Pace of U.S. Small Business Job Growth Moderated in 2024

Hourly earnings growth for small business workers remained below three percent for last five months of the year

Job growth in

“The pace of job growth among

“As we have done for more than 50 years, Paychex will continue to focus our efforts in the coming year on designing solutions to support the small business growth that ultimately fuels our broader economy,” Gibson added. “Our PEO (professional employer organization) and Paychex Insurance Agency have long offered companies the opportunity to save on healthcare costs. Other solutions we introduced in 2024 were designed to address evolving business challenges, such as Paychex Flex Perks®, Paychex Recruiting Copilot, HR Analytics with AI Insights, Paychex Funding Solutions, and Paychex Flex® Engage.”

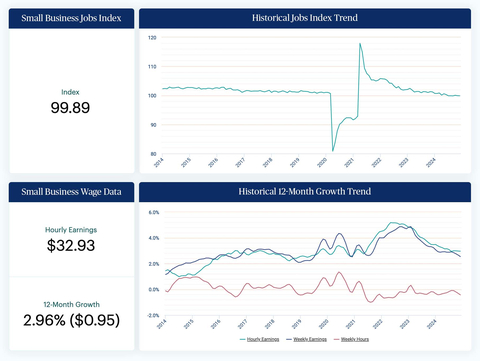

Jobs Index and Wage Data Highlights

- The national small business jobs index averaged 100.22 in 2024, representing modest employment growth. However, the national jobs index slowed 1.32 percentage points from 101.21 in December 2023 to 99.89 in December 2024.

-

The Midwest (100.20) remained the top region for small business employment growth for the seventh consecutive month in December.

Wisconsin (100.77) led Midwestern states and ranked second among all states for job growth in December, marking its best rank since March 2020. -

For the second-straight month,

Dallas (101.73) andHouston (101.16) ranked first and second, respectively, among metros for job growth in December. -

Three-month annualized hourly earnings growth (

3.02% ) reported above three percent for the first month since April. -

Weekly earnings growth (

2.54% ) slowed to a four-year low in December. Additionally, weekly hours worked growth (-0.43% ) remained negative year-over-year for the 21st consecutive month and hit its lowest level since July 2022. -

As workforce composition continues to evolve considering recent hurricanes,

Tampa (4.56% ) topped the metro rankings for hourly earnings growth for the second month in a row.

More Information

For more information about the Paychex Small Business Employment Watch, visit the website and sign up to receive monthly Employment Watch alerts.

*Information regarding the professions included in the industry data can be found at the Bureau of Labor Statistics website.

About the Paychex Small Business Employment Watch

The Paychex Small Business Employment Watch is released each month by Paychex, Inc. Focused exclusively on businesses with fewer than 50 workers, the monthly report offers analysis of national employment and wage trends and examines regional, state, metro, and industry sector activity. Drawing from the payroll data of approximately 350,000 Paychex clients, this powerful industry benchmark delivers real-time insights into the small business trends driving the

About Paychex

Paychex, Inc. (Nasdaq: PAYX) is an industry-leading HCM company delivering a full suite of technology and advisory services in human resources, employee benefit solutions, insurance, and payroll. The company serves more than 745,000 customers in the

View source version on businesswire.com: https://www.businesswire.com/news/home/20250107648114/en/

Media Contacts

Tracy Volkmann

Paychex, Inc.

Manager, Public Relations

(585) 387-6705

tvolkmann@paychex.com

@Paychex

Emily Walsh

Highwire Public Relations

Account Executive

(914) 815-8846

paychex@highwirepr.com

Source: Paychex, Inc.