NexPoint Residential Trust, Inc. Announces Entrance into Contract to Sell Old Farm in Houston, TX, and Silverbrook in Dallas, TX

- None.

- None.

Insights

Analyzing...

The Company expects the dispositions of these assets to generate approximately

The executed agreements have

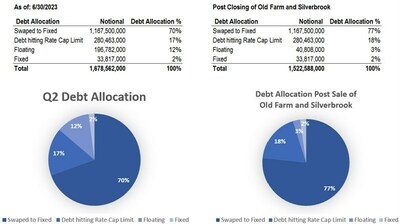

The dispositions are expected to close in early October. After completing these sales, the Company expects to pay off the entire

In addition, NXRT is currently in the process of selecting buyers for Timber Creek and Radbourne Lake in

"NXRT is excited to execute our strategic objectives to sell out of our

About NXRT

NexPoint Residential Trust is a publicly traded REIT, with its shares listed on the New York Stock Exchange under the symbol "NXRT," primarily focused on acquiring, owning and operating well-located middle-income multifamily properties with "value-add" potential in large cities and suburban submarkets of large cities, primarily in the Southeastern and

Cautionary Statement Regarding Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that are based on management's current expectations, assumptions and beliefs. Forward-looking statements can often be identified by words such as "expect," "estimate," "will," "should," and similar expressions, and variations or negatives of these words. These forward-looking statements include, but are not limited to, statements regarding the expected closing of the sale of the Old Farm and Silverbrook properties, the expected net sales proceeds and nominal cap rate and adjusted cap rate of the properties, the expected payoff of the corporate credit facility and related timing, the expected reduction of property-level debt and hedged debt, the asset sales provide greater strategic flexibility and derisk the Company's balance sheet heading into 2024, the timing and expected strong returns from the sale of Timber Creek, Radbourne Lake and Stone Creek at Old Farm and that these maneuvers will unlock liquidity which the Company can use to repurchase common stock, deleverage the portfolio and pursue internal and external growth strategies. They are not guarantees of future results and are subject to risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed in any forward-looking statement, including that the property sales do not close or are delayed and those described in our filings with the Securities and Exchange Commission, particularly those described in our Annual Report on Form 10-K. Readers should not place undue reliance on any forward-looking statements and are encouraged to review the Company's most recent Annual Report on Form 10-K and other filings with the SEC for a more complete discussion of the risks and other factors that could affect any forward-looking statements. The statements made herein speak only as of the date of this release and except as required by law, NXRT does not undertake any obligation to publicly update or revise any forward-looking statements.

Contact:

Kristen Thomas

Investor Relations

IR@nexpoint.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/nexpoint-residential-trust-inc-announces-entrance-into-contract-to-sell-old-farm-in-houston-tx-and-silverbrook-in-dallas-tx-301903305.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/nexpoint-residential-trust-inc-announces-entrance-into-contract-to-sell-old-farm-in-houston-tx-and-silverbrook-in-dallas-tx-301903305.html

SOURCE NexPoint Residential Trust, Inc.