Spark Power Builds Momentum Throughout Quarter; Optimistic About Second Half Performance

Spark Power Group Inc. announced a strong second quarter financial performance with revenues increasing 41.1% year over year to $65.4 million. The Renewables segment saw a significant growth of 44.1% in Q2. Despite these gains, gross margins dropped to 28.5% from 40.9% in the previous year. The company expects continued growth supported by a strong backlog and enhanced liquidity from a $5.6 million private placement. New leadership appointments and a focus on sustainability initiatives are also highlighted.

- Revenue increased 41.1% to $65.4 million in Q2 2021 compared to Q2 2020.

- Renewables segment revenue up 44.1% in Q2.

- Enhanced liquidity position with $15.2 million available under revolving credit facility.

- Awarded $5.3 million grant from the Ontario Skills Development Fund.

- New leadership appointments aim to drive organizational growth.

- Record backlog levels and improving margins in key segments.

- Gross margins decreased to 28.5% from 40.9% year over year.

- Adjusted EBITDA fell by 19.3% to $7.4 million, or 11.2% of revenue.

Insights

Analyzing...

Second Quarter revenue grows

Renewables segment continues strong revenue growth increasing

(Spark Power reports in Canadian dollars unless otherwise specified)

OAKVILLE, ONTARIO / ACCESSWIRE / August 16, 2021 / Spark Power Group Inc. (TSX:SPG), parent company of Spark Power Corp. ("Spark Power" or the "Company"), has announced its financial results for its second quarter, the three-and-six months period ended June 30, 2021. All amounts are in Canadian dollars unless otherwise specified.

"As COVID-19 restrictions continue to lift across North America, we are seeing signs of a steady return to pre-pandemic levels of operations and positive trends in margins in key parts of the business," said Richard Jackson, President & CEO of Spark Power. "Spark is continuing to gain momentum, particularly within our Renewables division, along with our branches in Western Canada and the U.S., and as we move into the latter half of the year, we expect to see continued organizational growth," said Jackson.

Spark recently welcomed two new high-calibre members to its Senior Leadership Team who will help to guide the organization. "The addition of Tom Duncan as our Executive Vice President, Technical Services - Canada, as well as Richard Perri as our Senior Vice President, Finance, will bring Spark one step closer to achieving our organizational objectives and fulfilling the Operational Excellence initiative; a key component of our Strategic Imperatives strategy," added Jackson.

In May, Spark was pleased to announce a

The Company is poised for a strong second half of 2021.

"With amendments to our credit agreement negotiated in June 2021 that expanded amounts available under our operating credit facility by

During this quarter, Spark re-launched the Strategic Review process originally announced in 2020, seeking opportunities to bring new capital into the business to support the execution of its growth strategy. Led by a Special Committee made up of independent Board members, Spark also announced the intention of its founders to sell their interests in the business.

"We are very happy with the progress being made by our investment banking partners, KeyBanc Capital Markets," said Co-Founder & Executive Board Chair, Jason Sparaga. "Based on the significant interest shown in the opportunity and strong capital markets, we remain highly confident that we will find the right partner for Rich and his team in the coming months," he added.

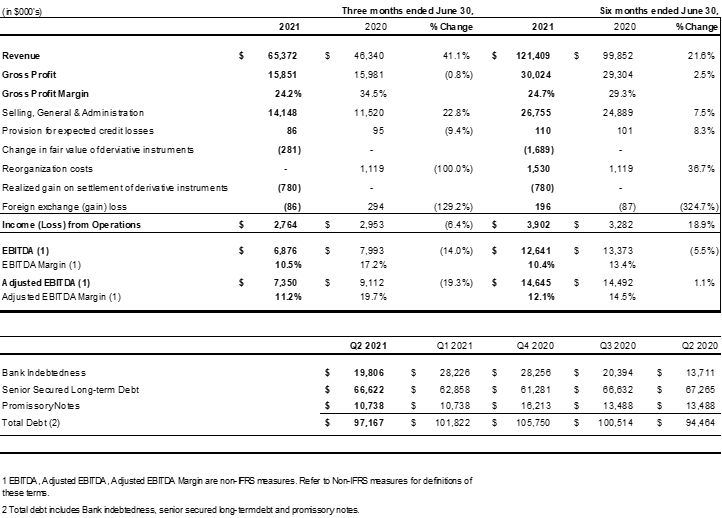

Financial Highlights

- The impact of the pandemic in Q2 2020, including lost revenue and government subsidies accounts for the majority of differences in quarter-on-quarter comparison.

- Revenue of

$65.4 million in Q2 2021, as compared to$46.3 million in Q2 2020, representing an increase of41.1% . - Gross margins, excluding depreciation and amortization, decreased to

28.5% in Q2 2021 as compared to40.9% in Q2 2020. - Selling, general and administration costs, excluding depreciation and amortization, were

$12.3 million or18.9% of revenue in Q2 2021 as compared to$8.8 million or18.9% of revenue in Q2 2020. - Adjusted EBITDA was

$7.4 million or11.2% of revenue in Q2 2021, as compared to$9.1 million or19.7% of revenue in Q2 2020, representing a decrease of$1.7 million or19.3% . - Available liquidity under the revolving credit facility was

$15.2 million at the end of the second quarter of 2021 as a result of the completion of a$5.6 million private placement and the expansion of availability under the companies operating line of credit by$5.0 million to$35.0 million .

Business Highlights - Operations

- Awarded three new EPC solar projects in Alberta with GP JOULE, a global renewable energy company - strengthening and growing our renewables footprint in Western Canada.

- The Company's sustainability division, Bullfrog Power, partnered with Hiram Walker & Sons Limited to provide their distillery in Windsor, ON with green natural gas.

- Launched energy efficiency services, designed to help customers save time and money by identifying optimizations and simple upgrades with short payback periods and tangible environmental benefits.

- Through the Company's sustainability division, Bullfrog Power, announced new solar solutions offerings to new and existing customers in California.

- Announced that the Company was awarded a

$5.3M grant from the Government of Ontario's Skills Development Fund, to support new employee training and advancement initiatives. - Partnered with FieldAware, a cloud-based field services solution, to efficiently manage field operations across the Company through the FieldAware for Netsuite App.

Business Highlights - Corporate

- Welcomed two new members who joined Spark's Senior Leadership Team - Tom Duncan, Executive Vice President, Technical Services - Canada, and Richard Perri, Senior Vice President, Finance.

- Spark's Special Committee recommended, and was approved by the Board of Directors, the initiation of a formal sale process for the Company - maximizing value for all shareholders and introducing new capital into the business to support the execution of its growth strategy.

- Held our Annual General Meeting, and pleased to share that we received shareholder approval for all resolutions voted upon at its annual and special meeting of shareholders.

Quarterly Conference Call

Management is hosting an investor conference call and webcast tomorrow, Tuesday, August 17, 2021, at 8:30 a.m. ET to discuss its financial results in greater detail. To join by telephone dial: +1-888-506-0062 (toll-free in North America) or +1-973-528-0011 (local and international), with conference ID: 42140 and entry code: 292256. To listen to a live webcast of the call, please visit the investor relations section of Spark Power's website at https://sparkpowercorp.com/about-us/investor-relations/. An archived replay of the webcast will be available following the conclusion of the call. Please dial in or log on 10 minutes prior to the start time to provide sufficient time to register for the event.

Spark Power's Second Quarter 2021 Interim Unaudited Condensed Consolidated Financial Statements is available on Spark Power's website at www.sparkpowercorp.com, and will be filed on SEDAR at www.sedar.com.

About Spark Power

Spark Power is a leading independent provider of end-to-end electrical services, operations and maintenance services, and energy sustainability solutions to the industrial, commercial, utility, and renewable asset markets in North America. We work to earn the right to be our customers' Trusted Partner in Power™. Our highly skilled and dedicated people, located in the communities we serve, combined with our knowledge of the power industry, technology expertise, and commitment to safety, ensures we deliver the right solutions that keep our customers' operations up and running today and better equipped for tomorrow. Learn more at www.sparkpowercorp.com.

Forward-Looking Statements

This news release may contain forward-looking statements (within the meaning of applicable securities laws) which reflect Spark Power's current expectations regarding future events. Forward-looking statements are identified by words such as "believe", "anticipate", "project", "expect", "intend", "plan", "will", "may", "estimate" and other similar expressions. The forward-looking statements in this press release include statements regarding the Company's future growth, return to pre-pandemic business levels and achievement of organizational objectives. The forward-looking statements in this news release are not guarantees of future performance and involve risks and uncertainties that are difficult to control or predict. Several factors could cause actual results to differ materially from the results discussed in the forward-looking statements. Such factors include, among others: the ability of the Company to find a suitable strategic partner, potential buyer or participants for a financing; currency fluctuations; disruptions or changes in the credit or security markets; results of operations; and general developments, market and industry conditions. Readers, therefore, should not place undue reliance on any such forward-looking statements. Further, these forward-looking statements are made as of the date of this news release and, except as expressly required by applicable law, Spark Power assumes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

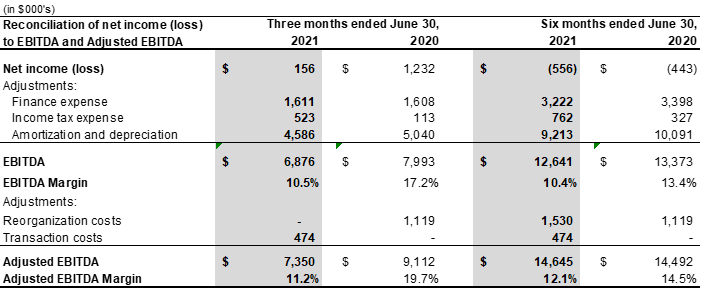

Non-IFRS Measures

The Company prepares and releases unaudited consolidated interim financial statements and audited consolidated annual financial statements prepared in accordance with IFRS. In this and other earnings releases and investor conference calls, as a complement to results provided in accordance with IFRS, the Company also discloses and discusses certain financial measures not recognized under IFRS and that do not have standard meanings prescribed by IFRS. These include "EBITDA", "Adjusted EBITDA", "Pro-forma Adjusted EBITDA", "EBITDA Margin", "Adjusted EBITDA Margin", "Pro-forma Adjusted EBITDA Margin", "Pro-forma Revenue", "Adjusted Working Capital", and "Adjusted Net and Comprehensive Income (Loss)". These non-IFRS measures are used to provide investors with supplemental measures of Spark Power's operating performance and highlight trends in Spark Power's business that may not otherwise be apparent when relying solely on IFRS measures. Spark also believes that providing such information to securities analysts, investors and other interested parties who frequently use non-IFRS measures in the evaluation of issuers will allow them to better compare Spark Power's performance against others in its industry. Management also uses non-IFRS measures in order to facilitate operating performance comparisons from period to period, to prepare annual operating budgets and forecasts and to determine components of management compensation. For a reconciliation of these non-IFRS measures see the Company's management's discussion and analysis for the three- and six- months ended June 30, 2021. The non-IFRS measures should not be construed as alternatives to results prepared in accordance with IFRS.

Selected Consolidated Financial Information:

Reconciliation of comprehensive income (loss) to EBITDA, Adjusted EBITDA, and Pro-forma Adjusted EBITDA:

The following table is a summary of Spark Power's results for the periods indicated:

Investor and Regulatory Inquiries:

Dan Ardila, Executive Vice President & Chief Financial Officer

dardila@sparkpowercorp.com

+1 (905) 829-3336 x127

Media Inquiries:

Kim Samlall, Director, Marketing Communications

media@sparkpowercorp.com

+1 (905) 829-3336 x185

SOURCE: Spark Power Group Inc.

View source version on accesswire.com:

https://www.accesswire.com/660057/Spark-Power-Builds-Momentum-Throughout-Quarter-Optimistic-About-Second-Half-Performance