SilverBow Resources Announces Bolt-On Acquisition Expanding Premier Liquids Weighted Position in DeWitt and Gonzales Counties

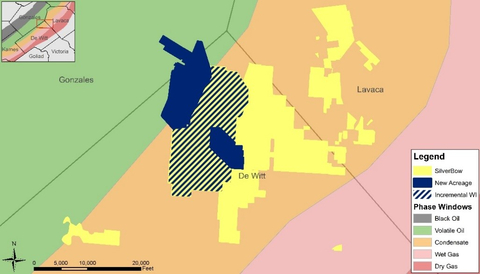

SilverBow Resources, Inc. (NYSE: SBOW) has reached a definitive agreement to acquire oil and gas assets in DeWitt and Gonzales counties for approximately $87 million. This acquisition is set to enhance SilverBow's position in the Eagle Ford and Austin Chalk formations, increasing net production to around 1,100 barrels of oil equivalent per day, 44% of which is oil. The deal includes 5,200 net acres and aims to optimize development by allowing for 70,000 additional lateral feet to be drilled with fewer wells, significantly improving capital efficiency.

- Acquisition of 5,200 net acres in productive oil and condensate regions, enhancing resource base.

- Increased net production to approximately 1,100 barrels of oil equivalent per day, improving revenue potential.

- Optimized development allows for 70,000 additional lateral feet to be drilled with 12 fewer wells, enhancing capital efficiency.

- None.

Insights

Analyzing...

Combined acreage position: SilverBow's current assets across

Acquisition Highlights:

- Transaction comprised of incremental working interest on SilverBow’s existing acreage as well as new adjacent acreage; provides for extended laterals, additional inventory locations and more efficient development

-

June 2022 net production of approximately 1,100 barrels of oil equivalent per day;44% oil -

Adds 5,200 net acres in the proven highly economic oil and condensate windows of

Dewitt andGonzales counties -

Significant upside in

Austin Chalk , which has been de-risked with one well in center of acreage block having produced over 200,000 barrels of oil to date - In combination with existing position, Acquisition creates consolidated 13,000 net acre block with 100 high rate of return drilling locations

- Combined position allows optimized development allowing for 70,000 additional lateral feet to be drilled with 12 fewer wells; optimized development significantly improves capital efficiency

MANAGEMENT COMMENTS

Sean Woolverton, SilverBow’s Chief Executive Officer, commented, “This transaction fits our disciplined growth strategy of adding production at attractive valuations and increasing our high-quality inventory across both the Eagle Ford and

TRANSACTION DETAILS

The Acquisition has an effective date of

ABOUT

FORWARD-LOOKING STATEMENTS

This release includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements represent management's expectations or beliefs concerning future events, and it is possible that the results described in this release will not be achieved. These forward-looking statements are based on current expectations and assumptions and are subject to a number of risks and uncertainties, many of which are beyond our control. Important factors that could cause actual results to differ materially from our expectations include, but are not limited to, risks and uncertainties discussed in the Company’s reports filed with the

View source version on businesswire.com: https://www.businesswire.com/news/home/20221003005281/en/

Director of Finance & Investor Relations

(281) 874-2700, (888) 991-SBOW

Source: