PyroGenesis Provides Guidance for Q4 and Full-Year 2024

PyroGenesis has released guidance for Q4 and full-year 2024, projecting Q4 revenue of at least $4 million and full-year revenue of at least $15 million. This represents a 32% increase in quarterly revenue compared to Q4 2023 ($3.03M) and a 22% increase in annual revenue versus 2023 ($12.3M).

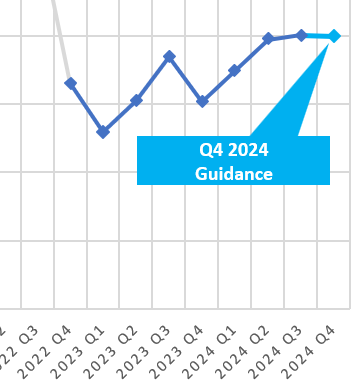

The company's backlog has grown significantly to $58 million, showing a more than 100% increase from the previous $29 million. According to CEO P. Peter Pascali, Q4 2024 is expected to be the strongest quarter since Q3 2022, demonstrating continued momentum since the revenue low of Q1 2023.

PyroGenesis operates in three key verticals: Energy Transition and Emission Reduction, Commodity Security and Optimization, and Waste Remediation, providing ultra-high temperature technology solutions for heavy industry.

PyroGenesis ha rilasciato le previsioni per il quarto trimestre e l'intero anno 2024, prevedendo un fatturato per il Q4 di almeno 4 milioni di dollari e un fatturato annuale di almeno 15 milioni di dollari. Ciò rappresenta un 32% di aumento nel fatturato trimestrale rispetto al Q4 2023 (3,03 milioni di dollari) e un 22% di aumento nel fatturato annuale rispetto al 2023 (12,3 milioni di dollari).

Il backlog dell'azienda è cresciuto significativamente a 58 milioni di dollari, mostrando un aumento di oltre il 100% rispetto ai precedenti 29 milioni. Secondo il CEO P. Peter Pascali, il Q4 2024 è previsto essere il trimestre più forte dal Q3 2022, dimostrando un continuo slancio dalla bassa di fatturato del Q1 2023.

PyroGenesis opera in tre settori chiave: Transizione Energetica e Riduzione delle Emissioni, Sicurezza e Ottimizzazione delle Materie Prime, e Bonifica dei Rifiuti, fornendo soluzioni tecnologiche ad ultra alta temperatura per l'industria pesante.

PyroGenesis ha publicado orientaciones para el cuarto trimestre y el año completo 2024, proyectando ingresos para el Q4 de al menos 4 millones de dólares y ingresos anuales de al menos 15 millones de dólares. Esto representa un 32% de aumento en los ingresos trimestrales en comparación con el Q4 2023 (3,03 millones de dólares) y un 22% de aumento en los ingresos anuales frente a 2023 (12,3 millones de dólares).

El backlog de la empresa ha crecido significativamente a 58 millones de dólares, mostrando un aumento de más del 100% con respecto a los anteriores 29 millones. Según el CEO P. Peter Pascali, se espera que el Q4 2024 sea el trimestre más fuerte desde el Q3 2022, demostrando un impulso continuo desde el bajo ingreso del Q1 2023.

PyroGenesis opera en tres verticales clave: Transición Energética y Reducción de Emisiones, Seguridad y Optimización de Materias Primas, y Remediación de Residuos, proporcionando soluciones tecnológicas de ultra alta temperatura para la industria pesada.

PyroGenesis는 2024년 4분기 및 연간 매출 전망을 발표하며, 4분기 매출을 최소 400만 달러, 연간 매출을 최소 1500만 달러로 예상하고 있습니다. 이는 2023년 4분기(303만 달러) 대비 분기 매출이 32% 증가한 것이며, 2023년(1230만 달러) 대비 연간 매출은 22% 증가한 것입니다.

회사의 백로그는 5800만 달러로 크게 증가하여 이전의 2900만 달러에서 100% 이상 증가했습니다. CEO P. Peter Pascali에 따르면, 2024년 4분기는 2022년 3분기 이후 가장 강력한 분기가 될 것으로 예상되며, 2023년 1분기의 매출 저점 이후 지속적인 모멘텀을 보여주고 있습니다.

PyroGenesis는 에너지 전환 및 배출 감소, 원자재 안전 및 최적화, 폐기물 정화의 세 가지 주요 분야에서 운영되며, 중공업을 위한 초고온 기술 솔루션을 제공하고 있습니다.

PyroGenesis a publié des prévisions pour le quatrième trimestre et l'année complète 2024, projetant un chiffre d'affaires d'au moins 4 millions de dollars pour le Q4 et un chiffre d'affaires annuel d'au moins 15 millions de dollars. Cela représente une augmentation de 32% des revenus trimestriels par rapport au Q4 2023 (3,03 millions de dollars) et une augmentation de 22% des revenus annuels par rapport à 2023 (12,3 millions de dollars).

Le carnet de commandes de l'entreprise a considérablement augmenté pour atteindre 58 millions de dollars, montrant une augmentation de plus de 100% par rapport aux précédents 29 millions. Selon le PDG P. Peter Pascali, le Q4 2024 devrait être le trimestre le plus fort depuis le Q3 2022, démontrant un élan continu depuis le creux de revenus du Q1 2023.

PyroGenesis opère dans trois secteurs clés : Transition énergétique et réduction des émissions, sécurité et optimisation des matières premières, et remediation des déchets, fournissant des solutions technologiques à très haute température pour l'industrie lourde.

PyroGenesis hat Prognosen für das 4. Quartal und das Gesamtjahr 2024 veröffentlicht, mit einer Umsatzprognose von mindestens 4 Millionen Dollar im Q4 und mindestens 15 Millionen Dollar im Gesamtjahr. Dies stellt einen 32%igen Anstieg des Quartalsumsatzes im Vergleich zum Q4 2023 (3,03 Millionen Dollar) und einen 22%igen Anstieg des Jahresumsatzes im Vergleich zu 2023 (12,3 Millionen Dollar) dar.

Der Auftragsbestand des Unternehmens ist erheblich auf 58 Millionen Dollar gestiegen, was eine Steigerung von mehr als 100% im Vergleich zu den vorherigen 29 Millionen Dollar zeigt. Laut CEO P. Peter Pascali wird das Q4 2024 voraussichtlich das stärkste Quartal seit Q3 2022 sein, was einen anhaltenden Aufwärtstrend seit dem Umsatztief im Q1 2023 demonstriert.

PyroGenesis ist in drei wichtigen Bereichen tätig: Energiewende und Emissionsreduktion, Rohstoffsicherheit und -optimierung sowie Abfallbeseitigung, und bietet ultrahochtemperaturtechnologische Lösungen für die Schwerindustrie an.

- Q4 2024 revenue expected to increase 32% YoY to $4M

- Full-year 2024 revenue projected to grow 22% to $15M

- Backlog doubled to $58M from $29M

- Best quarterly revenue performance since Q3 2022

- None.

MONTREAL, Feb. 12, 2025 (GLOBE NEWSWIRE) -- PyroGenesis Inc. (“PyroGenesis”) (http://pyrogenesis.com) (TSX: PYR) (OTCQX: PYRGF) (FRA: 8PY1), a high-tech company that designs, develops, manufactures and commercializes advanced all-electric plasma processes and sustainable solutions to support heavy industry in their energy transition, emission reduction, commodity security, and waste remediation efforts, today announces guidance for the fourth quarter and full year, both ended December 31, 2024.

The Company rarely gives guidance, having only given such for three previous occasions (see news releases for Q3 2021, Q4 2020, Q3 2020), which the Company subsequently surpassed.

Based on preliminary financial information, and subject to year-end closing adjustments, PyroGenesis expects revenue for the fourth quarter 2024 will be at least

The Q4 2024 guidance and actual 2023 results noted above are summarized in the following table:

| 2023 Actual | 2024 Guidance | % Increase | ||

| Q4 Revenue | > | > | ||

| Full Year Revenue | > | > | ||

| Backlog | > | > | ||

Backlog to date, assuming

“Assuming the guidance provided, Q4 2024 will be the best quarterly revenue posted since Q3 2022 and continues the upswing in revenues we have witnessed over the past two years. This momentum, which we have been tracking and communicating to our readers, since our revenue low of Q1 2023, continues to provide evidence that our long-term strategy is paying off,” noted P. Peter Pascali, President and CEO of PyroGenesis. “Combined with our revenue backlog of signed contracts in excess of

The company intends to release the 2024 Q4 and full year earnings on or before March 31, 2025.

Figure 1: quarterly revenue for the Company since Q4 2022.

PyroGenesis’ designs, develops, and manufactures ultra-high temperature technology solutions as part of its three-vertical solution ecosystem that aligns with the economic drivers that are key to global heavy industry. The three verticals are (1) Energy Transition and Emission Reduction, where fuel switching to PyroGenesis’ electric-powered plasma torches, along with gas purification, separation and conversion technologies, helps heavy industry reduce energy costs, fossil fuel use, and emissions while expanding the energy grid; (2) Commodity Security and Optimization, where the recovery of viable metals, and the optimization of production to increase the output of these metals, helps to maximize raw materials and improve the overall availability of critical minerals; and (3) Waste Remediation, encompassing the safe destruction of hazardous materials, and the recovery and valorization of underlying substances such as chemicals and minerals.

About PyroGenesis Inc.

PyroGenesis, a high-tech company, is a proud leader in the design, development, manufacture and commercialization of advanced plasma processes and sustainable solutions which reduce greenhouse gases (GHG) and are economically attractive alternatives to conventional “dirty” processes. PyroGenesis has created proprietary, patented and advanced plasma technologies that are being vetted and adopted by multiple multibillion dollar industry leaders in four massive markets: iron ore pelletization, aluminum, waste management, and additive manufacturing. With a team of experienced engineers, scientists and technicians working out of its Montreal office, and its 3,800 m2 and 2,940 m2 manufacturing facilities, PyroGenesis maintains its competitive advantage by remaining at the forefront of technology development and commercialization. The operations are ISO 9001:2015 and AS9100D certified, having been ISO certified since 1997. PyroGenesis’ shares are publicly traded on the TSX in Canada (TSX: PYR), the OTCQX in the US (OTCQX: PYRGF), and the Frankfurt Stock Exchange in Germany (FRA: 8PY1).

Cautionary and Forward-Looking Statements

This news release refers to certain financial measures that are not specified, defined or determined in accordance with Generally Accepted Accounting Principles ("GAAP"), including adjusted earnings before interest, taxes, depreciation and amortization ("adjusted EBITDA").

NON-IFRS MEASURES

This news release may make reference to certain non-IFRS measures. These measures are not recognized measures under IFRS and do not have a standardized meaning prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other] companies. Rather, these measures are provided as additional information to complement those IFRS measures by providing further understanding of our results of operations from management’s perspective. Accordingly, these measures should not be considered in isolation nor as a substitute for analysis of our financial information reported under IFRS.

We use non-IFRS measures, including EBITDA and Modified EBITDA, both of which are not considered an alternative to income or loss from operations, or to net earnings or loss, in the context of measuring a company’s performance. EBITDA is used by management in order to facilitate operating performance comparisons from period to period, to prepare annual operating budgets and forecasts and to determine components of management compensation. Management believes that EBITDA is used by investors as it provides supplemental measures of operating performance and thus highlights trends in our business that may not otherwise be apparent when relying solely on IFRS measures, and to compare the results of our operations with other entities that have similar structures. Management uses Modified EBITDA as it brings additional clarity to operating performance, and it eliminates variations in the fair value of strategic investments, among others, which may be beyond the control of the Company. Management believes that investors use Modified EBITDA for similar purposes as management and to evaluate performance while adjusting for non-cash discretionary expenses. Modified EBITDA allows for a more appropriate comparison to other companies whose earnings or loss is not adjusted by fair value adjustments from strategic investments.

The Company also uses “Backlog” or “Backlog of signed and/or awarded contracts” interchangeably, as a non-IFRS measure. Backlog figures allow management of the Company to foresee and predict their future needs and resource planning. Management believes that “Backlog” is used by investors to evaluate the Company, its future performance and better understand the production capacity.

EBITDA: We define EBITDA as net earnings before net financing costs, income taxes, depreciation and amortization.

Modified EBITDA: We define Modified EBITDA as EBITDA and adjust for non-cash items namely share-based payments expenses and changes in fair value of strategic investments.

Backlog or Backlog of signed and/or awarded contracts: This measure is defined as contracts with customers, firm purchase order and contracts agreed between us and the customer, whereby we can determine the proceeds and the obligations to perform.

This press release contains “forward-looking information” and “forward-looking statements” (collectively, “forward-looking statements”) within the meaning of applicable securities laws. In some cases, but not necessarily in all cases, forward-looking statements can be identified by the use of forward-looking terminology such as “plans”, “targets”, “expects” or “does not expect”, “is expected”, “an opportunity exists”, “is positioned”, “estimates”, “intends”, “assumes”, “anticipates” or “does not anticipate” or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might”, “will” or “will be taken”, “occur” or “be achieved”. In addition, any statements that refer to expectations, projections or other characterizations of future events or circumstances contain forward-looking statements. Forward-looking statements are not historical facts, nor guarantees or assurances of future performance but instead represent management’s current beliefs, expectations, estimates and projections regarding future events and operating performance.

Forward-looking statements are necessarily based on a number of opinions, assumptions and estimates that, while considered reasonable by PyroGenesis as of the date of this release, are subject to inherent uncertainties, risks and changes in circumstances that may differ materially from those contemplated by the forward-looking statements. Important factors that could cause actual results to differ, possibly materially, from those indicated by the forward-looking statements include, but are not limited to, the risk factors identified under “Risk Factors” in PyroGenesis’ latest annual information form, and in other periodic filings that it has made and may make in the future with the securities commissions or similar regulatory authorities, all of which are available under PyroGenesis’ profile on SEDAR+ at www.sedarplus.ca. These factors are not intended to represent a complete list of the factors that could affect PyroGenesis. However, such risk factors should be considered carefully. There can be no assurance that such estimates and assumptions will prove to be correct. You should not place undue reliance on forward-looking statements, which speak only as of the date of this release. PyroGenesis undertakes no obligation to publicly update or revise any forward-looking statement, except as required by applicable securities laws.

Neither the Toronto Stock Exchange, its Regulation Services Provider (as that term is defined in the policies of the Toronto Stock Exchange) nor the OTCQX Best Market accepts responsibility for the adequacy or accuracy of this press release.

For further information please contact:

Rodayna Kafal, Vice President, IR/Comms. and Strategic BD

E-mail: ir@pyrogenesis.com

http://www.pyrogenesis.com

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/3b69c64b-eb00-45bc-a536-77350a3182ef