National Survey: Middle-Income Americans Grapple With Growing Financial Uncertainty; Inflation Once Again Is Top Concern

Primerica's latest Financial Security Monitor™ (FSM™) reveals increasing financial stress among middle-income Americans, with 62% reporting financial stress, up from 57% in Q4 2024. The survey shows that 46% expect their financial situation to worsen in the coming year, a significant increase from 27% in December 2024.

Key findings include:

- 86% expect food and grocery costs to rise

- 77% anticipate utility cost increases

- 76% predict fuel price increases

- 78% are limiting non-essential purchases

- 52% are considering or already have a second job

- 64% are setting aside emergency funds

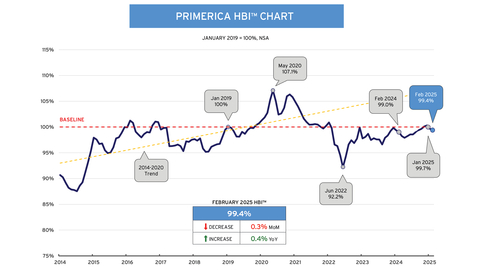

The Primerica Household Budget Index™ (HBI™) indicates a 0.3% drop in purchasing power for necessities in February compared to January, primarily driven by rising costs in car insurance, gasoline, and utilities. The survey also reveals that 53% of respondents expect a tax refund in 2024, with plans to save (38%), pay down debt (32%), or settle outstanding bills (30%).

Il recente Financial Security Monitor™ (FSM™) di Primerica rivela un aumento dello stress finanziario tra gli americani a medio reddito, con il 62% che riporta stress finanziario, in aumento rispetto al 57% nel quarto trimestre del 2024. Il sondaggio mostra che il 46% si aspetta che la propria situazione finanziaria peggiori nel prossimo anno, un aumento significativo rispetto al 27% di dicembre 2024.

Le principali scoperte includono:

- l'86% si aspetta un aumento dei costi per cibo e generi alimentari

- il 77% prevede un aumento dei costi delle utenze

- il 76% prevede un aumento dei prezzi dei carburanti

- il 78% sta limitando gli acquisti non essenziali

- il 52% sta considerando o ha già un secondo lavoro

- il 64% sta mettendo da parte fondi di emergenza

L'indice di bilancio familiare di Primerica™ (HBI™) indica un calo dello 0,3% del potere d'acquisto per le necessità a febbraio rispetto a gennaio, principalmente a causa dell'aumento dei costi per l'assicurazione auto, la benzina e le utenze. Il sondaggio rivela anche che il 53% degli intervistati si aspetta un rimborso fiscale nel 2024, con piani per risparmiare (38%), ridurre i debiti (32%) o saldare bollette in sospeso (30%).

El último Financial Security Monitor™ (FSM™) de Primerica revela un aumento del estrés financiero entre los estadounidenses de ingresos medios, con un 62% reportando estrés financiero, un aumento del 57% en el cuarto trimestre de 2024. La encuesta muestra que el 46% espera que su situación financiera empeore en el próximo año, un aumento significativo del 27% en diciembre de 2024.

Los hallazgos clave incluyen:

- el 86% espera que aumenten los costos de alimentos y comestibles

- el 77% anticipa aumentos en los costos de servicios públicos

- el 76% prevé aumentos en los precios de los combustibles

- el 78% está limitando las compras no esenciales

- el 52% está considerando o ya tiene un segundo trabajo

- el 64% está ahorrando fondos de emergencia

El índice de presupuesto familiar de Primerica™ (HBI™) indica una caída del 0.3% en el poder adquisitivo para necesidades en febrero en comparación con enero, impulsada principalmente por el aumento de costos en seguros de automóviles, gasolina y servicios públicos. La encuesta también revela que el 53% de los encuestados espera un reembolso de impuestos en 2024, con planes de ahorrar (38%), pagar deudas (32%) o liquidar facturas pendientes (30%).

프라이머리카의 최신 재정 안전 모니터™ (FSM™)는 중산층 미국인들 사이에서 재정적 스트레스가 증가하고 있음을 보여줍니다. 62%가 재정적 스트레스를 보고했으며, 이는 2024년 4분기의 57%에서 증가한 수치입니다. 설문 조사에 따르면 46%가 앞으로 1년 내에 재정 상황이 악화될 것으로 예상하고 있으며, 이는 2024년 12월의 27%에서 크게 증가한 것입니다.

주요 발견 사항은 다음과 같습니다:

- 86%가 식료품 및 장보기 비용이 상승할 것으로 예상합니다.

- 77%가 공공요금이 인상될 것으로 예상합니다.

- 76%가 연료 가격 인상을 예측합니다.

- 78%가 비필수 구매를 제한하고 있습니다.

- 52%가 두 번째 직업을 고려하거나 이미 가지고 있습니다.

- 64%가 비상 자금을 마련하고 있습니다.

프라이머리카 가계 예산 지수™ (HBI™)는 2월에 1월 대비 필수품 구매력이 0.3% 감소했음을 나타내며, 이는 주로 자동차 보험, 가솔린 및 공공요금의 상승 비용에 의해 주도되었습니다. 설문 조사에 따르면 응답자의 53%가 2024년에 세금 환급을 받을 것으로 예상하며, 저축(38%), 부채 상환(32%) 또는 미결제 청구서 정산(30%)을 계획하고 있습니다.

Le dernier Financial Security Monitor™ (FSM™) de Primerica révèle une augmentation du stress financier parmi les Américains à revenu moyen, avec 62 % signalant un stress financier, en hausse par rapport à 57 % au quatrième trimestre de 2024. L'enquête montre que 46 % s'attendent à ce que leur situation financière se détériore au cours de l'année à venir, une augmentation significative par rapport à 27 % en décembre 2024.

Les principales conclusions incluent :

- 86 % s'attendent à une augmentation des coûts alimentaires et des courses

- 77 % anticipent une hausse des coûts des services publics

- 76 % prévoient une augmentation des prix des carburants

- 78 % limitent leurs achats non essentiels

- 52 % envisagent ou ont déjà un deuxième emploi

- 64 % mettent de l'argent de côté pour les urgences

L'indice de budget familial de Primerica™ (HBI™) indique une baisse de 0,3 % du pouvoir d'achat pour les nécessités en février par rapport à janvier, principalement en raison de l'augmentation des coûts de l'assurance automobile, de l'essence et des services publics. L'enquête révèle également que 53 % des répondants s'attendent à un remboursement d'impôts en 2024, avec des projets d'épargne (38 %), de remboursement de dettes (32 %) ou de règlement de factures impayées (30 %).

Der aktuelle Financial Security Monitor™ (FSM™) von Primerica zeigt einen Anstieg des finanziellen Stresses unter amerikanischen Durchschnittsverdienern, wobei 62% finanziellen Stress berichten, ein Anstieg von 57% im vierten Quartal 2024. Die Umfrage zeigt, dass 46% erwarten, dass sich ihre finanzielle Situation im kommenden Jahr verschlechtern wird, was einen signifikanten Anstieg von 27% im Dezember 2024 darstellt.

Wichtige Ergebnisse sind:

- 86% erwarten steigende Lebensmittel- und Einkaufskosten

- 77% rechnen mit höheren Nebenkosten

- 76% prognostizieren steigende Kraftstoffpreise

- 78% schränken nicht notwendige Einkäufe ein

- 52% ziehen einen zweiten Job in Betracht oder haben bereits einen

- 64% legen Notfallfonds zurück

Der Primerica Haushalt Budget Index™ (HBI™) zeigt einen Rückgang der Kaufkraft für notwendige Ausgaben um 0,3% im Februar im Vergleich zu Januar, hauptsächlich bedingt durch steigende Kosten für Autoversicherungen, Benzin und Nebenkosten. Die Umfrage zeigt auch, dass 53% der Befragten im Jahr 2024 mit einer Steuererstattung rechnen, mit Plänen zu sparen (38%), Schulden abzubauen (32%) oder ausstehende Rechnungen zu begleichen (30%).

- None.

- None.

Food and Grocery Costs Expected to Rise According to

The latest Primerica Household Budget Index™ (HBI™), which measures the purchasing power of middle-income families, found that middle-income families’ perceptions of their personal finances align with overall economic conditions. Eighty-six percent (

“Middle-income Americans continue to face significant financial stress, and they are not anticipating relief in the near future,” said Glenn J. Williams, CEO of Primerica. “This makes having a clear financial game plan even more essential to helping families navigate whatever the future brings. Prioritization is key — understanding where to focus, what to adjust and how to stay on track amid economic uncertainty.”

The latest Primerica Household Budget Index™ (HBI™), which measures the purchasing power of middle-income families, found that middle-income families’ perceptions of their personal finances align with overall economic conditions. Eighty-six percent (

“Middle-income Americans are navigating a financial landscape that feels increasingly unpredictable, with rising costs stretching household budgets and disproportionately impacting middle-income families, accounting for over

Additional key findings from Primerica’s Q1 2025 U.S. Middle-Income Financial Security Monitor™ (FSM™)

-

Middle-income Americans are increasingly concerned about their financial future. Nearly half (

46% ) of respondents expect their financial situation to worsen in the coming year, up from27% in Q4 2024. Only18% believe their situation will improve in the next year, compared with26% of respondents in the previous survey. -

Families are cutting back on spending. Reaching the highest level in two years,

78% report limiting non-essential purchases, such as eating out and entertainment. In addition,64% say they are setting aside money for an emergency fund, up from59% in the previous survey. -

Changing jobs or even adding a second one is top of mind to close the gap between incomes and expenses. Fifty-two percent (

52% ) report either considering getting or already having a second job. More than half (55% ) are considering changing or are already actively switching jobs. -

Majority expect a 2024 tax refund. Fifty-three percent (

53% ) anticipate getting money back on their returns this year, with the top plans for those refunds including: saving (38% ), paying down debt (32% ) and/or paying outstanding bills (30% ).

Primerica Financial Security Monitor™ (FSM™) Topline Trends Data

Mar 2025 |

Dec

|

Sept

|

Jun 2024 |

Mar 2024 |

Dec 2023 |

Sept 2023 |

Jun 2023 |

Mar 2023 |

|

How would you rate the condition of your personal finances? |

|||||||||

Share reporting “Excellent” or “Good.” |

|

|

|

|

|

|

|

|

|

Analysis: Respondents’ assessments of their personal finances are down slightly from where they were a year ago. |

|||||||||

Overall, would you say your income is…? |

|||||||||

Share reporting “Falling behind the cost of living” |

|

|

|

|

|

|

|

|

|

Share reporting “Stayed about even with the cost of living” |

|

|

|

|

|

|

|

|

|

Analysis: Concern about meeting the increased cost of living remained steady with |

|||||||||

And in the next year, do you think the American economy will be…? |

|||||||||

Share reporting “Worse off than it is now” |

|

|

|

|

|

|

|

|

|

Share reporting “Uncertain” |

|

|

|

|

|

|

|

|

|

Analysis: The share of respondents expecting the economy to worsen over the next year has risen sharply since the previous poll. |

|||||||||

Do you have an emergency fund that would cover an expense of |

|||||||||

Reporting “Yes” responses |

|

|

|

|

|

|

|

|

|

Analysis: The percentage of Americans who have an emergency fund that would cover an expense of |

|||||||||

How would you rate the economic health of your community? |

|||||||||

Reporting “Not so good” and “Poor” responses |

|

|

|

|

|

|

|

|

|

Analysis: Respondents’ rating of the economic health of their communities has gotten worse over the past year. |

|||||||||

How would you rate your ability to save for the future? |

|||||||||

Reporting “Not so good” and “Poor” responses |

|

|

|

|

|

|

|

|

|

Analysis: A significant majority continue to feel it is difficult to save for the future. |

|||||||||

In the past three months, has your credit card debt…? |

|||||||||

Reporting “Increased” responses |

|

|

|

|

|

|

|

|

|

Analysis: Credit card debt has remained about the same over the past year. |

|||||||||

About Primerica’s Middle-Income Financial Security Monitor™ (FSM™)

Since September 2020, the Primerica Financial Security Monitor™ has surveyed middle-income households quarterly to gain a clear picture of their financial situation, and it coincides with the release of the monthly HBI™ four times annually. Polling was conducted online from March 3-6, 2025. Using Dynamic Online Sampling, Change Research polled 1,240 adults nationwide with incomes between

About the Primerica Household Budget Index™ (HBI™)

The Primerica Household Budget Index™ (HBI™) is constructed monthly on behalf of Primerica by its chief economic consultant Amy Crews Cutts, PhD, CBE®. The index measures the purchasing power of middle-income families with household incomes from

The HBI™ uses January 2019 as its baseline, with the value set to

Periodically, prior HBI™ values may be modified due to revisions in the CPI series and Consumer Expenditure Survey releases by the

About Primerica, Inc.

Primerica, Inc., headquartered in

View source version on businesswire.com: https://www.businesswire.com/news/home/20250409910736/en/

Media Contact:

Gana Ahn

678-431-9266

Email: Gana.Ahn@primerica.com

Investor Contact:

Nicole Russell

470-564-6663

Email: Nicole.Russell@primerica.com

Source: Primerica, Inc.