Santander US Paths to Prosperity Research Finds Consumers Resilient Though Pressures Mounting

-

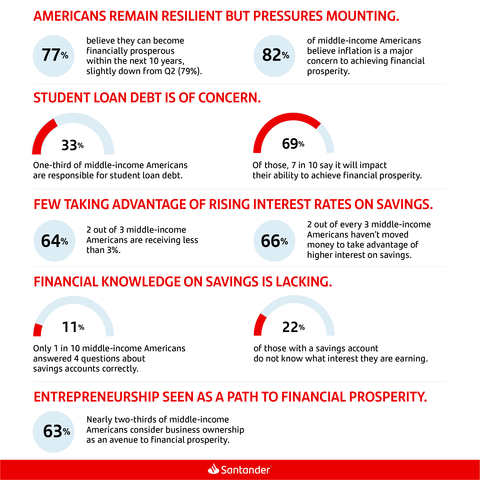

77% of middle-income Americans believe they will achieve financial prosperity in the next 10 years. - Of those responsible for student-debt payments, 7 in 10 expected to be impacted by resumption of federal student-loan payments.

- Two-thirds have not yet taken advantage of rising interest rates on savings.

- Auto access remains essential to achieving financial prosperity.

(Graphic: Business Wire)

However, prolonged inflation and the resumption of federal student-loan payments are clear economic stressors for middle-income households. More than 7 in 10 say they are unable to save as much as a result of inflation, which remained the number one obstacle to achieving prosperity. Approximately a third of respondents – across all generations – are responsible for student-loan debt, with

The study also revealed that many middle-income Americans are missing out on an opportunity to offset these inflationary pressures by earning more on their savings. Interest rates on savings have climbed steadily to the highest levels in decades, yet two-thirds (

“Having the information needed to make important financial decisions is crucial for reaching one’s financial goals,” said Tim Wennes, Santander US CEO. “At Santander, we recognize our important role in providing customers with the support and guidance they need — in a way that is simple and easy to understand — so they can take control of their decision-making. Conducting this research each quarter provides us with essential insights, so that we can best meet our customers where they are in their journey to financial prosperity.”

The study, which built upon research conducted in the first and second quarters, assessed middle-income Americans’ current financial state and future aspirations, with a focus on how current economic conditions have impacted their households. It also identified areas for economic growth and demand, including entrepreneurship, financial education, and vehicle ownership.

Auto Access

The majority of middle-income Americans (

Entrepreneurship a Ticket to Prosperity

Business ownership was identified by middle-income Americans as a driver of financial prosperity, especially among Black (

This research on financial prosperity, conducted by Morning Consult on behalf of Santander US, surveyed 2,213 American bank and/or financial services customers, ages 18-76. Survey participants had household income in the “middle-income” range of

The full report and more information about the Santander US survey is available here.

About Santander US

Santander Holdings USA, Inc. (SHUSA) is a wholly owned subsidiary of

Santander Bank, N.A. is a Member FDIC and a wholly owned subsidiary of Banco Santander, S.A. © 2023 Santander Bank, N.A. All rights reserved. Santander, Santander Bank, the Flame Logo are trademarks of Banco Santander, S.A. or its subsidiaries in

View source version on businesswire.com: https://www.businesswire.com/news/home/20231030238461/en/

Media:

Andrew Simonelli

andrew.simonelli@santander.us

Caroline Connolly

caroline.connolly@santander.us

Source: Santander Holdings USA, Inc.