Job Gains Continue Among U.S. Small Businesses to Start 2024

- None.

- None.

Insights

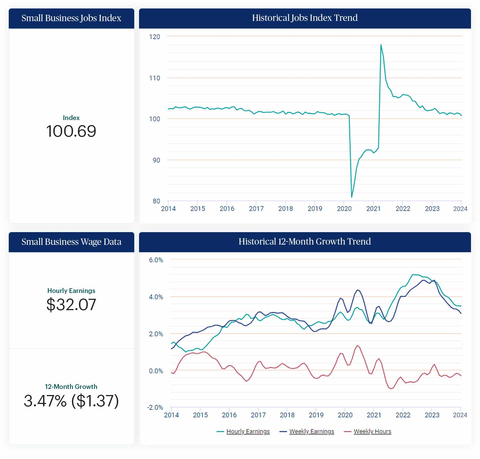

The reported job growth in small businesses for 34 consecutive months is indicative of a resilient sector that has adapted to economic challenges. The job growth index at 100.69, although signaling growth, suggests a deceleration in the rate of new job creation. This could reflect a maturing job market or potential headwinds such as labor shortages and regulatory burdens.

Stable wage growth at 3.47% underscores a balance between employee compensation and inflationary pressures. Notably, the regional variation in wage growth, with the West leading at 4.03% and the South trailing at 3.33%, may reflect differing economic conditions and cost of living adjustments across the U.S. The strong performance in Washington and Seattle in particular, with hourly earnings growth exceeding 5%, could be attributed to local economic policies or sector-specific demands.

It is also significant that the GDP increased by 3.3% in Q4 of 2023 and the unemployment rate reached a historic low, which suggests a robust economy. However, these figures must be balanced against the context of federal policy actions aimed at managing inflation and ensuring economic stability. The emphasis on the need for policymakers to address growth capital for small businesses and long-term labor market issues is a critical point for sustaining the health of this economic segment.

From a market perspective, the continuous job growth in small businesses could be seen as a positive indicator for consumer spending and economic activity. Small businesses are often seen as a bellwether for broader economic trends and sustained job creation within this sector might suggest confidence among business owners and entrepreneurs.

The Education and Health Services sector leading in job growth is a noteworthy trend. This could be indicative of demographic shifts, such as an aging population and potentially increased investments in these areas. The data also points to regional disparities that may influence market strategies for businesses operating in different parts of the country. For instance, companies might need to adjust their compensation packages to attract talent in regions with higher wage growth.

Furthermore, the data on hours worked in the Construction sector and wage growth in Leisure and Hospitality provide insights into sector-specific labor dynamics. These trends could have implications for investment and operational decisions within these industries, particularly as they relate to staffing and wage strategies in a competitive labor market.

For investors, the steady job and wage growth in small businesses may be interpreted as a signal of economic stability and potential for growth in consumer-oriented sectors. The stability in wage growth, while beneficial for managing business costs, may also reflect a ceiling in employees' bargaining power, which can affect consumer spending power.

The report's implications for federal policy, especially regarding access to growth capital, could influence financial markets. If policymakers respond with measures to ease access to capital, small businesses might experience an uptick in growth, potentially impacting sectors like financial services that facilitate such capital flows.

It is important to consider the long-term implications of the labor market trends, such as participation rates and workforce quality, as these will affect the sustainable growth of small businesses and, by extension, the broader economy. Investors may need to monitor these indicators closely as they can impact consumer spending, labor costs and overall market sentiment.

January marks the 34th-straight month of continued job growth for

“As we begin 2024, job growth in small businesses is continuing at a steady pace,” says John Gibson, Paychex president and CEO. “Nationally, wage growth remains stable despite 65 minimum wage changes taking effect in various states and localities on January 1. Small and medium-sized businesses remain resilient in the face of many challenges, including a tight labor market for qualified workers, the cost of and access to capital, rising employer regulations, and cost of providing benefits to attract and retain employees.”

“Several macroeconomic data sources point to a strong close to 2023,” adds Gibson. “Gross domestic product (GDP) increased

Jobs Index Highlights:

- At 100.69, the national index indicates continued job growth but at a slower pace.

- With indexes above 100, all regions continue to report positive job growth in January. The South (101.12) leads the pace of regional job growth in January and has ranked first among regions for 16 of the last 17 months.

-

Leading the South,

Tennessee (102.19),Texas (102.06), andVirginia (102.01) are all reporting index levels above 102 in January. -

Ranked first among top

U.S. metros in January,Dallas jumped 1.60 percentage points to 103.30 and has now increased its job growth rate for three-straight months. - Education and Health Services (101.91) leads industries for small business job growth to start 2024. Indicating strong, sustained job growth, this sector’s jobs index was above 102 for 33 consecutive months leading up to January 2024.

Wage Data Highlights:

-

At

3.47% , hourly earnings growth has stabilized and is essentially unchanged over the past three months (3.48% in December 2023,3.49% in November 2023). -

At

4.03% , the West leads regional hourly earnings growth for the eighth consecutive month. The South (3.33% ) has the lowest hourly earnings growth rate among regions. -

Washington’s

5.17% hourly earnings growth in January is the highest among states for the sixth consecutive month. -

Seattle reports5.27% hourly earnings growth in January, the fifth consecutive month over five percent, and ranked first among topU.S. metros. -

Construction has the strongest weekly hours worked among sectors for January, up

0.32% since December. Leisure and Hospitality also experienced strong one-month hourly earnings growth (5.10% ).

The complete Small Business Employment Watch results for January 2024, including interactive charts detailing the data at a national, regional, state, metro, and industry sector level are available at www.paychex.com/watch. Learn more and sign up to receive monthly Employment Watch alerts.

About the Paychex Small Business Employment Watch

The Paychex Small Business Employment Watch is released each month by Paychex, Inc. Focused exclusively on businesses with less than 50 workers, the monthly report offers analysis of national employment and wage trends, as well as examines regional, state, metro, and industry sector activity. Drawing from the payroll data of approximately 350,000 Paychex clients, this powerful industry benchmark delivers real-time insights into the small business trends driving the

About Paychex

Paychex, Inc. (Nasdaq: PAYX) is an industry-leading HCM company delivering a full suite of technology and advisory services in human resources, employee benefit solutions, insurance, and payroll. The company serves approximately 740,000 customers in the

View source version on businesswire.com: https://www.businesswire.com/news/home/20240130198054/en/

Media Contacts

Chris Muller

Paychex, Inc.

585-338-4346

cmuller@paychex.com

@Paychex

Colleen Bennis

Matter Communications

Account Director

(585) 666-9510

cbennis@matternow.com

Source: Paychex, Inc.

FAQ

How many months of consecutive job growth has the Paychex Small Business Employment Watch reported for U.S. small businesses?

What is the current hourly wage growth for workers according to the report?

Which region leads the pace of regional job growth according to the report?

Which industry leads small business job growth in 2024 according to the report?