New Found Intercepts 14.5 g/t Au Over 27.8m, 9.7 g/t Au Over 20.3m, 34.6 g/t Au Over 5.3m, 39 g/t Au Over 4.3m & 33 g/t Au Over 4.8m at Iceberg

- Positive: High-grade gold intercepts at Iceberg and Iceberg East, including 33.07 g/t Au over 4.80m and 14.54 g/t Au over 27.80m. These results demonstrate strong continuity of high-grade gold mineralization.

- Positive: Intercepts occur within a shallow window at depths of up to 160m, making them easily accessible for mining.

- Positive: Results expand the high-grade segment of the Keats-Baseline Fault Zone at Iceberg, indicating the potential for further gold mineralization.

- Positive: The Queensway project, where the Iceberg discovery is located, comprises a large area of 1,662km2 and is easily accessible via the Trans-Canada Highway.

- Positive: New Found Gold Corp. is currently undertaking a 500,000m drill program at Queensway, with approximately 57,000m of core pending assay results.

- Negative: The true widths of the intercepts are generally estimated to be 170% to 95% and 240% to 70% of reported intervals, introducing some uncertainty in the results.

- Negative: The company has not completed any economic evaluations of its Queensway project, and it does not have any resources or reserves.

- Negative: The company has an at-the-market equity offering program, which could dilute the value of existing shares.

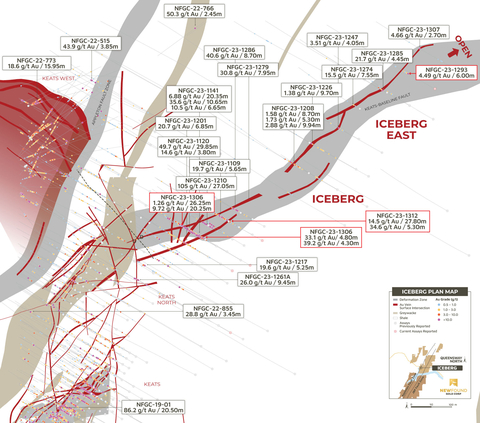

Figure 2. Iceberg-Iceberg East plan view map (Graphic: Business Wire)

Iceberg and Iceberg East Highlights:

Hole No. |

From (m) |

To (m) |

Interval (m) |

Au (g/t) |

Zone |

NFGC-23-12732 |

128.00 |

138.60 |

10.60 |

1.13 |

Iceberg |

NFGC-23-12932 |

79.05 |

85.05 |

6.00 |

4.49 |

Iceberg East |

Including |

79.05 |

79.70 |

0.65 |

30.49 |

|

NFGC-23-13062 |

141.95 |

146.75 |

4.80 |

33.07 |

Iceberg |

Including |

141.95 |

142.90 |

0.95 |

160.50 |

|

And1 |

153.15 |

157.45 |

4.30 |

39.23 |

|

Including |

153.15 |

154.05 |

0.90 |

175.00 |

|

And2 |

162.00 |

188.25 |

26.25 |

1.26 |

|

Including |

187.60 |

188.25 |

0.65 |

11.50 |

|

And2 |

204.15 |

224.40 |

20.25 |

9.72 |

|

Including |

204.15 |

205.50 |

1.35 |

130.48 |

|

NFGC-23-13121 |

94.75 |

122.55 |

27.80 |

14.54 |

Iceberg |

Including |

99.80 |

101.05 |

1.25 |

214.40 |

|

Including |

104.95 |

105.95 |

1.00 |

66.00 |

|

Including |

120.10 |

120.50 |

0.40 |

36.20 |

|

And1 |

127.30 |

132.60 |

5.30 |

34.59 |

|

Including |

127.85 |

128.95 |

1.10 |

161.14 |

Table 1: Iceberg and Iceberg East Drilling Highlights

Note that the host structures are interpreted to be steeply dipping and true widths are generally estimated to be 1

- 14.5 g/t Au over 27.80m and 34.6 g/t Au over 5.30m in NFGC-23-1312 were intersected at Iceberg, located 50m along strike to the northeast of previously released 105 g/t Au over 27.05m in NFGC-23-1210 (June 5, 2023). These intervals are interpreted to be close to true width and occur just 70m from the surface.

- 33.1 g/t Au over 4.80m, 39.2 g/t Au over 4.30m, 1.26 g/t Au over 26.25m and 9.72 g/t Au over 20.25m in NFGC-23-1306 occur at a vertical depth of 120m and are located 50m along strike to the southwest of NFGC-23-1312 and 50m down-dip of previously released 49.7 g/t Au over 29.85m in NFGC-23-1120 (March 13, 2023).

- A further 430m to the northeast, at Iceberg East, highlight interval of 4.49 g/t Au over 6.00m in NFGC-23-1293 was intersected 50m along strike of previously released 21.7 g/t Au over 4.45m in NFGC-23-1285 at a vertical depth of just 60m.

- These results expand the high-grade segment of the Keats-Baseline Fault Zone at Iceberg and continue to demonstrate strong continuity of high-grade gold mineralization (Figures 1-4).

Melissa Render, VP of Exploration of New Found, stated: “Today’s results speak for themselves. It is thrilling to experience continued success at Iceberg, a highly gold-enriched segment of the Keats-Baseline Fault, comprised of a network of high-grade gold-bearing veins that span a domain having true widths ranging from 10-40m. Iceberg starts at surface and all intercepts reported to date occur within a very shallow window at depths of up to a mere 160m. We look forward to continued exploration at Iceberg and Iceberg East, as well as numerous other zones being discovered along the Appleton North Corridor.”

Drillhole Details

Hole No. |

From (m) |

To (m) |

Interval (m) |

Au (g/t) |

Zone |

NFGC-23-12733 |

112.00 |

114.10 |

2.10 |

1.04 |

Iceberg |

And2 |

118.85 |

121.35 |

2.50 |

1.70 |

|

And2 |

128.00 |

138.60 |

10.60 |

1.13 |

|

And2 |

193.65 |

197.15 |

3.50 |

2.76 |

|

NFGC-23-12882 |

280.45 |

283.10 |

2.65 |

5.02 |

Iceberg |

Including |

282.55 |

283.10 |

0.55 |

12.26 |

|

NFGC-23-12932 |

79.05 |

85.05 |

6.00 |

4.49 |

Iceberg East |

Including |

79.05 |

79.70 |

0.65 |

30.49 |

|

NFGC-23-13062 |

141.95 |

146.75 |

4.80 |

33.07 |

Iceberg |

Including |

141.95 |

142.90 |

0.95 |

160.50 |

|

And1 |

153.15 |

157.45 |

4.30 |

39.23 |

|

Including |

153.15 |

154.05 |

0.90 |

175.00 |

|

And2 |

162.00 |

188.25 |

26.25 |

1.26 |

|

Including |

187.60 |

188.25 |

0.65 |

11.50 |

|

And1 |

194.00 |

196.00 |

2.00 |

9.56 |

|

Including |

195.20 |

196.00 |

0.80 |

23.40 |

|

And2 |

204.15 |

224.40 |

20.25 |

9.72 |

|

Including |

204.15 |

205.50 |

1.35 |

130.48 |

|

And3 |

240.00 |

242.00 |

2.00 |

2.75 |

|

NFGC-23-13121 |

94.75 |

122.55 |

27.80 |

14.54 |

Iceberg |

Including |

99.80 |

101.05 |

1.25 |

214.40 |

|

Including |

104.95 |

105.95 |

1.00 |

66.00 |

|

Including |

120.10 |

120.50 |

0.40 |

36.20 |

|

And1 |

127.30 |

132.60 |

5.30 |

34.59 |

|

Including |

127.85 |

128.95 |

1.10 |

161.14 |

Table 2: Summary of composite results reported in this press release for Iceberg and Iceberg East

Note that the host structures are interpreted to be steeply dipping and true widths are generally estimated to be 1

Hole number |

Azimuth () |

Dip () |

Length (m) |

UTM E |

UTM N |

Prospect |

NFGC-23-1273 |

300 |

-45 |

377 |

658472 |

5427749 |

Iceberg |

NFGC-23-1288 |

300 |

-45 |

368 |

658469 |

5427636 |

Iceberg |

NFGC-23-1293 |

299 |

-45.5 |

318 |

658844 |

5428084 |

Iceberg East |

NFGC-23-1306 |

300 |

-45 |

290 |

658505 |

5427759 |

Iceberg |

NFGC-23-1312 |

300 |

-45 |

260 |

658527 |

5427805 |

Iceberg |

Table 3: Details of drill holes reported in this press release

Queensway 500,000m Drill Program Update

The Company is currently undertaking a 500,000m drill program at Queensway and approximately 57,000m of core is currently pending assay results.

Sampling, Sub-sampling, and Laboratory

All drilling recovers HQ core. Drill core is split in half using a diamond saw or a hydraulic splitter for rare intersections with incompetent core.

A geologist examines the drill core and marks out the intervals to be sampled and the cutting line. Sample lengths are mostly 1.0 meter and adjusted to respect lithological and/or mineralogical contacts and isolate narrow (<1.0m) veins or other structures that may yield higher grades.

Technicians saw the core along the defined cutting line. One-half of the core is kept as a witness sample and the other half is submitted for analysis. Individual sample bags are sealed and placed into totes, sealed and marked with the contents.

New Found has submitted samples for gold determination by fire assay to ALS Canada Ltd. (“ALS”) and by photon assay to MSALABS (“MSA”) since June 2022. ALS and MSA operate under a commercial contract with New Found.

Drill core samples are shipped to ALS for sample preparation in

Drill core samples are also submitted to MSA in Val-d’Or,

At ALS, the entire sample is crushed to approximately

At MSA, the entire sample is crushed to approximately

For samples that have VG identified or are within a mineralized zone, the entire crushed sample is weighed into multiple jars and are submitted for photon assay. The assays from all jars are combined on a weight-averaged basis.

All samples prepared at ALS or MSA are also analyzed for a multi-element ICP package (ALS method code ME-ICP61) at ALS Vancouver.

Drill program design, Quality Assurance/Quality Control and interpretation of results are performed by qualified persons employing a rigorous Quality Assurance/Quality Control program consistent with industry best practices. Standards and blanks account for a minimum of

Quality Control data are evaluated on receipt from the laboratories for failures. Appropriate action is taken if assay results for standards and blanks fall outside allowed tolerances. All results stated have passed New Found’s quality control protocols.

New Found’s quality control program also includes submission of the second half of the core for approximately

The Company does not recognize any factors of drilling, sampling or recovery that could materially affect the accuracy or reliability of the assay data disclosed.

The assay data disclosed in this news release have been verified by the Company’s Qualified Person against the original assay certificates.

The Company notes that it has not completed any economic evaluations of its Queensway Project and that the Queensway Project does not have any resources or reserves.

Qualified Person

The scientific and technical information disclosed in this press release was reviewed and approved by Greg Matheson, P. Geo., Chief Operating Officer, and a Qualified Person as defined under National Instrument 43-101. Mr.

At-The-Market Quarterly Update

The Company is pleased to provide a quarterly update with respect to the Company’s at-the-market equity offering program (the “ATM”) implemented on August 26, 2022, pursuant to an equity distribution agreement (the “Equity Distribution Agreement”) with BMO Nesbitt Burns Inc., Paradigm Capital Inc. (together, the “Canadian Agents”) and BMO Capital Markets Corp. (the “U.S. Agent” and, together with the Canadian Agents, the “Agents”).

From the commencement of the ATM to June 30, 2023, the Company issued an aggregate of 1,991,218 common shares in the capital of the Company (the “ATM Shares”), through the facilities of the TSX Venture Exchange and NYSE American, at an average price per ATM Share of

This press release shall not constitute an offer to sell or a solicitation of an offer to buy, nor will there be any sale of these securities in any state or jurisdiction in which such an offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

About New Found Gold Corp.

New Found holds a

Please see the Company’s website at www.newfoundgold.ca and the Company’s SEDAR profile at www.sedar.com.

Acknowledgements

New Found acknowledges the financial support of the Junior Exploration Assistance Program, Department of Natural Resources, Government of

Contact

To contact the Company, please visit the Company’s website, www.newfoundgold.ca and make your request through our investor inquiry form. Our management has a pledge to be in touch with any investor inquiries within 24 hours.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statement Cautions

This press release contains certain “forward-looking statements” within the meaning of Canadian securities legislation, relating to exploration, drilling and mineralization on the Company’s Queensway gold project in

View source version on businesswire.com: https://www.businesswire.com/news/home/20230705646824/en/

New Found Gold Corp.

Per: “Collin Kettell”

Collin Kettell, Chief Executive Officer

Email: ckettell@newfoundgold.ca

Phone: +1 (845) 535-1486

Source: New Found Gold Corp.

FAQ

What are the highlights of the drill program at the Iceberg discovery?

Where is the Queensway project located?

What is the current drill program at Queensway?

Does the company have any economic evaluations or resources at the Queensway project?

What is the potential impact of the at-the-market equity offering program?