PolyMet Receives Non-Binding Proposal to Go Private

- Glencore proposes to acquire all outstanding shares of PolyMet at a premium price of US$2.11 per share, representing an approximately 167% premium over the previous closing price.

- No negative takes identified.

Insights

Analyzing...

St. Paul, Minnesota--(Newsfile Corp. - July 3, 2023) - PolyMet Mining Corp. (TSX: POM) (NYSE American: PLM) ("PolyMet" or the "company") announced today that its independent Special Committee (the "Special Committee") of PolyMet's Board of Directors received a non-binding proposal from Glencore AG ("Glencore") to acquire all outstanding shares of PolyMet that it does not already own for cash consideration of US

The Special Committee welcomes the engagement with Glencore and the proposal is being reviewed by the Special Committee in accordance with its fiduciary duties and in consultation with its independent financial and legal advisors.

PolyMet cautions its shareholders and others considering trading in its securities that no decisions have been made with respect to PolyMet's response to the proposal. There can be no assurance that any definitive offer will be made, that any definitive agreement will be executed or that this or any other transaction will be approved or consummated. PolyMet does not undertake any obligation to provide any updates with respect to this or any other transaction, except as required by applicable law.

PolyMet shareholders do not need to take any action at this time.

* * * *

About PolyMet

PolyMet is a mine development company holding a

For further information, please contact:

Media

Bruce Richardson, Corporate Communications

Tel: +1 (651) 389-4111

brichardson@polymetmining.com

Investor Relations

Tony Gikas, Investor Relations

Tel: +1 (651) 389-4110

investorrelations@polymetmining.com

PolyMet Disclosures

This news release contains certain forward-looking statements concerning anticipated developments in PolyMet's operations in the future. Forward-looking statements are frequently, but not always, identified by words such as "expects," "anticipates," "believes," "intends," "estimates," "potential," "possible," "projects," "plans," and similar expressions, or statements that events, conditions or results "will," "may," "could," or "should" occur or be achieved or their negatives or other comparable words. Forward-looking statements relate to future events or future performance and reflect management's expectations or beliefs regarding future events including, but not limited to, statements with respect to the Special Committee's consideration of Glencore's proposal and other statements that are not historical facts. Actual results may differ materially from those in the forward-looking statements due to risks facing PolyMet or due to actual facts differing from the assumptions underlying its predictions.

PolyMet's forward-looking statements are based on the beliefs, expectations and opinions of management on the date the statements are made, and PolyMet does not assume any obligation to update (except as required by law) forward-looking statements if circumstances or management's beliefs, expectations and opinions should change.

Specific reference is made to risk factors and other considerations underlying forward-looking statements discussed in PolyMet's most recent Annual Report on Form 40-F for the fiscal year ended December 31, 2022, and in our other filings with Canadian securities authorities and the U.S. Securities and Exchange Commission.

The Annual Report on Form 40-F also contains the company's mineral resource and other data as required under National Instrument 43-101.

No regulatory authority has reviewed or accepted responsibility for the adequacy or accuracy of this release.

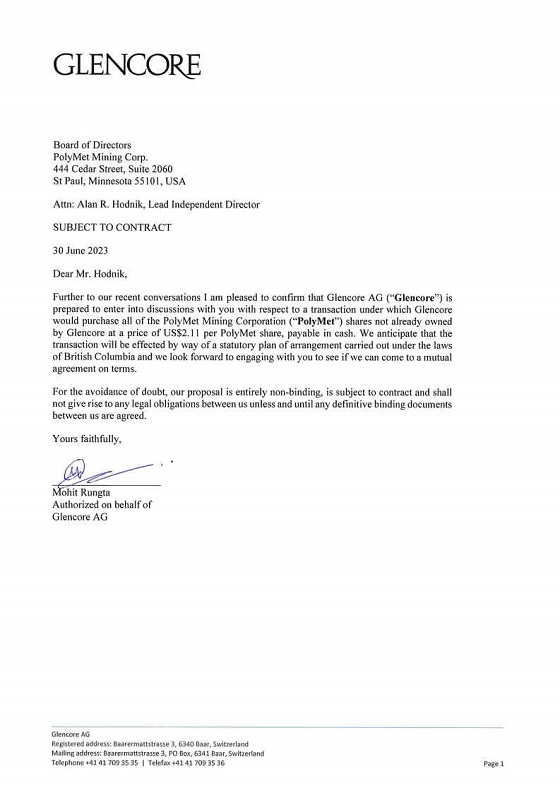

EXHIBIT "A"

GLENCORE NON-BINDING PROPOSAL

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1009/172181_polymet1en.jpg

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/172181