Soluna Holdings Reports Q3’24 Results

Soluna Holdings reported strong Q3 2024 financial results, with revenue increasing 30% to $7.5 million compared to Q3 2023. Year-to-date revenue reached a record $29.7 million, up 172% from 2023. The company secured significant funding, including $30 million for Project Dorothy expansion and a $25 million growth capital line. Key developments include launching Soluna Cloud AI business with HPE partnership, breaking ground on Project Dorothy 2, and expanding their development pipeline to 2.6 GW. Year-to-date adjusted EBITDA improved to $3.5 million from a $4.5 million loss in 2023, while unrestricted cash grew 38% to $8.8 million.

Soluna Holdings ha riportato risultati finanziari solidi per il terzo trimestre del 2024, con un aumento del fatturato del 30%, arrivando a 7,5 milioni di dollari rispetto al terzo trimestre del 2023. Il fatturato dall'inizio dell'anno ha raggiunto un record di 29,7 milioni di dollari, in crescita del 172% rispetto al 2023. L'azienda ha ottenuto un finanziamento significativo, inclusi 30 milioni di dollari per l'espansione del Progetto Dorothy e una linea di capitale per la crescita di 25 milioni di dollari. I principali sviluppi includono il lancio dell'attività Soluna Cloud AI in collaborazione con HPE, l'avvio dei lavori sul Progetto Dorothy 2 e l'espansione del loro pipeline di sviluppo a 2,6 GW. L'EBITDA rettificato dall'inizio dell'anno è migliorato a 3,5 milioni di dollari, rispetto a una perdita di 4,5 milioni di dollari nel 2023, mentre la liquidità non vincolata è aumentata del 38%, arrivando a 8,8 milioni di dollari.

Soluna Holdings reportó resultados financieros sólidos para el tercer trimestre de 2024, con ingresos que aumentaron un 30% hasta alcanzar los 7.5 millones de dólares en comparación con el tercer trimestre de 2023. Los ingresos hasta la fecha alcanzaron un récord de 29.7 millones de dólares, lo que representa un incremento del 172% respecto a 2023. La compañía aseguró financiamiento significativo, incluyendo 30 millones de dólares para la expansión del Proyecto Dorothy y una línea de capital de crecimiento de 25 millones de dólares. Los desarrollos clave incluyen el lanzamiento del negocio Soluna Cloud AI en asociación con HPE, el inicio de la obra del Proyecto Dorothy 2, y la expansión de su pipeline de desarrollo a 2.6 GW. El EBITDA ajustado hasta la fecha mejoró a 3.5 millones de dólares desde una pérdida de 4.5 millones en 2023, mientras que el efectivo no restringido creció un 38% hasta llegar a 8.8 millones de dólares.

Soluna Holdings는 2024년 3분기 재무 결과가 강력하다고 보고하며, 2023년 3분기 대비 매출이 30% 증가하여 750만 달러에 이르렀습니다. 연초부터 지금까지의 매출은 기록적인 2,970만 달러에 도달했으며, 이는 2023년보다 172% 증가한 수치입니다. 이 회사는 프로젝트 도로시 확장을 위한 3,000만 달러와 성장 자본 라인으로 2,500만 달러를 포함한 상당한 자금을 확보했습니다. 주요 개발 사항으로는 HPE와의 파트너십을 통해 Soluna Cloud AI 사업을 시작하고, 프로젝트 도로시 2의 기초 작업을 시작하며, 개발 파이프라인을 2.6GW로 확장하는 것이 포함됩니다. 연초 기준 조정된 EBITDA는 2023년 450만 달러 손실에서 350만 달러로 개선되었고, 제한 없는 현금은 38% 증가하여 880만 달러에 달했습니다.

Soluna Holdings a annoncé de solides résultats financiers pour le troisième trimestre 2024, avec une augmentation des revenus de 30% atteignant 7,5 millions de dollars par rapport au troisième trimestre 2023. Les revenus cumulés depuis le début de l'année ont atteint un record de 29,7 millions de dollars, soit une augmentation de 172% par rapport à 2023. L'entreprise a obtenu un financement significatif, comprenant 30 millions de dollars pour l'expansion du Projet Dorothy et une ligne de capital de croissance de 25 millions de dollars. Les dévéloppements clés incluent le lancement de l'activité Soluna Cloud AI en partenariat avec HPE, le démarrage des travaux sur le Projet Dorothy 2 et l'expansion de leur pipeline de développement à 2,6 GW. L'EBITDA ajusté depuis le début de l'année a amélioré à 3,5 millions de dollars contre une perte de 4,5 millions de dollars en 2023, tandis que la trésorerie non restreinte a augmenté de 38% pour atteindre 8,8 millions de dollars.

Soluna Holdings meldete starke Finanzzahlen für das 3. Quartal 2024, mit einem Umsatzanstieg um 30% auf 7,5 Millionen Dollar im Vergleich zum 3. Quartal 2023. Der Umsatz von Januar bis heute erreichte mit 29,7 Millionen Dollar einen Rekord, was einem Anstieg von 172% im Vergleich zu 2023 entspricht. Das Unternehmen sicherte sich bedeutende Finanzierungen, darunter 30 Millionen Dollar für die Expansion von Projekt Dorothy und eine Wachstumsfinanzierungslinie von 25 Millionen Dollar. Zu den wichtigen Entwicklungen gehören der Start des Soluna Cloud AI-Geschäfts in Partnerschaft mit HPE, der Baustart für Projekt Dorothy 2 und die Erweiterung ihrer Entwicklungspipeline auf 2,6 GW. Das angepasste EBITDA des Jahres bis heute verbesserte sich auf 3,5 Millionen Dollar von einem Verlust von 4,5 Millionen Dollar im Jahr 2023, während die unbeschränkte Liquidität um 38% auf 8,8 Millionen Dollar wuchs.

- Revenue increased 30% YoY to $7.5M in Q3 2024

- Record YTD revenue of $29.7M, up 172% from 2023

- YTD adjusted EBITDA improved to $3.5M from -$4.5M in 2023

- Secured $30M funding for Project Dorothy expansion

- Unrestricted cash increased 38% to $8.8M

- Digital segment YTD gross profit reached $12.5M vs $1.0M in 2023

- Development pipeline expanded to 2.6 GW

- Q3 2024 consolidated gross loss of $1.36M

- Soluna Cloud segment reported $2.86M cost of revenue with no revenue

- Project Dorothy 1B reported gross loss of $228,000

Insights

The Q3 2024 results show significant growth with

- Q3 revenue up

30% YoY to$7.5 million - YTD adjusted EBITDA improved by

$8.0 million to$3.5 million - Unrestricted cash grew

38% to$8.8 million

The strategic partnership with HPE and deployment of 512 H100 GPUs marks a significant pivot into the high-growth AI infrastructure market. The company's unique positioning at the intersection of renewable energy and computing infrastructure - particularly in AI and Bitcoin mining - creates a competitive advantage. The 2.6 GW pipeline, with 1.2 GW in active negotiations, demonstrates strong market demand for green computing solutions. The three-pronged business model through Digital, Cloud and Energy divisions provides diversified revenue streams and reduces dependency on volatile crypto markets.

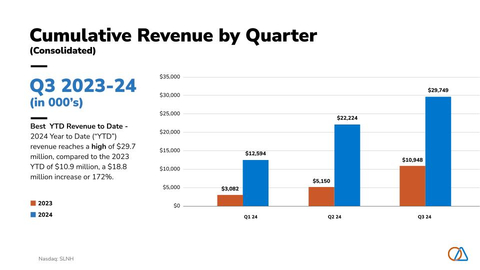

SLNH Cumulative Revenue by Quarter (Graphic: Business Wire)

John Belizaire, CEO of Soluna, said, “Soluna continues to move at a fast pace and has achieved several important milestones this quarter including, launching our Soluna Cloud AI business and strategic partnership with Hewlett Packard Enterprises (HPE), securing financing for our Project Dorothy expansion and breaking ground and securing

Soluna is on a mission to make renewable energy a global superpower, using computing as a catalyst. The company designs, develops, and operates digital infrastructure that transforms surplus renewable energy into scalable computing resources. Soluna’s data centers are strategically co-located with wind, solar, and hydroelectric power plants to support high-performance computing applications, including Bitcoin mining, generative AI, and other compute-intensive tasks.

Soluna ensures seamless integration with renewable energy power plants, providing cost-effective and sustainable computing solutions while providing the flexible load required for a greener grid. The Company now operates through three core subsidiary businesses:

- Soluna Digital (“Digital”) – Bitcoin Hosting and Proprietary mining business that builds, owns, and operates its modular, behind-the-meter, data centers delivering managed infrastructure to hyperscale miners. Digital develops data centers co-located with renewable energy projects.

- Soluna Cloud (“Cloud”) – Soluna’s GPU cloud business provides services for generative AI and colocation services for HPC and enterprise AI workloads. Soluna’s Cloud develops behind-the-meter data centers co-located with renewable energy projects.

- Soluna Energy (“Energy”) – Signs power purchase agreements and leases or acquires land in partnership with renewable energy power producers. It has more than 2.6 GW of a long-term pipeline and delivers grid ancillary services in collaboration with Soluna Digital.

This integrated approach positions Soluna to leverage renewable energy as a global superpower, transforming surplus energy into valuable computing resources across AI, digital assets, and grid services.

Belizaire continued, “Another tangible sign of Soluna’s growth trajectory is the significant expansion of our development pipeline, which is now more than 2.6 GW with 1.2 GW currently in active Term Sheet negotiations. This demonstrates a core competence of the company - our ability to find, evaluate, and secure access to renewable power that is suited to development into data centers for High-Performance Computing/AI and Bitcoin computing with industry-leading costs.”

Corporate Highlights

- Enterprise AI Services with HPE - Soluna Cloud partnered with HPE to make 512 H100 SXM GPUs available, boosting support for generative AI workloads.

-

$30 million $30 million Texas . -

$25 million $25 million -

$13.75 million $13.75 million $1.25M - 187 MW Pipeline Expansion – Soluna signed term sheets for power and land for Project Rosa, a new 187 MW Data Center indicating an important step forward in the Company’s expansion efforts.

- Leading the Conversation in Renewable Computing – CEO John Belizaire hosted a webinar with HPE on Sustainable AI Practices and attended the 2024 Ai4 Conference to speak on AI’s transformative impact and renewable-powered data centers.

Consolidated Finance and Operational Highlights:

-

Strong Third Quarter Revenue Growth - Revenue increased by

30% to$7.5 million $5.8 million -

Best YTD Revenue to Date - 2024 Year to Date (“YTD”) revenue reached a high of

$29.7 million $10.9 million $18.8 million 172% . -

Resilient Adjusted EBITDA - 2024 YTD adjusted EBITDA is

$3.5 million $4.5 million $8.0 million -

Strong 2024 YTD Cash Growth - Unrestricted cash increased

38% from the end of 2023, reaching$8.8 million

Subsidiary Financial and Operational Highlights:

Soluna Digital:

-

Revenue for the third quarter of 2024 was

$7.5 million 100% of the company's consolidated revenue. This is an increase of$1.7 million -

Total Cost of Revenue for the third quarter of 2024 was

$6.0 million $4.4 million

Revenue & Cost of Revenue by Project Site |

||||||||||||||||||||||||

Third Quarter 2024 |

||||||||||||||||||||||||

| Digital | Cloud | Total | ||||||||||||||||||||||

| (Dollars in thousands) | Project Dorothy 1B |

Project Dorothy 1A |

Project Sophie |

Other |

Digital Subtotal | Project Ada |

||||||||||||||||||

| Cryptocurrency mining revenue | $ | 2,811 |

|

$ | - |

$ | - |

$ | - |

$ | 2,811 |

$ | - |

|

$ | 2,811 |

|

|||||||

| Data hosting revenue | - |

|

3,515 |

756 |

- |

4,271 |

- |

|

4,271 |

|

||||||||||||||

| High-performance computing service revenue | - |

|

- |

- |

- |

- |

- |

|

- |

|

||||||||||||||

| Demand response services | - |

|

- |

- |

443 |

443 |

- |

|

443 |

|

||||||||||||||

| Total revenue | 2,811 |

|

3,515 |

756 |

443 |

7,525 |

- |

|

7,525 |

|

||||||||||||||

| Cost of cryptocurrency mining, exclusive of depreciation | 1,963 |

|

- |

- |

- |

1,963 |

- |

|

1,963 |

|

||||||||||||||

| Cost of data hosting revenue, exclusive of depreciation | - |

|

2,025 |

521 |

9 |

2,555 |

- |

|

2,555 |

|

||||||||||||||

| Cost of high-performance computing services | - |

|

- |

- |

- |

- |

2,859 |

|

2,859 |

|

||||||||||||||

| Cost of revenue- depreciation | 1,076 |

|

284 |

152 |

- |

1,512 |

- |

|

1,512 |

|

||||||||||||||

| Total cost of revenue | $ | 3,039 |

|

$ | 2,309 |

$ | 673 |

$ | 9 |

$ | 6,030 |

$ | 2,859 |

|

$ | 8,889 |

|

|||||||

| Gross Profit | $ | (228 |

) | $ | 1,206 |

$ | 83 |

$ | 434 |

$ | 1,495 |

$ | (2,859 |

) | $ | (1,364 |

) | |||||||

Revenue & Cost of Revenue by Project Site |

||||||||||||||||||||

Third Quarter 2023 |

||||||||||||||||||||

| Digital | Digital Total |

|||||||||||||||||||

| (Dollars in thousands) | Project Dorothy 1B |

Project Dorothy 1A |

Project Sophie |

Project Marie |

Other | |||||||||||||||

| Cryptocurrency mining revenue | $ | 1,739 |

|

$ | - |

$ | 47 |

$ | - |

|

$ | - |

$ | 1,786 |

||||||

| Data hosting revenue | - |

|

3,016 |

991 |

- |

|

4 |

4,011 |

||||||||||||

| Demand response services | - |

|

- |

- |

- |

|

- |

- |

||||||||||||

| Total revenue | 1,739 |

|

3,016 |

1,038 |

- |

|

4 |

5,797 |

||||||||||||

| Cost of cryptocurrency mining, exclusive of depreciation | 1,023 |

|

- |

17 |

- |

|

- |

1,040 |

||||||||||||

| Cost of data hosting revenue, exclusive of depreciation | - |

|

1,766 |

384 |

- |

|

- |

2,150 |

||||||||||||

| Cost of revenue- depreciation | 739 |

|

284 |

171 |

6 |

|

- |

1,200 |

||||||||||||

| Total cost of revenue | $ | 1,762 |

|

$ | 2,050 |

$ | 572 |

$ | 6 |

|

$ | - |

$ | 4,390 |

||||||

| Gross Profit | $ | (23 |

) |

$ | 966 |

$ | 466 |

$ | (6 |

) |

4 |

$ | 1,407 |

|||||||

Cumulative Year-to-Date Gross Profit by Quarter - Digital

-

Year-to-date 2024 Gross Profit is

$12.5 million $1.0 million

Soluna Cloud

-

Year-to-date and third quarter 2024 total cost of revenue was

$2.9 million -

Funding of an additional

$1.25 million $13.75 million - Helix One concept phase kicked off with a top-tier hyperscale design firm.

Soluna Energy

- Project Kati secured ERCOT approval for its Reactive Power Study, nearing exit of planning.

- Project Rosa PPA and land Term Sheets signed for a 187 MW Texas-based data center.

- Project Grace announced to build 2 MW of AI data center adjacent to Project Dorothy.

- 8 Term Sheets under active negotiations for over 1.2 GW of new data center projects, bringing the total pipeline size to more than 2.6 GW.

The unaudited condensed consolidated financial statements are available online, here. A presentation of this Third Quarter Update can also be found online, here.

Safe Harbor Statement

This announcement contains forward-looking statements. These statements are made under the “safe harbor” provisions of the

In addition to figures prepared in accordance with GAAP, Soluna from time to time presents alternative non-GAAP performance measures, e.g., EBITDA, adjusted EBITDA, adjusted net profit/loss, adjusted earnings per share, free cash flow. These measures should be considered in addition to, but not as a substitute for, the information prepared in accordance with GAAP. Alternative performance measures are not subject to GAAP or any other generally accepted accounting principle. Other companies may define these terms in different ways.

About Soluna Holdings, Inc (SLNH)

Soluna is on a mission to make renewable energy a global superpower using computing as a catalyst. The company designs, develops and operates digital infrastructure that transforms surplus renewable energy into global computing resources. Soluna’s pioneering data centers are strategically co-located with wind, solar, or hydroelectric power plants to support high-performance computing applications including Bitcoin Mining, Generative AI, and other compute intensive applications. Soluna’s proprietary software MaestroOS(™) helps energize a greener grid while delivering cost-effective and sustainable computing solutions, and superior returns. To learn more visit solunacomputing.com. Follow us on X (formerly Twitter) at @SolunaHoldings.

View source version on businesswire.com: https://www.businesswire.com/news/home/20241115504527/en/

John Tunison

Chief Financial Officer

Soluna Holdings, Inc.

jtunison@soluna.io

Source: Soluna Holdings, Inc.