Pitney Bowes BOXpoll: For One in Three Americans, Moving is On the Table

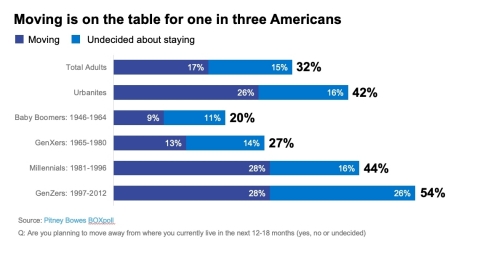

Pitney Bowes (NYSE: PBI) reports findings from its latest BOXpoll™, indicating that one in three Americans either plan to relocate or are uncertain about their current residence in the next 12-18 months. The survey highlights a trend towards moving to less populated areas, especially among younger demographics. Forty-five percent of movers expect better delivery and return services at their new locations, signaling changing consumer expectations in ecommerce logistics.

- One in three Americans plan to move or are undecided about their residence.

- Increased demand for improved home delivery and return services as 45% of movers expect better logistics.

- None.

Insights

Analyzing...

Pitney Bowes Inc. (NYSE: PBI), a global technology company that provides commerce solutions in the areas of ecommerce, shipping, mailing and financial services, today released results from its latest BOXpoll™. The weekly consumer survey finds that one in three Americans either plan to move in the next 12 to 18 months (17 percent) or are undecided about staying in their current residence (15 percent). Gen Z adults, Millennials and city residents are most likely to move, and one-third of all movers say they are heading to less densely populated locations. The findings shed new light on what the residential picture of a post-pandemic America may look like and how it will impact ecommerce logistics companies, as well as the clients and consumers they serve.

(Graphic: Business Wire)

“Work-from-home policies are becoming more prevalent and more permanent for many Americans. That means where they choose to live is less dependent on who they work for than ever before,” said Gregg Zegras, EVP and President of Global Ecommerce at Pitney Bowes. “This change is inspiring many individuals to move, or to think about where they want to live in a new context.”

The dispersion of the population is happening simultaneous with the continued growth of ecommerce and rising consumer expectations about the quality of home delivery and returns services. Forty-five percent of movers said they expect improved home delivery and home pick-up returns services at their future addresses.

“A migration to less densely populated areas will lead ecommerce brands and logistics providers to rethink their rural delivery infrastructure, particularly as consumers expect an even easier delivery and returns experience when the pandemic subsides,” said Zegras.

Please visit www.pitneybowes.com/boxpoll for all of the latest BOXpoll findings, including four new articles covering the physical dispersion of consumers.

Methodology

BOXpoll™ by Pitney Bowes is a weekly consumer survey on current events, culture and ecommerce logistics. Morning Consult conducts weekly polls on behalf of Pitney Bowes among a national sample of more than 2,000 online shoppers. The results included in this press release are extracted from surveys conducted over past month. The interviews were conducted online and the data were weighted to approximate a target sample of adults based on age, educational attainment, gender, race, and region. Results from the full survey have a margin of error of +/- 2 percentage points.

About Pitney Bowes

Pitney Bowes (NYSE:PBI) is a global technology company providing commerce solutions that power billions of transactions. Clients around the world, including 90 percent of the Fortune 500, rely on the accuracy and precision delivered by Pitney Bowes solutions, analytics, and APIs in the areas of ecommerce fulfillment, shipping and Returns; cross-border ecommerce; office mailing and shipping; presort services; and financing. For 100 years Pitney Bowes has been innovating and delivering technologies that remove the complexity of getting commerce transactions precisely right. For additional information visit Pitney Bowes at www.pitneybowes.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210323005746/en/