The New York Times Company Reports 2020 Fourth-Quarter and Full-Year Results and Announces Dividend Increase

The New York Times Company (NYSE: NYT) reported fourth-quarter 2020 earnings with diluted EPS from continuing operations at $0.06, down from $0.41 in Q4 2019. Adjusted diluted EPS was $0.40, slightly below $0.43 from the previous year. Total revenues increased marginally to $509.4 million, driven by a 14.7% rise in subscription revenues to $315.8 million. Digital-only subscription additions surged to 2.3 million for the year. The company declared a $0.07 dividend, payable April 22, 2021. Cash and marketable securities reached $882 million, reflecting strong digital subscription growth.

- Total revenues increased to $509.4 million, up 0.2% year-over-year.

- Subscription revenues rose 14.7% to $315.8 million.

- Record 2.3 million net new digital-only subscriptions added in 2020.

- Digital-only revenues grew 36.8% to $167 million, surpassing print revenue.

- Declared a dividend increase to $0.07 per share, payable April 22, 2021.

- Cash and marketable securities rose to $882 million, up $198.1 million year-over-year.

- Diluted EPS decreased to $0.06 from $0.41 year-over-year.

- Advertising revenues fell 18.7% to $139.3 million.

- Print advertising revenue declined 37.9% due to COVID-19 impacts.

The New York Times Company (NYSE: NYT) announced today fourth-quarter 2020 diluted earnings per share from continuing operations of $.06 compared with $.41 in the same period of 2019. Adjusted diluted earnings per share from continuing operations (defined below) was $.40 in the fourth quarter of 2020 compared with $.43 in the fourth quarter of 2019.

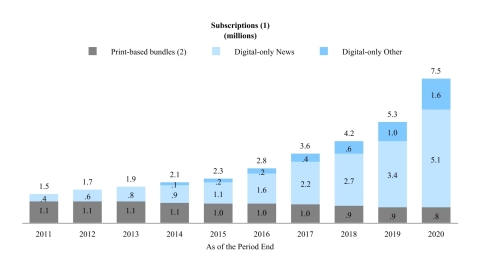

We believe that the significant growth over the last several years in subscriptions to The Times’s products demonstrates the success of our “subscription-first” strategy and the willingness of our readers to pay for high-quality journalism. The following charts illustrate the acceleration in net digital-only subscription additions and corresponding subscription revenues as well as the relative stability of our print domestic home delivery subscription products since the launch of the digital pay model in 2011. (1) Amounts may not add due to rounding. (2) Print domestic home delivery subscriptions include free access to some or all of our digital products. (3) Print Other includes single-copy, NYT International and other subscription revenues. Note: Revenues for 2012 and 2017 include the impact of an additional week. (Graphic: Business Wire)

Operating profit increased to

Meredith Kopit Levien, president and chief executive officer, The New York Times Company, said, “2020 was a seismic year for news. The need for quality, independent journalism was as acute as ever in my lifetime, and my colleagues across The Times rose to meet that need with the energy and rigor our mission demands.

“Our work, which was consumed at historic levels, led to a year of strong business results, including a record 2.3 million net new digital-only subscription additions, with 627,000 total net additions in the fourth quarter, 425,000 to our news product. At the end of 2020, The Times had 7.5 million total subscriptions across our digital and print products.

“In 2020, we reached two key milestones, both of which we expect to be enduring: digital revenue overtook print for the first time, and digital subscription revenue, long our fastest growing revenue stream, is also now our largest. Those two milestones, and our best year on record for subscriptions, mark the end of the first decade of The Times’s transformation into a digital-first, subscription-first company. They also mark the beginning of a new decade. The last ten years were about proving our strategy of journalism worth paying for; the next ten will be about scaling that idea. With a billion people reading digital news, and an expected 100 million willing to pay for it in English, it’s not hard to imagine that, over time, The Times’s subscriber base could be substantially larger than where we are today.”

Comparisons

Unless otherwise noted, all comparisons are for the fourth quarter of 2020 to the fourth quarter of 2019.

This release presents certain non-GAAP financial measures, including diluted earnings per share from continuing operations excluding severance, non-operating retirement costs and special items (or adjusted diluted earnings per share from continuing operations); operating profit before depreciation, amortization, severance, multiemployer pension plan withdrawal costs and special items (or adjusted operating profit); and operating costs before depreciation, amortization, severance and multiemployer pension plan withdrawal costs (or adjusted operating costs). Refer to Reconciliation of Non-GAAP Information in the exhibits for a discussion of management’s reasons for the presentation of these non-GAAP financial measures and reconciliations to the most comparable GAAP financial measures.

The Company changed the expense captions on its Condensed Consolidated Statement of Operations effective for the first quarter of 2020. These changes were made in order to reflect how the Company manages its business and to communicate where the Company is investing resources and how this aligns with the Company’s strategy. The Company reclassified expenses for the prior period in order to present comparable financial results. Refer to Reconciliation of GAAP Information in the exhibits for more details.

Fourth-quarter 2020 results included the following special items:

-

A

$5 million gain ($3.1 million or$0.02 per share after tax and net of noncontrolling interest) reflecting our proportionate share of a distribution from the sale of assets by Madison Paper Industries (“Madison”), in which the Company has an investment through a subsidiary. -

$80.6 million in pension settlement charges ($58.9 million after tax or$0.35 per share) in connection with the transfer of certain pension benefit obligations to an insurer.

There were no special items in the fourth quarter of 2019.

Results from Continuing Operations

Revenues

Total revenues for the fourth quarter of 2020 increased 0.2 percent to

Subscription revenues in the fourth quarter of 2020 rose due to growth in the number of subscriptions to the Company’s digital-only products, which include our news product, as well as our Games (previously Crossword), Cooking and audio products. Revenue from digital-only products increased 36.8 percent, to

The Company ended the fourth quarter of 2020 with approximately 7,523,000 subscriptions across its print and digital products. Paid digital-only subscriptions totaled approximately 6,690,000, a net increase of 627,000 subscriptions compared with the end of the third quarter of 2020 and a net increase of 2,295,000 subscriptions compared with the end of the fourth quarter of 2019. Of the 627,000 total net additions, 425,000 came from the Company’s digital news product, while 202,000 came from the Company’s Cooking, Games and audio products.

Fourth-quarter 2020 digital advertising revenue decreased 2.3 percent, while print advertising revenue decreased 37.9 percent. Digital advertising revenue was

Other revenues decreased 12.1 percent in the fourth quarter, primarily as a result of fewer episodes of our television series as well as lower revenues from live events and commercial printing. These declines were partially offset by higher Wirecutter affiliate referral revenues.

Operating Costs

Total operating costs decreased 0.4 percent in the fourth quarter of 2020 to

Cost of revenue decreased 3.4 percent to

Sales and marketing costs decreased 8.9 percent to

Product development costs increased 23.2 percent to

General and administrative costs increased 11.0 percent to

Other Data

Interest Income/(Expense) and Other, net

Interest income/(expense) and other, net increased in the fourth quarter of 2020 to

Income Taxes

The Company had an income tax benefit of

Liquidity

As of December 27, 2020, the Company had cash and marketable securities of

The Company has a

Dividends

The Company’s Board of Directors declared a $.07 dividend per share on the Company’s Class A and Class B common stock, an increase of $.01 from the previous quarter. The dividend is payable on April 22, 2021, to shareholders of record as of the close of business on April 7, 2021.

Pension Obligations

As part of the Company’s continued effort to reduce the overall size and volatility of its pension plan obligations, and the associated administrative costs, the Company has transferred to an insurer the pension benefit obligations and annuity administration for certain pension plan participants. This transfer of obligations allowed the Company to reduce its qualified pension plan obligations by approximately

As of December 27, 2020, the overfunded balance of our qualified pension plans was

Capital Expenditures

Capital expenditures totaled approximately

Outlook

Total subscription revenues in the first quarter of 2021 are expected to increase approximately 15 percent compared with the first quarter of 2020, with digital-only subscription revenue expected to increase approximately 35 percent to 40 percent.

Total advertising revenues in the first quarter of 2021 are expected to decline in the high-teens compared with the first quarter of 2020, with digital advertising revenue expected to increase in the low- to mid-single digits.

Other revenues in the first quarter of 2021 are expected to decrease approximately 10 percent to 15 percent compared with the first quarter of 2020.

Operating costs and adjusted operating costs in the first quarter of 2021 are expected to increase in the mid-single digits compared with the first quarter of 2020 as the Company continues to invest in the drivers of digital subscription growth.

The Company expects the following on a pre-tax basis in 2021:

-

Depreciation and amortization: approximately

$60 million , -

Interest income and other, net:

$6 million to$8 million , and -

Capital expenditures: approximately

$50 million .

Our outlook is based on our current knowledge and assumptions and could be impacted by the evolving COVID-19 pandemic.

Conference Call Information

The Company’s fourth-quarter 2020 earnings conference call will be held on Thursday, February 4, at 8:00 a.m. E.T.

Participants can pre-register for the telephone conference at dpregister.com/sreg/10150641/df8e8ed980, which will generate dial-in instructions allowing participants to bypass an operator at the time of the call. Alternatively, to access the call without pre-registration, dial 844-413-3940 (in the U.S.) or 412-858-5208 (international callers). Online listeners can link to the live webcast at investors.nytco.com.

An archive of the webcast will be available beginning about two hours after the call at investors.nytco.com. The archive will be available for approximately three months. An audio replay will be available at 877-344-7529 (in the U.S.) and 412-317-0088 (international callers) beginning approximately two hours after the call until 11:59 p.m. E.T. on Thursday, February 18. The replay access code is 10150641.

Except for the historical information contained herein, the matters discussed in this press release are forward-looking statements that involve risks and uncertainties that change over time, and actual results could differ materially from those predicted by such forward-looking statements. These risks and uncertainties include, but are not limited to, the impact of the evolving COVID-19 pandemic, changes in the business and competitive environment in which the Company operates, the impact of national and local economic and other conditions and developments in technology, each of which could influence the levels (rate and volume) of the Company’s subscriptions and advertising, the growth of its businesses and the implementation of its strategic initiatives. They also include other risks detailed from time to time in the Company’s publicly filed documents, including the Company’s Annual Report on Form 10-K for the year ended December 29, 2019, as updated in subsequent Quarterly Reports on Form 10-Q. The impact of the COVID-19 pandemic, which has already affected the Company, may give rise to additional risks that are currently unknown or exacerbate the foregoing risks, any of which could have a material effect on the Company. Forward-looking statements speak only as of the date they are made, and the Company undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

The New York Times Company is a global media organization dedicated to enhancing society by creating, collecting and distributing high-quality news and information. The Company includes The New York Times, NYTimes.com and related properties. It is known globally for excellence in its journalism, and innovation in its print and digital storytelling. Follow news about the company at @NYTimesPR.

This press release can be downloaded from www.nytco.com

Exhibits: |

Condensed Consolidated Statements of Operations |

|

Footnotes |

|

Reconciliation of Non-GAAP Information |

|

Reconciliation of GAAP Information |

THE NEW YORK TIMES COMPANY |

|||||||||||||||||||

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS |

|||||||||||||||||||

(Dollars and shares in thousands, except per share data) |

|||||||||||||||||||

|

Fourth Quarter |

|

Twelve Months |

||||||||||||||||

|

2020 |

|

2019 |

|

% Change |

|

2020 |

|

2019 |

|

% Change |

||||||||

Revenues |

|

|

|

|

|

|

|

|

|

|

|

||||||||

Subscription(a) |

$ |

315,795 |

|

|

$ |

275,283 |

|

|

|

|

$ |

1,195,368 |

|

|

$ |

1,083,851 |

|

|

|

Advertising(b) |

139,270 |

|

|

171,298 |

|

|

(18.7)% |

|

392,420 |

|

|

530,678 |

|

|

(26.1)% |

||||

Other(c) |

54,293 |

|

|

61,782 |

|

|

(12.1)% |

|

195,851 |

|

|

197,655 |

|

|

(0.9)% |

||||

Total revenues |

509,358 |

|

|

508,363 |

|

|

|

|

1,783,639 |

|

|

1,812,184 |

|

|

(1.6)% |

||||

Operating costs |

|

|

|

|

|

|

|

|

|

|

|

||||||||

Cost of revenue (excluding depreciation and amortization)(d) |

250,503 |

|

|

259,375 |

|

|

(3.4)% |

|

960,222 |

|

|

989,029 |

|

|

(2.9)% |

||||

Sales and marketing(d) |

65,000 |

|

|

71,330 |

|

|

(8.9)% |

|

229,040 |

|

|

272,657 |

|

|

(16.0)% |

||||

Product development(d) |

36,787 |

|

|

29,856 |

|

|

|

|

132,428 |

|

|

105,514 |

|

|

|

||||

General and administrative(d) |

60,766 |

|

|

54,724 |

|

|

|

|

223,557 |

|

|

206,778 |

|

|

|

||||

Depreciation and amortization |

15,768 |

|

|

15,113 |

|

|

|

|

62,136 |

|

|

60,661 |

|

|

|

||||

Total operating costs |

428,824 |

|

|

430,398 |

|

|

(0.4)% |

|

1,607,383 |

|

|

1,634,639 |

|

|

(1.7)% |

||||

Restructuring charge (e) |

— |

|

|

— |

|

|

— |

|

— |

|

|

4,008 |

|

|

* |

||||

Gain from pension liability adjustment(f) |

— |

|

|

— |

|

|

— |

|

— |

|

|

(2,045) |

|

|

* |

||||

Operating profit |

80,534 |

|

|

77,965 |

|

|

|

|

176,256 |

|

|

175,582 |

|

|

|

||||

Other components of net periodic benefit costs(g) |

82,419 |

|

|

1,800 |

|

|

* |

|

89,154 |

|

|

7,302 |

|

|

* |

||||

Gain from joint ventures(h) |

5,000 |

|

|

— |

|

|

* |

|

5,000 |

|

|

— |

|

|

* |

||||

Interest income/(expense) and other, net(i) |

3,153 |

|

|

(248) |

|

|

* |

|

23,330 |

|

|

(3,820) |

|

|

* |

||||

Income from continuing operations before income taxes |

6,268 |

|

|

75,917 |

|

|

(91.7)% |

|

115,432 |

|

|

164,460 |

|

|

(29.8)% |

||||

Income tax (benefit)/expense |

(4,475) |

|

|

7,705 |

|

|

* |

|

14,595 |

|

|

24,494 |

|

|

(40.4)% |

||||

Net income |

10,743 |

|

|

68,212 |

|

|

(84.3)% |

|

100,837 |

|

|

139,966 |

|

|

(28.0)% |

||||

Net income attributable to the noncontrolling interest |

(734) |

|

|

— |

|

|

* |

|

(734) |

|

|

— |

|

|

* |

||||

Net income attributable to The New York Times Company common stockholders |

$ |

10,009 |

|

|

$ |

68,212 |

|

|

(85.3)% |

|

$ |

100,103 |

|

|

$ |

139,966 |

|

|

(28.5)% |

Average number of common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

||||||||

Basic |

167,367 |

|

|

166,239 |

|

|

|

|

166,973 |

|

|

166,042 |

|

|

|

||||

Diluted |

168,197 |

|

|

167,728 |

|

|

|

|

168,038 |

|

|

167,545 |

|

|

|

||||

Basic earnings per share attributable to The New York Times Company common stockholders |

$ |

0.06 |

|

|

$ |

0.41 |

|

|

(85.4)% |

|

$ |

0.60 |

|

|

$ |

0.84 |

|

|

(28.6)% |

Diluted earnings per share attributable to The New York Times Company common stockholders |

$ |

0.06 |

|

|

$ |

0.41 |

|

|

(85.4)% |

|

$ |

0.60 |

|

|

$ |

0.83 |

|

|

(27.7)% |

Dividends declared per share |

$ |

0.06 |

|

|

$ |

0.05 |

|

|

|

|

$ |

0.24 |

|

|

$ |

0.20 |

|

|

|

* Represents a change equal to or in excess of |

|

|

|

|

|

|

|||||||||||||

See footnotes pages for additional information.

THE NEW YORK TIMES COMPANY |

|||||||||||||||||||||

FOOTNOTES |

|||||||||||||||||||||

(Amounts in thousands) |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

(a) |

The following table summarizes digital and print subscription revenues for the fourth quarters and twelve months of 2020 and 2019: |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

Fourth Quarter |

|

Twelve Months |

||||||||||||||||

|

|

|

2020 |

|

2019 |

|

% Change |

|

2020 |

|

2019 |

|

% Change |

||||||||

|

Digital-only subscription revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

News product subscription revenues(1) |

|

$ |

150,958 |

|

|

$ |

112,340 |

|

|

|

|

$ |

543,578 |

|

|

$ |

426,125 |

|

|

|

|

Other product subscription revenues(2) |

|

16,042 |

|

|

9,754 |

|

|

|

|

54,702 |

|

|

34,327 |

|

|

|

||||

|

Subtotal digital-only subscription revenues |

|

167,000 |

|

|

122,094 |

|

|

|

|

598,280 |

|

|

460,452 |

|

|

|

||||

|

Print subscription revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

Domestic home delivery subscription revenues(3) |

|

132,350 |

|

|

129,533 |

|

|

|

|

528,970 |

|

|

524,543 |

|

|

|

||||

|

Single-copy, NYT International and other subscription revenues(4) |

|

16,445 |

|

|

23,656 |

|

|

(30.5)% |

|

68,118 |

|

|

98,856 |

|

|

(31.1)% |

||||

|

Subtotal print subscription revenues |

|

148,795 |

|

|

153,189 |

|

|

(2.9)% |

|

597,088 |

|

|

623,399 |

|

|

(4.2)% |

||||

|

Total subscription revenues |

|

$ |

315,795 |

|

|

$ |

275,283 |

|

|

|

|

$ |

1,195,368 |

|

|

$ |

1,083,851 |

|

|

|

|

(1) Includes revenues from subscriptions to the Company’s news product. News product subscription packages that include access to the Company’s Games and Cooking products are also included in this category. |

||||||||||||||||||||

|

(2) Includes revenues from standalone subscriptions to the Company’s Games, Cooking and audio products. |

||||||||||||||||||||

|

(3) Includes free access to some or all of the Company’s digital products. |

||||||||||||||||||||

|

(4) NYT International is the international edition of our print newspaper. |

||||||||||||||||||||

|

The following table summarizes digital and print subscriptions as of the end of 2020 and 2019: |

||||||||

|

|

|

|

|

|

|

|

||

|

|

|

Fourth Quarter |

||||||

|

|

|

2020 |

|

2019 |

|

% Change |

||

|

Digital-only subscriptions: |

|

|

|

|

|

|

||

|

News product subscriptions(1) |

|

5,090 |

|

|

3,429 |

|

|

|

|

Other product subscriptions(2) |

|

1,600 |

|

|

966 |

|

|

|

|

Subtotal digital-only subscriptions |

|

6,690 |

|

|

4,395 |

|

|

|

|

Print subscriptions |

|

833 |

|

|

856 |

|

|

(2.7)% |

|

Total subscriptions |

|

7,523 |

|

|

5,251 |

|

|

|

|

(1) Includes subscriptions to the Company’s news product. News product subscription packages that include access to the Company’s Games and Cooking products are also included in this category. |

||||||||

|

(2) Includes standalone subscriptions to the Company’s Games, Cooking and audio products. During the first quarter of 2020, the Company acquired a subscription-based audio product. Approximately 20,000 of the audio product’s subscriptions were included in the Company’s digital-only other product subscriptions at the time of acquisition. |

||||||||

THE NEW YORK TIMES COMPANY |

|||||||||||||||||||||

FOOTNOTES |

|||||||||||||||||||||

(Amounts in thousands) |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

(b) |

The following table summarizes digital and print advertising revenues for the fourth quarters and twelve months of 2020 and 2019: |

||||||||||||||||||||

|

|

|

|

|

|

||||||||||||||||

|

|

|

Fourth Quarter |

|

Twelve Months |

||||||||||||||||

|

|

|

2020 |

|

2019 |

|

% Change |

|

2020 |

|

2019 |

|

% Change |

||||||||

|

Advertising revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

Digital |

|

$ |

90,141 |

|

|

$ |

92,232 |

|

|

(2.3)% |

|

$ |

228,594 |

|

|

$ |

260,454 |

|

|

(12.2)% |

|

|

49,129 |

|

|

79,066 |

|

|

(37.9)% |

|

163,826 |

|

|

270,224 |

|

|

(39.4)% |

|||||

|

Total advertising |

|

$ |

139,270 |

|

|

$ |

171,298 |

|

|

(18.7)% |

|

$ |

392,420 |

|

|

$ |

530,678 |

|

|

(26.1)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

(c) |

Other revenues primarily consist of revenues from licensing, Wirecutter affiliate referrals, the leasing of floors in the Company headquarters, commercial printing, television and film, retail commerce and NYT Live (our live events business). |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

(d) |

The Company changed the expense captions on its Condensed Consolidated Statement of Operations effective for the quarter ended March 29, 2020, and reclassified expenses for the prior period in order to present comparable financial results. There is no change to consolidated operating income, operating expense, net income or cash flows as a result of this change in classification. Refer to reconciliation information in the exhibits for a discussion of management’s reasons for the presentation change and reconciliations from the previously disclosed amounts to the recast amounts. |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

(e) |

In the third quarter of 2019, the Company recognized |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

(f) |

In the third quarter of 2019, the Company recorded a gain of |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

(g) |

In the fourth quarter of 2020, the Company recorded pension settlement charges of |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

(h) |

In the fourth quarter of 2020, the Company recorded a |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

(i) |

In the first quarter of 2020, the Company recorded a |

||||||||||||||||||||

THE NEW YORK TIMES COMPANY

RECONCILIATION OF NON-GAAP INFORMATION

In this release, the Company has referred to non-GAAP financial information with respect to diluted earnings per share from continuing operations excluding severance, non-operating retirement costs and special items (or adjusted diluted earnings per share from continuing operations); operating profit before depreciation, amortization, severance, multiemployer pension plan withdrawal costs and special items (or adjusted operating profit); and operating costs before depreciation, amortization, severance and multiemployer pension withdrawal costs (or adjusted operating costs). The Company has included these non-GAAP financial measures because management reviews them on a regular basis and uses them to evaluate and manage the performance of the Company’s operations. Management believes that, for the reasons outlined below, these non-GAAP financial measures provide useful information to investors as a supplement to reported diluted earnings/(loss) per share from continuing operations, operating profit/(loss) and operating costs. However, these measures should be evaluated only in conjunction with the comparable GAAP financial measures and should not be viewed as alternative or superior measures of GAAP results.

Adjusted diluted earnings per share provides useful information in evaluating the Company’s period-to-period performance because it eliminates items that the Company does not consider to be indicative of earnings from ongoing operating activities. Adjusted operating profit is useful in evaluating the ongoing performance of the Company’s business as it excludes the significant non-cash impact of depreciation and amortization as well as items not indicative of ongoing operating activities. Total operating costs include depreciation, amortization, severance and multiemployer pension plan withdrawal costs. Total operating costs excluding these items provide investors with helpful supplemental information on the Company’s underlying operating costs that is used by management in its financial and operational decision-making.

Management considers special items, which may include impairment charges, pension settlement charges and other items that arise from time to time, to be outside the ordinary course of our operations. Management believes that excluding these items provides a better understanding of the underlying trends in the Company’s operating performance and allows more accurate comparisons of the Company’s operating results to historical performance. In addition, management excludes severance costs, which may fluctuate significantly from quarter to quarter, because it believes these costs do not necessarily reflect expected future operating costs and do not contribute to a meaningful comparison of the Company’s operating results to historical performance.

Non-operating retirement costs include (i) interest cost, expected return on plan assets, amortization of actuarial gains and loss components and amortization of prior service credits of single-employer pension expense, (ii) interest cost, amortization of actuarial gains and loss components and amortization of prior service credits of retirement medical expense and (iii) all multiemployer pension plan withdrawal costs. These non-operating retirement costs are primarily tied to financial market performance including changes in market interest rates and investment performance. Management considers non-operating retirement costs to be outside the performance of the business and believes that presenting adjusted diluted earnings per share from continuing operations excluding non-operating retirement costs and presenting adjusted operating results excluding multiemployer pension plan withdrawal costs, in addition to the Company’s GAAP diluted earnings per share from continuing operations and GAAP operating results, provide increased transparency and a better understanding of the underlying trends in the Company’s operating business performance.

Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP measures are set out in the tables below.

THE NEW YORK TIMES COMPANY |

||||||||||||||||||||

RECONCILIATION OF NON-GAAP INFORMATION |

||||||||||||||||||||

(Dollars in thousands, except per share data) |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Reconciliation of diluted earnings per share from continuing operations excluding severance, non-operating retirement costs and special items (or adjusted diluted earnings per share from continuing operations) |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

Fourth Quarter |

|

Twelve Months |

||||||||||||||||

|

|

2020 |

|

2019 |

|

% Change |

|

2020 |

|

2019 |

|

% Change |

||||||||

Diluted earnings per share from continuing operations |

|

$ |

0.06 |

|

|

$ |

0.41 |

|

|

(85.4)% |

|

$ |

0.60 |

|

|

$ |

0.83 |

|

|

(27.7)% |

Add: |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Severance |

|

— |

|

|

0.01 |

|

|

* |

|

0.04 |

|

|

0.02 |

|

|

* |

||||

Non-operating retirement costs: |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Multiemployer pension plan withdrawal costs |

|

0.01 |

|

|

0.01 |

|

|

— |

|

0.03 |

|

|

0.04 |

|

|

(25.0)% |

||||

Other components of net periodic benefit costs |

|

0.01 |

|

|

0.01 |

|

|

— |

|

0.05 |

|

|

0.04 |

|

|

|

||||

Special items: |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Restructuring charge |

|

— |

|

|

— |

|

|

— |

|

— |

|

|

0.02 |

|

|

* |

||||

Gain from non-marketable equity security |

|

— |

|

|

— |

|

|

— |

|

(0.06) |

|

|

— |

|

|

* |

||||

Gain from pension liability adjustment |

|

— |

|

|

— |

|

|

— |

|

— |

|

|

(0.01) |

|

|

* |

||||

Gain from joint venture, net of noncontrolling interest |

|

(0.03) |

|

|

— |

|

|

* |

|

(0.03) |

|

|

— |

|

|

* |

||||

Pension settlement charge |

|

0.48 |

|

|

— |

|

|

* |

|

0.48 |

|

|

— |

|

|

* |

||||

Income tax expense of adjustments |

|

(0.13) |

|

|

(0.01) |

|

|

* |

|

(0.14) |

|

|

(0.03) |

|

|

* |

||||

Adjusted diluted earnings per share from continuing operations(1) |

|

$ |

0.40 |

|

|

$ |

0.43 |

|

|

(7.0)% |

|

$ |

0.97 |

|

|

$ |

0.92 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

(1) Amounts may not add due to rounding. |

||||||||||||||||||||

* Represents a change equal to or in excess of |

||||||||||||||||||||

|

||||||||||||||||||||

Reconciliation of operating profit before depreciation & amortization, severance, multiemployer pension plan withdrawal costs and special items (or adjusted operating profit) |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

Fourth Quarter |

|

Twelve Months |

||||||||||||||||

|

|

2020 |

|

2019 |

|

% Change |

|

2020 |

|

2019 |

|

% Change |

||||||||

Operating profit |

|

$ |

80,534 |

|

|

$ |

77,965 |

|

|

|

|

$ |

176,256 |

|

|

$ |

175,582 |

|

|

|

Add: |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Depreciation & amortization |

|

15,768 |

|

|

15,113 |

|

|

|

|

62,136 |

|

|

60,661 |

|

|

|

||||

Severance |

|

— |

|

|

1,538 |

|

|

* |

|

6,675 |

|

|

3,979 |

|

|

|

||||

Multiemployer pension plan withdrawal costs |

|

1,351 |

|

|

1,729 |

|

|

(21.9)% |

|

5,550 |

|

|

6,183 |

|

|

(10.2)% |

||||

Special items: |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Restructuring charge |

|

— |

|

|

— |

|

|

— |

|

— |

|

|

4,008 |

|

|

* |

||||

Gain from pension liability adjustment |

|

— |

|

|

— |

|

|

— |

|

— |

|

|

(2,045) |

|

|

* |

||||

Adjusted operating profit |

|

$ |

97,653 |

|

|

$ |

96,345 |

|

|

|

|

$ |

250,617 |

|

|

$ |

248,368 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

* Represents a change equal to or in excess of |

||||||||||||||||||||

RECONCILIATION OF NON-GAAP INFORMATION |

||||||||||||||||||||

(Dollars in thousands, except per share data) |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Reconciliation of operating costs before depreciation & amortization, severance and multiemployer pension plan withdrawal costs (or adjusted operating costs) |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

Fourth Quarter |

|

Twelve Months |

||||||||||||||||

|

|

2020 |

|

2019 |

|

% Change |

|

2020 |

|

2019 |

|

% Change |

||||||||

Operating costs |

|

$ |

428,824 |

|

|

$ |

430,398 |

|

|

(0.4)% |

|

$ |

1,607,383 |

|

|

$ |

1,634,639 |

|

|

(1.7)% |

Less: |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Depreciation & amortization |

|

15,768 |

|

|

15,113 |

|

|

|

|

62,136 |

|

|

60,661 |

|

|

|

||||

Severance |

|

— |

|

|

1,538 |

|

|

* |

|

6,675 |

|

|

3,979 |

|

|

|

||||

Multiemployer pension plan withdrawal costs |

|

1,351 |

|

|

1,729 |

|

|

(21.9)% |

|

5,550 |

|

|

6,183 |

|

|

(10.2)% |

||||

Adjusted operating costs |

|

$ |

411,705 |

|

|

$ |

412,018 |

|

|

(0.1)% |

|

$ |

1,533,022 |

|

|

$ |

1,563,816 |

|

|

(2.0)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

* Represents a change equal to or in excess of |

|

|

|

|

|

|

||||||||||||||

THE NEW YORK TIMES COMPANY |

RECONCILIATION OF GAAP INFORMATION |

(Dollars in thousands, except per share data) |

Reclassification

The Company changed the expense captions on its Condensed Consolidated Statement of Operations effective for the quarter ended March 29, 2020. These changes were made in order to reflect how the Company manages its business and to communicate where the Company is investing resources and how this aligns with the Company’s strategy. The Company reclassified expenses for the prior period in order to present comparable financial results. There was no change to consolidated operating income, operating expense, net income or cash flows as a result of this change in classification. A summary of changes is as follows:

“Production costs” has become “Cost of revenue”:

- Cost of revenue contains all costs related to content creation, subscriber and advertiser servicing, and print production and distribution costs as well as infrastructure costs related to delivering digital content, which include all cloud and cloud related costs as well as compensation for employees that enhance and maintain our platforms. This represents a change from previously disclosed production costs, which did not include distribution or subscriber servicing costs. In addition, certain product development costs previously included in production costs have been reclassified to product development.

“Selling, general and administrative” has been split into three lines:

- Sales and marketing represents all costs related to the Company’s marketing efforts as well as advertising sales costs.

- Product development represents the Company’s investment into developing and enhancing new and existing product technology, including engineering, product development, and data insights.

- General and administrative includes general management, corporate enterprise technology, building operations, unallocated overhead costs, severance and multiemployer pension plan withdrawal costs.

In addition, incentive compensation, which was previously wholly included in selling, general and administrative, was reclassified to align with the classification of the related wages across each of the expense captions.

THE NEW YORK TIMES COMPANY |

RECONCILIATION OF GAAP INFORMATION |

(Dollars in thousands) |

A reconciliation of the expenses as previously disclosed to the recast presentation for the quarter and twelve months ended December 29, 2019, is as follows:

|

|

As Reported for

the Quarter Ended

|

|

Reclassification |

|

Recast for the

Quarter Ended

|

||||||

Operating costs |

|

|

|

|

|

|

||||||

Production costs: |

|

|

|

|

|

|

||||||

Wages and benefits |

|

$ |

110,826 |

|

|

$ |

(110,826) |

|

(1)(2) |

$ |

— |

|

Raw materials |

|

18,377 |

|

|

(18,377) |

|

(1) |

— |

|

|||

Other production costs |

|

57,279 |

|

|

(57,279) |

|

(1)(2) |

— |

|

|||

Total production costs |

|

186,482 |

|

|

(186,482) |

|

(1)(2) |

— |

|

|||

Cost of revenue (excluding depreciation and amortization) |

|

— |

|

|

259,375 |

|

(1)(3)(4) |

259,375 |

|

|||

Selling, general and administrative costs |

|

228,803 |

|

|

(228,803) |

|

(3)(4)(5) |

— |

|

|||

Sales and marketing |

|

— |

|

|

71,330 |

|

(4)(5) |

71,330 |

|

|||

Product development |

|

— |

|

|

29,856 |

|

(2)(4)(5) |

29,856 |

|

|||

General and administrative |

|

— |

|

|

54,724 |

|

(4)(5) |

54,724 |

|

|||

Depreciation and amortization |

|

15,113 |

|

|

— |

|

|

15,113 |

|

|||

Total operating costs |

|

$ |

430,398 |

|

|

$ |

— |

|

|

$ |

430,398 |

|

|

|

As Reported for the Twelve Months Ended December 27, 2019 |

|

Reclassification |

|

Recast for the Twelve Months

Ended

|

||||||

Operating costs |

|

|

|

|

|

|

||||||

Production costs: |

|

|

|

|

|

|

||||||

Wages and benefits |

|

$ |

424,070 |

|

|

$ |

(424,070) |

|

(1)(2) |

$ |

— |

|

Raw materials |

|

75,904 |

|

|

(75,904) |

|

(1) |

— |

|

|||

Other production costs |

|

206,381 |

|

|

(206,381) |

|

(1)(2) |

— |

|

|||

Total production costs |

|

706,355 |

|

|

(706,355) |

|

(1)(2) |

— |

|

|||

Cost of revenue (excluding depreciation and amortization) |

|

— |

|

|

989,029 |

|

(1)(3)(4) |

989,029 |

|

|||

Selling, general and administrative costs |

|

867,623 |

|

|

(867,623) |

|

(3)(4)(5) |

— |

|

|||

Sales and marketing |

|

— |

|

|

272,657 |

|

(4)(5) |

272,657 |

|

|||

Product development |

|

— |

|

|

105,514 |

|

(2)(4)(5) |

105,514 |

|

|||

General and administrative |

|

— |

|

|

206,778 |

|

(4)(5) |

206,778 |

|

|||

Depreciation and amortization |

|

60,661 |

|

|

— |

|

|

60,661 |

|

|||

Total operating costs |

|

$ |

1,634,639 |

|

|

$ |

— |

|

|

$ |

1,634,639 |

|

| (1) | In the first quarter of 2020, the Company discontinued the use of the production cost caption. These costs, with the exception of product engineering and product design costs, which were reclassified to product development, were reclassified to cost of revenue. |

| (2) | Costs related to developing and enhancing new and existing product technology previously included in production costs were reclassified to product development. |

| (3) | Distribution and fulfillment costs and subscriber and advertising servicing related costs previously included in selling, general and administrative were reclassified to cost of revenue. |

| (4) | Incentive Compensation previously included in selling, general and administrative was reclassified to align with the related salaries in each caption. |

| (5) | In the first quarter of 2020, the Company discontinued the use of the selling, general and administrative cost caption. These costs, with the exception of those related to distribution and fulfillment, subscriber and advertising servicing and incentive compensation related to cost of revenue, were reclassified to the new captions: sales and marketing, product development and general and administrative. |

View source version on businesswire.com: https://www.businesswire.com/news/home/20210204005599/en/

FAQ

What were the earnings per share for New York Times Company in Q4 2020?

How much did subscription revenues increase in Q4 2020 for NYT?

What is the dividend amount declared by NYT?

When is the dividend payment date for NYT?