Prime Reports Significantly Expanded Gold and Silver Mineral Resource with Exceptional Upside Potential at its Los Reyes Property

Prime Mining Corp. (TSX: PRYM) (OTCQX: PRMNF) has reported a significant expansion in its 2024 Mineral Resource Estimate (MRE) for the Los Reyes Project in Mexico. Indicated Resources have increased 49% to 2.2 million gold-equivalent ounces (AuEq), while Inferred Resources have grown 11% to 0.8 million AuEq ozs. The update includes new high-grade underground resources, validating the company's strategy for a high-recovery, high-margin milling operation.

Key highlights include:

- Milled Indicated Resources grew 48% to 1.93 million AuEq ozs at 2.08 g/t AuEq

- Milled Inferred Resources increased 19% to 0.74 million AuEq ozs at 2.05 g/t AuEq

- The MRE is based on 240,172 metres of drilling, with Prime's discovery cost at just over $US 20 per Resource ounce added

- Significant upside potential remains as mineralization is open along strike and at depth

The updated MRE demonstrates the project's potential for both open-pit and underground mining operations, with ongoing exploration targeting further resource expansion.

Prime Mining Corp. (TSX: PRYM) (OTCQX: PRMNF) ha riportato un'espansione significativa nella sua Stima delle Risorse Minerarie 2024 (MRE) per il Progetto Los Reyes in Messico. Le Risorse Indicate sono aumentate del 49% a 2,2 milioni di once equivalenti d'oro (AuEq), mentre le Risorse Inferite sono cresciute dell'11% a 0,8 milioni di once AuEq. L'aggiornamento comprende nuove risorse sotterranee ad alto grado, convalidando la strategia dell'azienda per un'operazione di frantumazione ad alta recupero e margine elevato.

I principali punti salienti includono:

- Le Risorse Indicate lavorate sono cresciute del 48% a 1,93 milioni di once AuEq a 2,08 g/t AuEq

- Le Risorse Inferite lavorate sono aumentate del 19% a 0,74 milioni di once AuEq a 2,05 g/t AuEq

- La MRE si basa su 240.172 metri di perforazione, con il costo di scoperta di Prime che si attesta poco oltre i 20 dollari USA per oncia di Risorsa aggiunta

- Rimane un potenziale significativo poiché la mineralizzazione è aperta lungo il strike e in profondità

La MRE aggiornata dimostra il potenziale del progetto per operazioni minerarie sia a cielo aperto che sotterranee, con esplorazioni in corso che mirano a ulteriori espansioni delle risorse.

Prime Mining Corp. (TSX: PRYM) (OTCQX: PRMNF) ha informado sobre una expansión significativa en su Estimación de Recursos Minerales 2024 (MRE) para el Proyecto Los Reyes en México. Los Recursos Indicados han aumentado un 49% a 2.2 millones de onzas equivalentes de oro (AuEq), mientras que los Recursos Inferidos han crecido un 11% a 0.8 millones de onzas AuEq. La actualización incluye nuevos recursos subterráneos de alta ley, validando la estrategia de la empresa para una operación de molienda de alto rendimiento y alto margen.

Los aspectos más destacados incluyen:

- Los Recursos Indicados procesados crecieron un 48% a 1.93 millones de onzas AuEq a 2.08 g/t AuEq

- Los Recursos Inferidos procesados aumentaron un 19% a 0.74 millones de onzas AuEq a 2.05 g/t AuEq

- La MRE se basa en 240,172 metros de perforación, con un costo de descubrimiento de Prime de poco más de 20 dólares estadounidenses por onza de recurso añadida

- Permanece un potencial significativo ya que la mineralización está abierta a lo largo del strike y en profundidad

La MRE actualizada demuestra el potencial del proyecto tanto para operaciones mineras a cielo abierto como subterráneas, con una exploración en curso que apunta a una mayor expansión de recursos.

프라임 마이닝 코퍼레이션(TSX: PRYM) (OTCQX: PRMNF)은 멕시코 로스 레예스 프로젝트에 대한 2024년 광물 자원 추정(MRE)의 중요한 확장을 보고했습니다. 지시 자원은 49% 증가하여 220만 금Equivalent 온스로 늘어났습니다(AuEq), 한편 추정 자원은 11% 증가하여 80만 AuEq 온스로 성장했습니다. 이번 업데이트는 고 등급의 지하 자원을 포함하여 회사의 고회수, 고마진 밀링 운영 전략을 검증합니다.

주요 하이라이트는 다음과 같습니다:

- 가공된 지시 자원은 48% 증가하여 193만 AuEq 온스, 2.08 g/t AuEq입니다.

- 가공된 추정 자원은 19% 증가하여 74만 AuEq 온스, 2.05 g/t AuEq입니다.

- MRE는 240,172미터의 시추 기반이며, 프라임의 발견 비용은 추가된 자원 온스당 약 20달러입니다.

- 광물화는 스트라이크에 따라 개방되어 있으며, 깊이에서 여전히 상당한 상승 잠재력이 있습니다.

업데이트된 MRE는 프로젝트의 노천 및 지하 채굴 운영 잠재력을 보여주며, 지속적인 탐사가 자원 확장을 목표로 하고 있습니다.

Prime Mining Corp. (TSX: PRYM) (OTCQX: PRMNF) a signalé une expansion significative de son Estimation des Ressources Minérales 2024 (MRE) pour le Projet Los Reyes au Mexique. Les Ressources Indiquées ont augmenté de 49% pour atteindre 2,2 millions d'onces équivalentes en or (AuEq), tandis que les Ressources Inférées ont crû de 11% pour atteindre 0,8 million d'onces AuEq. La mise à jour inclut de nouvelles ressources souterraines de haute qualité, validant la stratégie de l'entreprise pour une opération de traitement à haut rendement et à forte marge.

Les points saillants incluent :

- Les Ressources Indiquées traitées ont crû de 48% pour atteindre 1,93 million d'onces AuEq à 2,08 g/t AuEq

- Les Ressources Inférées traitées ont augmentées de 19% pour atteindre 0,74 million d'onces AuEq à 2,05 g/t AuEq

- La MRE est basée sur 240 172 mètres de forages, avec un coût de découverte de Prime légèrement supérieur à 20 USD par once de ressource ajoutée

- Un potentiel significatif reste, car la minéralisation est ouverte le long du gisement et en profondeur

La MRE mise à jour démontre le potentiel du projet pour des opérations minières à ciel ouvert et souterraines, avec une exploration en cours visant à une plus grande expansion des ressources.

Die Prime Mining Corp. (TSX: PRYM) (OTCQX: PRMNF) hat eine signifikante Erweiterung ihrer Mineralressourcenschätzung 2024 (MRE) für das Los Reyes-Projekt in Mexiko berichtet. Die angezeigten Ressourcen sind um 49% auf 2,2 Millionen Goldäquivalent-Unzen (AuEq) gestiegen, während die zugeteilten Ressourcen um 11% auf 0,8 Millionen AuEq Unzen gewachsen sind. Das Update umfasst neue hochgradige Untergrundressourcen, die die Strategie des Unternehmens für einen hochgradigen, margenstarken Mühlenbetrieb validieren.

Wichtige Highlights sind:

- Die verarbeiteten angezeigten Ressourcen sind um 48% auf 1,93 Millionen AuEq Unzen bei 2,08 g/t AuEq gewachsen

- Die verarbeiteten zugeteilten Ressourcen sind um 19% auf 0,74 Millionen AuEq Unzen bei 2,05 g/t AuEq gestiegen

- Die MRE basiert auf 240.172 Metern Bohrungen, wobei die Entdeckungskosten von Prime bei etwas über 20 US-Dollar pro hinzugefügter Ressourcunze liegen

- Es bleibt ein erhebliches Aufwärtspotenzial, da die Mineralisierung entlang der Strike und in der Tiefe offen ist

Die aktualisierte MRE zeigt das Potenzial des Projekts für sowohl Tagebau- als auch Untertagebauoperationen, wobei die laufende Exploration auf eine weitere Ressourcenerweiterung abzielt.

- Indicated Resources increased 49% to 2.2 million gold-equivalent ounces

- Inferred Resources grew 11% to 0.8 million gold-equivalent ounces

- Milled Indicated Resources expanded 48% to 1.93 million AuEq ozs at 2.08 g/t AuEq

- Milled Inferred Resources increased 19% to 0.74 million AuEq ozs at 2.05 g/t AuEq

- Low discovery cost of just over $US 20 per Resource ounce added

- Addition of high-grade underground resources

- Improved gold recoveries from 93% to 95.6% based on metallurgical test work

- None.

Growth Driven by the Addition of High-Grade Underground Resources

VANCOUVER, British Columbia, Oct. 15, 2024 (GLOBE NEWSWIRE) -- Prime Mining Corp. (“Prime” or the “Company”) (TSX: PRYM) (OTCQX: PRMNF) (Frankfurt: 04V3) is reporting significant open pit expansion and new underground resources in its 2024 Mineral Resource Estimate (“MRE”) at the Company’s Los Reyes Project (the “Project”), located within the prolific Sierra Madre gold-silver belt in the state of Sinaloa, Mexico. These results reflect drilling up to July 17, 2024. The MRE was prepared by John Sims CPG (an Independent Qualified Person), President of Sims Resources LLC.

Resource Highlights:

- Indicated Resources have increased

49% to 2.2 million gold-equivalent ounces (“AuEq1”) and Inferred Resources have increased11% to 0.8 million AuEq ozs compared to the May 2023 MRE. - Substantial resource growth from higher-grade open pit and underground zones, validating the Company’s strategy of targeting a high-recovery, high-margin milling operation.

- Milled Indicated Resources have grown

48% to 1.93 million AuEq ozs at 2.08 g/t AuEq. - Milled Inferred Resources have grown

19% to 0.74 million AuEq ozs at 2.05 g/t AuEq.

- Milled Indicated Resources have grown

- Technical de-risking included in the updated MRE includes both higher gold recoveries based on extensive metallurgical test work and geotechnical parameter updates.

- The 2024 MRE includes an additional 86,650 metres drilled by Prime since the cutoff of the May 2023 MRE. In total, the 2024 MRE is based on 240,172 metres of drilling, of which Prime has drilled 191,451 metres. Prime’s discovery cost is just over $US 20 per Resource ounce added since acquisition.

- Considerable upside potential: mineralization at Los Reyes remains open along strike and at depth, with the ongoing drill program targeting high-grade mineralization along both the northwest and southeast extensions of the Z-T Trend, the southeast extension of the Guadalupe and Central Trends, as well as emerging Generative Areas.

Chief Executive Officer, Scott Hicks commented, “We are pleased to announce this significant Resource update on the high-grade gold-silver Los Reyes project. And, we are particularly excited to announce the addition of a high-grade underground resource at Los Reyes. With this update, we have demonstrated significant underground and open pit optionality. The new Resource demonstrates the potential for a high-grade, high-quality milling operation at Los Reyes. Given the impressive results from our drilling campaign since our May, 2023 resource statement, we are also able to highlight the potential of Los Reyes as an underground-only mine: if mined exclusively by underground, we have defined over 1 million gold-equivalent Indicated ounces at just over 4 g/t gold-equivalent and almost 1 million Inferred ounces at well over 3 g/t gold-equivalent (Table 3). The Company will continue its well-funded ‘success-based’ exploration approach with high confidence in further expansion of the resource – both open pit and underground – as all major trends remain open along strike and at depth.”

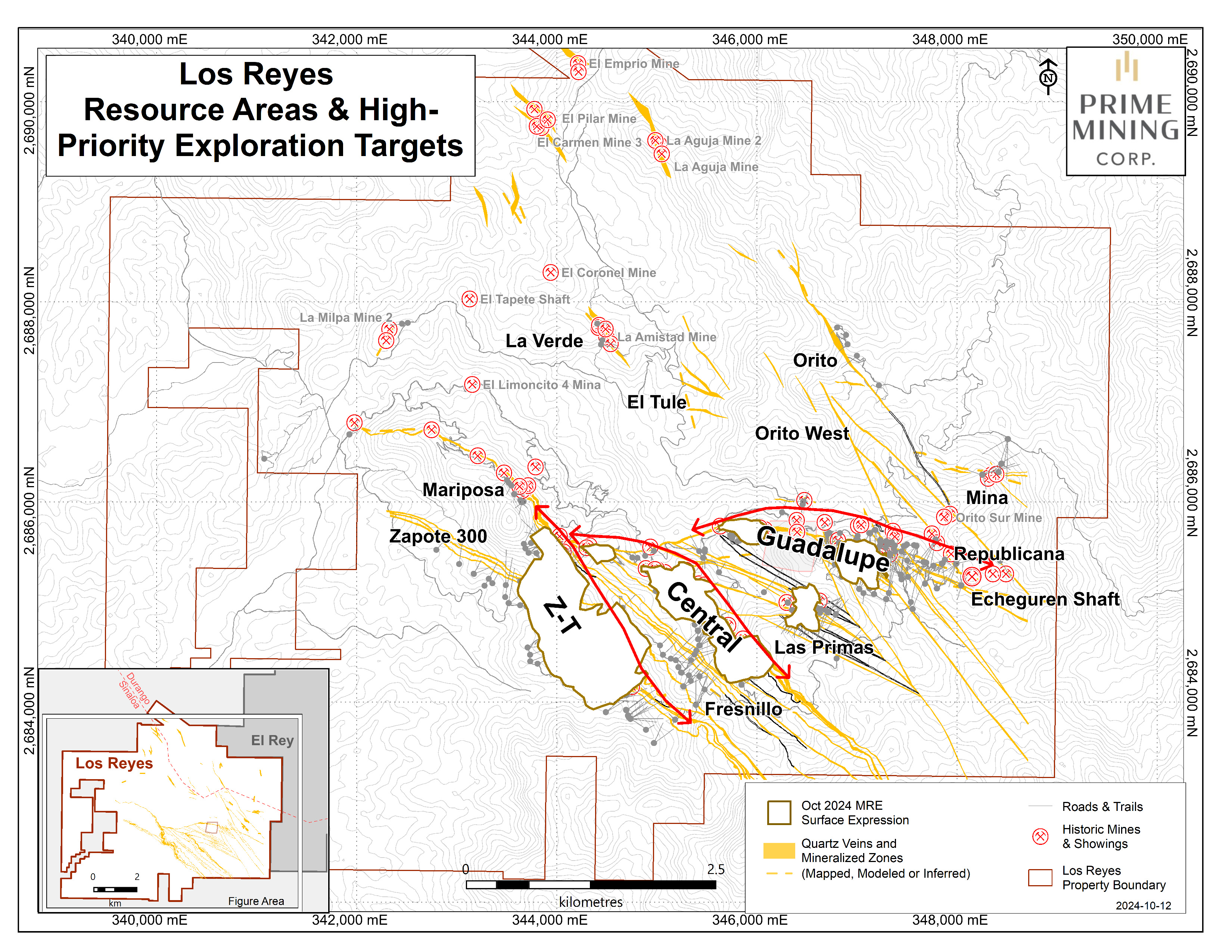

Scott Smith, Executive Vice President of Exploration, added: “Today’s update quantifies the excellent results of expansion drilling along our three known resource trends, but also highlights three ‘Generative Areas’, Las Primas, Mariposa and Fresnillo, which were not included in our past resource and which remain open in most directions. Ongoing drilling will continue to focus on discovering additional economic ounces across the property with many kilometres of mapped host structures that remain undrilled, as well as high-priority targets that could represent new discoveries within the prolific Los Reyes system (Figure 5). Since the July 17, 2024 drilling cutoff date for this MRE, we have completed an additional 9,000 m to-date across the property.”

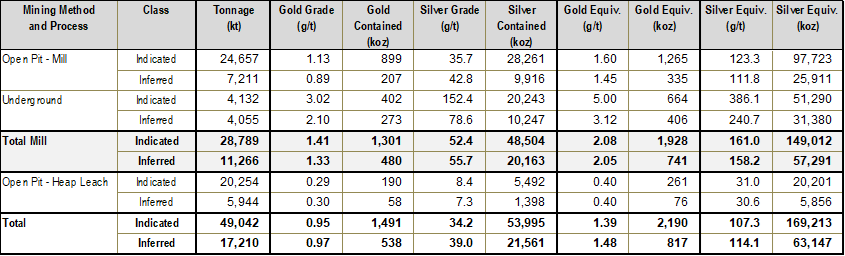

Key Details of the MRE:

Open-Pit Milled Indicated and Inferred Resources have grown to 1.27 million ounces gold-equivalent (“AuEq”) (24.7 million tonnes at 1.60 g/t AuEq) and 335,000 ounces AuEq (7.2 million tonnes at 1.45 g/t AuEq), respectively.

New Underground Milled Indicated and Inferred Resources of 664,000 ounces AuEq (4.1 million tonnes at 5.00 g/t AuEq) and 406,000 ounces AuEq (4.1 million tonnes at 3.12 g/t AuEq), respectively.

Open Pit Heap Leach Indicated and Inferred Resources have grown to 261,000 ounces AuEq (20.3 million tonnes at 0.40 g/t AuEq) and 76,000 ounces AuEq (5.9 million tonnes at 0.40 g/t AuEq), respectively.

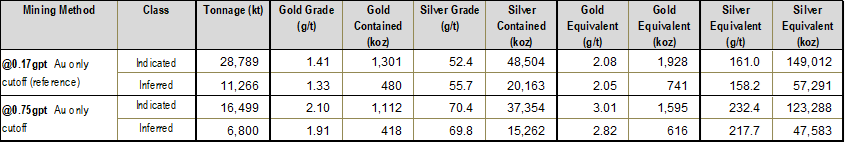

Table 1 – 2024 Resource Estimate

(

Resource Discussion

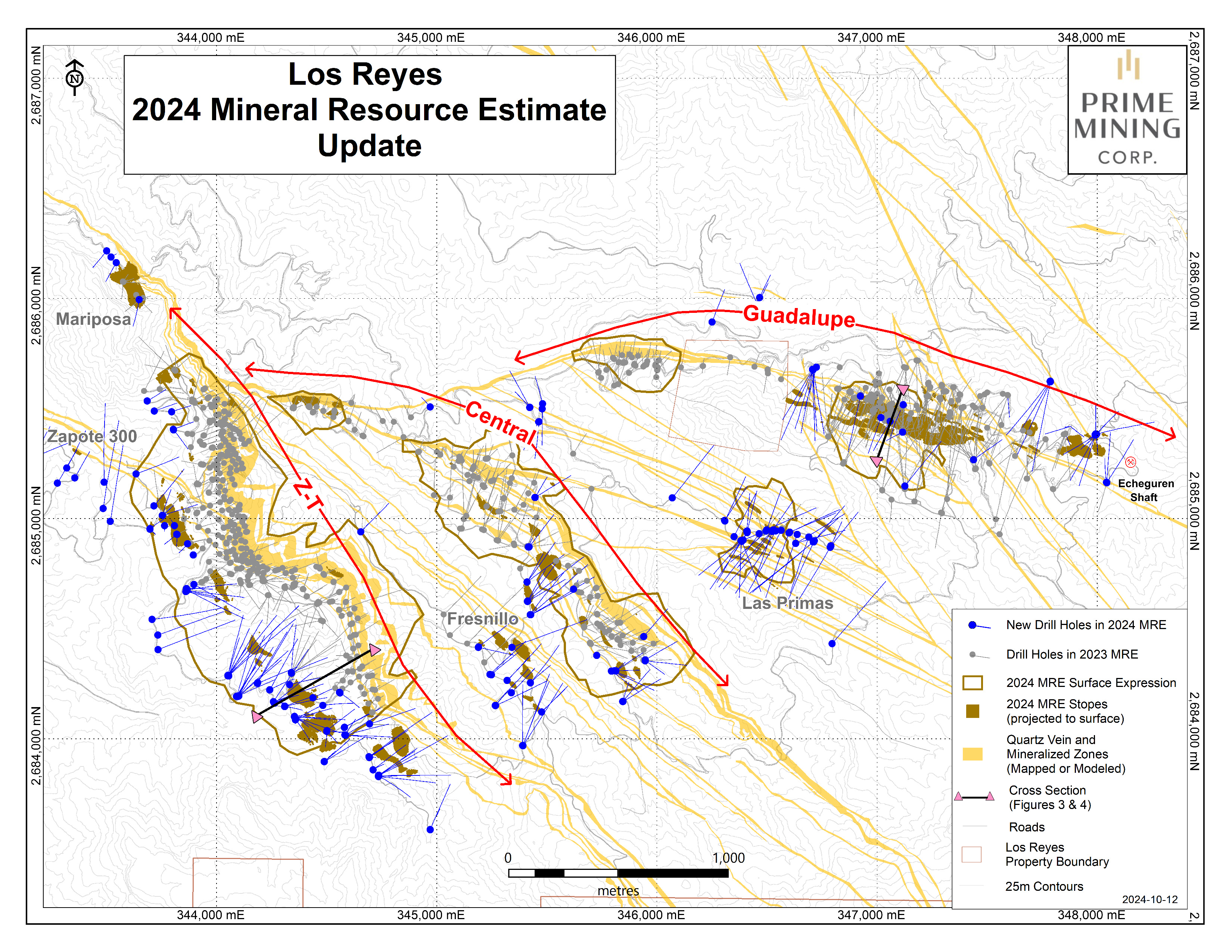

The Los Reyes Resource is hosted within low-sulfidation epithermal ‘horsetail’ structures containing significant gold and silver. The current MRE is contained within three major Trends and several ‘Generative Targets’ that have been recently drilled and were not included in last year’s resource estimate (see Figure 1 and Table 2).

- Z-T Trend (Zapote North, Zapote South and Tahonitas Areas)

- Guadalupe Trend (Guadalupe East and West Areas)

- Central Trend (San Miguel West, San Miguel East and Noche Buena Areas)

- Generative Areas

- Las Primas – recently drilled discovery between Guadalupe and Central

- Mariposa – northwest, and along strike in the Z-T Trend

- Fresnillo – recently drilled discovery area between Z-T and Central

The Company believes there is still tremendous potential for expansion of the three main Trends and Generative Targets within the current zones, along strike and down-dip, in addition to the under-explored north and northeast areas of the Los Reyes property (Figure 5). Exploration drilling continues across the property.

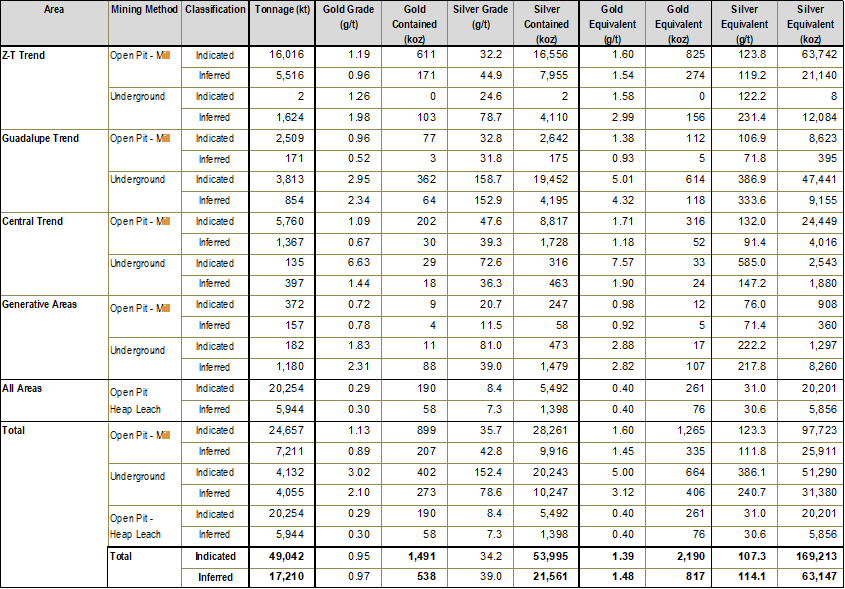

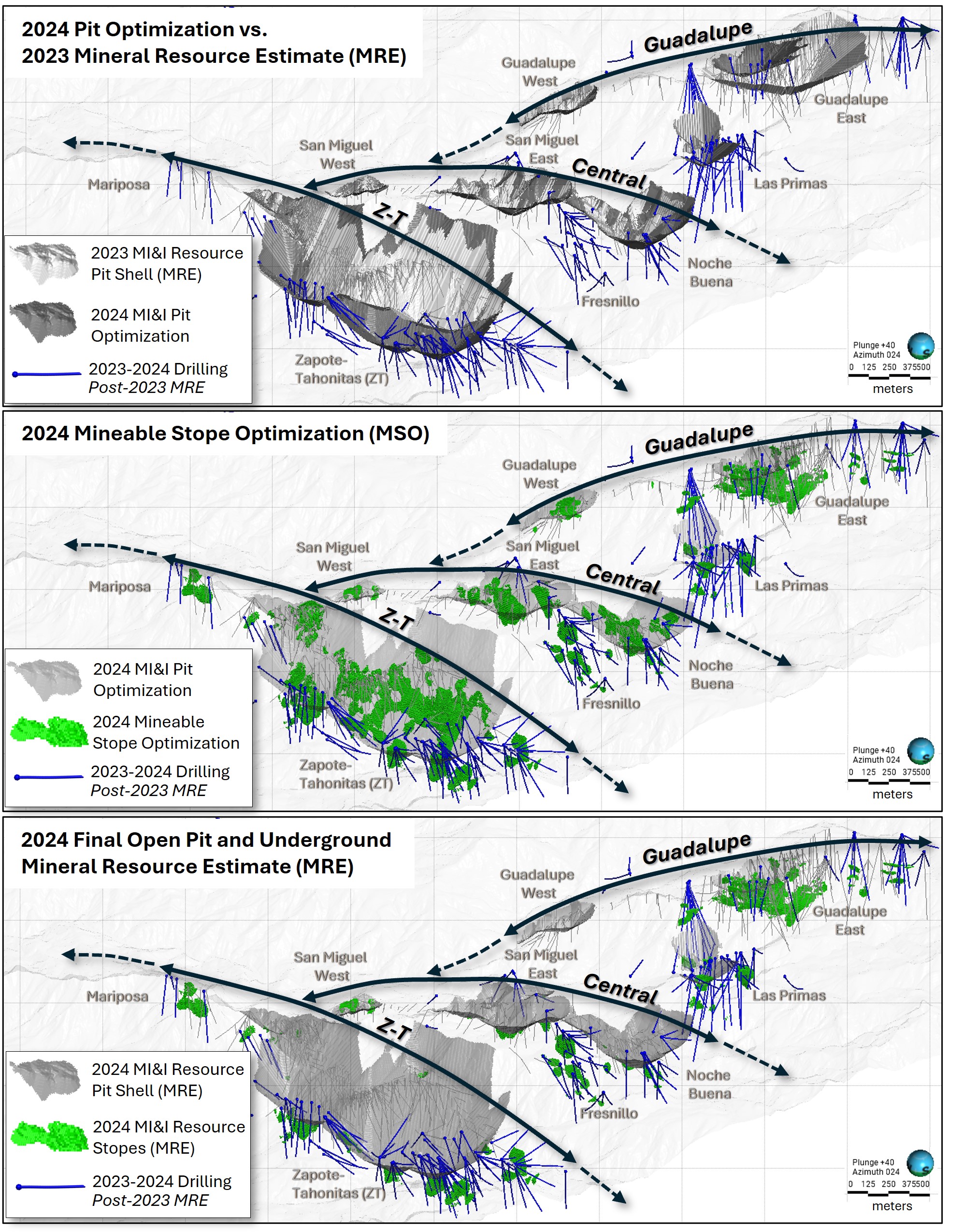

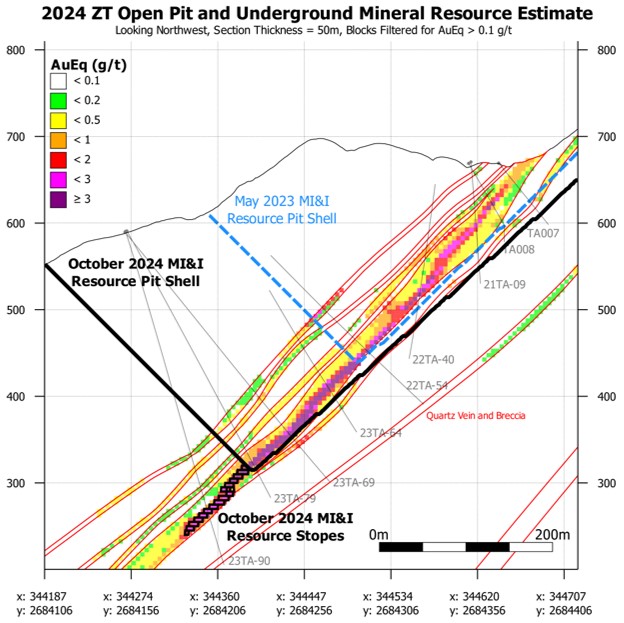

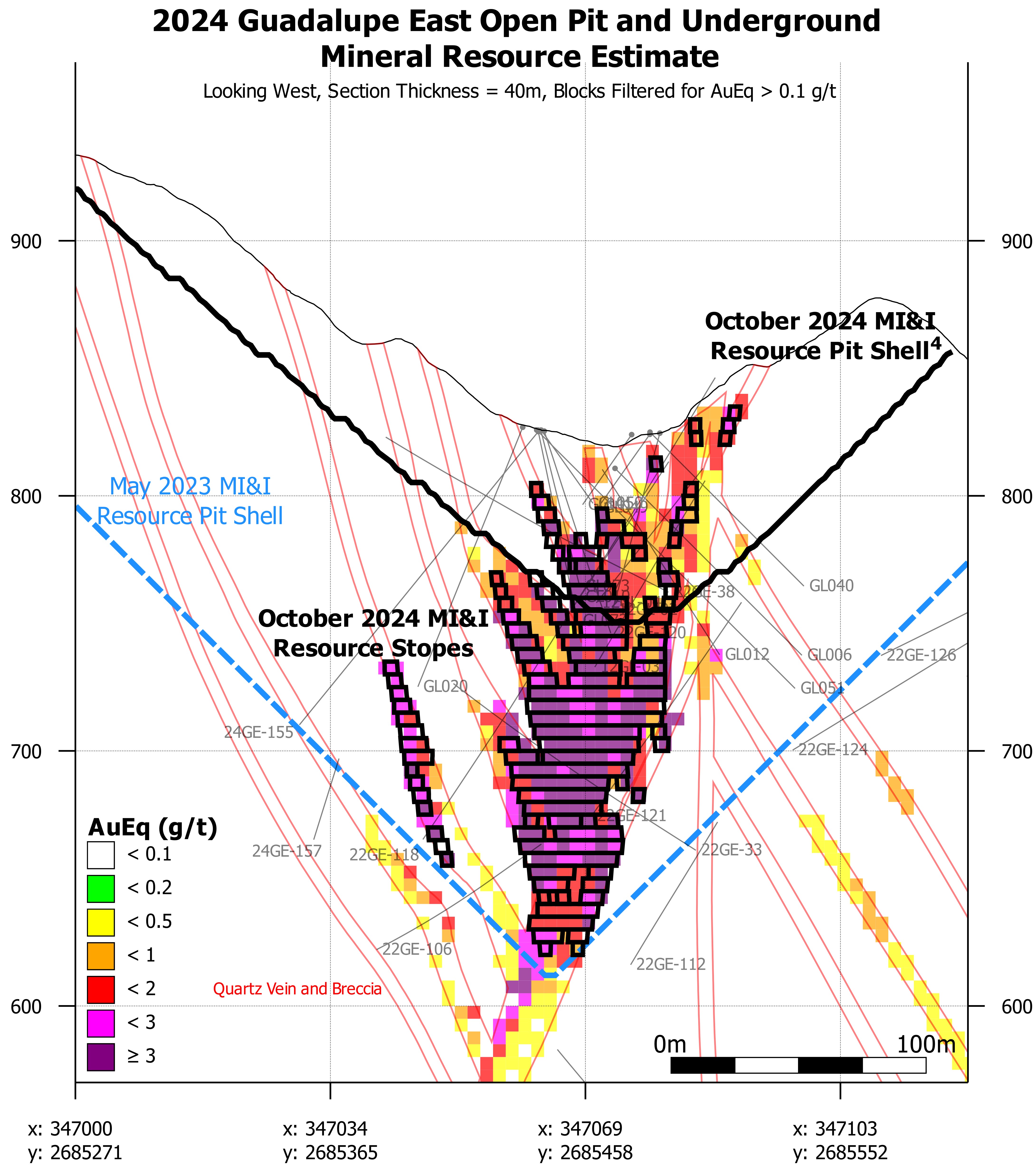

Los Reyes contains a high-grade core that, due to its grades, vein widths and continuity, can be mined by either open pit or underground methods. The updated Resource statement reflects a mixed approach that considers open pit versus underground mining on an area-by-area basis (Figure 2). For example, in the Z-T area, it is assumed that the majority of the ounces are mined by open pit, and that the remnant ounces are mined underground (see Figure 3). For the Guadalupe East area, within the Guadalupe Trend, the opposite is assumed – underground mining ounces are prioritized and residual ounces are mined within an economic residual pit4 (see Figure 4).

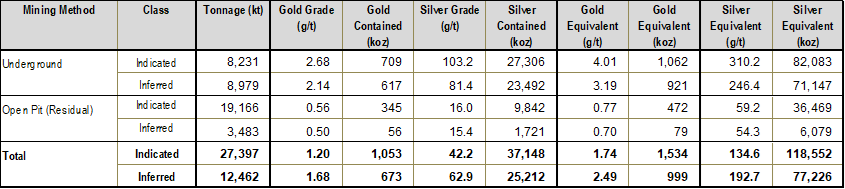

Table 3 demonstrates a sensitivity at Los Reyes that prioritizes underground economic stope shapes and then considers only the residual economic pits4 that remain. This optionality provides significant flexibility to ensure multiple mining faces and mining approaches, and can provide cost-effective optimization of future mine plans, including operational flexibility in regard to mining sequence and permitting.

To illustrate the high-grade core of the Los Reyes Resource, Table 4 shows the total mill inventories using the open pit resource Au only cutoff (of 0.17 g/t) and a sensitivity at an inflated 0.75 g/t Au only cutoff (for open pit material only). This sensitivity illustrates that at this elevated cutoff, the inventory grade would increase by almost

All reported Resource ounces are contained within economically constrained pits or underground stope shapes. Geotechnical parameters for open pit slope angles and stope dimension considerations were provided by Knight Piésold following their review of core photos and geotechnical logging.

Kappes Cassiday & Associates has provided a full review of current and past engineering metallurgical testwork and provided the recovery estimates along with benchmarked processing cost estimates for milling and heap leaching in the Resource constraints 2. Prime and previous owners have performed significant gravity, flotation and leach testing, including over 250 bottle roll tests across the three main resource trends. Results indicate strong gold recoveries across the property, especially in mill crush/grind sized samples where assumed average gold recoveries have increased from

MRE block models were constructed and classified using a drilling cut-off date of July 17, 2024. Open pit estimation was based on 5 x 5 x 5 m selective mining unit (SMU) models and the underground estimate used the Mineable Stope Optimizer algorithm on 2.5 x 2.5 x 2.5 m block models. The selected interpolation methodology for gold and silver in all block models was Inverse Distance Cubed (ID^3). Interpolation and resource classification confidence was based on approximately 191,451 m of drilling completed by Prime and 48,721 m by previous owners. Over

As part of this release, Prime is reporting 21 drill holes (8,110 m of assayed drill results) not previously released that were incorporated into the 2024 MRE (see link to Table 5 below).

This MRE was completed under the supervision of John Sims, a member of the American Institute of Professional Geologists since 2004, an ‘Independent Qualified Person’ as defined by NI 43-101 guidelines, with over 35 years of related experience. Prime will file a NI 43-101 compliant updated Technical Report in support of this resource within 45 days of this release.

Figure 1 –Resource Areas and MRE Drilling

Table 2 – 2024 Resource Estimate by Area

(

Underground Sensitivity3

The Los Reyes project is also amenable to a more substantial underground mining approach. In the following sensitivity table, Los Reyes is assumed to be mined by underground methods, backfilled, and then economically-constrained residual open pits4 are estimated at a 0.17 g/t Au only cutoff.

Table 3 – Sensitivity: Underground Mining Prioritized Scenario

(

Mill Only Cut-off Grade Sensitivity3

The following table illustrates the mill only open pit and underground economic inventories using an open-pit Au only cutoff grade of 0.17 g/t (Resource cutoff for reference) and a higher-grade cutoff of 0.75 g/t (Au only).

Table 4 – Sensitivity: Mill Only at Various Cutoff Grades

(

Figure 2 –Northeast View of Los Reyes Indicating Resource Pits and Stopes

Figure 3 – Cross-section of Z-T (Tahonitas) Area Illustrating Open Pit and Underground Resource Shapes

Figure 4 – Cross-section of Guadalupe East Area Illustrating Open Pit and Underground Resources Shapes

Figure 5 –Current Resource Areas and High-Priority Exploration Target Locations

Discovery Costs

To date, the Company has incurred approximately $CAD 55M in direct exploration expenditures since acquiring the property in 2019. This equates to an estimated discovery cost over the past four years of just over $US 20 per gold equivalent ounce for resources defined up to the cutoff date of July 17, 2024 for this MRE.

2024 Exploration Outlook

Given the results from Prime’s success-based drilling program at mid-year, the Company approved the expansion of its fiscal 2024 program to 50,000m from 40,000m. The drill program will continue to be evaluated according to this success-based approach. This evaluation will also include prioritization of targets based on probability of resource development and generative area discovery potential.

Five drill rigs are currently active on site at Los Reyes, with 2024 exploration focused on:

- Extending the high-grade Z-T Area shoots that remain open at depth, as well as along strike, both northwest and southeast.

- Expanding the known high-grade mineralization at Guadalupe East.

- Increasing the Central Area resource through additions at Noche Buena and its connection to San Miguel East.

- Generative target drilling of high-grade intercepts at Las Primas, Mariposa, Fresnillo, Mina and other targets to further develop the resource potential at Los Reyes.

Next Steps

With the resource areas remaining open along strike and at depth, and multiple high-priority Generative Areas with discovery potential, Prime will continue with its increased 50,000m exploration drilling plan at Los Reyes in 2024. Work will also continue on technical de-risking including metallurgical testwork, geotechnical assessments, mine and processing stream optimization and trade-offs, environmental studies, permit planning, community relations and stakeholder engagement.

Links to Figures:

- Figure 1 – Resource Areas and MRE Drilling

- Figure 2 – Northeast View of Los Reyes Indicating Resource Pits and Stopes

- Figure 3 – Cross-section of Z-T (Tahonitas) Area Illustrating Open Pit and Underground Resource Shapes

- Figure 4 – Cross-section of Guadalupe East Area Illustrating Open Pit and Underground Resources Shapes

- Figure 5 – Current Resource Areas and High-Priority Exploration Target Locations

Links to Tables:

- Table 1 – 2024 Resource Estimate

- Table 2 – 2024 Resource Estimate by Area

- Table 3 – Sensitivity: Underground Mining Prioritized Scenario

- Table 4 – Sensitivity: Mill Only at Various Cutoff Grades

- Table 5 – Drill Intercepts in this Release

- Table 6 – Drill Intercepts to Date

Notes

- Gold and silver equivalencies are calculated as in-situ contained precious metals, applying the assumed ratio of gold to silver prices using the following formula: AuEq grade (g/t) = Gold grade (g/t) + Silver grade (g/t) x (

$25.24 /$195 0). Silver equivalencies are calculated using the inverse of this ratio. Relative recoveries are not considered in the in-situ contained grade estimate but are stated below and utilized in the resource shell economic pit and Mineable Stope Optimizer constraints. All dollar values are in US dollars unless otherwise stated. - Resource estimates are based on economically constrained open pits and underground stopes using the following optimization parameters (all dollar values are in US dollars):

$1,950 /ounce gold price and$25.24 /ounce silver price.- Mill recoveries of

95.6% and81% for gold and silver, respectively. - Heap leach recoveries of

73% and25% for gold and silver, respectively. - Economically constrained open pit estimates consider:

- pit slopes by area ranging from 42-47 degrees overall slope angle

5% ore loss and5% dilution factor applied to the 5 x 5 x 5m open pit resource block models- Mining costs of

$2.00 per tonne of waste mined and$2.50 per tonne of ore mined - G&A cost of

$2.00 per tonne of material processed - A 0.17 g/t gold only cutoff was applied to ex-pit processed material (which is above the heap-leaching NSR cutoff)

- Mineable Stope Optimizer estimation parameters applied to the 2.5 x 2.5 x 2.5m MSO resource block models:

- Mechanized cut and fill mining with a

$60.00 per tonne cost - Diluted to a minimum 4m stope width with a

98% mining recovery - G&A cost of

$4.00 per tonne of material processed

- Mechanized cut and fill mining with a

- Milling costs of

$16.81 per tonne and heap leaching costs of$5.53 per tonne processed. 3% royalty costs and1% selling costs were also applied.- Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

- This and any other sensitivities presented are in lieu of, and not in addition to the 2024 MRE inventories.

- Where mentioned, “residual open pits” assumes that any underground stopes are backfilled with zero grade material at two-thirds of the original rock density. Economic-constrained open pits are then estimated with this mined-out, backfilled material in the open pit block SMU model and assuming the resource parameters above.

About the Los Reyes Gold and Silver Project

Los Reyes is a rapidly evolving high-grade, low sulphidation epithermal gold-silver project located in Sinaloa State, Mexico. Since acquiring Los Reyes in 2019, Prime has spent over CAD

Exploration is ongoing and suggests that the three known main deposit areas (Guadalupe, Central and Z-T) remain largely open along strike and down dip. Potential also exists for new discoveries where mineralized trends have been identified outside of the currently defined resource areas.

Historic operating results indicate that an estimated 1 million ounces of gold and 60 million ounces of silver were recovered from five separate operations at Los Reyes between 1770 and 1990. Prior to Prime’s acquisition, recent operators of Los Reyes had spent approximately US

QA/QC Protocols and Sampling Procedures

Drill core at the Los Reyes project is drilled in predominately HQ size (63.5 millimetre “mm”), reducing to NQ (47.6 mm) when required. Drill core samples are generally 1.50 m long along the core axis with allowance for shorter intervals if required to suit geological constraints. After logging intervals are identified to be sampled, the core is cut and one half is submitted for assay. RC drilling returns rock chips and fines from a 133.35 mm diameter tricone bit. The returns are homogenized and split into 2 halves, with one half submitted for analysis and the other half stored.

Sample QA/QC measures include unmarked certified reference materials, blanks, and field duplicates as well as preparation duplicates which are inserted into the sample sequence. These make up approximately

Samples are picked up from the Project by the laboratory personnel and transported to their facilities in Durango or Hermosillo Mexico, for sample preparation. Sample analysis is carried out by Bureau Veritas and ALS Labs, with fire assay, including over limits fire assay re-analysis, completed at their respective Hermosillo, Mexico laboratories and multi-element analysis completed in Vancouver, Canada. Drill core sample preparation includes fine crushing of the sample to at least

Gold in the drill core is analyzed by fire assay and atomic absorption spectroscopy of a 30 g sample (code FA430 or Au-AA23). Multi-element chemistry is analyzed by 4-Acid digestion of a 0.25-gram sample split (code MA300 or ME-ICP61) with detection by inductively coupled plasma emission spectrometer for a full suite of elements.

Gold assay techniques FA430 and Au-AA23 have an upper detection limit of 10 ppm. Any sample that produces an over-limit gold value via the initial assay technique is sent for gravimetric finish via method FA-530 or Au-GRA21. Silver analyses by MA300 and ME-ICP61 have an upper limit of 200 ppm and 100 ppm, respectively. Samples with over-limit silver values are re-analyzed by fire assay with gravimetric finish FA530 or Au-GRA21.

Both Bureau Veritas and ALS Labs are ISO/IEC accredited assay laboratories.

Additional Notes

Metres is represented by “m”; “etw” is Estimated True Width and is based on drill hole geometry or comparisons with other on-section drill holes; “Au” refers to gold, and “Ag” refers to silver; “g/t” or “gpt” is grams per metric tonne; “mt” refers to millions of metric tonnes; “kt” refers to thousands of metric tonnes; “oz” or “ozs” refers to troy ounces and “koz” refers to thousands of troy ounces; some figures may not sum due to rounding; Composite assay grades presented in summary tables are calculated using a Au grade minimum average of 0.20 g/t or 1.0 g/t as indicated in “Au Cut-off” column of Summary Tables. Maximum internal waste included in any reported composite interval is 3.00 m. The 1.00 g/t Au cut-off is used to define higher-grade “cores” within the lower-grade halo.

Gold equivalent grades are calculated based on an assumed gold price of US

Qualified Person

Scott Smith, P.Geo., Executive Vice President of Exploration, is a qualified person for the purposes of National Instrument 43-101 and has reviewed and approved the technical content in this news release.

About Prime Mining

Prime is managed by an ideal mix of successful mining executives, strong capital markets personnel and experienced local operators all focused on unlocking the full potential of the Los Reyes Project. The Company has a well-planned capital structure with a strong management team and insider ownership. Prime is targeting a material resource expansion at Los Reyes through a combination of new generative area discoveries and growth, while also building on technical de-risking activities to support eventual project development.

For further information, please visit https://primeminingcorp.ca or direct enquiries to:

Scott Hicks

CEO & Director

Indi Gopinathan

VP Capital Markets & Business Development

Prime Mining Corp.

710 – 1030 West Georgia St.

Vancouver, BC V6E 2Y3 Canada

+1(604) 238-1659

info@primeminingcorp.ca

Cautionary Notes to U.S. Investors Concerning Resource Estimates

This news release has been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of the U.S. securities laws. In particular, and without limiting the generality of the foregoing, the terms “mineral reserve”, “proven mineral reserve”, “probable mineral reserve”, “inferred mineral resources,” “indicated mineral resources,” “measured mineral resources” and “mineral resources” used or referenced in this presentation are Canadian mineral disclosure terms as defined in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) under the guidelines set out in the 2014 Canadian Institute of Mining, Metallurgy and Petroleum Standards for Mineral Resources and Mineral Reserves, Definitions and Guidelines, May 2014 (the “CIM Standards”). The CIM Standards differ from the mineral property disclosure requirements of the U.S. Securities and Exchange Commission (the “SEC”) in Regulation S-K Subpart 1300 (the “SEC Modernization Rules”) under the U.S. Securities Act of 1933, as amended (the “Securities Act”). As a foreign private issuer that is eligible to file reports with the SEC pursuant to the multijurisdictional disclosure system, the Company is not required to provide disclosure on its mineral properties under the SEC Modernization Rules and will continue to provide disclosure under NI 43-101 and the CIM Standards. Accordingly, the Company’s disclosure of mineralization and other technical information may differ significantly from the information that would be disclosed had the Company prepared the information under the standards adopted under the SEC Modernization Rules.

Forward Looking Information

This news release contains certain “forward-looking information” and “forward-looking statements” within the meaning of Canadian securities legislation as may be amended from time to time, including, without limitation, statements regarding the perceived merit of the Company’s properties, including additional exploration potential of Los Reyes, potential quantity and/or grade of minerals, the potential size of the mineralized zone, metallurgical recoveries, and the Company’s exploration and development plans in Mexico. Forward-looking statements are statements that are not historical facts which address events, results, outcomes, or developments that the Company expects to occur. Forward-looking statements are based on the beliefs, estimates and opinions of the Company’s management on the date the statements are made, and they involve several risks and uncertainties. Certain material assumptions regarding such forward-looking statements were made, including without limitation, assumptions regarding the price of gold, silver and copper; the accuracy of mineral resource estimations; that there will be no material adverse change affecting the Company or its properties; that all required approvals will be obtained, including concession renewals and permitting; that political and legal developments will be consistent with current expectations; that currency and exchange rates will be consistent with current levels; and that there will be no significant disruptions affecting the Company or its properties. Consequently, there can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements involve significant known and unknown risks and uncertainties, which could cause actual results to differ materially from those anticipated. These risks include, but are not limited to: risks related to uncertainties inherent in the preparation of mineral resource estimates, including but not limited to changes to the cost assumptions, variations in quantity of mineralized material, grade or recovery rates, changes to geotechnical or hydrogeological considerations, failure of plant, equipment or processes, changes to availability of power or the power rates, ability to maintain social license, changes to interest or tax rates, changes in project parameters, delays and costs inherent to consulting and accommodating rights of local communities, environmental risks, title risks, including concession renewal, commodity price and exchange rate fluctuations, risks relating to COVID-19, delays in or failure to receive access agreements or amended permits, risks inherent in the estimation of mineral resources; and risks associated with executing the Company’s objectives and strategies, including costs and expenses, as well as those risk factors discussed in the Company's most recently filed management's discussion and analysis, as well as its annual information form dated March 25, 2024, available on www.sedarplus.ca. Except as required by the securities disclosure laws and regulations applicable to the Company, the Company undertakes no obligation to update these forward-looking statements if management’s beliefs, estimates or opinions, or other factors, should change.

Infographics accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/c272925a-be45-4121-9695-f55aff2130d3

https://www.globenewswire.com/NewsRoom/AttachmentNg/39d655db-5791-497b-a648-81654bdf8efe

https://www.globenewswire.com/NewsRoom/AttachmentNg/91d6efe4-077c-4df2-8f86-e1d9157cc779

https://www.globenewswire.com/NewsRoom/AttachmentNg/903bd7f5-9325-42b7-bd8a-c6d268bf4463

https://www.globenewswire.com/NewsRoom/AttachmentNg/ef6e6cee-d9eb-4d6b-8583-5374cdc7f991

https://www.globenewswire.com/NewsRoom/AttachmentNg/a6ef298e-11d6-450b-a870-544e2b15b3e6

https://www.globenewswire.com/NewsRoom/AttachmentNg/a593d4d6-c389-4378-b78a-6e04ad76617c

https://www.globenewswire.com/NewsRoom/AttachmentNg/bd3cbb04-d9a3-43a5-abc2-8ac23054806d

https://www.globenewswire.com/NewsRoom/AttachmentNg/e19bfcd9-20e0-4ecf-8832-5d1436d08c4d