SURVEY: Amid growing concern over inflation, Canadians remain positive about finances

Better prepared, those with a financial professional feel more confident about their finances

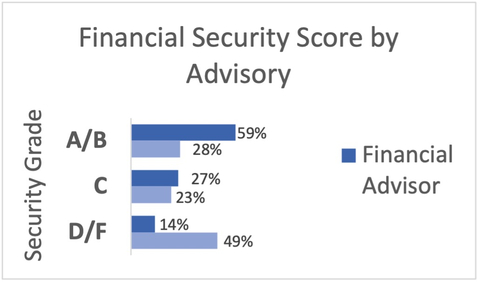

FINANCIAL SECURITY SCORECARD RESPONSES - Scorecard shows the value of professional financial advice. Primerica’s Canadian Monitor graded study participants based on whether they engage in five financial preparedness fundamentals, including saving for their future and protecting what they have through life insurance. The average grade was between B and C. The scorecard found that

The survey found that while nearly two-thirds (

“Canadian families are increasingly feeling the pinch of inflation and our survey data points to the benefits of having access to a financial professional, regardless of income,” said

Key Findings from Primerica’s Financial Security Monitor

-

Positive outlook on savings, negative outlook on future. The majority (

54% ) rate their ability to save for the future positively. However, about two-thirds (65% ) believe they will be worse off financially next year. -

Dipping into savings vs. increasing credit card use. Those with incomes in the

$40,000 $60,000 $60,000 $120,000 -

Online resources not a suitable replacement for in-person guidance. Most Canadians (

52% ) are not comfortable making financial investments in stocks, bonds or mutual funds online without working with a financial professional. In addition, a significant percentage say they’re not comfortable securing a mortgage (39% ) or buying life insurance (37% ) under these circumstances. -

Canadians value financial professionals when it comes to big decisions. When making a major financial move, nearly half (

49% ) would choose to talk with a licensed financial professional, while nearly two-fifths (39% ) would do their own research. Just1% would use a robo-advisor. -

Higher income families more likely to have greater access to financial advice. More than half (

54% ) of Canadians who make more than$80,000 36% ) of those making less than$80,000

“As Canadians mark Financial Literacy Month this November, the results of Primerica’s survey illustrate how middle- and low-income households are increasingly being left behind in today’s market,” continued Adams. “As economic headwinds shift and inflation continues to negatively impact Canadians, those who are less affluent should have access to more resources, not less.”

Scorecard Shows the Value of Professional Financial Advice

Primerica’s Canadian Monitor graded study participants based on whether they engage in five financial preparedness fundamentals, including saving for their future and protecting what they have through life insurance. The average grade was between B and C. The scorecard found that

About Primerica’s Canadian Financial Security Monitor

Using Dynamic Online Sampling,

About

Primerica is a leading provider of financial services to middle-income households in

Primerica insured over 5.7 million lives and had over 2.7 million client investment accounts as of

In Canada, Primerica representatives market term life insurance and segregated funds underwritten by

View source version on businesswire.com: https://www.businesswire.com/news/home/20221109006094/en/

gana.ahn@primerica.com

Source: