Pampa Energia Announces Fiscal Year and Fourth Quarter 2023 Results

BUENOS AIRES, ARGENTINA / ACCESSWIRE / March 6, 2024 / Pampa Energía S.A. (NYSE:PAM)(Buenos Aires Stock Exchange:PAMP), an independent company with active participation in the Argentine electricity and gas value chain, announces the results for the fiscal year and quarter ended on December 31, 2023.

Pampa's financial information adopts US$ as functional currency, converted into AR$ at transactional nominal exchange rate (‘FX'). However, our affiliates Transener and TGS's figures are adjusted for inflation as of December 31, 2023, and translated into US$ at the period's closing FX. The reported figures in US$ from previous periods remain unchanged.

The impact of the local currency depreciation

The steep US$ quote increase from AR

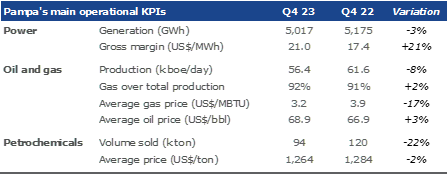

Q4 23 main results[1]

Operating performance highlighted by Ensenada Barragán Thermal Power Plant (‘CTEB')'s Combined Cycle (‘CCGT') and hydros:

Adjusted EBITDA[3] reached US

The income attributable to the Company's shareholders recorded a US

Net debt decreased to US

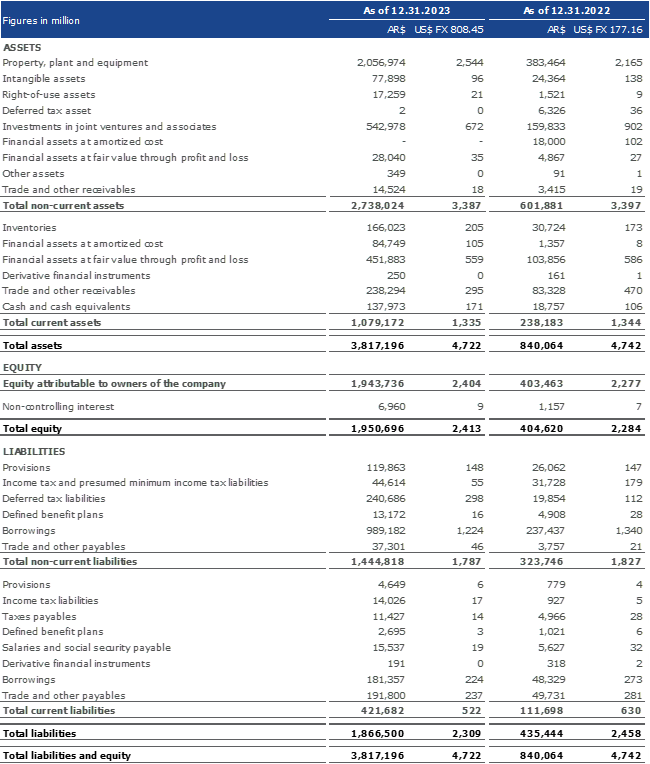

Consolidated balance sheet

(As of December 31, 2023 and 2022, in millions)

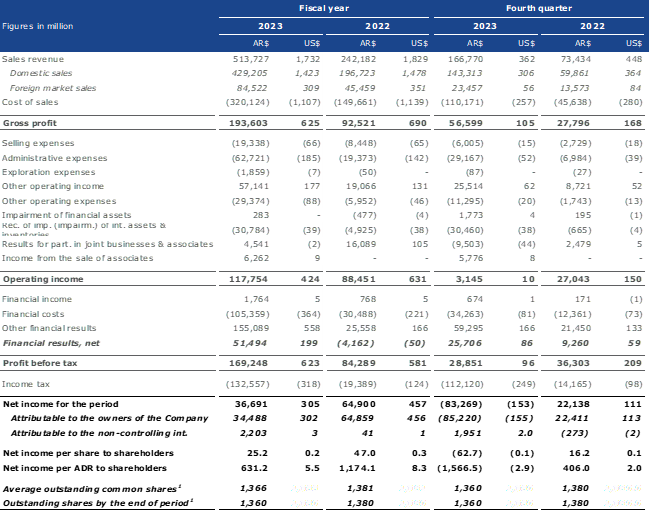

Consolidated income statement

(For the fiscal year and quarters ended on December 31, 2023 and 2022, in millions)

Note: 1: It considers the Employee stock-based compensation plan shares, which amounted to 3.9 million common shares as of December 31, 2022 and 2023.

For the full version of the Earnings Report, please visit Pampa's Investor Relations website: ri.pampaenergia.com/en.

Information about the videoconference

There will be a videoconference to discuss Pampa's Q4 23 results on Thursday, March 7, 2024, at 10:00 a.m. Eastern Standard Time/12:00 p.m. Buenos Aires Time. The hosts will be Gustavo Mariani, CEO, Nicolás Mindlin, CFO, Horacio Turri, executive director of E&P and Lida Wang, investor relations and sustainability officer at Pampa.

For those interested in participating, please register at bit.ly/Pampa4Q2023VC.

For further information about Pampa:

investor@pampaenergia.com

ri.pampaenergia.com/en

www.argentina.gob.ar/cnv

www.sec.gov

[1] The information is based on financial statements (‘FS') prepared according to International Financial Reporting Standards (‘IFRS') in force in Argentina.

[2] It does not include sales from the affiliates CTBSA, Transener and TGS, shown as ‘Results for participation in joint businesses and associates'.

[3] Consolidated adjusted EBITDA represents the results before financial items, income tax, depreciations and amortizations, extraordinary and non-cash income and expense, equity income and other adjustments, and includes affiliates' EBITDA at our ownership. Further information on section 3.1.

SOURCE: 1/3 Pampa Energía S.A.

View the original press release on accesswire.com