NHI Mails Letter to Stockholders Highlighting Superior Shareholder Returns and Refreshed Board

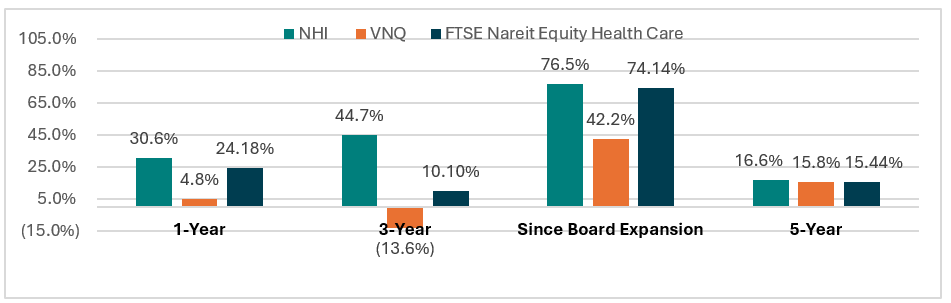

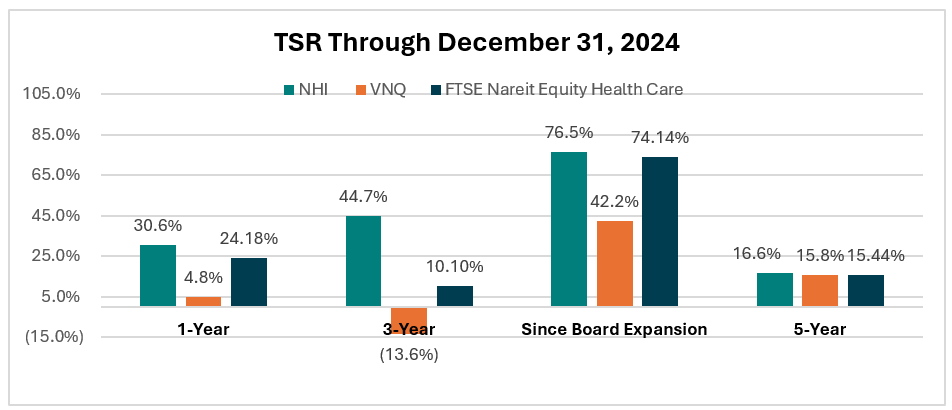

National Health Investors (NYSE:NHI) has mailed a letter to stockholders ahead of its May 21, 2025 Annual Meeting, urging them to vote 'FOR' four Board nominees on the WHITE proxy card. The letter highlights NHI's superior shareholder returns, with the company outperforming key REIT indices over 1-year, 3-year, and 5-year periods through December 31, 2024.

The company has significantly refreshed its Board since May 2020, adding six new members and increasing Board diversity from 0% to 37.5%. Notable achievements include reducing average tenure from 21 to 7 years and appointing new committee chairs. A Special Committee of Non-Interested Directors has been formed to oversee lease negotiations with National Healthcare (NHC), which represents 14% of NHI's 2024 NOI.

The letter addresses Land & Buildings' (L&B) proxy contest, which owns 1.3% of shares and nominated candidates to replace two board members. NHI's Board argues that L&B's candidates do not add value to the current Board's skill sets and that L&B has not proposed substantive ideas for improvement.

National Health Investors (NYSE:NHI) ha inviato una lettera agli azionisti in vista dell'Assemblea Annuale del 21 maggio 2025, esortandoli a votare 'A FAVORE' dei quattro candidati al Consiglio di Amministrazione sulla scheda bianca. La lettera sottolinea i rendimenti superiori per gli azionisti di NHI, che ha sovraperformato gli indici REIT principali nei periodi di 1, 3 e 5 anni fino al 31 dicembre 2024.

L'azienda ha rinnovato significativamente il Consiglio dal maggio 2020, aggiungendo sei nuovi membri e aumentando la diversità del Consiglio dal 0% al 37,5%. Tra i risultati più rilevanti vi sono la riduzione della durata media del mandato da 21 a 7 anni e la nomina di nuovi presidenti di comitato. È stato inoltre costituito un Comitato Speciale di Amministratori Indipendenti per supervisionare le trattative di locazione con National Healthcare (NHC), che rappresenta il 14% del NOI 2024 di NHI.

La lettera affronta la contestazione di proxy da parte di Land & Buildings (L&B), che detiene l'1,3% delle azioni e ha nominato candidati per sostituire due membri del Consiglio. Il Consiglio di NHI sostiene che i candidati di L&B non apportano valore alle competenze attuali del Consiglio e che L&B non ha proposto idee concrete per miglioramenti.

National Health Investors (NYSE:NHI) ha enviado una carta a los accionistas antes de su Junta Anual del 21 de mayo de 2025, instándolos a votar 'A FAVOR' de cuatro candidatos para el Consejo en la tarjeta blanca. La carta destaca los superiores retornos para los accionistas de NHI, que ha superado a los principales índices REIT en períodos de 1, 3 y 5 años hasta el 31 de diciembre de 2024.

La compañía ha renovado significativamente su Consejo desde mayo de 2020, incorporando seis nuevos miembros y aumentando la diversidad del Consejo del 0% al 37,5%. Logros destacados incluyen reducir la antigüedad promedio de 21 a 7 años y nombrar nuevos presidentes de comité. Se ha formado un Comité Especial de Directores Independientes para supervisar las negociaciones de arrendamiento con National Healthcare (NHC), que representa el 14% del NOI 2024 de NHI.

La carta aborda la contienda de representación accionaria de Land & Buildings (L&B), que posee el 1,3% de las acciones y nominó candidatos para reemplazar a dos miembros del Consejo. El Consejo de NHI argumenta que los candidatos de L&B no aportan valor a las habilidades actuales del Consejo y que L&B no ha propuesto ideas sustantivas para mejorar.

National Health Investors (NYSE:NHI)는 2025년 5월 21일 연례 주주총회를 앞두고 주주들에게 백색 위임장에 있는 이사회 후보 4명에 대해 '찬성' 투표를 요청하는 서한을 발송했습니다. 서한에서는 2024년 12월 31일까지 1년, 3년, 5년 기간 동안 주요 REIT 지수를 능가하는 NHI의 뛰어난 주주 수익률을 강조했습니다.

회사는 2020년 5월 이후로 이사회를 크게 쇄신하여 6명의 신규 이사를 추가하고 이사회 다양성을 0%에서 37.5%로 높였습니다. 주요 성과로는 평균 임기 기간을 21년에서 7년으로 단축하고 새로운 위원회 의장을 임명한 점이 있습니다. 또한 NHI 2024년 NOI의 14%를 차지하는 National Healthcare (NHC)와의 임대 협상을 감독하기 위해 이해관계가 없는 이사들로 구성된 특별위원회를 구성했습니다.

서한은 1.3%의 지분을 보유한 Land & Buildings (L&B)의 위임장 경쟁에 대해 언급하며, L&B가 두 명의 이사 교체를 위해 후보를 지명했다고 밝혔습니다. NHI 이사회는 L&B 후보들이 현재 이사회의 전문성에 도움이 되지 않으며, L&B가 실질적인 개선 방안을 제시하지 않았다고 주장합니다.

National Health Investors (NYSE:NHI) a envoyé une lettre aux actionnaires avant son Assemblée Générale Annuelle du 21 mai 2025, les incitant à voter 'POUR' quatre candidats au Conseil d'administration sur la carte blanche. La lettre souligne les rendements supérieurs pour les actionnaires de NHI, la société ayant surperformé les principaux indices REIT sur des périodes de 1, 3 et 5 ans jusqu'au 31 décembre 2024.

L'entreprise a considérablement renouvelé son Conseil depuis mai 2020, ajoutant six nouveaux membres et augmentant la diversité du Conseil de 0 % à 37,5 %. Parmi les réalisations notables figurent la réduction de la durée moyenne des mandats de 21 à 7 ans et la nomination de nouveaux présidents de comité. Un Comité Spécial de Directeurs Indépendants a été formé pour superviser les négociations de baux avec National Healthcare (NHC), qui représente 14 % du NOI 2024 de NHI.

La lettre traite du conflit de procuration initié par Land & Buildings (L&B), qui détient 1,3 % des actions et a proposé des candidats pour remplacer deux membres du Conseil. Le Conseil de NHI soutient que les candidats de L&B n'apportent pas de valeur ajoutée aux compétences actuelles du Conseil et que L&B n'a pas proposé d'idées concrètes d'amélioration.

National Health Investors (NYSE:NHI) hat den Aktionären vor der Jahreshauptversammlung am 21. Mai 2025 einen Brief geschickt, in dem sie aufgefordert werden, für vier Vorstandsmitglieder auf der weißen Stimmkarte zu stimmen. Der Brief hebt die überlegenen Aktionärsrenditen von NHI hervor, das die wichtigsten REIT-Indizes über Zeiträume von 1, 3 und 5 Jahren bis zum 31. Dezember 2024 übertroffen hat.

Das Unternehmen hat seinen Vorstand seit Mai 2020 erheblich erneuert, sechs neue Mitglieder hinzugefügt und die Diversität im Vorstand von 0 % auf 37,5 % erhöht. Zu den bemerkenswerten Erfolgen zählen die Verringerung der durchschnittlichen Amtszeit von 21 auf 7 Jahre und die Ernennung neuer Ausschussvorsitzender. Ein Sonderausschuss unabhängiger Direktoren wurde gebildet, um die Mietverhandlungen mit National Healthcare (NHC) zu überwachen, das 14 % des NOI von NHI im Jahr 2024 ausmacht.

Der Brief befasst sich mit dem Proxy-Kampf von Land & Buildings (L&B), das 1,3 % der Aktien hält und Kandidaten zur Ablösung von zwei Vorstandsmitgliedern nominiert hat. Der Vorstand von NHI argumentiert, dass die Kandidaten von L&B keinen Mehrwert für die aktuellen Fähigkeiten des Vorstands bringen und dass L&B keine substanziellen Verbesserungsvorschläge gemacht hat.

- Superior shareholder returns with 30.6% 1-year TSR through December 31, 2024

- Significant Board refreshment with increased diversity from 0% to 37.5%

- Strong market position with $3.5B market capitalization

- Potential uncertainty around NHC lease renewal representing 14% of NOI

- Ongoing proxy contest with activist investor Land & Buildings

NHI Urges Stockholders to Vote "FOR" National Health Investors, Inc.'s Highly Qualified and Experienced Nominees on the WHITE Proxy Card

MURFREESBORO, TN / ACCESS Newswire / April 17, 2025 / National Health Investors, Inc. (NYSE:NHI) ("NHI" or "the Company") announced today that it has mailed a letter to stockholders in connection with its upcoming Annual Meeting of Stockholders, which is scheduled to be held virtually on May 21, 2025. Stockholders of record as of the close of business on March 28, 2025, are entitled to vote at the meeting. The letter urges stockholders vote on the WHITE proxy card "FOR" the election of NHI's highly qualified Board members, Robert G. Adams, Robert W. Chapin, Jr., James R. Jobe and Candice W. Todd.

Highlights of the letter include:

NHI has delivered superior shareholder returns relative to its peers.

NHI recently refreshed its Board and successfully addressed any perceived conflicts of interest.

The NHC lease renewal is a high priority, and the Company is focused on exploring all options to deliver the greatest returns for stockholders.

Land & Buildings has not proposed any substantive ideas to enhance stockholder value.

Your Board's nominees are, in our view, the best qualified people to execute our strategy, to continue driving sustainable, long-term TSR, and to protect your investment and our positive momentum.

Over the 1-year, 3-year, 5-year periods, and since the Board first expanded in May 2020, NHI's total shareholder return ("TSR") has outperformed the FTSE Nareit Equity Health Care Index and the broader REIT market as measured by the Vanguard Real Estate Index Fund ETF (VNQ) through December 31, 2024.

NHI's definitive proxy materials and other materials regarding the Board's recommendation for the Annual Meeting of Stockholders can be found at https://nhireit.com.

PROTECT THE VALUE OF YOUR INVESTMENT

Vote "FOR" Robert G. Adams, Robert W. Chapin, Jr., James R. Jobe and Candice W. Todd on the Enclosed WHITE Proxy Card Today

The full text of the letter being mailed to stockholders follows.

April 17, 2025

Dear Fellow Stockholders:

As the NHI Annual Meeting of Stockholders quickly approaches, we are asking for your support and urge that you vote "FOR" our highly qualified Board members, including Robert G. Adams, Robert W. Chapin, Jr., James R. Jobe and Candice W. Todd.

The Company and the NHI Board of Directors have undertaken significant changes in the last five years. We believe these proactive changes have driven superior shareholder returns. Over the 1-year, 3-year, 5-year periods, and since the Board first expanded in May 2020, NHI's total shareholder return ("TSR") has outperformed the FTSE Nareit Equity Health Care Index and the broader REIT market as measured by the Vanguard Real Estate Index Fund ETF (VNQ).

Unfortunately, in a letter dated April 9, 2025, Land & Buildings ("L&B") cynically claimed that our "stockholder returns have meaningfully underperformed" our peer group. Our Board urges stockholders not to believe these misleading claims. L&B recklessly invented an "index" composed solely of just two "cherry picked" companies, Welltower and Ventas, each very different from and many times larger than NHI. Further, as seen in the chart below, average outperformance of this so-called "index" of two companies over the 1-year and 3-year periods ended December 31, 2024, was entirely driven by Welltower as NHI's TSR was superior to Ventas.

| TSR Through December 31, 2024 |

|

| Current |

| |||||||||||

| 1- Year |

|

| 3 -Year |

|

| 5-Year |

|

| Market Cap ($B) |

| |||||

NHI |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Ventas |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Welltower |

|

|

|

|

|

|

|

|

|

|

|

| ||||

NHI stockholders are encouraged to read the NHI proxy statement and not to be misled by L&B's attempts to develop a hand-picked index in an attempt to misdirect stockholder attention from the progress made by our Board and mischaracterize NHI's superior stock price appreciation in comparison to its accurate REIT peers. You are strongly encouraged to vote "FOR" our highly qualified Board members to protect your investment and to help NHI drive sustainable, long-term stockholder value.

THE NHI BOARD HAS BEEN REFRESHED, EXPANDED

AND HAS ADDRESSED PERCEIVED CONFLICTS OF INTEREST

Since the Board first expanded in May 2020, six new members have been appointed which has increased Board diversity from

Further, there have been several changes to the leadership of the NHI Board Committees which we believe strengthen the overall governance of the Company including:

Robert A. McCabe, Executive Chairman of Pinnacle Financial Partners, was appointed as the Chair of the NHI Board;

Tracy M.J. Colden was appointed Chair of the Nominating and Corporate Governance Committee in May 2024 due to her significant experience in legal affairs and corporate governance from her current role and prior roles as general counsel and corporate secretary for large hospitality and lodging companies;

James R. Jobe was appointed Chair of the Compensation Committee in January 2025 and subsequently retained Ferguson Partners as an independent compensation consultant which is a first in the Company's history and should better align stockholder interests with Board and executive compensation; and

Candice W. Todd was appointed Chair of the Audit Committee in January 2025 due to her expertise in real estate investments, finance and accounting having served as Chief Financial Officer for Morgan Stanley Real Estate Investments. Ms. Todd is also on the Board of Highwoods Properties, Inc. (HIW) where she serves as a financial expert and on the Audit Committee.

Additionally, NHI formed a Special Committee of Non-Interested Directors currently consisting of Messrs. McCabe and Chapin and Mses. Colden and Todd to oversee the ongoing lease negotiations with National Healthcare Corporation ("NHC"). The Company has also retained Blueprint Healthcare Real Estate Advisors (Blueprint), a leading national independent consultancy firm to advise and assist NHI on the lease renewal process.

The NHC lease covers a portfolio of 32 skilled nursing facilities and three independent living communities across seven states. The lease matures on December 31, 2026, and NHC has the right to renew the lease at a fair market rent rate. NHC is required to provide six months' notice to NHI as to NHC's intent to renew the lease. The NHC lease accounted for approximately

L&B HAS NOT PROPOSED ANY SUBSTANTIVE IDEAS, AND THEIR DEMAND TO HAVE TWO

HAND-PICKED CANDIDATES PUT ON THE NHI BOARD IS SELF-SERVING

Despite NHI's strong track record of operational performance and shareholder returns, L&B, a stockholder that owns approximately

Our Board interviewed and carefully considered both of L&B's candidates whose primary experience has been in capital markets and financing, which our Board does not believe is additive to the Board's current skill sets and experiences. In particular, our recent additions to the Board, Candice W. Todd and Robert W. Chapin, Jr., both possess significant expertise in capital markets and real estate investments. In addition, Mr. Chapin brings decades of experience in senior housing operations and acquisitions, providing a very specific and helpful skill set as the Company embarks on growing its senior housing operating platform amidst the favorable industry tailwinds that this sector is experiencing.

L&B has offered no substantive ideas for NHI and has only continued to direct its criticisms to the composition of the Board - the same Board that has overseen significant value creation for stockholders over both the near-term and, more importantly, long-term. We believe, as does L&B, that "the Company has an extraordinary opportunity today to drive substantial accretion through acquisitions." Your Board's nominees are, in our view, the best qualified people to execute our strategy, to continue driving sustainable, long-term TSR, and to protect your investment and our positive momentum.

Against this backdrop, you now face an important decision regarding the future of your investment and go-forward Board of Directors. Your Board has four directors up for election who have highly relevant skills and expertise and are important contributors to NHI's ongoing success. To protect your investment, we strongly recommend that you vote the enclosed universal WHITE proxy card today "FOR" all four of NHI's qualified and experienced director nominees: Robert G. Adams, Robert W. Chapin, Jr., James R. Jobe and Candice W. Todd. Please vote today to ensure your voice is heard at the Company's Annual Meeting of Stockholders on May 21, 2025.

We look forward to continuing our dialogue with all stockholders and greatly appreciate your support.

Sincerely,

The NHI Board of Directors

Forward-Looking Statements

This communication includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements regarding the Company's, tenants', operators', borrowers' or managers' expected future financial position, results of operations, cash flows, funds from operations, dividend and dividend plans, financing opportunities and plans, capital market transactions, business strategy, budgets, projected costs, operating metrics, capital expenditures, competitive positions, acquisitions, investment opportunities, dispositions, acquisition integration, growth opportunities, expected lease income, continued qualification as a REIT, plans and objectives of management for future operations, continued performance improvements, ability to service and refinance our debt obligations, ability to finance growth opportunities, and similar statements including, without limitation, those containing words such as "may", "will", "should", "believes", "anticipates", "expects", "intends", "estimates", "plans", "projects", "likely" and other similar expressions are forward-looking statements.

Forward-looking statements involve known and unknown risks and uncertainties that may cause our actual results in future periods to differ materially from those projected or contemplated in the forward-looking statements. Such risks and uncertainties include, among other things; the operating success of our tenants, managers and borrowers for collection of our lease and interest income; the risk that our tenants, managers and borrowers may become subject to bankruptcy or insolvency proceedings; risks related to the concentration of a significant percentage of our portfolio to a small number of tenants; risks associated with pandemics, epidemics or outbreaks on our operators' business and results of operations; risks related to governmental regulations and payors, principally Medicare and Medicaid, and the effect that changes to laws, regulations and reimbursement rates would have on our tenants' and borrowers' business; the risk that the cash flows of our tenants, managers and borrowers may be adversely affected by increased liability claims and liability insurance costs; the risk that we may not be fully indemnified by our tenants, managers and borrowers against future litigation; the success of property development and construction activities, which may fail to achieve the operating results we expect; the risk that the illiquidity of real estate investments could impede our ability to respond to adverse changes in the performance of our properties; risks associated with our investments in unconsolidated entities, including our lack of sole decision-making authority and our reliance on the financial condition of other interests; risks related to our joint venture investment with Life Care Services for Timber Ridge; inflation and increased interest rates; adverse developments affecting the financial services industry, including events or concerns involving liquidity, defaults, or non-performance by financial institutions; operational risks with respect to our SHOP structured communities, risks related to our ability to maintain the privacy and security of Company information; risks related to environmental laws and the costs associated with liabilities related to hazardous substances; the risk of damage from catastrophic weather and other natural or man-made disasters and the physical effects of climate change; the success of our future acquisitions and investments; our ability to reinvest cash in real estate investments in a timely manner and on acceptable terms; competition for acquisitions may result in increased prices for properties; our ability to retain our management team and other personnel and attract suitable replacements should any such personnel leave; the risk that our assets may be subject to impairment charges; our ability to raise capital through equity sales is dependent, in part, on the market price of our common stock, and our failure to meet market expectations with respect to our business, or other factors we do not control, could negatively impact such market price and availability of equity capital; the potential need to refinance existing debt or incur additional debt in the future, which may not be available on terms acceptable to us; our ability to meet covenants related to our indebtedness which impose certain operational limitations and a breach of those covenants could materially adversely affect our financial condition and results of operations; downgrades in our credit ratings could have a material adverse effect on our cost and availability of capital; we rely on external sources of capital to fund future capital needs, and if we encounter difficulty in obtaining such capital, we may not be able to make future investments necessary to grow our business or meet maturing commitments; our dependence on revenues derived mainly from fixed rate investments in real estate assets, while a portion of our debt bears interest at variable rates; our ability to pay dividends in the future; legislative, regulatory, or administrative changes; and our dependence on the ability to continue to qualify for taxation as a real estate investment trust and other risks which are described under the heading "Risk Factors" in Item 1A in our Form 10-K for the year ended December 31, 2024. Many of these factors are beyond the control of the Company and its management. The Company assumes no obligation to update any of the foregoing or any other forward looking statements, except as required by law, and these statements speak only as of the date on which they are made. Investors are urged to carefully review and consider the various disclosures made by NHI in its periodic reports filed with the Securities and Exchange Commission, including the risk factors and other information in the above referenced Form 10-K. Copies of these filings are available at no cost on the SEC's web site at https://www.sec.gov or on NHI's web site at https://www.nhireit.com.

Important Additional Information Regarding Proxy Solicitation

NHI has filed a definitive proxy statement and WHITE proxy card (the "Proxy Statement") with the SEC in connection with the solicitation of proxies for the Company's Annual Meeting. The Company, its directors and certain of its executive officers will be participants in the solicitation of proxies from stockholders in respect of the Annual Meeting. Information regarding the names of the Company's directors and executive officers and their respective interests in the Company by security holdings or otherwise is set forth in the Proxy Statement. To the extent holdings of such participants in the Company's securities have changed since the amounts described in the Proxy Statement, such changes have been reflected on Initial Statements of Beneficial Ownership on Form 3 or Statements of Change in Ownership on Form 4 filed with the SEC. Additional information can also be found in the Company's Annual Report on Form 10-K for the year ended December 31, 2024, filed with the SEC on February 25, 2025. Details concerning the nominees of the Company's Board of Directors for election at the Annual Meeting are included in the Proxy Statement. BEFORE MAKING ANY VOTING DECISION, INVESTORS AND STOCKHOLDERS OF THE COMPANY ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH OR FURNISHED TO THE SEC, INCLUDING THE COMPANY'S DEFINITIVE PROXY STATEMENT AND ANY AMENDMENTS AND SUPPLEMENTS THERETO BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. These documents, including the definitive Proxy Statement (and any amendments or supplements thereto) and other documents filed by the Company with the SEC, are available for no charge at the SEC's website at www.sec.gov and at the Company's investor relations website at https://investors.nhireit.com.

Glossary and Reconciliation of Non-GAAP Financial Measures

These financial performance measures do not represent cash generated from operating activities in accordance with U.S. generally accepted accounting principles ("GAAP") (these measures do not include changes in operating assets and liabilities) and therefore should not be considered an alternative to net earnings as an indication of performance, or to net cash flow from operating activities as determined by GAAP as a measure of liquidity, and are not necessarily indicative of cash available to fund cash needs. These supplemental performance measures may not be comparable to similarly titled measures used by other REITs that may use a different definition of these performance measures. Consequently, our Net Operating Income ("NOI") may not provide a meaningful measure of our performance as compared to that of other REITs.

Net Operating Income

NOI is a U.S. non-GAAP supplemental financial measure used to evaluate the operating performance of real estate. NOI is defined as total revenues, less tenant reimbursements and property operating expenses. The Company believes NOI provides investors relevant and useful information as it measures the operating performance of our properties at the property level on an unleveraged basis. The Company uses NOI to make decisions about resource allocations and to assess the property level performance of our properties.

NOI Reconciliations |

| Years Ended December 31, |

| |||||

($ in thousands) |

| 2024 |

|

| 2023 |

| ||

Net income |

| $ | 136,639 |

|

| $ | 134,381 |

|

Gain on forward sale agreement, net |

|

| (6,261 | ) |

|

| - |

|

Gains from equity method investment |

|

| (402 | ) |

|

| (555 | ) |

Other income |

|

| - |

|

|

| (202 | ) |

Loss on early retirement of debt |

|

| - |

|

|

| 73 |

|

(Gain) loss on operations transfer, net |

|

| - |

|

|

| (20 | ) |

Gains on sales of real estate |

|

| (6,678 | ) |

|

| (14,721 | ) |

Loan and realty losses, net |

|

| 5,295 |

|

|

| 1,376 |

|

General and administrative |

|

| 20,736 |

|

|

| 19,314 |

|

Franchise, excise and other taxes |

|

| 38 |

|

|

| 449 |

|

Legal |

|

| 1,052 |

|

|

| 507 |

|

Interest |

|

| 59,903 |

|

|

| 58,160 |

|

Depreciation |

|

| 71,443 |

|

|

| 69,973 |

|

Consolidated NOI |

| $ | 281,765 |

|

| $ | 268,735 |

|

Contact: Dana Hambly, Vice President, Investor Relations

Phone: (615) 890-9100

SOURCE: National Health Investors

View the original press release on ACCESS Newswire