Permian Resources Announces Strategic Bolt-On Acquisition of Core Delaware Basin Assets

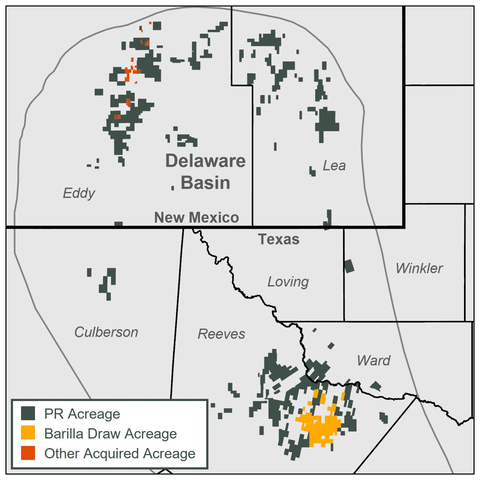

Permian Resources Acquired Acreage Map (Graphic: Business Wire)

Transaction Highlights

- Large, contiguous acreage position, offset existing core operating areas

- Adds >200 gross operated, two-mile locations with high NRIs, which immediately compete for capital

- Substantial midstream assets, including >100 miles of oil and natural gas pipelines, robust water infrastructure system with a ~25,000 Bbls/d water recycling facility and >10,000 surface acres

-

Purchased at an attractive valuation:

-

~3.4x 2025E EBITDAX and ~

17% free cash flow yield - Accretive to cash flow per share, free cash flow per share and NAV per share

-

~3.4x 2025E EBITDAX and ~

-

Conservatively financed through combination of equity and debt

- Expect to maintain leverage of ~1x net debt-to-EBITDAX

Management Commentary

“This acquisition is a natural fit for us given its high-return inventory and proximity to our current operated position,” said Will Hickey, Co-CEO of Permian Resources. “As the Delaware Basin’s low-cost leader, we are highly confident that our team will be able to leverage its operational expertise of the asset to significantly reduce costs and drive meaningful synergies, maximizing value for our shareholders.”

“Our overarching goal is to drive value for our investors, and this acquisition of high-quality assets adjacent to our existing position is a perfect example. Consistent with our strategy of pursuing sound M&A opportunities, this bolt-on acquisition adds core inventory which immediately competes for capital and is accretive to key metrics over both the short and long-term,” said James Walter, Co-CEO of Permian Resources. “Furthermore, the substantial midstream infrastructure and surface acres represent material value and will provide us with significant flexibility going forward.”

Financial Benefits

The transaction is attractively valued at approximately 3.4x 2025E EBITDAX1 and

Acquisition Overview

The acquired assets consist of approximately 29,500 net acres and 9,900 net royalty acres primarily located in

The acquired assets in

(For maps and further details summarizing Permian Resources’ recent acquisition, please see the presentation materials on its website under the Investor Relations tab.)

Financing and Liquidity Highlights

The Company intends to fund the acquisition, subject to market conditions and other factors, through proceeds from one or more capital markets transactions. Permian Resources anticipates that the financing of the acquisition will be leverage neutral on a forward looking and pro forma basis, allowing the Company to maintain a strong balance sheet with an expected year-end 2024 pro forma net debt-to-EBITDAX1 ratio of approximately 1x on a last quarter annualized basis, assuming strip prices.

Second Quarter 2024 Update

As of the date of this release, the Company has not finalized its financial and operating results for the second quarter of 2024. Based on preliminary information, Permian Resources estimates its average daily oil production volumes during the second quarter to be between 152.1 and 153.6 MBbls/d and its cash capital expenditures to be between

About Permian Resources

Headquartered in

Cautionary Note Regarding Forward-Looking Statements

The information in this press release includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical fact included in this press release, regarding the consummation of the recently announced acquisition, the expected benefits of the recently announced acquisition, integration plans, synergies, opportunities and anticipated future performance, our strategy, future operations, financial position, estimated revenues and losses, projected costs, prospects, plans, objectives and expectations of management are forward-looking statements. When used in this press release, the words “could,” “may,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project,” “goal,” “plan,” “target” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on management’s current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. When considering forward-looking statements, you should keep in mind the risk factors and other cautionary statements described under “Item 1A. Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023 (the “2023 Annual Report”) and the risk factors and other cautionary statements contained in our other filings with the United States Securities and Exchange Commission (“SEC”). Although we believe that the expectations reflected in these forward-looking statements are reasonable, they do involve certain assumptions, risks and uncertainties and we can give no assurance that such expectations will prove to have been correct.

Forward-looking statements may include statements about:

-

volatility of oil, natural gas and NGL prices or a prolonged period of low oil, natural gas or NGL prices and the effects of actions by, or disputes among or between, members of the Organization of Petroleum Exporting Countries (“OPEC”), such as

Saudi Arabia , and other oil and natural gas producing countries, such asRussia , with respect to production levels or other matters related to the price of oil, natural gas and NGLs; -

political and economic conditions and events in or affecting other producing regions or countries, including the

Middle East ,Russia ,Eastern Europe ,Africa andSouth America ; - our business strategy and future drilling plans;

- our reserves and our ability to replace the reserves we produce through drilling and property acquisitions;

- our drilling prospects, inventories, projects and programs;

- our financial strategy, return of capital program, leverage, liquidity and capital required for our development program;

- the timing and amount of our future production of oil, natural gas and NGLs;

- our ability to identify, complete and effectively integrate acquisitions of properties, assets or businesses;

- our ability to realize the anticipated benefits and synergies from the bolt-on acquisition and effectively integrate and strategize upon the assets acquired in such transaction;

- the timing and terms of the recently announced acquisition

- our hedging strategy and results;

- our competition;

- our ability to obtain permits and governmental approvals;

- our compliance with government regulations, including those related to climate change as well as environmental, health and safety regulations and liabilities thereunder;

- our pending legal matters;

- the marketing and transportation of our oil, natural gas and NGLs;

- our leasehold or business acquisitions;

- cost of developing or operating our properties;

- our anticipated rate of return;

- general economic conditions;

- weather conditions in the areas where we operate;

- credit markets;

- our ability to make dividends, distributions and share repurchases;

- uncertainty regarding our future operating results;

- our plans, objectives, expectations and intentions contained in this press release that are not historical; and

- the other factors described in our 2023 Annual Report, and any updates to those factors set forth in our subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K.

We caution you that these forward-looking statements are subject to all of the risks and uncertainties, most of which are difficult to predict and many of which are beyond our control, incident to the exploration for and development, production, gathering and sale of oil, natural gas and NGLs. Factors which could cause our actual results to differ materially from the results contemplated by forward-looking statements include, but are not limited to, commodity price volatility (including regional basis differentials), uncertainty inherent in estimating oil, natural gas and NGL reserves, including the impact of commodity price declines on the economic producibility of such reserves, and in projecting future rates of production, geographic concentration of our operations, lack of availability of drilling and production equipment and services, lack of transportation and storage capacity as a result of oversupply, government regulations or other factors, competition in the oil and natural gas industry for assets, materials, qualified personnel and capital, drilling and other operating risks, environmental and climate related risks, including seasonal weather conditions, regulatory changes including those that may result from the

Reserve engineering is a process of estimating underground accumulations of oil and natural gas that cannot be measured in an exact way. The accuracy of any reserve estimate depends on the quality of available data, the interpretation of such data, and price and cost assumptions made by reserve engineers. In addition, the results of drilling, testing and production activities may justify revisions of estimates that were made previously. If significant, such revisions would change the schedule of any further production and development drilling. Accordingly, reserve estimates may differ significantly from the quantities of oil and natural gas that are ultimately recovered.

Should one or more of the risks or uncertainties described in this press release occur, or should any underlying assumptions prove incorrect, our actual results and plans could differ materially from those expressed in any forward-looking statements. All forward-looking statements, expressed or implied, included in this press release are expressly qualified in their entirety by this cautionary statement. This cautionary statement should also be considered in connection with any subsequent written or oral forward-looking statements that we or persons acting on our behalf may issue.

Except as otherwise required by applicable law, we disclaim any duty to update any forward-looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this press release.

1) EBITDAX, free cash flow, free cash flow yield and net debt-to-EBITDAX are non-GAAP financial measures. While management believes that such measures are useful for investors, they should not be used as a replacement for financial measures that are in accordance with

Non-GAAP Financial Measures

Adjusted EBITDAX is a supplemental non-GAAP financial measure that the Company defines as net income attributable to Class A Common Stock before net income attributable to noncontrolling interest, interest expense, income taxes, depreciation, depletion and amortization, impairment and abandonment expense, non-cash gains or losses on derivatives, stock-based compensation (not cash-settled), exploration and other expenses, merger and integration expense, gain/loss from the sale of long-lived assets and other non-recurring items.

The Company defines free cash flow, which is a non-GAAP financial measure, as unlevered cash flow from operating activities before changes in working capital in excess of cash capital expenditures and defines free cash flow yield, which is a non-GAAP financial measure, as unlevered cash flow from operating activities before changes in working capital in excess of cash capital expenditures divided by the value of the applicable transaction.

Net debt-to-EBITDAX is a non-GAAP financial measure. The Company defines net debt as long-term debt, net, plus unamortized debt discount, premium and debt issuance costs on our senior notes minus cash and cash equivalents. The Company defines net debt-to-EBITDAX as net debt (defined above) divided by Adjusted EBITDAX (defined above).

View source version on businesswire.com: https://www.businesswire.com/news/home/20240728309912/en/

Hays Mabry – Vice President, Investor Relations

(432) 315-0114

ir@permianres.com

Source: Permian Resources Corporation