LexisNexis Insurance Demand Meter Registers as "Nuclear" for New Policy Growth and "Hot" for Shopping in Q4 2022

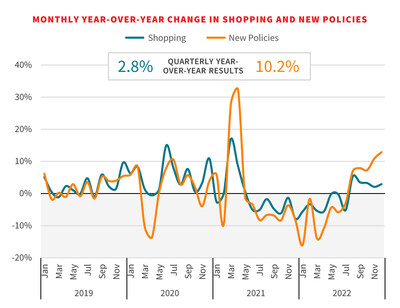

The LexisNexis Risk Solutions Insurance Demand Meter reported that U.S. auto insurance shopping grew by 2.8% in Q4 2022, up from 1.2% in Q3 2022. New policy growth surged 10.2% year-over-year, indicating a shift in consumer behavior due to rate increases averaging over 9% in 2022. Significant spikes in shopping occurred in November and December, driven by uneven rate revisions among insurers. The 55+ demographic exhibited the highest rate increases, as consumers sought more cost-effective policies. Moving into 2023, volatility in vehicle and insurance shopping rates is expected to continue, influenced by ongoing insurer rate revisions.

- Q4 2022 new policy growth reached +10.2% YoY.

- U.S. auto insurance shopping increased by +2.8% in Q4 2022.

- Record high shopping volumes in November and December 2022.

- Significant opportunity for insurers leveraging data and technology.

- Overall average auto insurance premiums rose by over +9% in 2022.

- Insurers facing challenges in profitability due to rising costs.

Auto insurance shopping and policy switching spiked in response to rate increases from U.S. carriers

ATLANTA, Feb. 23, 2023 /PRNewswire/ -- The latest edition of the LexisNexis® Risk Solutions Insurance Demand Meter reports the quarterly year-over-year U.S. auto insurance shopping growth rate rose

"The shopping activity we're seeing in the market continues to be extremely volatile as insurers take rate to combat profitability concerns due to rising inflation, loss costs and interest rates," said Adam Pichon, vice president and general manager of Auto and Home Insurance at LexisNexis Risk Solutions. "As consumers receive their renewals, sticker shock may be coming into play, and we're seeing switching rates rising to levels not seen in several years. While insurers are facing a number of obstacles, there is still significant opportunity for those carriers who can leverage data, analytics and artificial intelligence (AI) to help optimize their operations and invest in technology that helps allow them to provide better customer service at a lower cost for the benefit of consumers."

Late Year 2022 Auto Insurance Rate Increases Inspire More Q4 Shoppers to Purchase New Policies

Some of the largest rate revisions from U.S. auto insurers began to hit the market in August 2022, driving more shoppers to switch their policies, particularly in the last two months of the quarter.

"We attribute significant November and December jumps in new policy purchases, and consumers switching carriers to two primary factors," said Chris Rice, associate vice president of strategic business intelligence at LexisNexis Risk Solutions. "First, not all auto carriers are implementing rate revisions at the same time or at the same levels, so a lot of consumers are looking for and finding more cost-effective policies. Second, much of the growth was in the independent channel, where purchase rates have historically been higher than other distribution channels."

The rate at which shoppers switched or purchased coverage was up across all demographics. In particular, the 55+ age demographic saw the largest increase in purchase rates, along with consumers that carry high bodily injury limits and those who have long tenure with their previous carriers. Despite inflation and auto premiums rising, consumers are maintaining their current coverage levels when they switch carriers. In fact, consumers with bodily injury limits in the

"One very notable trend we saw in 2022 was the fact that some lower-risk, experienced drivers who traditionally don't shop that often are now shopping more and are more likely to switch when they do shop," said Pichon.

A Look Ahead

2023 could likely be headed for another year of vehicle and insurance shopping volatility in year-over-year growth rates. The first half of the year could be very interesting as tax-related payouts from 2022, which would typically help drive increased shopping during the first quarter, are expected by LexisNexis Risk Solutions to be less significant than in the past few years.

Conversely, insurer rate revisions are expected to last well into 2023, so that could continue to help drive higher shopping than we might otherwise see outside of tax season-driven shopping.

"We do expect to see a continuation of higher consumer purchase rates in the coming months," said Pichon. "With millions of consumers still slated to see upcoming rate increases when they receive their renewal notices, combined with insurers still looking to return to profitability, there's a strong likelihood that the Insurance Demand Meter's reported shopping and purchasing levels should remain high."

Download the latest Insurance Demand Meter.

About the LexisNexis Insurance Demand Meter

The LexisNexis Insurance Demand Meter is a quarterly analysis of shopping volume and frequency, new business volume and related data points. LexisNexis Risk Solutions offers this unique market-wide perspective of consumer shopping and switching behavior based on its analysis of billions of consumer shopping transactions since 2009, representing nearly

About LexisNexis Risk Solutions

LexisNexis® Risk Solutions harnesses the power of data and advanced analytics to provide insights that help businesses and governmental entities reduce risk and improve decisions to benefit people around the globe. We provide data and technology solutions for a wide range of industries including insurance, financial services, healthcare and government. Headquartered in metro Atlanta, Georgia, we have offices throughout the world and are part of RELX (LSE: REL/NYSE: RELX), a global provider of information and analytics for professional and business customers. For more information, please visit www.risk.lexisnexis.com, and www.relx.com.

Media Contacts:

Chas Strong

LexisNexis Risk Solutions

Phone: +1.706.714.7083

Charles.Strong@lexisnexisrisk.com

Donna Armstrong

Brodeur Partners for LexisNexis Risk Solutions

Phone: +1.646.746.5611

darmstrong@brodeur.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/lexisnexis-insurance-demand-meter-registers-as-nuclear-for-new-policy-growth-and-hot-for-shopping-in-q4-2022-301754767.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/lexisnexis-insurance-demand-meter-registers-as-nuclear-for-new-policy-growth-and-hot-for-shopping-in-q4-2022-301754767.html

SOURCE LexisNexis Risk Solutions

FAQ

What does the LexisNexis Insurance Demand Meter report about Q4 2022?

How much did auto insurance premiums increase in 2022?

What demographic saw the highest increase in auto insurance policy purchases?

What trends are expected for auto insurance shopping in 2023?