Spark Power Experiences Slower Growth in the Third Quarter

- Steady gross profit margin and core business adjusted EBITDA

- Continued progress on net working capital reductions

- Obtained waiver of financial covenant breaches

- Strategic acquisition by an affiliate of American Pacific Group, LP

- 11.0% year-over-year decrease in revenue from continuing operations

- Decrease in gross profit margins from the prior year

- Lower adjusted EBITDA compared to Q3 2022

Insights

Analyzing...

Third Quarter Gross Profit Margin of

Core Business Adjusted EBITDA of

Continued progress on Net Working Capital reductions

Obtained waiver of financial covenant breaches

(Spark Power reports in Canadian dollars unless otherwise specified)

OAKVILLE, ON / ACCESSWIRE / November 13, 2023 / Spark Power Group Inc. (TSX:SPG), parent company of Spark Power Corp. ("Spark Power" or the "Company"), has announced its financial results for the three- and nine-month periods ended September 30, 2023. All amounts are in Canadian dollars unless otherwise specified.

"In the third quarter, we have remained committed to realizing the full potential of our Let's Grow Better strategy. We continued to build on the positive momentum in our US business with increasing backlog and revenue trends, but the traction on our new go-to-market plan in our Canadian business is slower than expected and taking longer to convert into new business. We continue to invest in expanding our sales channel and developing the new systems and technologies that will support future growth," said Richard Jackson, President & CEO of Spark Power. "Notably, we've entered into an arrangement agreement to be acquired and taken private by an affiliate of American Pacific Group, LP ("APG"), a reputable private equity firm, and we expect the transaction to close on or around December 5, 2023, subject to shareholder approval, final court approval and the satisfaction of other customary closing conditions. We look forward to completion of the transaction which will provide us with the capital support to execute our long-term growth strategy," added Jackson.

"With the gradual ramp up of our new go-to-market strategy, we are operationally focused on delivering consistent gross margin realization and managing costs," said Richard Perri, Executive Vice President & CFO of Spark Power. "Regarding working capital, we continue to execute our plans to improve cash conversion and reduce days sales outstanding for both Accounts Receivable and Contract Assets," added Perri.

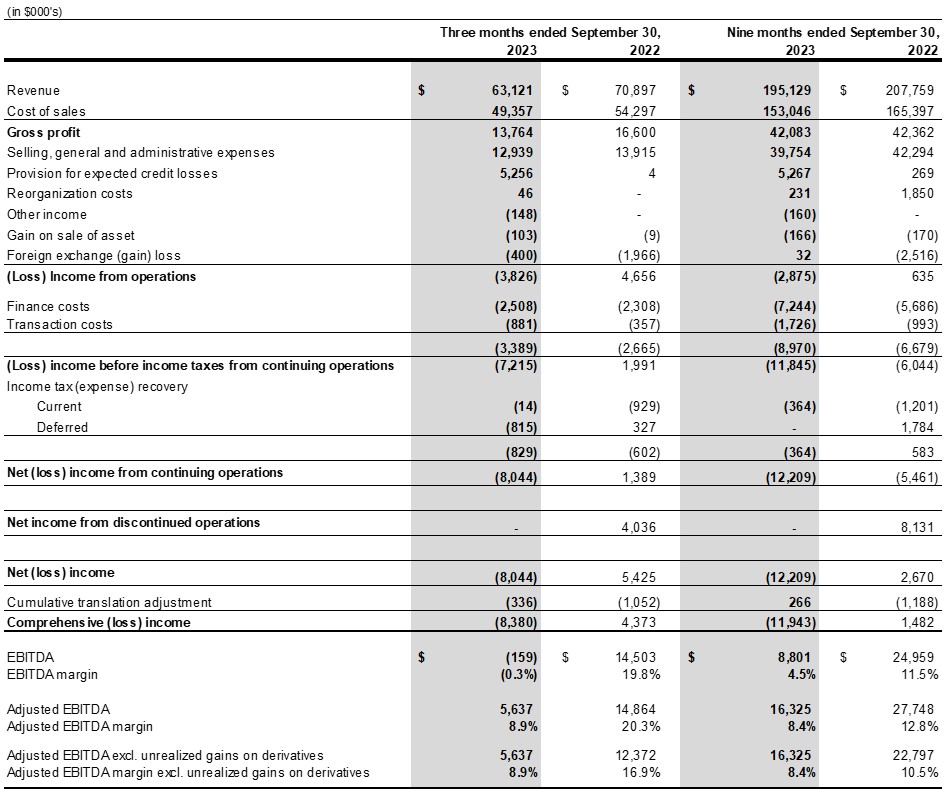

Financial Highlights - Q3 2023

- Revenue from continuing operations was

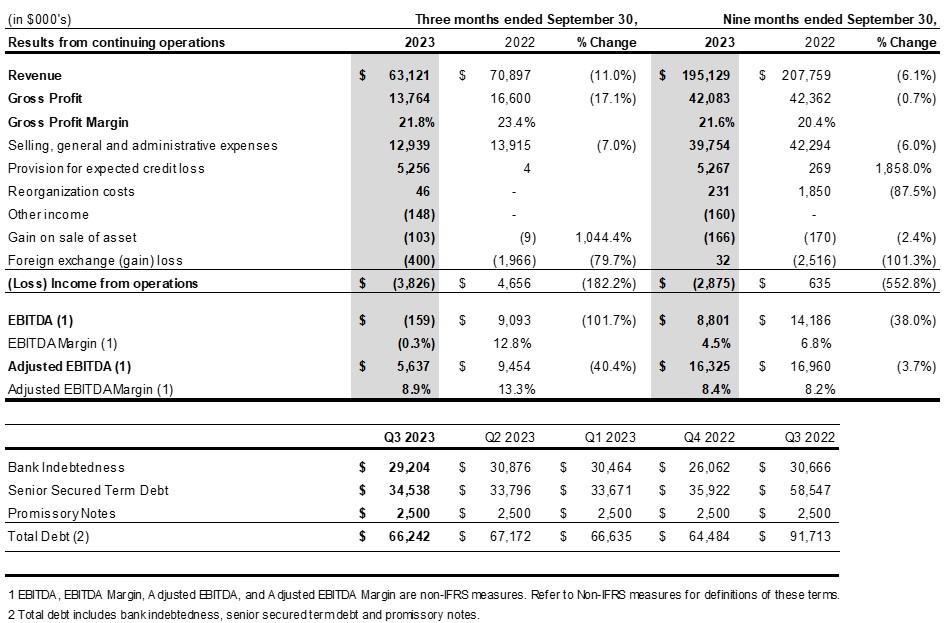

$63.1 million in Q3 2023, as compared to$70.9 million in Q3 2022, representing a decrease of11.0% year-over-year. The year-over-year change reflects the intentional focus on our go-to-market strategy to pursue higher margin service work and prior period comparatives that include large project work in the Technical Services segment. - Gross Profit Margins from continuing operations, excluding depreciation and amortization, were

25.7% in Q3 2023, as compared to27.7% in Q3 2022. The decrease from prior year is primarily due to lower volumes and a shift in Renewables mix. - Selling, General and Administration (SG&A) expenses from continuing operations, excluding depreciation and amortization, were

$10.9 million , down$1.3 million , or10.6% from Q3 2022, reflecting the benefits of initiatives implemented in the business through 2022 partially offset by investments in sales and marketing. - Adjusted EBITDA from continuing operations was

$5.6 million or8.9% of revenue in Q3 2023, excluding foreign exchange gains of$0.4 million in the quarter. This compares to Adjusted EBITDA of$9.5 million or13.3% of revenue in Q3 2022. The year-over-year change reflects lower volumes due to large projects in the prior year partially offset by lower SG&A costs. - Cash flow from continuing operations was

$2.7 million in the quarter, compared to$6.9 million in Q3 2022 tied to lower earnings partially offset by a reduction in net working capital. - As of September 30, 2023, the Company was in breach of the financial covenants in effect pursuant to its credit facility. The Company has obtained a waiver from its lender for the third quarter covenant breach. The waiver ceases to be in effect if the Transaction (as defined herein) is not completed by December 14, 2023.

Business Highlights - Q3 2023

- In the third quarter, Spark Power continued to execute its go-to-market plan in support of the ‘Let's Grow Better' strategy. The organization remains focused on deliberate and sustainable growth.

- Ongoing efforts to enhance margins and boost sales volumes in alignment with the ‘Let's Grow Better' Strategy.

- Continuing the implementation of our enterprise-wide technology and business process integration initiative, Project Darwin, to streamline operations and enhance efficiency.

- In the quarter, the Company resolved a long-standing customer dispute through arbitration proceedings. The impact was a net write-down of

$3.2 million , net of cash settlement proceeds and credit loss reserve. - On October 13, 2023, the Company announced it entered into an arrangement agreement (the "Arrangement Agreement") with Generator-Spark Canada Buyer Inc., an affiliate of APG (the "Purchaser"), pursuant to which the Purchaser agreed to, among other things, acquire all of the issued and outstanding common shares of Spark Power, in an all-cash transaction valued at approximately

$140.0 million (including assumed debt) (the "Transaction"). Subject to the satisfaction of all conditions to closing set out in the Arrangement Agreement, it is anticipated that the transaction will be completed on or around December 5, 2023. Copies of the news release relating to the Transaction, the Arrangement Agreement and the management information circular relating to the special meeting of shareholders to approve the Transaction are accessible on SEDAR+ (www.sedarplus.ca) under the Company's issuer profile.

Quarterly Conference Call

Management is hosting an investor conference call and webcast on Wednesday, November 15, 2023, at 8:30 a.m. ET to discuss its financial results in greater detail. To join by telephone dial: +1-877-545-0523 (toll-free in North America) or +1-973-528-0016 (local and international), with conference ID: 49405 and entry code: 286844. To listen to a live webcast of the call, please visit the investor relations section of Spark Power's website at https://sparkpowercorp.com/about-us/investor-relations/. An archived replay of the webcast will be available following the conclusion of the call.

Please dial in or log on 10 minutes prior to the start time to provide sufficient time to register for the event.

Spark Power's Third-Quarter 2023 Interim Unaudited Condensed Consolidated Financial Statements are available on Spark Power's website www.sparkpowercorp.com and will be filed on SEDAR+ (www.sedarplus.ca) under the Company's issuer profile.

About Spark Power

Spark Power is the leading independent provider of end-to-end electrical services and operations and maintenance services to the industrial, utility, and renewable asset markets in North America. We work to earn the right to be our customers' Trusted Partner in Power™. Our highly skilled and dedicated people, located in the communities we serve, combined with our knowledge of the power industry, technology expertise, and commitment to safety, ensures we deliver the right solutions that keep our customers' operations up and running today and better equipped for tomorrow. Learn more at www.sparkpowercorp.com.

Forward-Looking Statements

This news release may contain forward-looking statements (within the meaning of applicable securities laws), which reflect Spark Power's current expectations regarding future events. Forward-looking statements are identified by words such as "believe", "anticipate", "project", "expect", "intend", "plan", "will", "may", "estimate" and other similar expressions. The forward-looking statements in this press release include statements regarding the Company's opportunities for future growth, acquisitions and expansions, future liquidity, pro forma annualized costs, the calculation of charges, and other statements that are not historical fact, and without limitation, include statements by Messrs. Jackson and Perri regarding execution on Spark Power's growth strategy, earnings growth, SG&A efficiency realizations, the stabilizing global economy, the support of third parties, the successful implementation of Spark Power's technology platform, the ability of Spark Power to complete the Transaction (and the terms thereof) and the expected date of the completion of the Transaction. The forward-looking statements in this news release are not guarantees of future performance and involve risks and uncertainties that are difficult to control or predict. Several factors could cause actual results to differ materially from the results discussed in the forward-looking statements. Such factors include, among others: the ability of the Company to implement its planned efficiency measures; currency fluctuations; disruptions or changes in the credit or security markets; results of operations; general developments, market and industry conditions; the Transaction not being completed in accordance with the terms currently contemplated or the timing currently expected, or at all; the impact on the Company if the Transaction is not completed by December 14, 2023; and the expenses incurred by Spark Power in connection with the Transaction. Readers, therefore, should not place undue reliance on any such forward-looking statements. Further, these forward-looking statements are made as of the date of this news release and, except as expressly required by applicable law, neither Spark Power nor Spark Power Corp. assumes any obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

Non-IFRS Measures

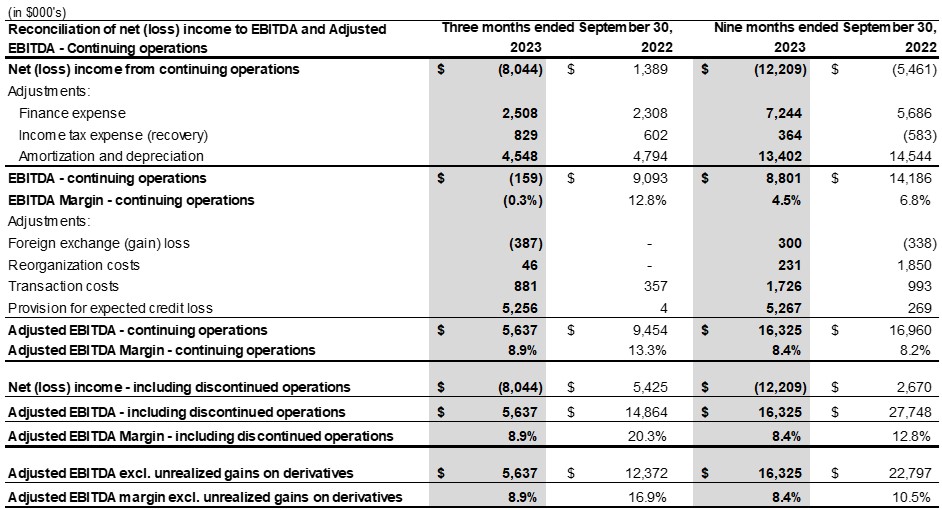

The Company prepares and releases unaudited consolidated interim financial statements and audited consolidated annual financial statements prepared in accordance with IFRS. In this and other earnings releases and investor conference calls, as a complement to results provided in accordance with IFRS, the Company also discloses and discusses certain financial measures not recognized under IFRS and that do not have standard meanings prescribed by IFRS. These include "EBITDA", "Adjusted EBITDA", "Pro-forma Adjusted EBITDA", "EBITDA Margin", "Adjusted EBITDA Margin", "Pro-forma Adjusted EBITDA Margin", "Pro-forma Revenue", "Pro-forma Annualized Selling, General and Administration Costs", "Adjusted Working Capital", and "Adjusted Net and Comprehensive Income (Loss)". These non-IFRS measures are used to provide investors with supplemental measures of Spark Power's operating performance and highlight trends in Spark Power's business that may not otherwise be apparent when relying solely on IFRS measures. Spark Power also believes that providing such information to securities analysts, investors and other interested parties who frequently use non-IFRS measures in the evaluation of issuers will allow them to better compare Spark Power's performance against others in its industry. Management also uses non-IFRS measures in order to facilitate operating performance comparisons from period to period, to prepare annual operating budgets and forecasts and to determine components of management compensation. For a reconciliation of these non-IFRS measures, see the Company's management's discussion and analysis for the three and nine months ended September 30, 2023, a copy of which is available on SEDAR+ (www.sedarplus.ca) under the Company's issuer profile. The non-IFRS measures should not be construed as alternatives to results prepared in accordance with IFRS.

Selected Consolidated Financial Information:

Reconciliation of net (loss) income to EBITDA and Adjusted EBITDA:

The following table is a summary of Spark Power's results for the periods indicated:

Investor and Regulatory Inquiries:

Richard Perri, Executive Vice President & Chief Financial Officer

investor@sparkpowercorp.com

+1 (905) 829-3336

Media Inquiries:

Lauren D'Andrea, Manager of Corporate Communications & Brand

media@sparkpowercorp.com

+1 (416) 902-4393

SOURCE: Spark Power Group Inc.

View source version on accesswire.com:

https://www.accesswire.com/802988/spark-power-experiences-slower-growth-in-the-third-quarter