With No Competing Offers, Beacon Roofing’s Board Stalls and Misleads

QXO has released a letter to Beacon Roofing Supply shareholders addressing their $124.25 per share all-cash offer and challenging Beacon's recent communications. The offer represents a 37% premium to Beacon's 90-day unaffected VWAP and a 26% premium to the unaffected spot price as of November 15, 2024.

QXO criticizes Beacon's performance, noting that consensus analysts expect Beacon to miss all margin targets under its 'Ambition 2025' plan. The company's revenue CAGR of 7.7% from 2019 through LTM September 2024 is the lowest among peers. QXO also highlights that Beacon insiders, including the Chairman and CEO, recently sold shares at prices significantly below the offer price, with the Chairman selling 20.9% of shares at $94.80 and the CEO selling 9.8% at $97.91.

The tender offer will remain effective until February 24, 2025, with no financing or due diligence conditions attached.

QXO ha inviato una lettera agli azionisti di Beacon Roofing Supply facendo riferimento alla loro offerta in contante di $124,25 per azione e contestando le recenti comunicazioni di Beacon. L'offerta rappresenta un premio del 37% rispetto al VWAP non influenzato di 90 giorni di Beacon e un premio del 26% rispetto al prezzo spot non influenzato al 15 novembre 2024.

QXO critica le performance di Beacon, sottolineando che gli analisti di consenso si aspettano che Beacon non raggiunga alcun obiettivo di margine del suo piano 'Ambition 2025'. Il CAGR del fatturato dell'azienda del 7,7% dal 2019 fino a settembre 2024 è il più basso rispetto ai concorrenti. QXO evidenzia anche che i dirigenti di Beacon, incluso il Presidente e CEO, hanno recentemente venduto azioni a prezzi significativamente inferiori rispetto al prezzo dell'offerta, con il Presidente che ha venduto il 20,9% delle azioni a $94,80 e il CEO che ha venduto il 9,8% a $97,91.

L'offerta pubblica rimarrà valida fino al 24 febbraio 2025, senza condizioni di finanziamento o di due diligence.

QXO ha emitido una carta a los accionistas de Beacon Roofing Supply abordando su oferta en efectivo de $124.25 por acción y desafiando las comunicaciones recientes de Beacon. La oferta representa un premio del 37% sobre el VWAP no afectado de 90 días de Beacon y un premio del 26% sobre el precio spot no afectado a partir del 15 de noviembre de 2024.

QXO critica el rendimiento de Beacon, señalando que los analistas de consenso esperan que Beacon no cumpla con los objetivos de margen de su plan 'Ambition 2025'. La tasa de crecimiento anual compuesta (CAGR) de los ingresos de la compañía del 7.7% desde 2019 hasta septiembre de 2024 es la más baja entre sus pares. QXO también destaca que los ejecutivos de Beacon, incluido el Presidente y CEO, han vendido recientemente acciones a precios significativamente por debajo del precio de la oferta, con el Presidente vendiendo el 20.9% de las acciones a $94.80 y el CEO vendiendo el 9.8% a $97.91.

La oferta permanecerá en vigor hasta el 24 de febrero de 2025, sin condiciones de financiamiento o debida diligencia.

QXO는 Beacon Roofing Supply 주주에게 $124.25의 현금 제안과 Beacon의 최근 커뮤니케이션에 대한 반박을 담은 서신을 발송했습니다. 이 제안은 Beacon의 90일 비영향 VWAP에 대해 37%의 프리미엄을 나타내며, 2024년 11월 15일 기준 비영향 현물 가격에 대해 26%의 프리미엄을 갖고 있습니다.

QXO는 Beacon의 성과를 비판하며, 컨센서스 분석가들이 Beacon이 'Ambition 2025' 계획 하의 모든 마진 목표를 놓칠 것이라고 예상하고 있다고 언급합니다. 2019년부터 2024년 9월까지의 회사 매출 CAGR은 또래 중 가장 낮은 7.7%입니다. QXO는 또한 Beacon의 내부자들, 즉 의장 및 CEO가 최근 제안 가격보다 상당히 낮은 가격에 주식을 판매했다고 강조하며, 의장은 $94.80에 20.9%의 주식을, CEO는 $97.91에 9.8%의 주식을 판매했다고 전합니다.

입찰 제안은 2025년 2월 24일까지 유효하며, 자금 조달 또는 실사 조건이 붙지 않습니다.

QXO a publié une lettre aux actionnaires de Beacon Roofing Supply concernant leur offre en espèces de 124,25 $ par action et contestant les récentes communications de Beacon. L'offre représente une prime de 37% par rapport au VWAP non affecté de 90 jours de Beacon et une prime de 26% par rapport au prix au comptant non affecté au 15 novembre 2024.

QXO critique la performance de Beacon, notant que les analystes de consensus s'attendent à ce que Beacon manque tous les objectifs de marge de son plan 'Ambition 2025'. Le CAGR des revenus de l'entreprise de 7,7% de 2019 jusqu'à septembre 2024 est le plus bas parmi ses pairs. QXO souligne également que les initiés de Beacon, y compris le Président et le CEO, ont récemment vendu des actions à des prix significativement inférieurs au prix de l'offre, le Président ayant vendu 20,9% des actions à 94,80 $ et le CEO 9,8% à 97,91 $.

L'offre d'achat restera valable jusqu'au 24 février 2025, sans conditions de financement ou de diligence raisonnable.

QXO hat einen Brief an die Aktionäre von Beacon Roofing Supply veröffentlicht, in dem auf ihr Angebot von $124,25 pro Aktie in bar eingegangen wird und die jüngsten Mitteilungen von Beacon in Frage gestellt werden. Das Angebot stellt einen 37%igen Aufschlag auf den nicht beeinflussten VWAP von 90 Tagen von Beacon dar und einen 26%igen Aufschlag auf den nicht beeinflussten Spotpreis zum 15. November 2024.

QXO kritisiert die Leistung von Beacon und weist darauf hin, dass Konsensanalysten erwarten, dass Beacon alle Margenziele des 'Ambition 2025'-Plans verpassen wird. Das Umsatz-CAGR des Unternehmens von 7,7% von 2019 bis September 2024 ist das niedrigste unter den Mitbewerbern. QXO hebt auch hervor, dass Insider von Beacon, einschließlich des Vorsitzenden und CEO, kürzlich Aktien zu Preisen verkauft haben, die erheblich unter dem Angebotspreis liegen, wobei der Vorsitzende 20,9% der Aktien zu $94,80 und der CEO 9,8% zu $97,91 verkauft hat.

Das Angebotsverfahren bleibt bis zum 24. Februar 2025 wirksam, ohne dass Bedingungen für Finanzierung oder Due Diligence attached sind.

- Premium offer of $124.25 per share represents 37% above 90-day VWAP

- No financing or due diligence conditions attached to the offer

- Transaction could close shortly after tender offer expiration

- Beacon's revenue CAGR of 7.7% is lowest among peer group

- Company expected to miss all 'Ambition 2025' margin targets

- Beacon's total shareholder return trails Building Products Proxy Peers by 86% over past five years

- Board and management own only 1.3% of outstanding shares

- Insiders recently sold significant shares below offer price

Insights

The hostile takeover bid by QXO for Beacon Roofing Supply represents a significant development in the building materials distribution sector. The

Several critical factors strengthen QXO's position:

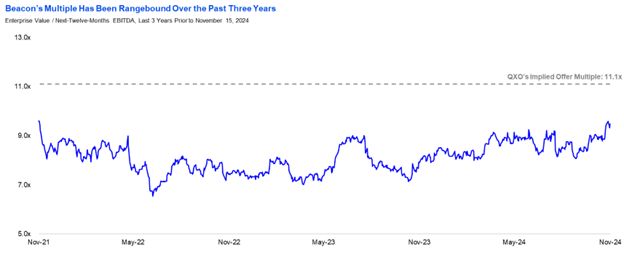

- The offer represents a 3.0x premium to Beacon's historical EV/EBITDA multiple, significantly above its 8.1x three-year average

- Beacon's operational performance shows concerning trends, with the lowest revenue CAGR (

7.7% ) among peers and projected misses on key margin targets - Recent insider sales by both the Chairman (

20.9% of holdings at$94.80 ) and CEO (9.8% at$97.91 ) at prices well below the offer raise questions about management's confidence in future prospects - The absence of competing offers or signed NDAs after two months suggests strategic alternatives

The timing of Beacon's announced March Investor Day, coming shortly after QXO's direct appeal to shareholders, appears defensive rather than strategic. The

The tender offer's February 24 deadline creates urgency for shareholders to evaluate this premium offer against Beacon's standalone prospects, particularly given the company's historical underperformance relative to peers and missed operational targets. The transaction's lack of financing or due diligence conditions, coupled with expected regulatory clearance, reduces execution risk significantly.

Beacon Insiders Recently Sold Shares Well Below Offer Price, Undermining Beacon’s Case Against QXO

QXO Calls on Beacon Roofing to Let Shareholders Decide on QXO’s

GREENWICH, Conn., Feb. 10, 2025 (GLOBE NEWSWIRE) -- QXO, Inc. (NYSE: QXO) today released a letter to Beacon Roofing Supply, Inc. shareholders regarding its

Dear Beacon Shareholders,

We seek to set the record straight on some of the numerous misleading statements in Beacon’s recent communications.

1. QXO’s Offer to Acquire Beacon Roofing Supply is Highly Compelling and at a Significant Premium to Beacon’s Unaffected Share Price

In evaluating QXO’s offer, Beacon conveniently ignores that its share price reflects our acquisition interest following the Wall Street Journal’s November 18, 2024 report. That day, Beacon’s stock rose

A more appropriate analysis shows that QXO’s offer represents:

- A

37% premium to Beacon’s 90-day unaffected VWAP of$91.02 per share as of November 15, 2024; - A

26% premium to Beacon’s unaffected spot price of$98.75 per share as of November 15, 2024; and - A higher price than Beacon’s stock has ever traded.

Indeed, Beacon acknowledges that November 15, 2024 is a significant date, referencing stock performance “from January 2, 2020 to November 15, 2024 (the last trading day before rumors surfaced).”

Moreover, since November 15, 2024, Beacon’s Building Products Proxy Peers have lost

- A

41% premium to an implied spot share price of$88.42 ; and - A

52% premium to the peer-adjusted 90-day VWAP of$81.50 2.

2. Data Indicates that Beacon Will Miss its Margin Targets. The Board’s Claim of Strong Performance is Flawed

Beacon’s Board touts cherry-picked historical performance, painting a misleading picture of its track record. Consensus analysts’ estimates indicate that Beacon will miss all margin targets under its “Ambition 2025” plan. Further, Beacon’s revenue growth largely stems from extraordinary inflation and inorganic growth between 2022 and 2024. From 2019 through LTM September 2024, Beacon’s

Despite setting unambitious “Ambition 2025” targets, consensus analysts’ estimates indicate that Beacon will:

- Miss its 2025 Gross Margin target by 130 basis points;

- Miss its 2025 EBITDA Margin target by 114 basis points; and

- Deliver EBITDA margins 20bps lower in 2025 than when the “Ambition 2025” plan was introduced4.

Furthermore, Beacon’s claims of superior stock performance are easily debunked. Over the past five years, Beacon’s total shareholder return has trailed its Building Products Proxy Peers by

3. QXO’s Offer Represents a 3.0x Premium to Beacon’s Historical Multiple

Beacon’s lackluster operational performance and relative share price underperformance are reflected in its enterprise value to next-twelve-months EBITDA multiple, which has remained rangebound at an average of 8.1x over the past three years. Meanwhile, its valuation gap relative to its Building Products Proxy Peers widened by 1.3x6 over the same period.

Since Beacon has not closed the valuation multiple gap despite implementing “Ambition 2025,” reporting supposedly strong results and stock markets nearing all-time highs, we urge shareholders to decide if the current management and Board are the right team to create value for shareholders. QXO’s proposal provides a 3.0x premium to Beacon’s average historical next-twelve-months EBITDA multiple7, providing substantial immediate cash-certain value to shareholders.

4. If Beacon is Truly Confident in its Future, it Should Release its Projections Today

Beacon’s upcoming financial projections for its March Investor Day warrant skepticism. Management itself acknowledged in its filings that its upcoming 2028 targets are "ambitious," implying they may not be realistic. Beacon has already fallen short of some "Ambition 2025" goals. Adding to the skepticism, its decision to announce the Investor Day came only days after QXO disclosed its plan to go directly to shareholders.

Further, these newly constructed projections will not be revealed for another month—more than three months after Beacon’s Board first rejected QXO‘s offer. Why the delay? What is Beacon formulating in the interim? If the company had strong, credible projections, there would be no reason for such a drawn-out disclosure process.

5. Actions Speak Louder than Words: Beacon Insiders Recently Sold Shares at Prices Far Below QXO’s Offer

Since early 2024, Beacon’s Chairman and CEO have sold a significant percentage of their shares at prices well below QXO’s

- Chairman Stuart Randle sold

20.9% of his shares at$94.80 8; - CEO Julian Francis sold

9.8% of his shares at$97.91 9; - CD&R, arguably the most sophisticated financial sponsor in the distribution space, exited its position in Beacon at

$83.16 per share.

If Beacon’s future is so bright under current management, why are insiders selling shares sharply below QXO’s offer price?

Additionally, Beacon’s Board and management collectively own only

6. Beacon’s Own Filings Suggest that No Actionable Competing Offer Exists

Beacon’s recent filings indicate no viable third-party alternative to QXO’s premium offer. Beacon’s 14D-9 filing has not disclosed any competing offers, or even a single NDA being signed.

Interestingly, on December 2, 2024, representatives of J.P. Morgan explicitly informed representatives of Morgan Stanley that they had been authorized to approach other potential suitors for Beacon. QXO’s letter to Beacon sent on the following day stated this clearly, yet Beacon made no effort to dispute this until two months later, on February 6, 2025.

QXO’s offer is clear, compelling and in shareholders’ best interest. It is time for Beacon’s Board to stop obstructing shareholders and let them decide their own financial future.

QXO's tender offer for all of Beacon’s outstanding common stock will be effective until 12:00 midnight (New York City time) at the end of February 24, 2025, and QXO is prepared to complete the acquisition shortly after the tender expires, subject to the terms of the offer. The transaction is not subject to any financing conditions or due diligence conditions, and QXO expects that the waiting periods under the Hart-Scott-Rodino Act and the Canadian Competition Act will have expired or been waived by the time the tender offer expires.

Advisors

Morgan Stanley & Co. LLC is acting as lead financial advisor to QXO, and Paul, Weiss, Rifkind, Wharton & Garrison LLP is acting as legal counsel.

About QXO

QXO provides technology solutions, primarily to clients in the manufacturing, distribution and service sectors. The company provides consulting and professional services, including specialized programming, training and technical support, and develops proprietary software. As a value-added reseller of business application software, QXO offers solutions for accounting, financial reporting, enterprise resource planning, warehouse management systems, customer relationship management, business intelligence and other applications. QXO plans to become a tech-forward leader in the

Forward-Looking Statements

This communication contains forward-looking statements. Statements that are not historical facts, including statements about beliefs, expectations, targets, goals, regulatory approval timing and nominating directors are forward-looking statements. These statements are based on plans, estimates, expectations and/or goals at the time the statements are made, and readers should not place undue reliance on them. In some cases, readers can identify forward-looking statements by the use of forward-looking terms such as “may,” “will,” “should,” “expect,” “opportunity,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “target,” “goal,” or “continue,” or the negative of these terms or other comparable terms. Forward-looking statements involve inherent risks and uncertainties and readers are cautioned that a number of important factors could cause actual results to differ materially from those contained in any such forward-looking statements. Such factors include but are not limited to: the ultimate outcome of any possible transaction between QXO, Inc. (“QXO”) and Beacon Roofing Supply, Inc. (“Beacon”), including the possibility that the parties will not agree to pursue a business combination transaction or that the terms of any definitive agreement will be materially different from those proposed; uncertainties as to whether Beacon will cooperate with QXO regarding the proposed transaction; the ultimate result should QXO commence a proxy contest for election of directors to Beacon’s board of directors; QXO’s ability to consummate the proposed transaction with Beacon; the conditions to the completion of the proposed transaction, including the receipt of any required shareholder approvals and any required regulatory approvals; QXO’s ability to finance the proposed transaction; the substantial indebtedness QXO expects to incur in connection with the proposed transaction and the need to generate sufficient cash flows to service and repay such debt; that operating costs, customer loss and business disruption (including, without limitation, difficulties in maintaining relationships with employees, customers or suppliers) may be greater than expected following the proposed transaction or the public announcement of the proposed transaction; QXO’s ability to retain certain key employees; and general economic conditions that are less favorable than expected. QXO cautions that forward-looking statements should not be relied on as predictions of future events, and these statements are not guarantees of performance or results. Forward-looking statements herein speak only as of the date each statement is made. QXO does not assume any obligation to update any of these statements in light of new information or future events, except to the extent required by applicable law.

Important Additional Information and Where to Find It

This communication is for informational purposes only and does not constitute a recommendation, an offer to purchase or a solicitation of an offer to sell Beacon securities. QXO and Queen MergerCo, Inc. (the “Purchaser”) filed a Tender Offer Statement on Schedule TO with the Securities and Exchange Commission (the “SEC”) on January 27, 2025, and Beacon filed a Solicitation/Recommendation Statement on Schedule 14D-9 with respect to the tender offer with the SEC on February 6, 2025. Investors and security holders are urged to carefully read the Tender Offer Statement (including the Offer to Purchase, the related Letter of Transmittal and certain other tender offer documents, as each may be amended or supplemented from time to time) and the Solicitation/Recommendation Statement, as these materials contain important information that investors and security holders should consider before making any decision regarding tendering their common stock, including the terms and conditions of the tender offer. The Tender Offer Statement, Offer to Purchase, Solicitation/Recommendation Statement and related materials are filed with the SEC, and investors and security holders may obtain a free copy of these materials and other documents filed by QXO and Beacon with the SEC at the website maintained by the SEC at www.sec.gov. In addition, the Tender Offer Statement and other documents that QXO and the Purchaser file with the SEC will be made available to all investors and security holders of Beacon free of charge from the information agent for the tender offer: Innisfree M&A Incorporated, 501 Madison Avenue, 20th Floor, New York, NY 10022, toll-free telephone: +1 (888) 750-5834.

QXO and the other participants intend to file a preliminary proxy statement and accompanying WHITE universal proxy card with the SEC to be used to solicit proxies for, among other matters, the election of its slate of director nominees at the 2025 annual meeting of stockholders of Beacon. QXO strongly advises all stockholders of Beacon to read the preliminary proxy statement, any amendments or supplements to such proxy statement, and other proxy materials filed by QXO with the SEC as they become available because they will contain important information. Such proxy materials will be available at no charge on the SEC’s website at www.sec.gov and at QXO’s website at investors.qxo.com. In addition, the participants in this proxy solicitation will provide copies of the proxy statement, and other relevant documents, without charge, when available, upon request. Requests for copies should be directed to the participants’ proxy solicitor.

Certain Information Concerning the Participants

The participants in the proxy solicitation are anticipated to be QXO, Brad Jacobs, Ihsan Essaid, Matt Fassler, Mark Manduca and the individuals nominated by QXO (the “QXO Nominees”). QXO expects to determine and announce the QXO Nominees prior to the nomination deadline for the 2025 annual meeting of stockholders of Beacon. As of the date of this communication, other than 100 shares of common stock of Beacon beneficially owned by QXO, none of the participants who have been identified has any direct or indirect interest, by security holdings or otherwise, in Beacon.

Media Contacts

Joe Checkler

joe.checkler@qxo.com

203-609-9650

Steve Lipin / Lauren Odell

Gladstone Place Partners

212-230-5930

Investor Contacts

Mark Manduca

mark.manduca@qxo.com

203-321-3889

Scott Winter / Jonathan Salzberger

Innisfree M&A Incorporated

212-750-5833

1 Market data as of February 7, 2025. Average of building products subset of the peer list presented in Beacon’s April 2024 Proxy Statement; includes: Builders FirstSource, Boise Cascade, GMS, Pool Corp, SiteOne, WATSCO, Wesco (“Building Products Proxy Peers”)

2 Based on Beacon’s unaffected share price as of November 15, 2024 and the average share price performance since November 15, 2024 for the Building Products Proxy Peers

3 Reported revenues for Beacon and Building Products Proxy Peers

4 Based on median 2025E Wall Street research estimates, sourced from Capital IQ as of February 7, 2025

5 Market data as of November 15, 2024. Total shareholder return reflects stock price performance adjusted for cash dividends paid, stock splits, rights offerings and spin-offs during the period

6 As per Capital IQ as of November 15, 2024

7 As of November 15, 2024; next-twelve-months EBITDA calculated using calendarized annual broker EBITDA estimates for Beacon

8 As per Mr. Randle’s Form 4 filed with the SEC on May 28, 2024. According to Mr. Randle’s Form 4, this sale was not made pursuant to a Rule 10b5-1 plan or to pay any exercise price or tax liability incident to the receipt, exercise or vesting of equity awards.

9 As per Mr. Francis’s Form 4 filed with the SEC on May 22, 2024. According to Mr. Francis’s Form 4, this sale was not made pursuant to a Rule 10b5-1 plan or to pay any exercise price or tax liability incident to the receipt, exercise or vesting of equity awards.

10 As per Schedule 14D-9 filed with the SEC on February 6, 2025

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/5854092c-16b2-41c5-918c-3c0e68bd5705