DAT Truckload Volume Index: Freight volumes bounced back in August

- Truckload freight volumes increased in August

- Van TVI increased by 8% from July

- Reefer TVI increased by 4% from July

- Flatbed TVI increased by 9% from July

- Load-to-truck ratios for van and reefer rose in August

- Spot line-haul rates strengthened

- Line-haul rates declined compared to July

- Contract rates have not increased since May 2022

Insights

Analyzing...

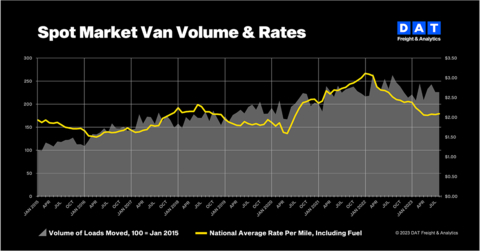

Freight volumes bounced back in August (Graphic: DAT Freight & Analytics)

Buoyed by shipments of retail goods and fresh food, the DAT Truckload Volume Index (TVI) increased for van, refrigerated (“reefer”) and flatbed freight compared to July:

-

Van TVI: 241, up

8% from July and down8% year over year -

Reefer TVI: 175, up

4% from July and down5% year over year -

Flatbed TVI: 259, up

9% from July and down0.4% year over year

Load-to-truck ratios strengthened

DAT’s national average van and reefer load-to-truck ratios rose in August, reflecting higher demand for these services:

- Van ratio: 2.8, up from 2.6 in July, meaning there were 2.8 loads for every truck on the DAT One marketplace

- Reefer ratio: 4.4, up from 3.8

- Flatbed ratio: 6.0, down from 7.1

Spot line-haul rates slipped

Broker-to-carrier benchmark spot rates strengthened as carriers negotiated to cover rising fuel expenses. The DAT benchmark spot van rate was

Line-haul rates, which subtract an amount equal to a fuel surcharge, tumbled compared to July:

-

Line-haul van rate:

$1.57 6 cents -

Line-haul reefer rate:

$1.94 2 cents -

Line-haul flatbed rate:

$1.89 12 cents

Contract rates declined

DAT benchmark rates for contracted freight have not increased month over month since May 2022:

-

Contract van rate:

$2.57 -

Contract reefer rate:

$2.99 8 cents -

Contract flatbed rate:

$3.19 10 cents

“At

About the DAT Truckload Volume Index

The DAT Truckload Volume Index reflects the change in the number of loads with a pickup date during that month; the actual index number is normalized each month to accommodate any new data sources without distortion. A baseline of 100 equals the number of loads moved in January 2015, as recorded in DAT RateView, a truckload pricing database and analysis tool with rates paid on an average of 3 million loads per month.

Spot truckload rates are negotiated for each load and paid to the carrier by a freight broker. National average spot rates are derived from payments to carriers by freight brokers, third-party logistics providers and other transportation buyers for hauls of 250 miles or more with a pickup date during the month reported. DAT’s rate analysis is based on

Load-to-truck ratios reflect truckload supply and demand on the DAT One marketplace and indicate the pricing environment for spot truckload freight.

About DAT Freight & Analytics

DAT Freight & Analytics operates the largest truckload freight marketplace in

Founded in 1978, DAT is a business unit of Roper Technologies (Nasdaq: ROP), a constituent of the S&P 500 and Fortune 1000 indices.

View source version on businesswire.com: https://www.businesswire.com/news/home/20230918882743/en/

Annabel Reeves

Corporate Communications, DAT Freight & Analytics

PR@dat.com / annabel.reeves@dat.com; 503-501-0143

Source: DAT Freight & Analytics