Retirement Confidence for American Workers Has Been Low Since 2022, According to New PGIM RetireWell™ Confidence Index

- None.

- None.

PGIM also finds individuals approaching retirement had lowest average retirement confidence scores in Q4 2023

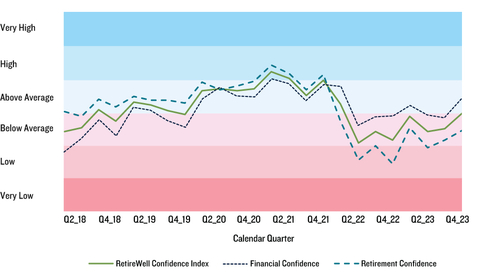

PGIM RetireWell Confidence Index: Using the Prudential financial wellness assessment, the current question used to estimate financial confidence asks respondents, “Overall, how are you feeling about your finances?” while the retirement confidence question asks, “Do you think you’ll have enough savings for the retirement you want?” The PGIM RetireWell Confidence Index is the average of the financial confidence score and the retirement confidence score. (Graphic: Business Wire)

The 2022 dive in retirement confidence coincides with the start of one of the most turbulent years for investors, with the S&P 500 index losing approximately

“2022 was a relatively traumatic year for investors, where both stocks and bonds experienced double-digit losses. This is incredibly rare, historically,” explains David Blanchett, PGIM DC Solutions portfolio manager and head of retirement research. “If the economy keeps doing relatively well, I wouldn’t be surprised if financial confidence meets or exceeds 2021 levels at some point in 2024, but it will clearly take some time before retirement confidence returns to where it was.”

PGIM’s quarterly report provides a breakdown of retirement and financial confidence scores across age and household income levels, ranging from 0 (low confidence) to 100 (high confidence). Alarmingly, individuals between 45 and 59 years of age, those approaching retirement, had the lowest average retirement confidence score (37) among age groups. This emphasizes the importance of personalization when it comes to financial advice and retirement solutions, as age alone often doesn’t tell the full story.

Michael Miller, head of PGIM DC Solutions, added, “We see the PGIM RetireWell Confidence Index as a value-add for employers who want a better understanding of how American workers are thinking and feeling about retirement and their finances in general. Our goal is to offer this wellness assessment more broadly, so that we can provide companies with plan-level insights to improve financial wellness over time.”

The PGIM RetireWell Confidence Index is part of PGIM RetireWell™ Solutions, a suite of tools, products and solutions developed to help defined contribution plan participants achieve better retirement outcomes through holistic advice and guidance.

About the PGIM RetireWell™ Confidence Index

The PGIM RetireWell™ Confidence Index is a comprehensive wellness sentiment index based on more than 300,000 completed responses to a financial wellness assessment survey offered by Prudential Financial, Inc. through a group insurance benefits platform or through a defined contribution plan since 2018. The index, updated on a quarterly basis, considers both financial confidence and retirement confidence to develop the overall index score. Please see the methodology overview for more detail.

ABOUT PGIM DC SOLUTIONS

As the retirement solutions provider of PGIM, PGIM DC Solutions seeks to deliver innovative defined contribution solutions founded on market leading research and capabilities. Our highly experienced team partners with clients on customized solutions to solve for retirement income. As of Sept. 30, 2023, PGIM has

ABOUT PGIM

PGIM, the global asset management business of Prudential Financial, Inc. (NYSE: PRU), is a leading global investment manager with more than

Prudential Financial, Inc. (PFI) of

1 The term PGIM as used in this announcement includes PGIM DC Solutions LLC.

The PGIM RetireWell™ Confidence Index is not an investable index. While the Index was launched as of Q2 2023, PGIM DC Solutions used historical data to calculate prior Confidence Index levels.

The index is based on over 300,000 completed financial wellness assessments offered by Prudential Financial, Inc. for American workers who typically have access to a defined contribution plan. The Index controls for the demographic factors related to confidence, such as age, income, gender, and marital status, and provides context as to how sentiment has evolved over time. There are six potential confidence levels, which are (from best to worst): Very High, High, Above Average, Below Average, Low, and Very Low.

All investments involve risk, including the possible loss of capital. Asset allocation, diversification, dollar-cost averaging and/or rebalancing do not ensure a profit or protect against loss.

The information presented is for informational purposes only and is not intended as investment advice and is not a recommendation about managing or investing retirement savings. These materials do not take into account individual investment objectives or financial situations. These materials are for informational, illustrative and educational purposes only.

PGIM DC Solutions LLC ("PGIM DC Solutions") is an SEC-registered investment adviser, a

PGIM DC Solutions aims to help participants achieve their retirement goals through their suite of “PGIM RetireWell™” solutions. These solutions may include a range of investment options including target date portfolios, retirement spending strategies, and managed accounts powered by our proprietary advice engine. There is no guarantee that investment or retirement goals will be achieved. Use of the term “RetireWell” and any related phrase is not intended to indicate that such goals will be achieved.

© 2024 Prudential Financial, Inc. and its related entities. Prudential, the Rock symbol, and the PGIM logo are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.

CONNECT WITH US:

Visit pgim.com

Join the conversation @PGIM

PGIM DCS – 3367175

View source version on businesswire.com: https://www.businesswire.com/news/home/20240205887895/en/

Kylie Scott

+1 973 902 2503

kylie.scott@pgim.com

Source: PGIM