projects: Energy Sands (18 holes, 3,200 feet total) and Jupiter (30 holes, 15,360 feet total). The company reports recent insider buying activity from CEO Christian Timmins and Director Noah Komavli, demonstrating leadership confidence.

The company aims to capitalize on favorable uranium market conditions, including growing global demand for clean energy, supply deficits, and U.S. government support through a $75 million strategic uranium reserve. Pegasus highlights Utah's strategic importance with existing infrastructure and proximity to the White Mesa Mill.

Pegasus Resources riflette su un 2024 trasformativo e delinea i piani per il 2025 nell'esplorazione dell'uranio. I risultati chiave del 2024 includono: esplorazione di successo presso Energy Sands con 13 campioni che mostrano oltre l'1% di U₃O₈ (picco 18,8%), acquisizione del Progetto Jupiter con oltre 100 pozzi storici, e ottenimento dei permessi di Notifica di Intenzione per le campagne di trivellazione.

Per il 2025, l'azienda prevede programmi di trivellazione in entrambi i progetti principali: Energy Sands (18 pozzi, 3.200 piedi totali) e Jupiter (30 pozzi, 15.360 piedi totali). L'azienda riporta recenti attività di acquisto da parte di insider, tra cui il CEO Christian Timmins e il Direttore Noah Komavli, dimostrando la fiducia della leadership.

L'azienda mira a capitalizzare sulle favorevoli condizioni di mercato dell'uranio, tra cui la crescente domanda globale di energia pulita, i deficit di fornitura e il supporto del governo statunitense attraverso una riserva strategica di uranio di 75 milioni di dollari. Pegasus evidenzia l'importanza strategica nello Utah con l'infrastruttura esistente e la vicinanza al White Mesa Mill.

Pegasus Resources reflexiona sobre un 2024 transformador y esboza planes para 2025 en la exploración de uranio. Los logros clave de 2024 incluyen: exploración exitosa en Energy Sands con 13 muestras que muestran más del 1% de U₃O₈ (pico de 18.8%), adquisición del Proyecto Jupiter con más de 100 agujeros históricos, y aseguramiento de permisos de Notificación de Intención para campañas de perforación.

Para 2025, la empresa planea programas de perforación en ambos proyectos insignia: Energy Sands (18 agujeros, 3,200 pies en total) y Jupiter (30 agujeros, 15,360 pies en total). La empresa informa de recientes actividades de compra interna por parte del CEO Christian Timmins y del Director Noah Komavli, demostrando la confianza del liderazgo.

La empresa aspira a capitalizar las condiciones favorables del mercado de uranio, incluida la creciente demanda global de energía limpia, déficits de suministro y el apoyo del gobierno de EE. UU. a través de una reserva estratégica de uranio de 75 millones de dólares. Pegasus subraya la importancia estratégica de Utah con su infraestructura existente y la proximidad al White Mesa Mill.

페가수스 리소스는 2024년의 변화의 해를 돌아보고 2025년의 우라늄 탐사 계획을 제시합니다. 2024년의 주요 성과로는: Energy Sands에서의 성공적인 탐사로 13개의 샘플이 1% 이상의 U₃O₈(최고 18.8%)을 보여주었고, 100개 이상의 역사적 드릴 홀이 있는 Jupiter 프로젝트의 인수, 그리고 드릴링 캠페인을 위한 의도 공지 허가 확보가 포함됩니다.

2025년에는 두 개의 주력 프로젝트인 Energy Sands(18홀, 총 3,200피트)와 Jupiter(30홀, 총 15,360피트)에서 드릴링 프로그램을 계획하고 있습니다. 회사는 CEO 크리스찬 팀민스와 이사 노아 코마블리의 최근 내부 구매 활동을 보고하며, 리더십의 신뢰를 보여줍니다.

회사는 청정 에너지에 대한 전 세계 수요 증가, 공급 부족, 그리고 미 정부의 7천5백만 달러의 전략적 우라늄 비축을 통한 지원 등 유리한 우라늄 시장 조건을 활용할 계획입니다. 페가수스는 기존 인프라와 화이트 메사 밀과의 인접성을 통해 유타의 전략적 중요성을 강조합니다.

Pegasus Resources fait le point sur une année 2024 transformative et esquisse ses projets pour 2025 dans l'exploration de l'uranium. Les réalisations clés de 2024 comprennent : une exploration réussie à Energy Sands avec 13 échantillons montrant plus de 1 % d'U₃O₈ (pic à 18,8 %), l'acquisition du projet Jupiter avec plus de 100 forages historiques, et l'obtention de permis de notification d'intention pour des campagnes de forage.

Pour 2025, l'entreprise prévoit des programmes de forage sur ses deux projets phares : Energy Sands (18 forages, 3 200 pieds au total) et Jupiter (30 forages, 15 360 pieds au total). L'entreprise rapporte des activités d'achat récentes de la part de son directeur général Christian Timmins et du directeur Noah Komavli, ce qui démontre la confiance de la direction.

L'entreprise vise à tirer parti des conditions de marché favorables pour l'uranium, notamment de la demande mondiale croissante pour une énergie propre, des déficits d'approvisionnement, et du soutien du gouvernement américain par le biais d'une réserve stratégique d'uranium de 75 millions de dollars. Pegasus souligne l'importance stratégique de l'Utah avec ses infrastructures existantes et sa proximité avec le White Mesa Mill.

Pegasus Resources blickt auf ein transformierendes Jahr 2024 zurück und skizziert Pläne für 2025 im Bereich der Uranexploration. Zu den wichtigsten Erfolgen 2024 gehören: erfolgreiche Explorationen bei Energy Sands mit 13 Proben, die über 1% U₃O₈ (Höchstwert 18,8%) zeigen, die Akquisition des Jupiter-Projekts mit über 100 historischen Bohrlöchern und die Sicherstellung von Genehmigungen nach dem Notice of Intention für Bohrkampagnen.

Für 2025 plant das Unternehmen Bohrprogramme an beiden Flagship-Projekten: Energy Sands (18 Löcher, insgesamt 3.200 Fuß) und Jupiter (30 Löcher, insgesamt 15.360 Fuß). Das Unternehmen berichtet von jüngsten Insider-Käufe durch CEO Christian Timmins und Direktor Noah Komavli, was das Vertrauen der Führung zeigt.

Das Unternehmen verfolgt das Ziel, von den günstigen Marktbedingungen für Uran zu profitieren, einschließlich der wachsenden globalen Nachfrage nach sauberer Energie, Angebotsengpässen und der Unterstützung der US-Regierung durch eine strategische Uranreserve in Höhe von 75 Millionen US-Dollar. Pegasus hebt utahs strategische Bedeutung durch bestehende Infrastruktur und die Nähe zur White Mesa Mill hervor.

- High-grade exploration results at Energy Sands with 13 samples over 1% U₃O₈, peak at 18.8%

- Strategic acquisition of Jupiter Project with valuable historical drilling data

- Secured regulatory approvals (NOI) for drilling campaigns

- Insider buying activity from CEO and Director showing confidence

- Fully permitted for upcoming drilling programs at both flagship projects

- None.

2024 highlights include: Energy Sands exploration success, Jupiter acquisition, successful permitting

2025 milestones include: drilling at Energy Sands and Jupiter, evaluation of strategic acquisitions and corporate opportunities, macro and micro tailwinds

VANCOUVER, BC / ACCESSWIRE / January 14, 2025 / Pegasus Resources Inc. (TSXV:PEGA)(Frankfurt:0QS0)(OTC PINK:SLTFF) (the "Company" or "Pegasus") is pleased to reflect on a transformative 2024, marked by significant milestones that position the Company as a leading uranium explorer in Utah. With high-grade results, strategic acquisitions, and regulatory approvals, Pegasus is poised to capitalize on the surging demand for uranium, driven by the global transition to clean energy and increasing energy security concerns.

Pegasus achieved substantial progress in advancing its uranium exploration projects in Utah. With high-grade results, strategic acquisitions, and critical regulatory approvals, 2024 was a pivotal year of growth and development for the Company. Pegasus has continued to be a good steward of investor capital, adding significant value through creative and unique strategies. The Company continues to build relationships on the ground in Utah, which should continue to yield value creation opportunities.

"2024 was a pivotal year for Pegasus, as we made significant strides in advancing our uranium exploration projects," stated Christian Timmins, CEO of Pegasus. "From the Energy Sands exploration success to the acquisition of the historically drilled Jupiter Project and securing key regulatory approvals, these achievements position the Company to define meaningful uranium resources in Utah-a region with proven uranium production."

"As the global demand for uranium accelerates, and M&A activity in North America signals a thriving sector, Pegasus is uniquely placed to create long-term shareholder value. Our focus in 2025 will be on executing our drill campaigns and evaluating strategic opportunities to further enhance our portfolio."

Insider Buying Signals Strong Leadership Confidence

Pegasus is pleased to spotlight recent insider buying activity, highlighting the unwavering confidence of its leadership team in the Company's growth potential and strategic direction.

Christian Timmins, CEO, and Noah Komavli, Director, have significantly increased their personal stakes in Pegasus through open market purchases and private placements. This demonstrates their strong belief in the Company's vision and commitment to advancing its uranium exploration projects.

Insider buying showcases the alignment between leadership and shareholder interests, reinforcing the team's confidence in Pegasus' ability to deliver value and drive meaningful progress. This proactive investment by Pegasus' insiders reflects their optimism about the Company's ability to unlock high-grade uranium resources and capitalize on the surging global demand for clean, reliable energy. It is a clear testament to the leadership's commitment to creating long-term value for shareholders.

Highlights from 2024

Energy Sands Exploration Success:

Collected 41 samples, with 13 showing over

1% U₃O₈, including a standout result of18.8% U₃O₈.Developed a geological model to guide future drilling, building on historical high-grade results and the success of the recent ground sampling program on this past-producing property.

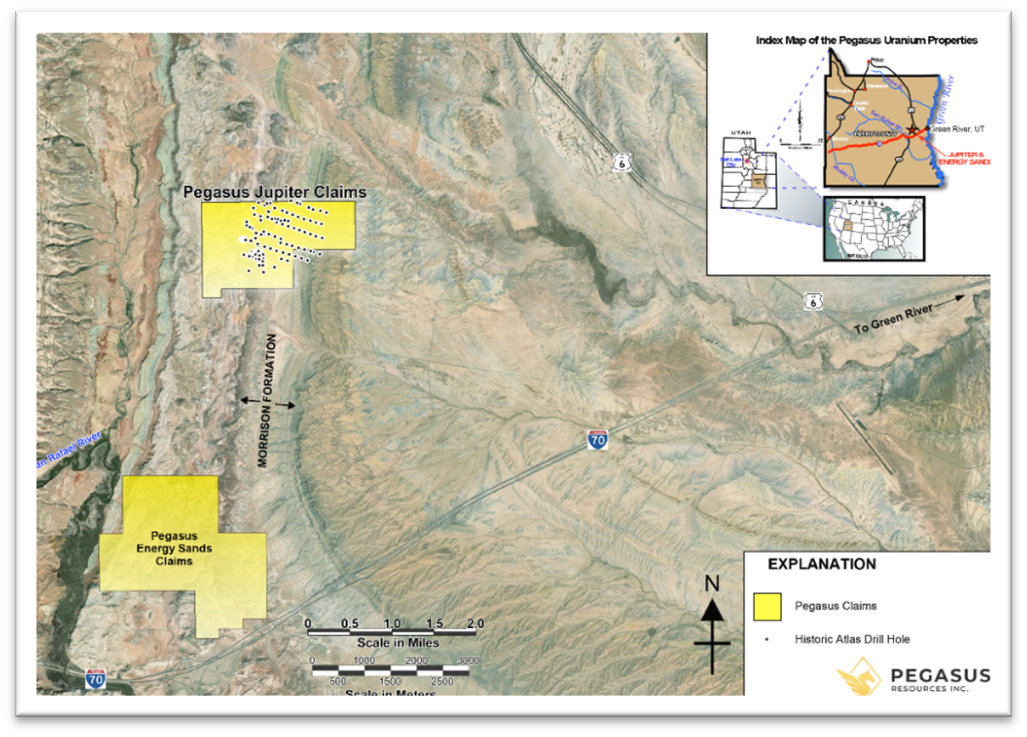

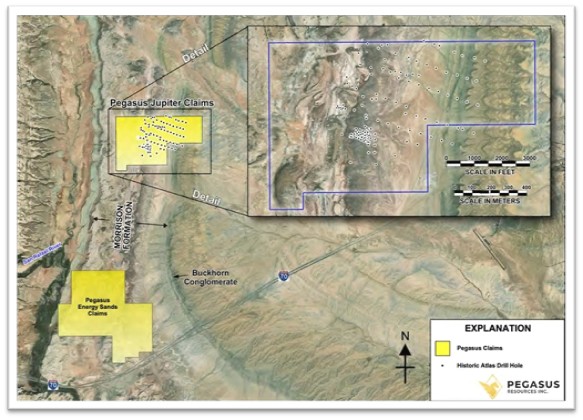

Jupiter Project Acquisition:

Acquired a strategic uranium property featuring over 100+ densely drilled historical holes, providing valuable data for resource development.

Permits Secured:

Obtained the Notice of Intention (NOI) to commence exploration, enabling transformative drilling campaigns at the

100% -owned Energy Sands and the Jupiter projects in Utah.

Leadership Expansion:

Strengthened the team with the addition of Derrick Strickland to the Board of Directors and Mike Magrum to the Advisory Board, bringing decades of industry expertise.

2025 Outlook

Pegasus is poised to commence drilling at its two flagship uranium projects in Utah:

Energy Sands Project:

Jupiter Project:

Plans include 18 drill holes with an average depth of 178 feet, totaling approximately 3,200 feet of drilling. These efforts will target mineral-hosting paleochannels identified in the geological model and historical high-grade intercepts of over

The program includes 30 drill holes with an average depth of 550 feet, totaling approximately 15,360 feet of drilling. This property's extensive historical drilling data will guide efforts to define a current resource estimate.

With these drilling campaigns, Pegasus aims to further advance its projects toward resource development, meet the growing global demand for uranium, and strengthen its position in the energy sector. The Company remains committed to delivering shareholder value through strategic exploration and development initiatives.

Evaluation of Strategic Acquisitions and Corporate Opportunities

Pegasus has been successful in its cost-efficient property expansion and acquisition strategy, as highlighted by the Jupiter acquisition, which will continue to be a core focus for value creation. The Company will continue to explore areas for collaboration and development of all its assets, as it seeks to create shareholder value.

Macro and Micro Tailwinds

The uranium sector is undergoing a renaissance, driven by surging global demand for clean energy and the growing need for secure domestic supply chains. Pegasus' Utah projects are strategically positioned to capitalize on these dynamics, supported by local infrastructure and proven uranium potential:

Macro Tailwinds: A Global Energy Shift

Surging Demand for Clean Energy: As nations worldwide pursue net-zero carbon emissions, nuclear power is emerging as a cornerstone of clean energy strategies. Its reliability as a baseload power source makes it indispensable in the transition away from fossil fuels.

Uranium Supply Deficit: Despite growing demand, uranium production has lagged, leading to tightening supplies. This supply-demand imbalance is setting the stage for sustained price increases.

US Government Support: The U.S. government has prioritized domestic uranium production, recognizing it as critical to energy security. Recent bipartisan initiatives, such as the establishment of a

$75 million strategic uranium reserve, underscore the commitment to reducing reliance on foreign uranium supplies.Nuclear Expansion: Over 60 new reactors are under construction globally, with many more in planning phases, ensuring long-term demand for uranium.

Micro Tailwinds: Utah's Strategic Importance

Proven Uranium Potential: Utah is home to established uranium mining districts and producing mines, highlighting the region's viability. With Pegasus' Energy Sands and Jupiter projects located in uranium-rich areas, the opportunity to contribute to domestic production has never been greater.

Proximity to Infrastructure: Utah benefits from existing uranium milling infrastructure, including Energy Fuels' White Mesa Mill-the only operational conventional uranium mill in the U.S.-positioning Pegasus for cost-effective development.

Energy Security Concerns: With geopolitical tensions affecting global energy markets, domestically sourced uranium is increasingly valued as a secure and reliable supply chain solution.

High-Grade Discoveries: Pegasus' exploration success, including Energy Sands sample results of up to

18.8% U₃O₈, positions the Company as a key player in unlocking new domestic uranium resources.

The Time Is Now

The combination of global uranium demand, supportive government policies, and the strategic advantages of Pegasus' Utah projects present a compelling opportunity for investors. Pegasus is uniquely positioned to capitalize on these tailwinds, advancing critical energy resources while delivering significant shareholder value.

NI 43-101 Disclosure

The technical content of this news release has been reviewed and approved by Jacob Anderson, CPG, MAusIMM, who is a Resource Geologist for Dahrouge Geological Consulting USA Ltd., and a Qualified Person under National Instrument 43-101, who has prepared and/or reviewed the content of this press release.

The results discussed in this document are historical. Pegasus nor the qualified person have performed sufficient work or data verification of the historical data. Although the historical results may not be reliable, the Company nevertheless believes that they provide an indication of the properties potential and are relevant for any future exploration programs.

About Pegasus Resources Inc.

Pegasus Resources Inc. is a diversified Junior Canadian Mineral Exploration Company with a focus on uranium, gold, and base metal properties in North America. The Company is also actively pursuing the right opportunity in other resources to enhance shareholder value. For additional information, please visit the Company at www.pegasusresourcesinc.com.

On Behalf of the Board of Directors:

Christian Timmins

President, CEO and Director

Pegasus Resources Inc.

700 - 838 West Hastings Street

Vancouver, BC V6C 0A6

PH: 1-403-597-3410

X: https://twitter.com/MrChris_Timmins

X: https://twitter.com/pegasusresinc

E: info@pegasusresourcesinc.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accept responsibility for the adequacy or accuracy of this release.

Disclaimer for Forward-Looking Information

This news release contains certain information that may be deemed "forward-looking information" with respect to the Company within the meaning of applicable securities laws. Such forward-looking information involves known and unknown risks, uncertainties and other factors that may cause the Company's actual results, performance or achievements, or developments in the industry to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking information. Forward-looking information includes statements that are not historical facts and are generally, but not always, identified by the words "expects," "plans," "anticipates," "believes," "intends," "estimates," "projects," "potential" and similar expressions, or that events or conditions "will," "would," "may," "could" or "should" occur.

Although the Company believes the forward-looking information contained in this news release is reasonable based on information available on the date hereof, by its nature, forward-looking information involves assumptions and known and unknown risks, uncertainties and other factors which may cause our actual results, level of activity, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking information.

Examples of such assumptions, risks and uncertainties include, without limitation, assumptions, risks and uncertainties associated with general economic conditions; adverse industry events; the receipt of required regulatory approvals and the timing of such approvals; that the Company maintains good relationships with the communities in which it operates or proposes to operate, future legislative and regulatory developments in the mining sector; the Company's ability to access sufficient capital from internal and external sources, and/or inability to access sufficient capital on favorable terms; mining industry and markets in Canada and generally; the ability of the Company to implement its business strategies; competition; the risk that any of the assumptions prove not to be valid or reliable, which could result in delays, or cessation in planned work, risks associated with the interpretation of data, the geology, grade and continuity of mineral deposits, the possibility that results will not be consistent with the Company's expectations, as well as other assumptions risks and uncertainties applicable to mineral exploration and development activities and to the Company, including as set forth in the Company's public disclosure documents filed on the SEDAR+ website at www.sedarplus.ca.

The forward-looking information contained in this press release represents the expectations of Pegasus as of the date of this press release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward-looking information and should not rely upon this information as of any other date. While Pegasus may elect to, it does not undertake to update this information at any particular time except as required in accordance with applicable laws.

SOURCE: Pegasus Resources, Inc.

View the original press release on accesswire.com