PowerBand Announces Second Quarter 2024 Financial Results

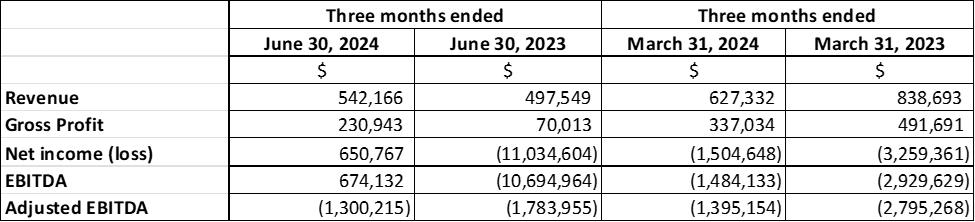

PowerBand Solutions (TSXV:PBX)(OTC PINK:PWWBF) has released its Q2 2024 financial results. Revenue decreased to $542,166 from Q1 2024's $627,332 but increased compared to Q2 2023's $497,549. The revenue primarily came from servicing the existing lease portfolio. Adjusted EBITDA loss decreased relative to the revenue decline. Operating expenses remained consistent due to cost management initiatives. Cash on hand as of June 30, 2024, was $2,220,567, up from $1,934,209 on March 31, 2024. The cash balance includes collections from lease holders. PowerBand has scheduled its Annual General and Special Meeting for September 18th, 2024, at 11:00am EDT.

PowerBand Solutions (TSXV:PBX)(OTC PINK:PWWBF) ha pubblicato i risultati finanziari per il secondo trimestre del 2024. Il fatturato è diminuito a $542,166 rispetto ai $627,332 del primo trimestre del 2024, ma è aumentato rispetto ai $497,549 del secondo trimestre del 2023. I ricavi provengono principalmente dalla gestione dell'attuale portafoglio di leasing. La perdita dell'EBITDA adjusted è diminuita in relazione al calo del fatturato. Le spese operative sono rimaste costanti grazie a iniziative di gestione dei costi. La liquidità disponibile al 30 giugno 2024 era di $2,220,567, in aumento rispetto a $1,934,209 del 31 marzo 2024. Il saldo di cassa include le riscossioni dai locatari. PowerBand ha programmato la propria Assemblea Generale Annuale e Speciale per il 18 settembre 2024, alle 11:00 EDT.

PowerBand Solutions (TSXV:PBX)(OTC PINK:PWWBF) ha publicado sus resultados financieros del segundo trimestre de 2024. Los ingresos disminuyeron a $542,166 desde los $627,332 del primer trimestre de 2024, pero aumentaron en comparación con los $497,549 del segundo trimestre de 2023. Los ingresos provienen principalmente de la gestión del portafolio de arrendamientos existente. La pérdida de EBITDA ajustada disminuyó en relación con la caída de ingresos. Los gastos operativos se mantuvieron constantes gracias a iniciativas de gestión de costos. El efectivo disponible al 30 de junio de 2024 fue de $2,220,567, frente a $1,934,209 del 31 de marzo de 2024. El saldo de efectivo incluye las cobranzas de los arrendatarios. PowerBand ha programado su Asamblea General y Especial Anual para el 18 de septiembre de 2024, a las 11:00 am EDT.

파워밴드 솔루션즈(TSXV:PBX)(OTC PINK:PWWBF)는 2024년 2분기 재무 결과를 발표했습니다. 수익은 $542,166로 감소했습니다, 이는 2024년 1분기의 $627,332에서 줄어든 수치이나, 2023년 2분기의 $497,549와 비교하여 증가한 것입니다. 수익은 주로 기존 임대 포트폴리오의 서비스에서 발생했습니다. 조정된 EBITDA 손실은 감소했습니다 수익 감소에 비해. 운영 비용은 비용 관리 이니셔티브 덕분에 일관성을 유지했습니다. 2024년 6월 30일 현재 현금 보유액은 $2,220,567였습니다, 이는 2024년 3월 31일의 $1,934,209에서 증가한 수치입니다. 현금 잔고에는 임대 보유자로부터의 수금이 포함됩니다. 파워밴드는 2024년 9월 18일 오전 11시 EDT에 연례 총회 및 특별 회의를 예약했습니다.

PowerBand Solutions (TSXV:PBX)(OTC PINK:PWWBF) a publié ses résultats financiers pour le deuxième trimestre 2024. Les revenus ont diminué à 542 166 $ par rapport à 627 332 $ au premier trimestre 2024, mais ont augmenté par rapport à 497 549 $ au deuxième trimestre 2023. Les revenus proviennent principalement de la gestion du portefeuille de baux existant. La perte d'EBITDA ajusté a diminué par rapport à la baisse des revenus. Les frais d'exploitation sont restés constants grâce aux initiatives de gestion des coûts. La liquidité disponible au 30 juin 2024 était de 2 220 567 $, en hausse par rapport à 1 934 209 $ au 31 mars 2024. Le solde de trésorerie inclut les encaissements des locataires. PowerBand a programmé son Assemblée générale annuelle et sa réunion spéciale pour le 18 septembre 2024 à 11h00 EDT.

PowerBand Solutions (TSXV:PBX)(OTC PINK:PWWBF) hat seine finanziellen Ergebnisse für das zweite Quartal 2024 veröffentlicht. Der Umsatz sank auf $542,166 gegenüber $627,332 im ersten Quartal 2024, stieg jedoch im Vergleich zu $497,549 im zweiten Quartal 2023. Der Umsatz stammt hauptsächlich aus der Betreuung des bestehenden Leasingportfolios. Der Verlust des bereinigten EBITDA verringerte sich im Verhältnis zum Umsatzrückgang. Die Betriebskosten blieben konstant dank von Kostenmanagementmaßnahmen. Der Bargeldbestand am 30. Juni 2024 betrug $2,220,567, ein Anstieg von $1,934,209 am 31. März 2024. Der Bargeldbestand umfasst die Zahlungen von den Leasingnehmern. PowerBand hat seine Jahreshauptversammlung und Sonderversammlung für den 18. September 2024 um 11:00 Uhr EDT angesetzt.

- Increased revenue compared to Q2 2023

- Consistent operating expenses due to cost management initiatives

- Increased cash on hand from $1,934,209 to $2,220,567 quarter-over-quarter

- Decreased revenue from $627,332 in Q1 2024 to $542,166 in Q2 2024

- Adjusted EBITDA loss reported for Q2 2024

TORONTO, ON / ACCESSWIRE / August 21, 2024 / PowerBand Solutions (TSXV:PBX)(OTC PINK:PWWBF)(Frankfurt:1ZVA) ("PowerBand" "PBX" or the "Company"), a comprehensive e-commerce solution transforming the online experience to lease and finance vehicles, is announcing that it has filed its Interim Consolidated Financial Statements and Management's Discussion and Analysis report for the three and six-month periods ended June 30, 2024. These documents may be viewed under the Company's profile at www.sedarplus.ca.

Revenue for the second quarter of 2024 decreased to

Cash on hand as at June 30, 2024 was

The Company has scheduled the Annual General and Special Meeting of shareholders for September 18th, 2024 at 11:00am EDT.

About PowerBand Solutions, Inc.

PowerBand Solutions Inc., listed on the TSX Venture Exchange and the OTC PINK, and Frankfurt markets, is a fintech provider disrupting the automotive industry. PowerBand's integrated, cloud-based transaction platform facilitates transactions amongst consumers, dealers, and funders. PowerBand's transaction platform is being made available across the United States of America.

For further information, please contact:

Shibu Abraham

Chief Financial Officer and Director

E: info@powerbandsolutions.com

P: 1-866-768-7653

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this news release.

Non-IFRS Measures:

This news release contains non-IFRS financial measures; the Company believes that these measures provide investors with useful supplemental information about the financial performance of its business, enable comparison of financial results between periods where certain items may vary independent of business performance, and allow for greater transparency with respect to key metrics used by management in operating its business. Although management believes these financial measures are important in evaluating the Company's performance, they are not intended to be considered in isolation or as a substitute for, or superior to, financial information prepared and presented in accordance with IFRS. These non-IFRS financial measures do not have any standardized meaning and may not be comparable with similar measures used by other companies. For certain non-IFRS financial measures, there are no directly comparable amounts under IFRS. These non-IFRS financial measures should not be viewed as alternatives to measures of financial performance determined in accordance withIFRS. Moreover, presentation of certain of these measures is provided for year-over-year comparison purposes, and investors should be cautioned that the effect of the adjustments thereto provided herein have an actual effect on the Company's operating results.

FORWARD-LOOKING STATEMENTS

This news release contains forward-looking statements relating to the Company and other statements that are not historical facts. Forward-looking statements are often identified by terms such as "will", "may", "should", "anticipate", "expects" and similar expressions. All statements other than statements of historical fact, included in this release, including, without limitation, statements regarding future plans and objectives of the Company, are forward looking statements that involve risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements.

The reader is cautioned that assumptions used in the preparation of any forward-looking information may prove to be incorrect. Events or circumstances may cause actual results to differ materially from those predicted, as a result of numerous known and unknown risks, uncertainties, and other factors, many of which are beyond the control of the Company. As a result, we cannot guarantee that any forward-looking statement will materialize, and the reader is cautioned not to place undue reliance on any forward-looking information. Such information, although considered reasonable by management at the time of preparation, may prove to be incorrect and actual results may differ materially from those anticipated.

Forward-looking statements contained in this news release are expressly qualified by this cautionary statement. The forward-looking statements contained in this news release are made as at the date of this news release, and the Company does not undertake any obligation to update publicly or to revise any of the included forward-looking statements, whether as a result of new information, future events or otherwise, except as expressly required by Canadian securities law.

This press release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act") or any state securities laws and may not be offered or sold within the United States unless registered under the U.S. Securities Act and applicable state securities laws, unless an exemption from such registration is available.

SOURCE: PowerBand Solutions Inc.

View the original press release on accesswire.com